I’m trying to cover the bear market from every angle because the psychology of these market environments fascinates me to no end for a few reasons:

- Fundamentals more or less don’t matter when stocks are falling (and occasionally rising) during a market downtrend (more on this tomorrow).

- The psychology of market participants is more manic than the market itself.

- Sentiment can change based on the direction of the market at any moment.

- Investment decisions that are typically made without a second thought in normal times are now second and third-guessed as hindsight bias can be instantaneous with such huge price swings.

- Certain investors become more overconfident as markets fall while others become more confused (count me in the second camp).

- Every market environment is different but there are often patterns in human nature that repeat.

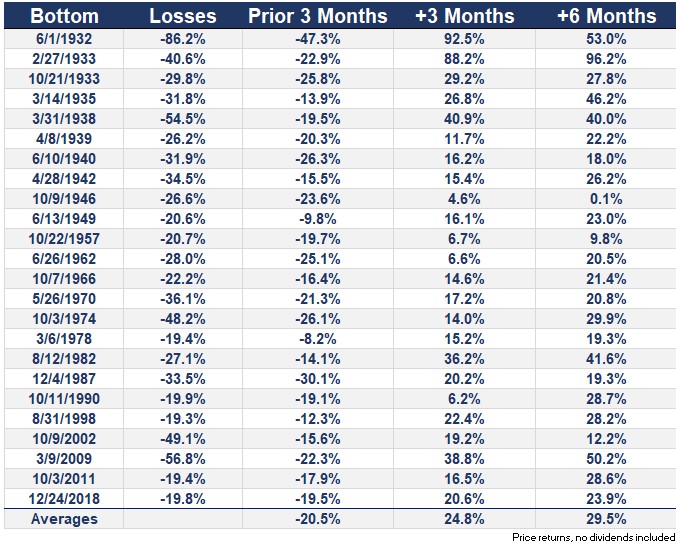

I’ve looked at the returns from the bottom of a bear market and the fact that the gains coming out of the bottom tend to be strong but a comment on Twitter this week caused me to look at this from a different angle.

What do the returns look like in the 3 months before stocks bottom in a bear market?

Had you bought 3 months early during these previous bear markets, roughly half the time you would have been made whole and then some 3 and 6 months later. This also means roughly half the time had you bought 3 months early you would not have been made whole 3 and 6 months later.

Michael and I discussed on a recent Animal Spirits:

Buying too early means you could experience some pain if stocks continue to fall further. Buying too late means you could experience some pain if stocks have already bounced.

The stock market is the ultimate place for regret because there is always reason to second-guess your decisions.

But this only really matters for people who concern themselves with the short-term. Over the long-term a few months here or there won’t make a difference in your portfolio. Regret should only truly exist in portfolio decisions that are made outside of a well thought out plan.

Would it be nice to nail the bottom with every purchase during a down market?

Of course.

Is it reasonable to assume you’re going to nail the bottom of a bear market?

Nope.

Do people over-think these things to their own detriment?

Probably.

Are you better off just buying shares on a set schedule automatically rather than trying to time things?

That’s probably the less stressful option.

For some reason it becomes easier to slip into an outcome-based mindset during a bear market. Markets move so fast that you immediately feel like you’ve been vindicated or invalidated with every buy/sell decision you make.

This is a slippery slope.

It’s more important than ever during a bear market to remember your time horizon as investors are tempted into thinking like short-term traders with long-term capital.

I’ve given up worrying about being too early or too late with my retirement contributions because I know in 20-30 years I’ll never remember the exact price points or entry levels when I buy into a down market.

But I do know that I would regret it if I tried to get too cute with my decisions and completely abandoned my plan simply because emotions are heightened at the moment.

Further Reading:

What If You Buy Stocks Too Early During a Market Crash?