Demographics are destiny but the reactions to that destiny aren’t set in stone.

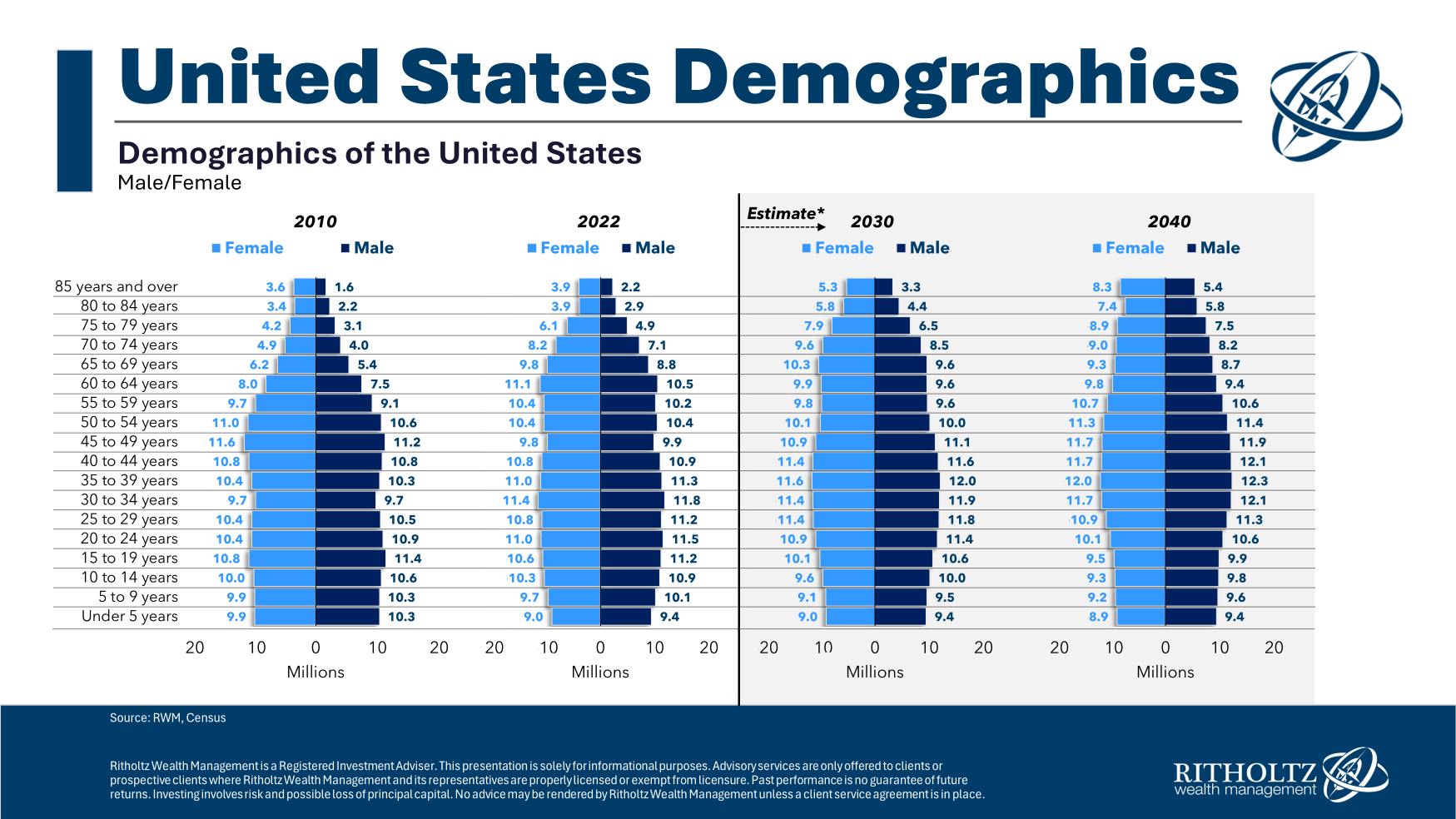

Take a look at how things have changed from 2010 to today along with where we’re going in the future:

The largest age brackets today are in the 30-34 and 35-39 range. Hello millennials.

By the 2030s and 2040s the largest cohorts will be in their 30s to 50s.

But look at how the older buckets will slowly fill up over time. We will have tens of millions of people in their 60s, 70s, 80s and beyond.

We’ve never had a demographic profile like this before. When the baby boomers were coming up there wasn’t a competing demographic anywhere close to their size. Gen X is the forgotten generation for a reason — they weren’t big enough. Now the baby boomer generation has millennials as an offset.

I have some questions about the impact of our demographics in the years ahead:

Will we have enough healthcare resources to deal with the aging boomer population? Have you tried to get test results from a hospital lately? Or get an answer from your doctor about something that’s ailing you?

Maybe it’s just me but it seems like our healthcare system is getting slower.

Is our healthcare system ready for 70 million baby boomers entering a stage in their lives that will require more medical care? Do we have enough doctors, nurses, lab techs, etc. to handle it?

And what about end of life care? Will the robots be here in time to help?

I’m concerned our healthcare system will be overwhelmed in the years ahead.

Will millennials turn into their parents? My baseline assumption is every generation turns into their parents.

It’s why I was so certain millennials would be fine in the post-Great Financial Crisis era when all of the coastal journalists were losing their minds predicting my generation would never buy cars or a home.

Every young generation assumes they’re different. Then they grow up and turn into adults.

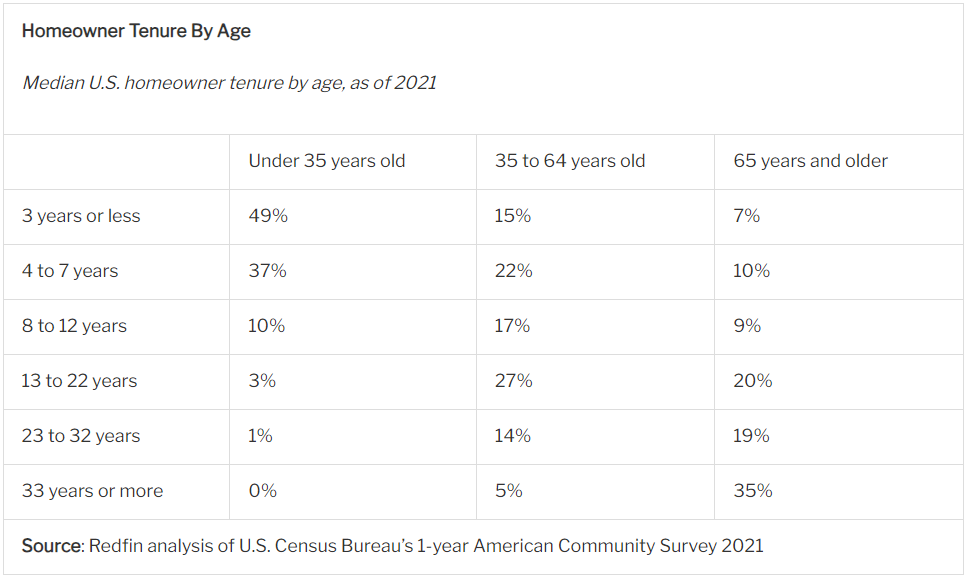

However, I wonder if millennials will be more fickle about their housing tastes and move more than the baby boomers. Redfin has data on homeowner tenure by age:

Over half of people 65 or older have lived in the same home for 23 years or more! One-third have been in their home for 33 years or longer.

It’s possible 3% mortgages will keep many millennials in their homes but I have a feeling there will more trading up with my generation.

Will we have enough McMansions for millennials? The broke millennial trope needs to end. The oldest millennials are in their 40s. We have money now. We’re entering our prime earning years.

Ten thousand baby boomers are retiring every day from now until 2030 but ten thousand millennials are turning 40 every day too.

We grew up watching HGTV. We want more stuff than our parents’ generation did. We want open floor plans, quartz countertops, spots to entertain, bathrooms that are to die for, home offices, and big backyards.

The shortage of started homes will likely morph into a shortage of McMansions for older millennials with higher incomes and loads of home equity.

If I were a homebuilder I would be gearing up for luxury house demand.

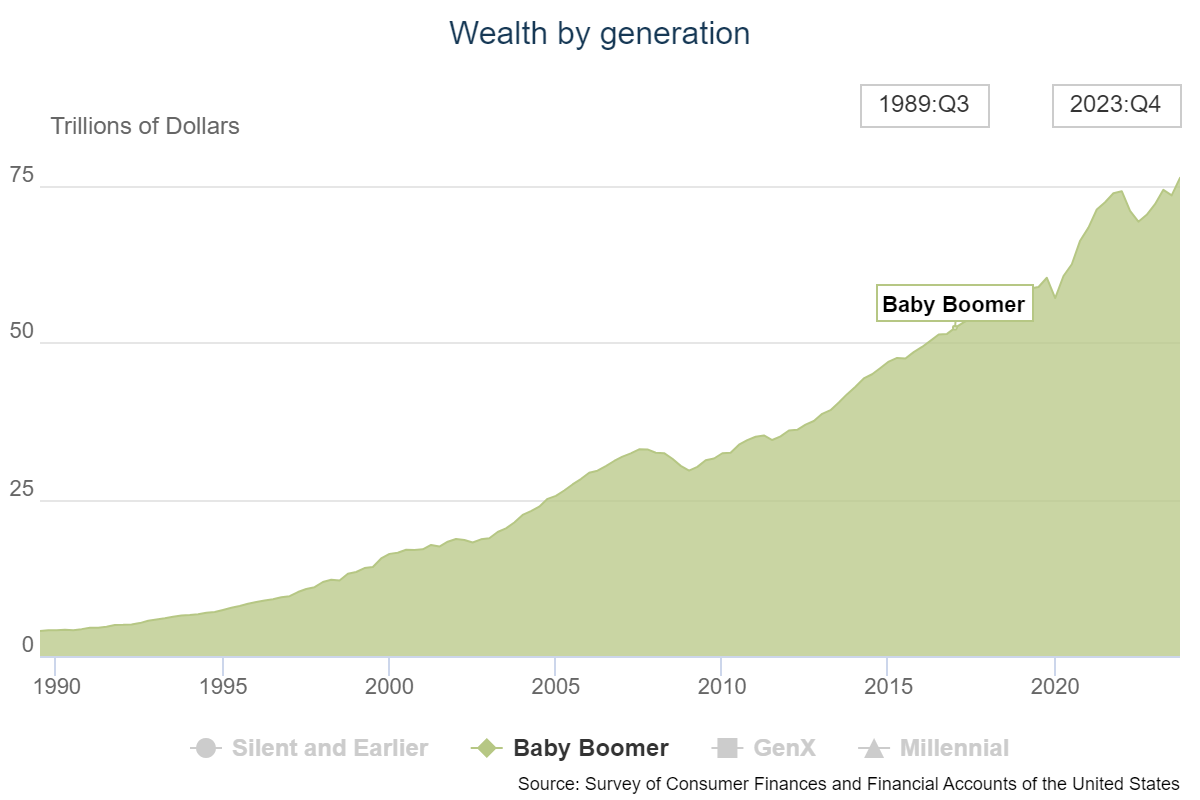

How large will baby boomer wealth grow? The hard part about compounding is most of the big gains come toward the end. You need money to make money.

The baby boomer generation controls more than $76 trillion:

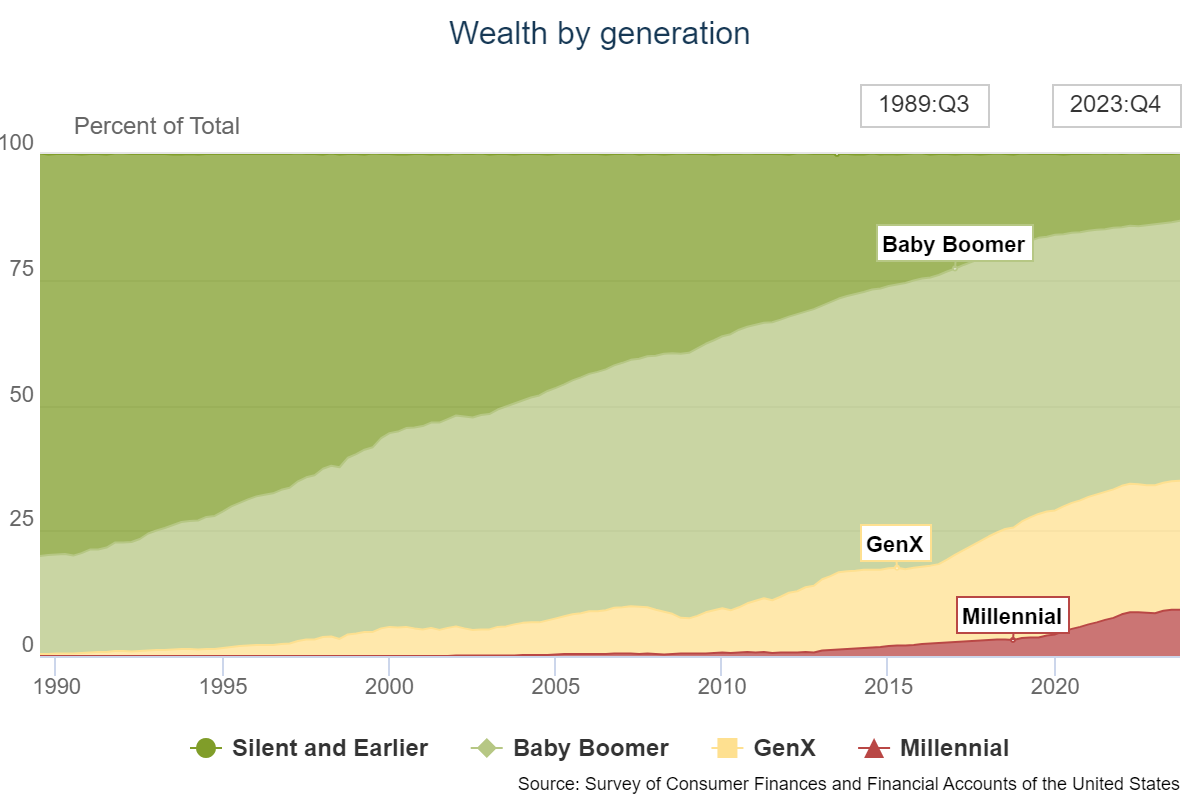

That’s more than 51% of all wealth in the United States.

That money has been compounding for four decades. Although baby boomers will be spending some of their wealth it could have another 2-3 decades of growth.

We’ve never had a demographic this large with this much wealth live this long before.

The wealthiest baby boomers will likely see even greater gains in the years ahead, at least in terms of absolute wealth.

Will the baby boomers spend it all or pass it down? Will the baby boomers spend all of their accumulated wealth on cruises or hold back and pass most of it down to the next generation?

There will obviously be a mixture depending on lifestyle and where they sit on the wealth spectrum.

But 20-30 years from now millennials will be the richest generation through some combination of inheritance from their parents and income growth in the years ahead.

And then all of the younger generations will hate millennials, just like they blame baby boomers for all of society’s ills today.

It’s the demographic circle of life.

Further Reading:

Demographics Rule Everything Around Me