I have more questions than answers because predicting the future is hard.

Here are 10 questions I’m contemplating heading into 2024:

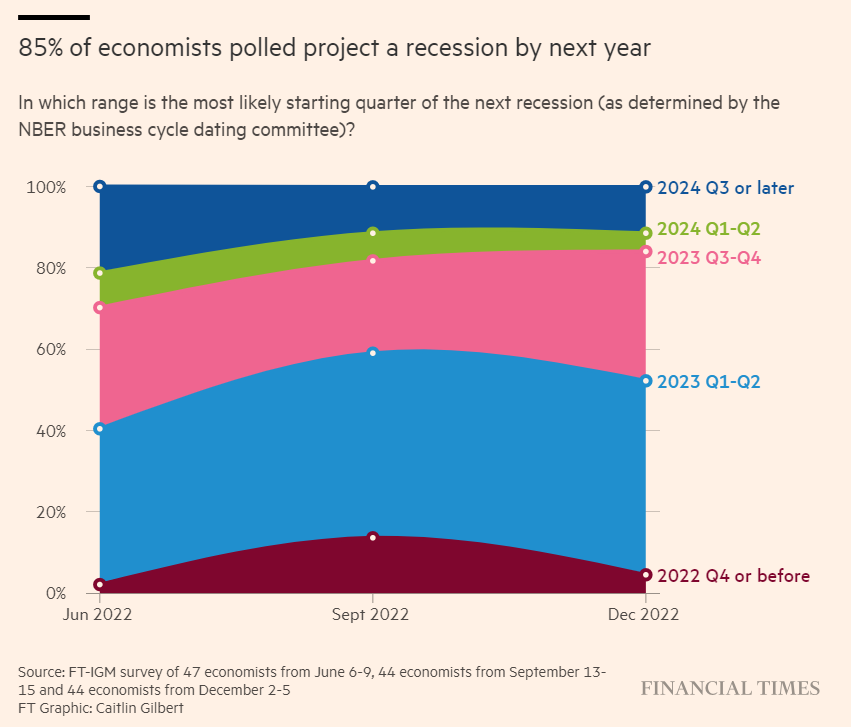

1. What’s something people are generally certain about that will be proven wrong? Back in December 2022, the Financial Times published a survey that showed 85% of economists were projecting a recession in 2023:

Whoops.

It’s not always easy to figure out what the consensus thinks these days since anyone and everyone has a platform for their opinions.

Does everyone still think a recession is coming?

Is a soft landing now consensus?

Do investors think rates are heading higher or lower? How about stocks?

People are bound to be wrong about what happens in the new year. We just don’t know what they’re going to be wrong about yet.

2. What comes after a soft landing? My take is we already had something of a soft landing. We’re just on a layover in Detroit waiting for the next flight to take off.

Let’s assume the next flight goes without a hitch and we get the ever-elusive soft landing most economists assumed was impossible.

What comes next?

A soft landing seemed like such a low-probability event that no one even considered what the economy would look like if one actually occurred.

Could we see a resurgence in inflation?

Will we see a return to the pre-2020 economy?

Or are we entering an entirely new environment?

3. What’s priced into the stock market? Since the market went into a mini-correction in the fall, stocks have been lights out. These are the total returns since late-October:

- S&P 500 +17%

- Nasdaq 100 +20%

- Dow +17%

- Russell 2000 +26%

That’s a pretty good run considering stocks had already staged a furious comeback from the 2022 bear market.

So where do we go from here?

Have stocks already all but priced in 3-4 rate cuts from the Fed next year?

What happens if inflation goes back up?

What if bond yields are done falling?

What if the economy slows?

For some reason it always feels like stocks are “priced for perfection” after they stage a rally.

Most of the time, they keep going up, but sometimes they go down. That’s about the best I can do as far as forecasts go.

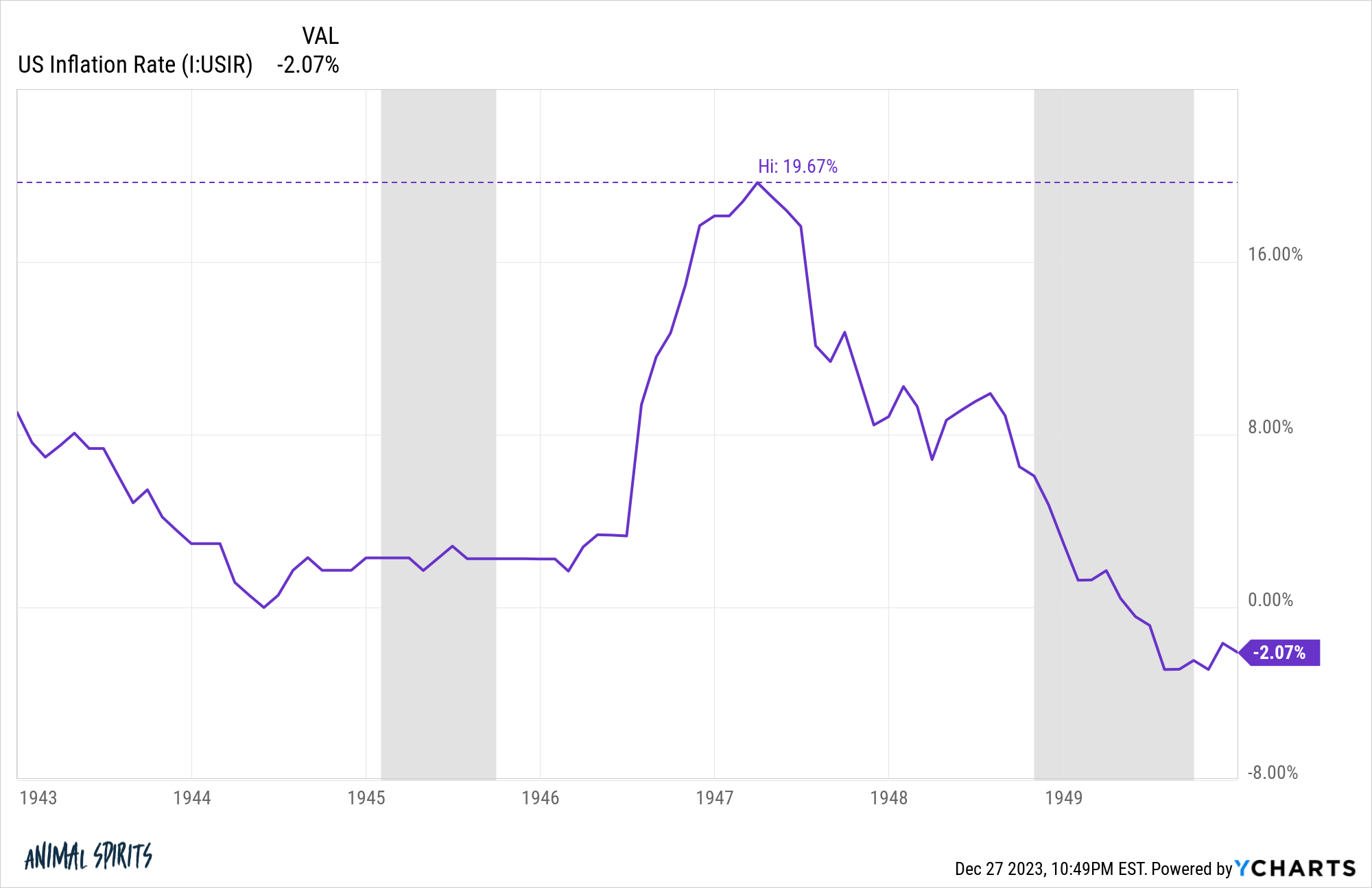

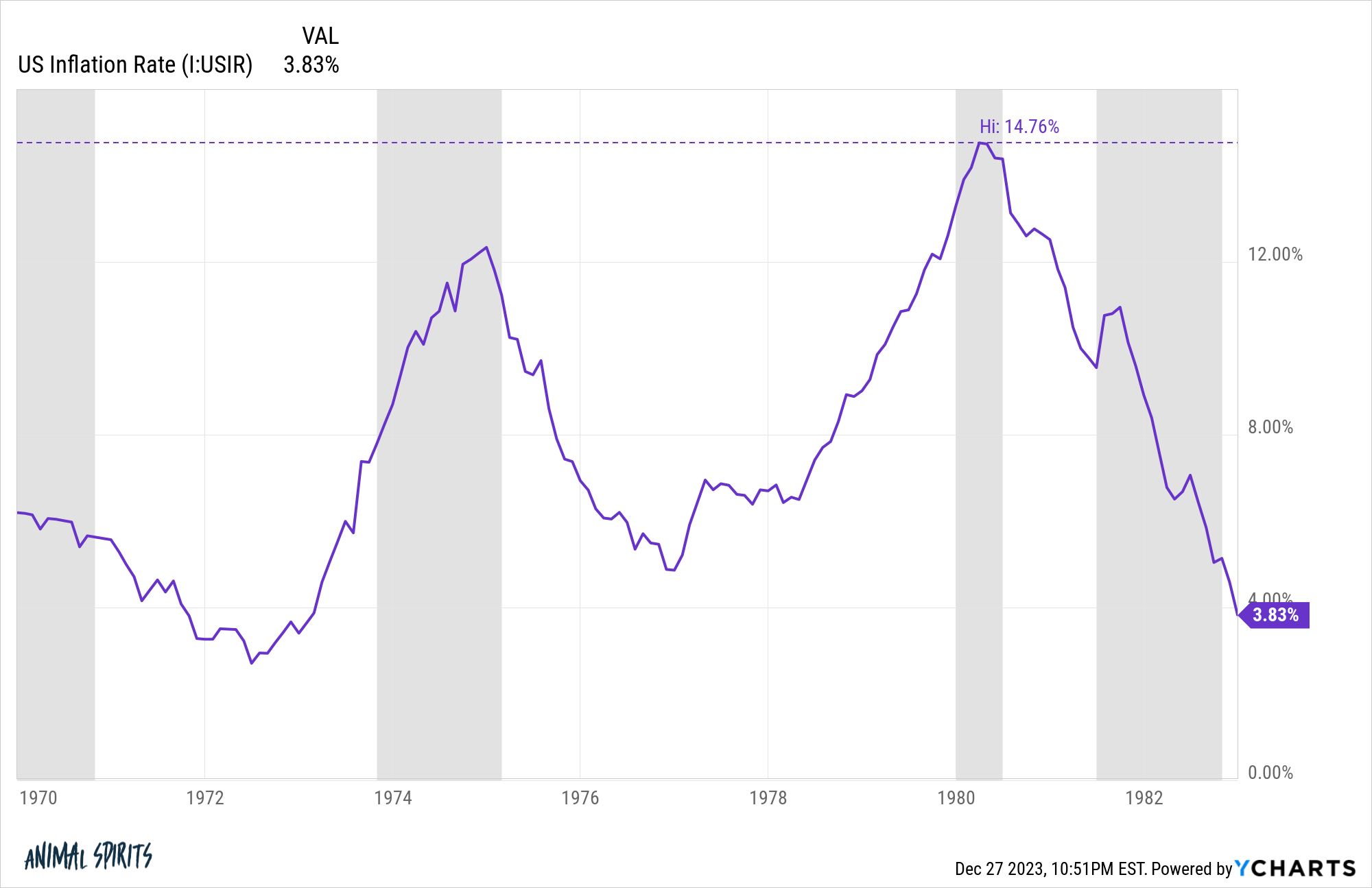

4. Is high inflation done done? One of the reasons we’re all so bad at predicting the outcomes from inflationary periods is we don’t have much history to draw from.

It’s basically the 1970s and post-WWII boom-flation. That’s it.

Most economists spend all their time worrying about a repeat of the 1970s because there are still people around who lived through that period.

After the war, inflation went nuts in the 1940s, then fell precipitously:

In the 1970s, inflation rose, then fell, then rose again:

That second mountain is worrying for sure. I don’t think this is a repeat of the 1970s but that doesn’t mean inflation is extinguished for good.

The 1940s situation is obviously preferable, but we’re more likely in uncharted territory.

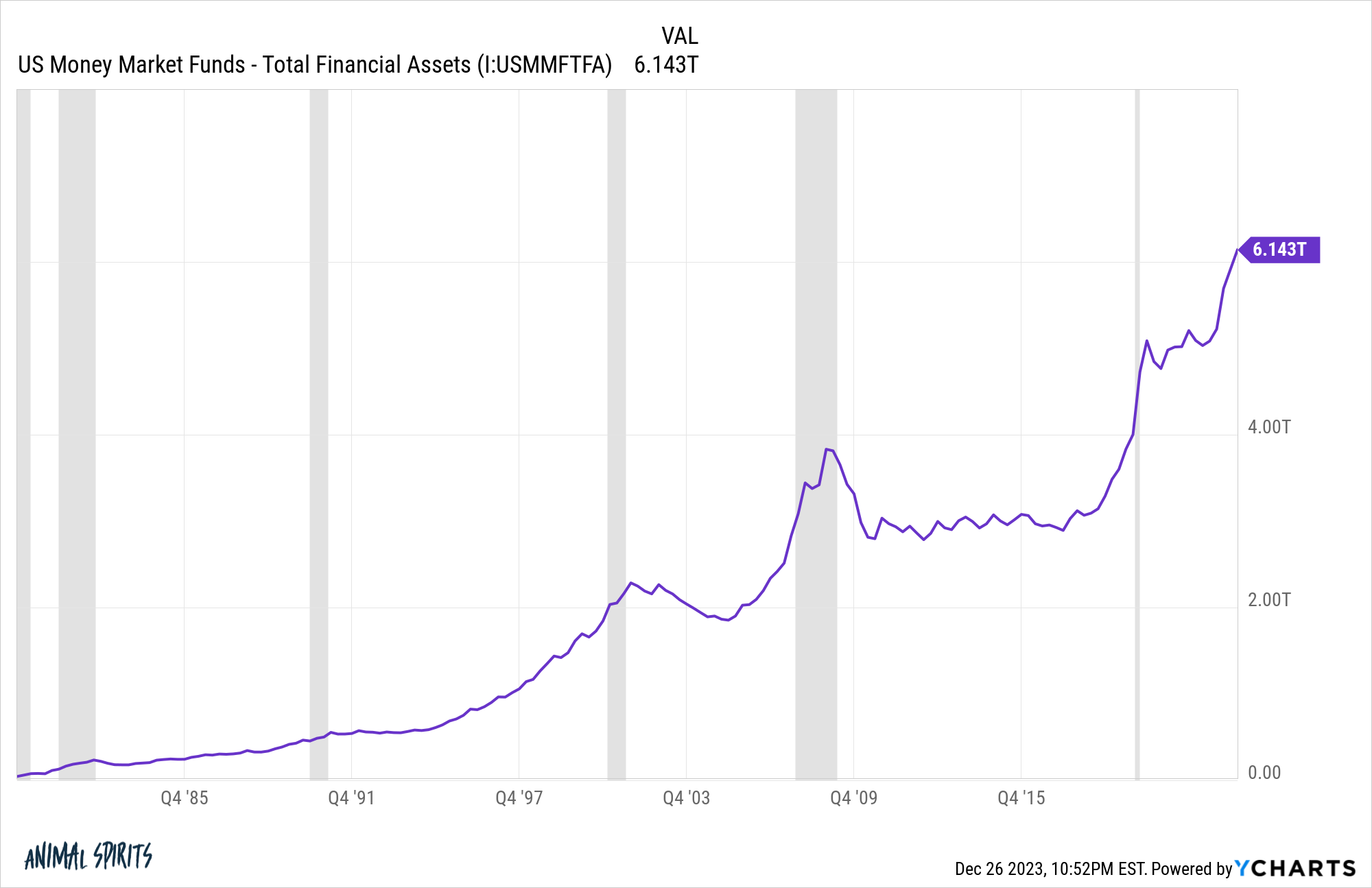

5. What happens to all the cash on the sidelines? With short-term yields hitting 5% this year for the first time in forever and a day, trillions of dollars piled into money market funds:

It’s possible this is simply a catch up from the 0% interest rate world.

But what happens if the Fed cuts rates a few times and these yields begin to fall?

Does this money stay put? Does it chase stocks or bonds or something else with a better yield?

How low would rates have to fall for that money to find its way into something else?

6. Can the consumer keep it going? Some people assume the continued boom in consumer spending has to be people racking up credit card debt.

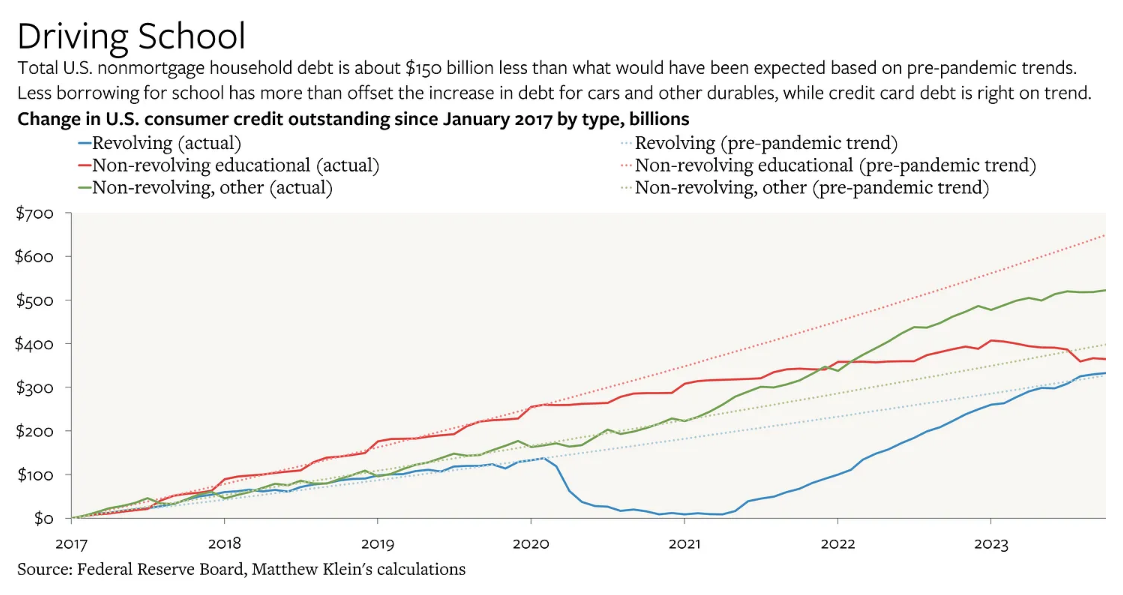

Matthew Klein shows credit card debt (revolving) is just now getting back on the pre-pandemic trend:

Klein notes:

Relatively low levels of debt–including among those who have relatively less cash on hand–means that many Americans have a lot of latent financial firepower to increase their spending above and beyond their income, should they wish to do so. That may not be attractive now, but lower interest rates could potentially change things.

Wages are higher. Households repaired their balance sheets for years following the Great Financial Crisis. Those balance sheets looked even better after the pandemic changed the world forever.

Consumers were more prepared than ever heading into a potential economic slowdown (which is one of the reasons it didn’t happen).

Credit card debt isn’t nearly as out of control as some would have you believe but it’s possible consumers do go into debt to keep up elevated spending habits.

Will households choose to go deeper into debt to keep the binge going or pull back, causing a slowdown?

7. When will people turn on Taylor Swift? She had one of the best pop culture years of my lifetime but nothing lasts forever in the Internet age.

Our culture loves to build people up, only to tear them down (and then root for a comeback).

Swift has one of the highest approval ratings on the planet.

I wonder how long she can keep it going before some manufactured backlash sets in.

8. Is Ozempic going to change the economy? I initially didn’t pay much attention when these drugs came out because almost every weight loss cure is fleeting or a fad.

This one seems different.

Not only are people losing 15-20% of their body weight but results show behavioral modification as well. Subjects report less snacking on salty and sugary snacks, drinking, biting their nails and even gambling.

The cynical side of me almost thought these results had to be faked or this is a miracle drug with no in-between.

The in-between is obviously side effects we aren’t aware of just yet but if a drug can give people self control it’s a massive game-changer.

How many companies, industries and products could be impacted if a decent subset of the country is on these drugs?

And how will those companies fight back if they are impacted?

9. Will we finally see some streamer consolidation? Listen, I love having a near endless amount of entertainment options across all of my devices.

But all of the logins and apps are getting ridiculous. It’s too much.

Netflix, HBO Max, Prime, Apple TV+, Disney+, Hulu, Peacock, Paramount+, Starz, probably some other streamer I’m forgetting.

Let’s roll them all up under Netflix and Amazon (maybe Apple too). Then put those streamers as stations on YouTube TV for the cable portion and call it a day.

We’ll call it…the strundle (still workshopping).

10. Can the Lions win a playoff game? I don’t even care at this point.

We have our first division title in like 30 years which comes with a home playoff game.

They’ll probably lose in heartbreaking fashion but I’m just happy to be in the conversation after decades of misery.

[BONUS] What could go right in 2024? Investors, economists and pundits spend a lot of time worrying about risks — recessions, bear markets, black swans, geopolitics, societal collapse, etc.

Few people ever think about what can go right.

More stuff usually goes right than wrong which is how we get progress.

I don’t know if that will be the case in 2024 but I feel confident this will be the case going forward over the long haul.

Further Reading:

5 Questions I Have About the Economy