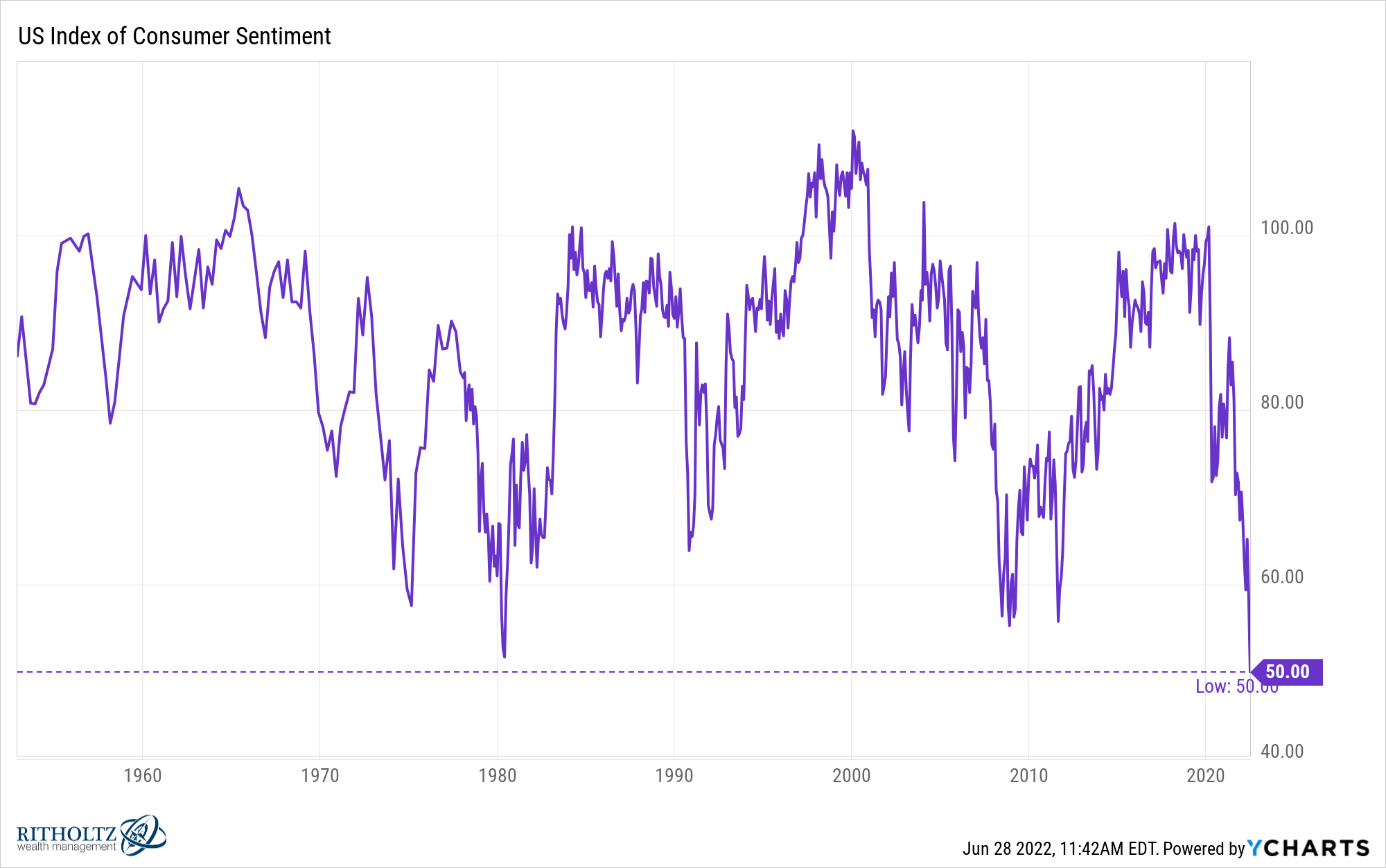

Consumer sentiment is as low as it’s ever been going all the way back to the early-1950s:

Considering the consumer makes up 70% of the U.S. economy, this feels like a troubling development.

We know the reasons here — the highest inflation in four decades, rising interest rates, supply issues, high gas prices, expensive housing, war and a whole host of other issues that we’re constantly peppered with on the news 24/7.

But if consumer spending is the main driver of economic activity, that 70% of the economy is in pretty good shape right now from a financial perspective. You could argue the consumer has never been more prepared for a slowdown in the economy.

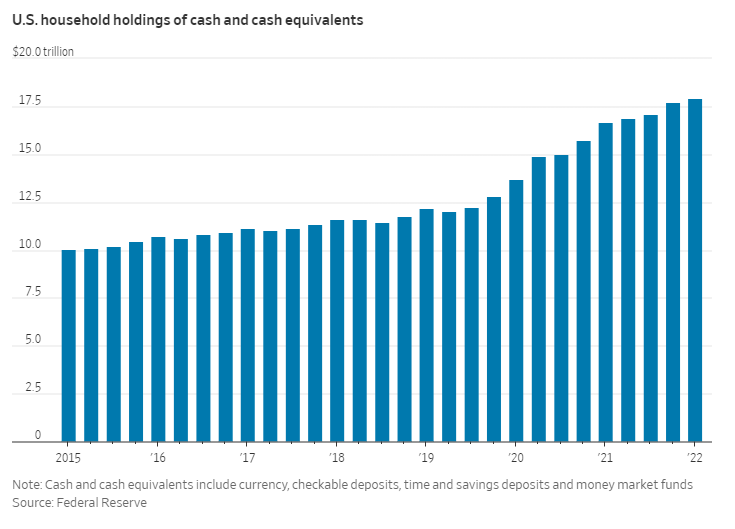

Just look at how much cash households are sitting on right now:

Here’s the breakdown from the Wall Street Journal:

Federal Reserve data show that as of the end of the first quarter, U.S. households held $17.9 trillion in cash and cash equivalents, up a bit from the fourth quarter and much higher than the $13.7 trillion they had at the end of the first quarter of 2020. Indeed, before the pandemic, U.S. households never experienced anything like the increase in cash they have experienced over the past two years, and this remains true even after adjusting for the run up in inflation.

I’m sure many people would push back on this, pointing out that it’s mostly wealth households hoarding cash as the moment. But that’s not the case:

People in the top 10% by wealth held 32% more in cash and cash equivalents in the first quarter from two years earlier, but people in the bottom half held 45% more.

The growth in cash levels is across all levels of wealth, not just the rich.

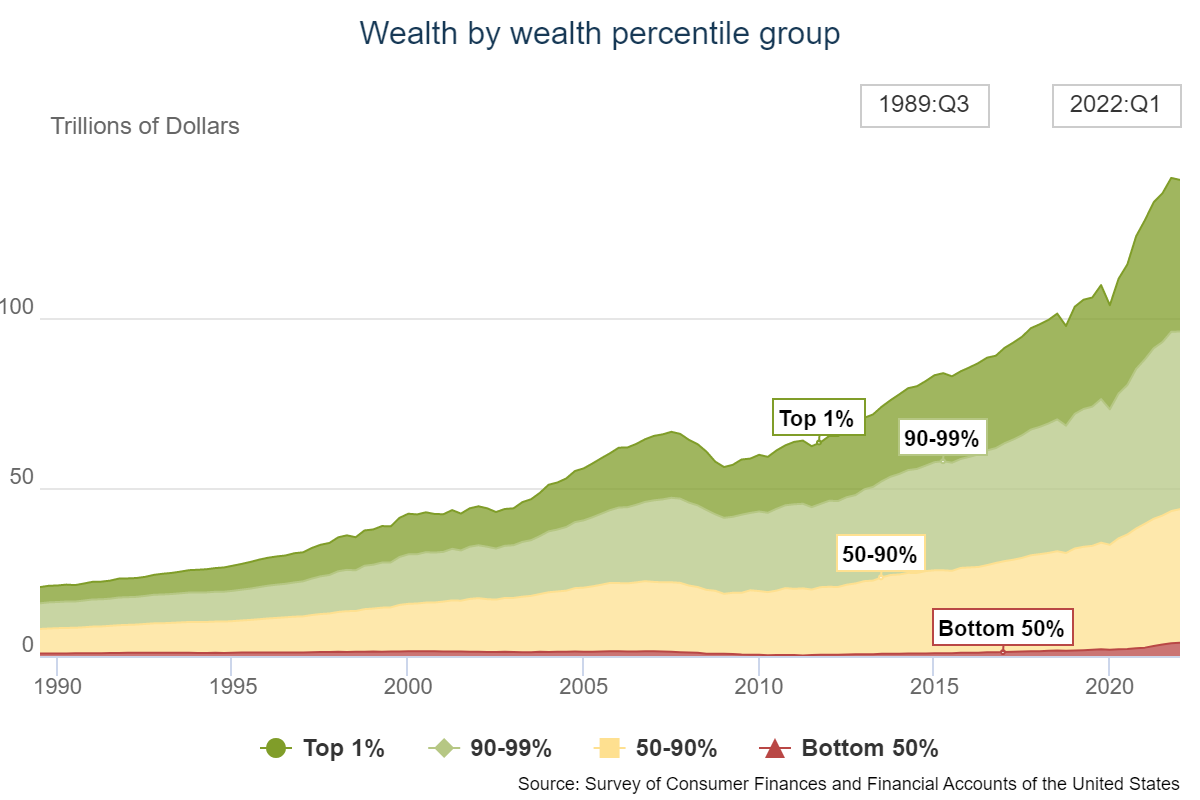

It’s not just cash either. Wealth has exploded higher since the onset of the pandemic:

Total household wealth has increased from $109.9 trillion in the fourth quarter of 2019 to $141.1 trillion as of March 31, 2022, an increase of nearly 30%. Households have never been richer.

Obviously, it would make sense people are wealthier following a bull market. These levels would certainly fall during a recession but consumers have a much bigger margin of safety than they had just a few short years ago.

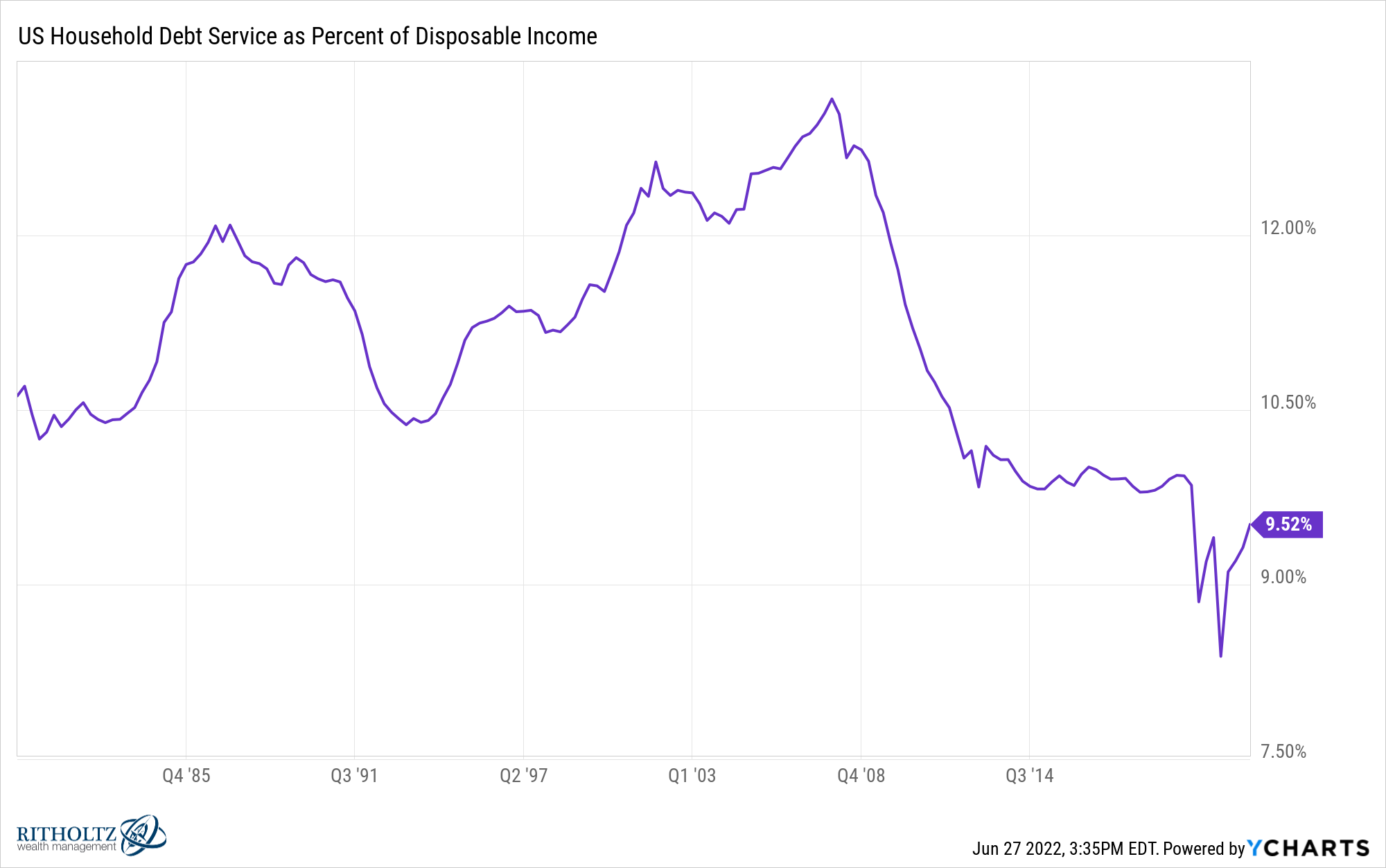

Assets are higher while liabilities have been shored up.

Housing debt service as a percentage of disposable income is off the floor but still lower than it was at anytime from 1980-2020:

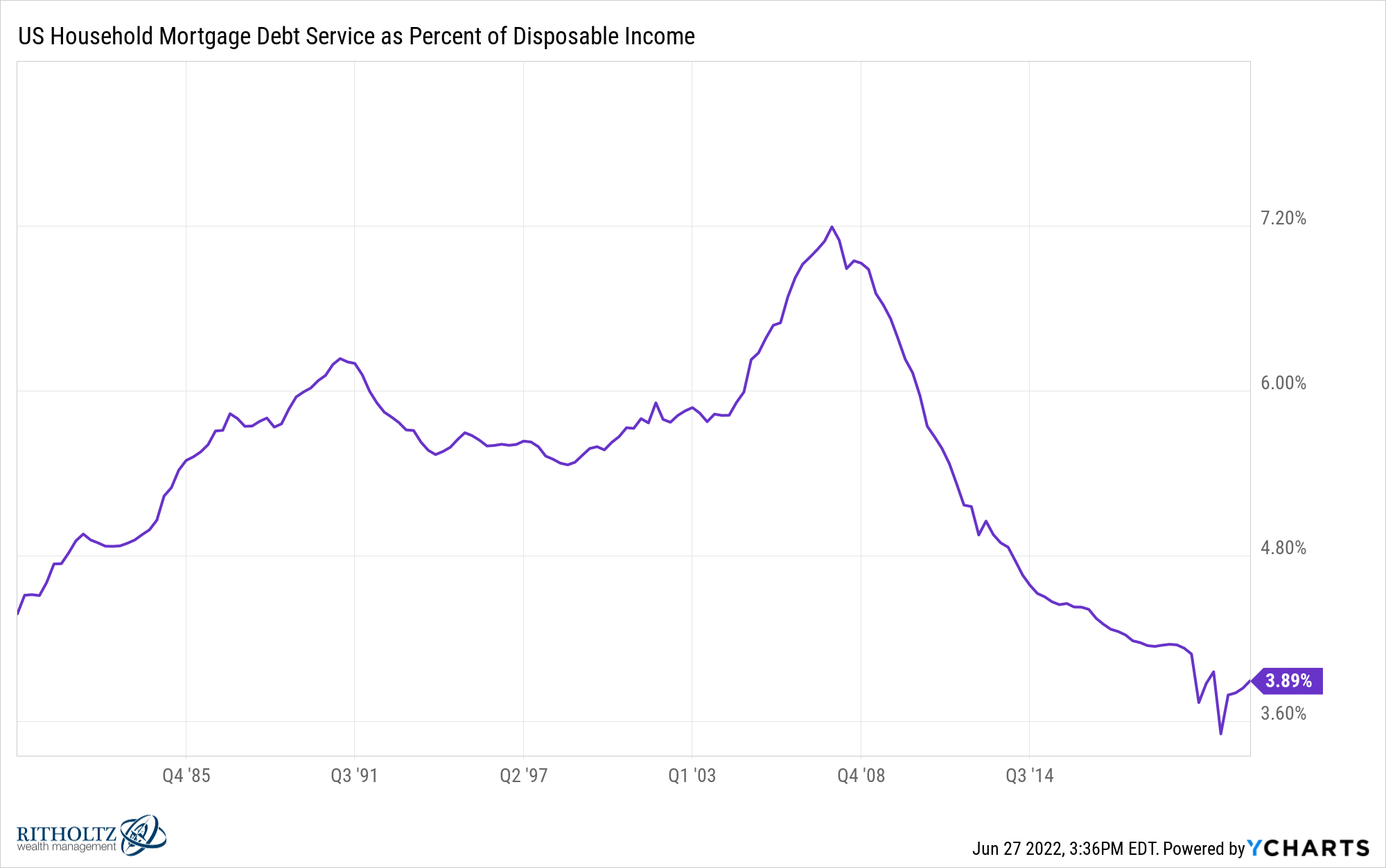

The same is true of mortgage debt:

Mortgage rates and housing prices are now much higher so you would expect this number to rise in the coming months but those who already own a home are in a much better position than they were during the last housing bust.

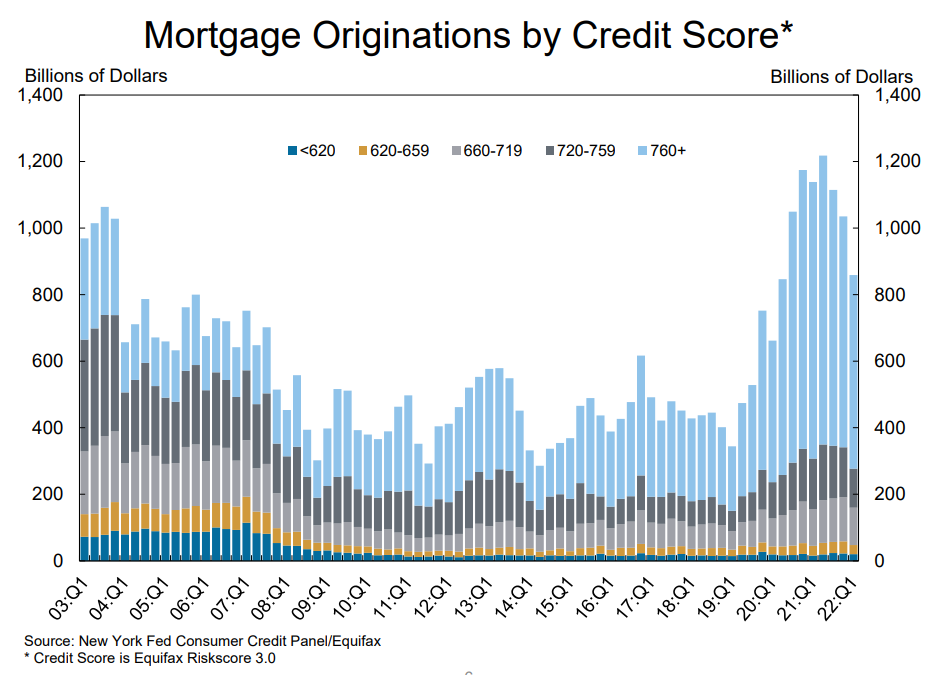

Just look at mortgage originations over time by credit score (from the NY Fed):

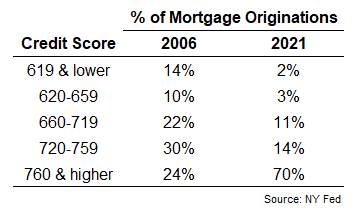

The difference in mortgage originations between the height of the housing bubble in 2006 and last year are striking:

There were 7x as many subprime borrowers (619 & lower) getting loans in 2006. Last year 70% of mortgage originations were households with excellent credit scores (760 & up) versus only 24% in 2006.

The biggest problem with the subprime housing bubble is people with poor credit were taking on loans they couldn’t service when their teaser rates rose on adjustable-rate mortgages. And when housing prices fell, it was a double-whammy of being underwater on their house.

Today, homeowners have a record amount of equity in their homes (from the WSJ):

Total U.S. home equity increased almost 20% in the first quarter to $27.8 trillion, a record high, according to the Federal Reserve.

The amount of tappable equity increased by a record $1.2 trillion in the first quarter of 2022, to more than $11 trillion, according to Black Knight. Close to 75% of it belongs to borrowers with mortgage rates below 4%, the Black Knight data show.

The vast majority of borrowers have equity in their home, fixed rate financing and a low borrowing rate. Even if people see the value of their home decline in the coming years, there’s a huge cushion and they don’t need to worry about their mortgage rates resetting.

The other side of this argument would tell you that’s fine but eventually, inflation is going to eat into those savings, the pandemic is basically over and the government isn’t going to send out any more checks.

This is fair.

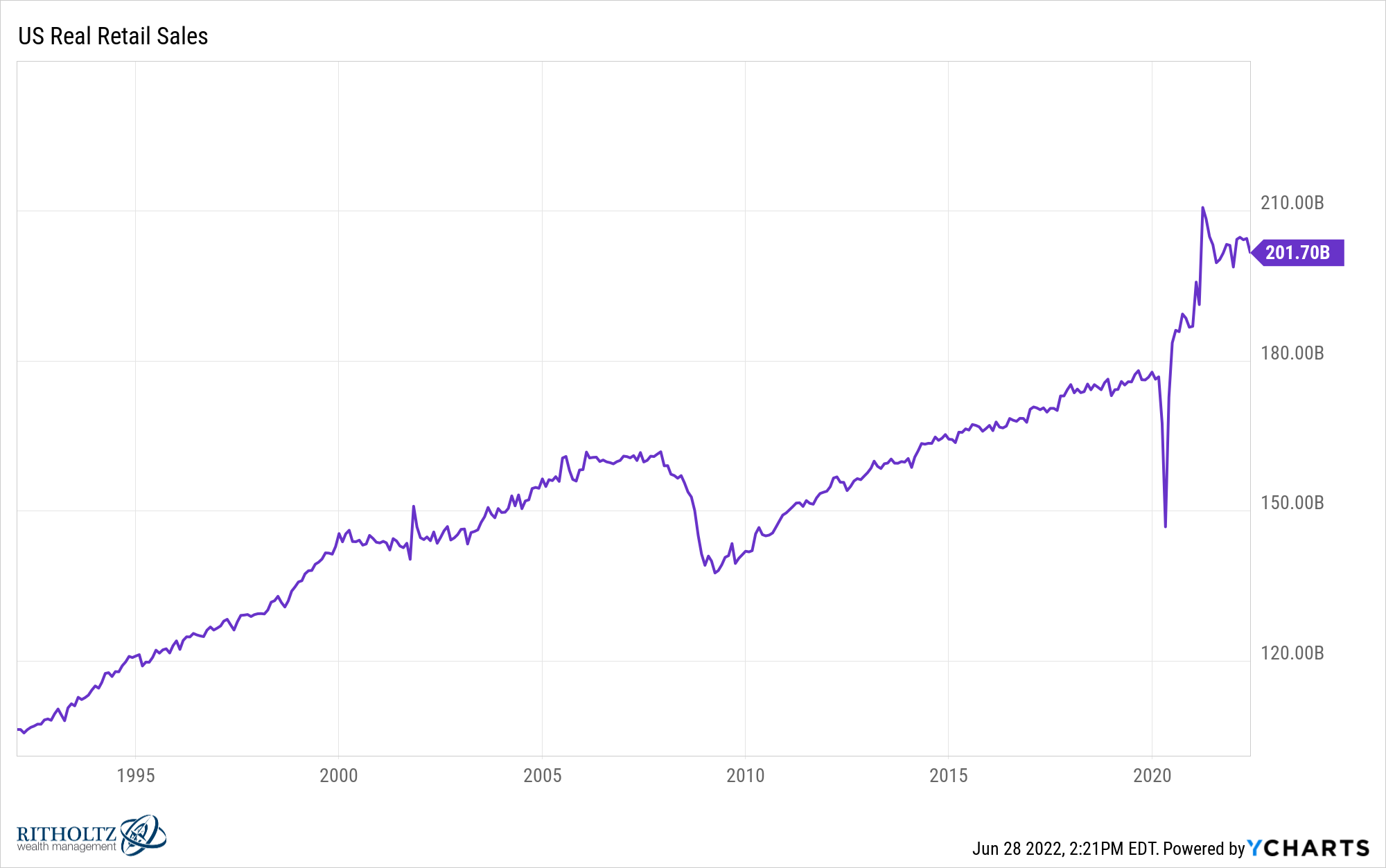

You can see real retail sales are finally starting to roll over a bit, even if they’re still elevated from pre-pandemic levels:

It’s also true that spending by consumers has now shifted from stuff to experiences (or goods to services).

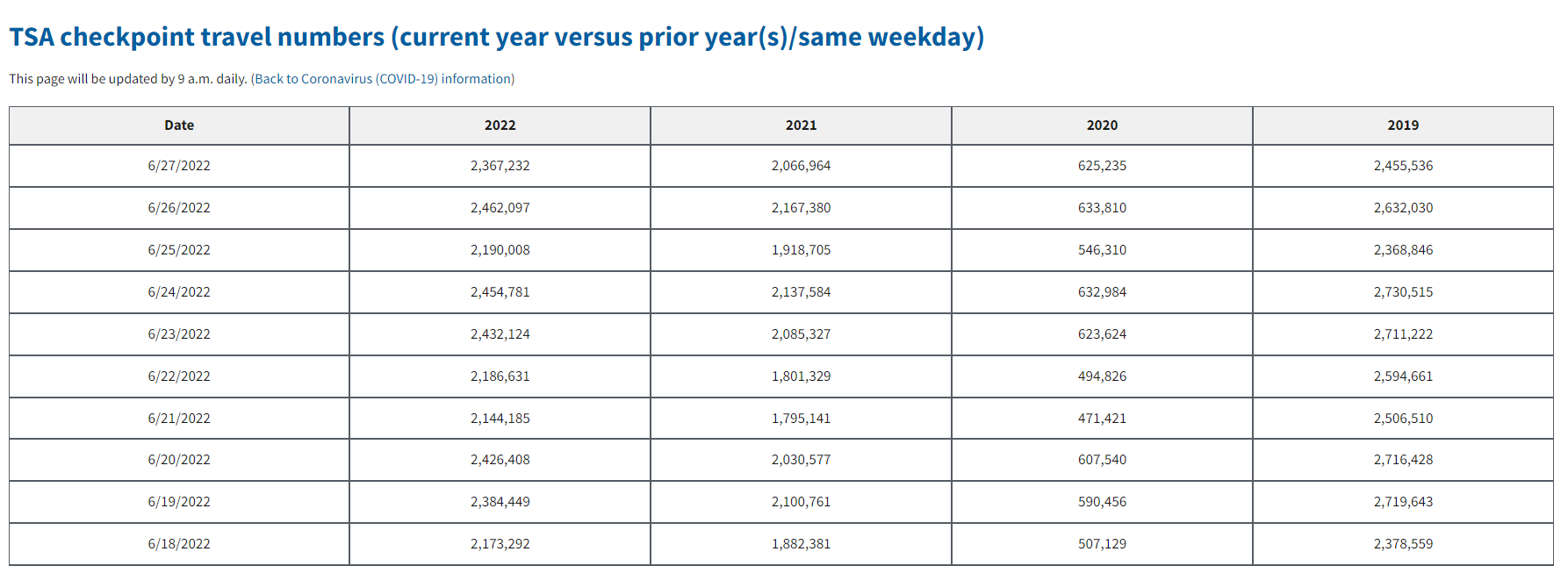

Airports are now at their highest levels of passengers since the pandemic started:

This is even more impressive when you consider that business travel is still down 30% from pre-pandemic levels.

There are lots of people traveling and spending money right now.

This spending could be cyclical. It could be a lot of catch-up for trips not taken during the pandemic that will slowly recede.

My point here is despite consumers hating inflation with every fiber of their being, in aggregate, households are in pretty good shape.

They are in good enough shape that we could potentially put off a recession for a while longer if people simply keep spending through the inflation.

And even if we do go into a recession, there is a high probability the downturn could be minor because consumer balance sheets are in such good shape.

Never say never when it comes to the economy or the markets. There could always be a calamity where things get out of hand from some exogenous shock.

If we have a recession people will lose their jobs. Wealth levels will fall. It won’t be great.

But consumers are wealthier now than they’ve ever been. They have a huge cash hoard. They have record levels of home equity. And a lot of people locked in very low borrowing rates on their largest financial asset.

The U.S. consumer has never been more prepared for a recession.

Further Reading:

Why the Housing Market is More Important Than the Stock Market