This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

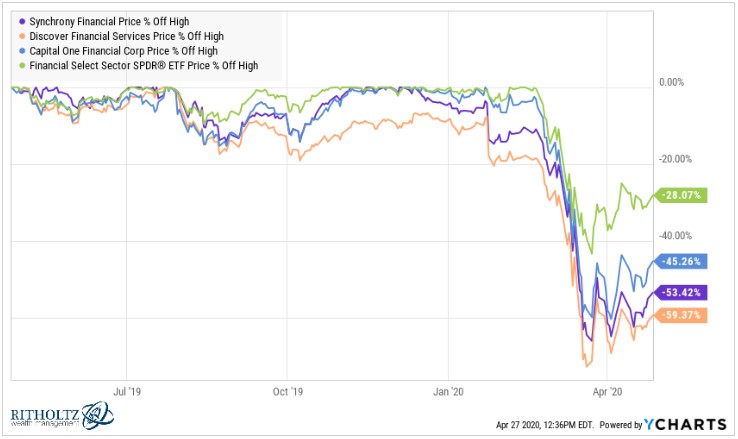

- More bang for the buck: wiping out student loan debt or credit card debt?

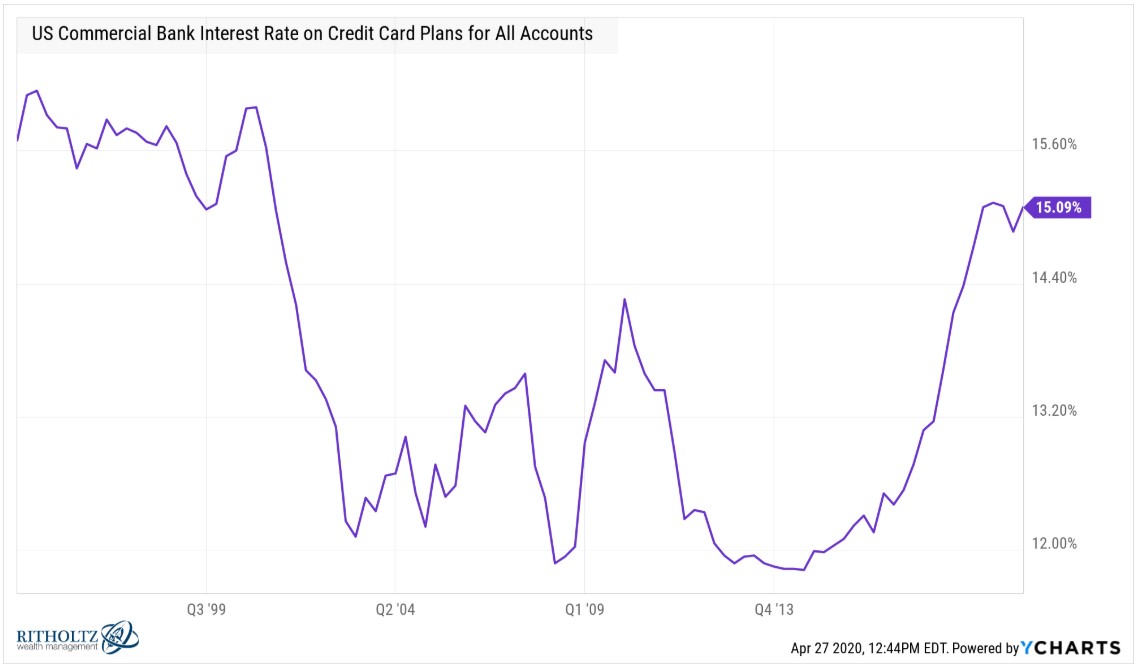

- Why haven’t credit card rates moved lower?

- What are we over- and under-estimating about behavioral changes from the crisis?

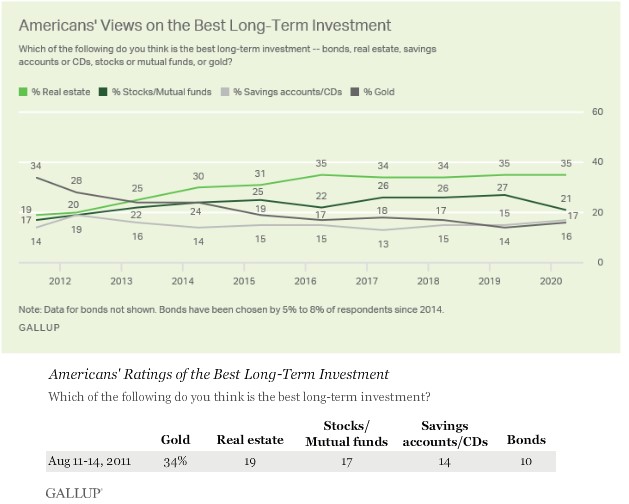

- Why do people favor real estate as an investment?

- Who profited from negative oil prices?

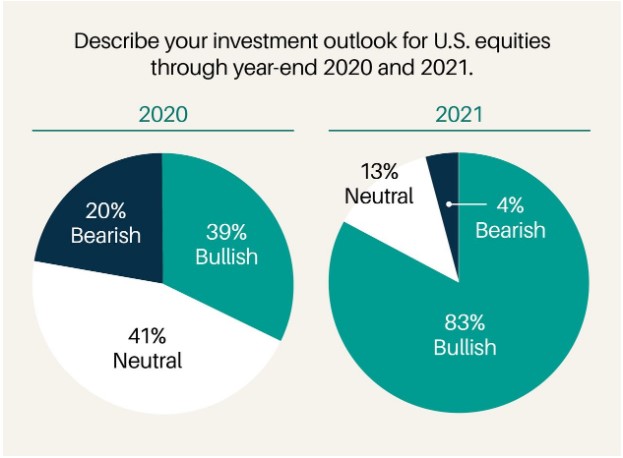

- Are investors too bullish about the future?

- Are gyms in big trouble?

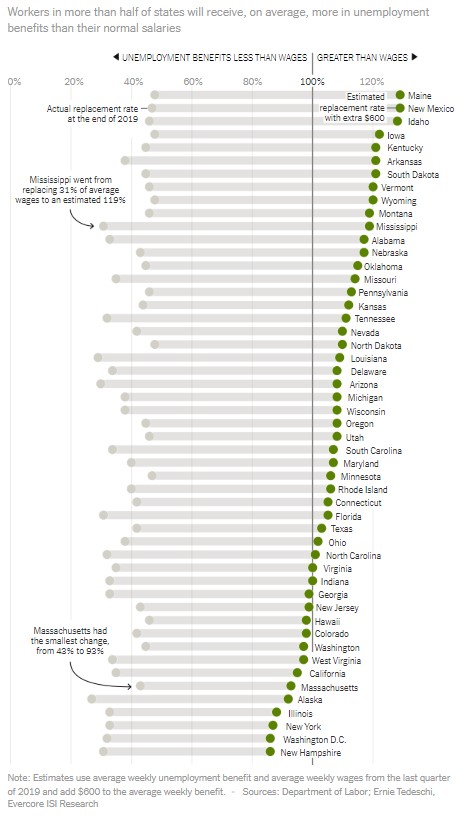

- How many unemployed people are being made whole?

- Will there be an exodus from cities?

- Will more people retire early because of the crisis?

- How long until we get a vaccine?

- Are things so much better today that we can’t psychologically handle something like a pandemic?

- Will there be a fall semester for college students?

- How a crisis can change your investment thesis on the fly

- The benefits of having a behavioral release valve in your portfolio

- Why do Netflix movies feel like they’re only 80% finished?

- When can we officially declare value investing dead and more

Listen here:

Stories mentioned:

- Millions of credit-card customers can’t pay their bills

- Capitalism as we know it will likely be changed forever

- The 20 minutes that broke the U.S. oil market?

- Barron’s big money poll

- Peloton attracts record 23,000 to class

- The $600 unemployment booster shot

- Why being laid off can hurt so much

- Michigan unemployment numbers trend upward

- Labor markets during COVID-19

- The first modern pandemic

- Seattle’s leaders let scientists take the lead

- Will there be a fall semester on campus?

- More Americans are taking money from their 401k

- Some crisis investing lessons from my fun portfolio

- Laurence Gonzales on Deep Survival

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: