A reader asks:

I appreciate Ben’s long-term view of stock market corrections but what if this time is different? What are the stats when the Fed is actively offloading trillions of assets AND raising rates? What if this cycle is an anomaly and should be treated as such?

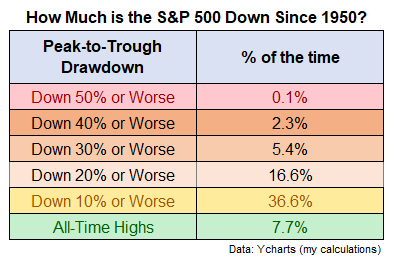

This question was written in response to a recent post where I used the following table to show the historical distribution of losses over the past 70+ years in U.S. stocks:

By my calculation, the S&P 500 was down 10.3% since the end of July as of the close last Friday.

That’s a run-of-the-mill correction but it doesn’t feel like a run-of-the-mill correction to many investors.

What about the trillions in government debt?!

What about rising interest rates?!

What about the potential for a recession?!

What about higher for longer?!

What about the geopolitical strain across the globe?!

I know the world feels fragile right now. The geopolitical situation feels like a powder keg ready to burst. The economy is in unchartered territory with rates going from 0% to 5% in a hurry. Uncertainty seems to be at an all-time high.

I don’t mean to sound insincere about anything going on right now, but the future is always uncertain. The only people who assume the world has never been in a worse place are those who have never opened a history book.

In the 20th century, we endured a pandemic, the Great Depression, two world wars, the Vietnam War, the Korean War, the Cold War, the Gulf War, 19 recessions, high inflation, low inflation, deflation, high rates, low rates, Black Monday, a handful of stock market crashes and dozens of corrections along the way.

In the 21st century, we’ve endured 9/11, the Iraq war, the war in Afghanistan, an insurrection at the Capitol, the pandemic, the Great Financial Crisis, the highest inflation in 40 years, negative oil prices, a lost decade in the stock market bookended by separate 50% crashes and a handful of recessions.

The list of bad stuff I missed here is nearly endless. History is littered with unspeakable tragedies and yet we as a species somehow forge ahead. We create. We innovate. We grow. Life goes on. Things eventually get better.

Despite all of that nasty stuff that occurred the stock market was up 10% per year.

Can I guarantee this will continue?

Of course not.

Does that mean you should abandon the stock market?

I’m not going to.

You could make the case the stock market is one of the last remaining sane institutions in this country.

One of the hard parts about investing in the stock market is every historical dip on a long-term chart looks like a wonderful buying opportunity. Everyone can look at a backtest and confidently say they would have stepped up to buy when stocks were down.

It’s much harder to do so when stocks are in the midst of a downturn because no one knows how bad things will get or how low prices will go.

It sounds intelligent to say this time is different for the stock market but every time is different. Each market and economic cycle is unique. If there were a playbook for this stuff investing would be a whole lot easier.

Here’s what I know about the history of corrections in the stock market:

Since 1928 the U.S. stock market has averaged a 10% correction in roughly two-thirds of all years, a bear market once every 4 years and a crash of 40% or worse once every 13 years.

The average peak-to-trough drawdown in a given year going back to 1928 has been a little more than 16%. In 6 out of the past 10 years alone, the S&P 500 has experienced a double-digit correction.1

The stock market goes up most of the time but sometimes it goes down.

The stock market usually falls for good reason as well.

It makes sense the stock market is in correction territory right now. We’ve not only gone through a painful economic regime shift but the bull market of the 2010s was a strong one. Mean reversion was bound to make an appearance at some point.

I don’t know what’s going to happen to stock prices from here.

I don’t know how long this correction will last.

And I cannot guarantee the stock market will produce the same returns in the future that it has in the past.

But I do know that every correction feels like it will never end while you are in it and then always looks like a buying opportunity with the benefit of hindsight.

No one ever said investing was easy. That’s why the stock market offers you a risk premium — it’s never easy.

I’m not saying this is some generational buying opportunity. It’s not. But I’m not ready to abandon the stock market just because there are some scary headlines.

History is full of scary headlines and the stock market has done just fine.

Corrections in the stock market are completely normal. It’s the cost of doing business. Future corrections will always feel different because markets and investors are constantly changing and evolving. That doesn’t mean you abandon risk assets because they make you feel uncomfortable.

You’re never going to survive in the stock market if you treat every downturn like it’s the end of the world.

We discussed this question on the latest edition of Ask the Compound:

Josh Brown joined me again today to answer questions about when to sell big gainers in your stock portfolio, the difference between now and the dot-com bubble for tech stocks, de-risking your portfolio as you approach retirement and how to handle allowance for your children.

Further Reading:

No One Knows What Will Happen

12015 (-12.4%), 2016 (-10.5%), 2018 (-19.8%), 2020 (-33.9%), 2022 (-25.4%) and now 2023 (-10.3%).