Way back in 2017, I wrote about how bananas Canadian housing prices were.

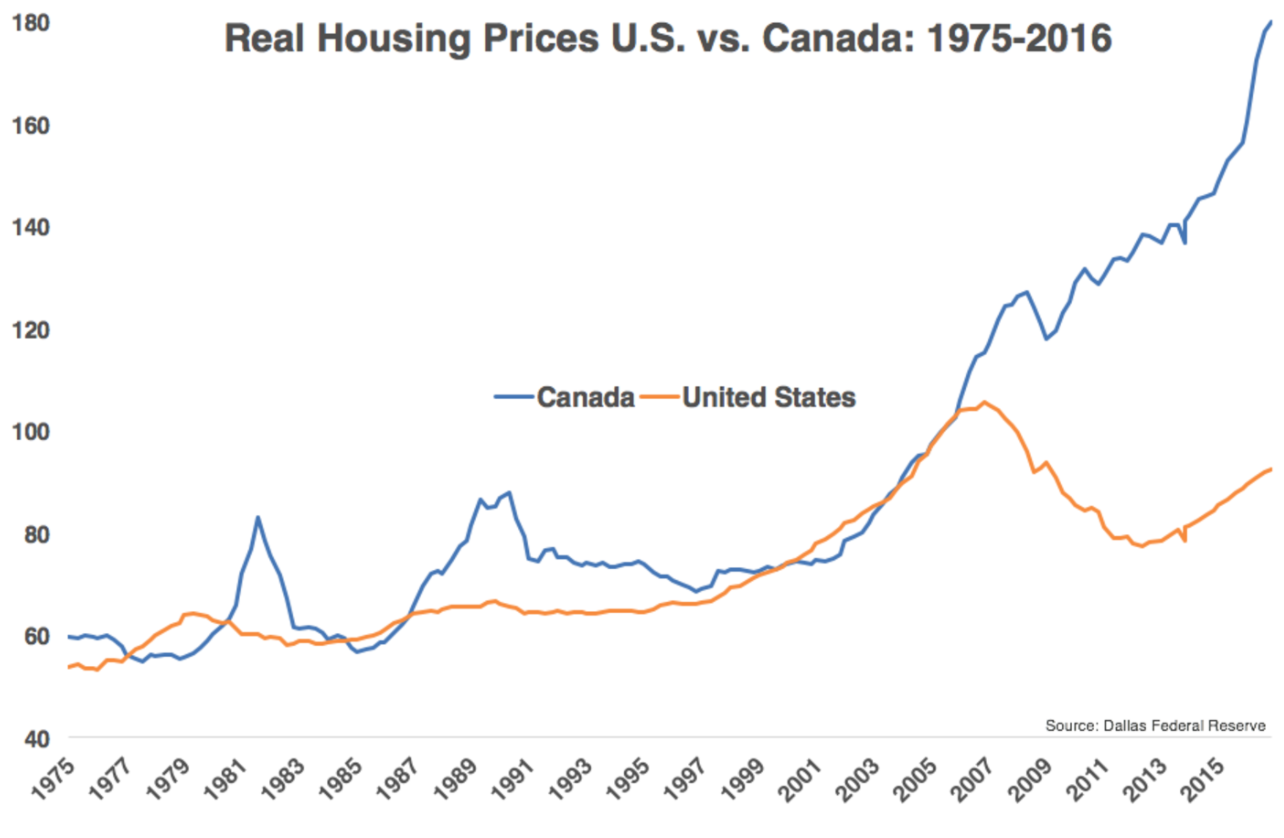

This was the chart I used at the time:

Canada basically skipped the housing bust from the Great Financial Crisis.

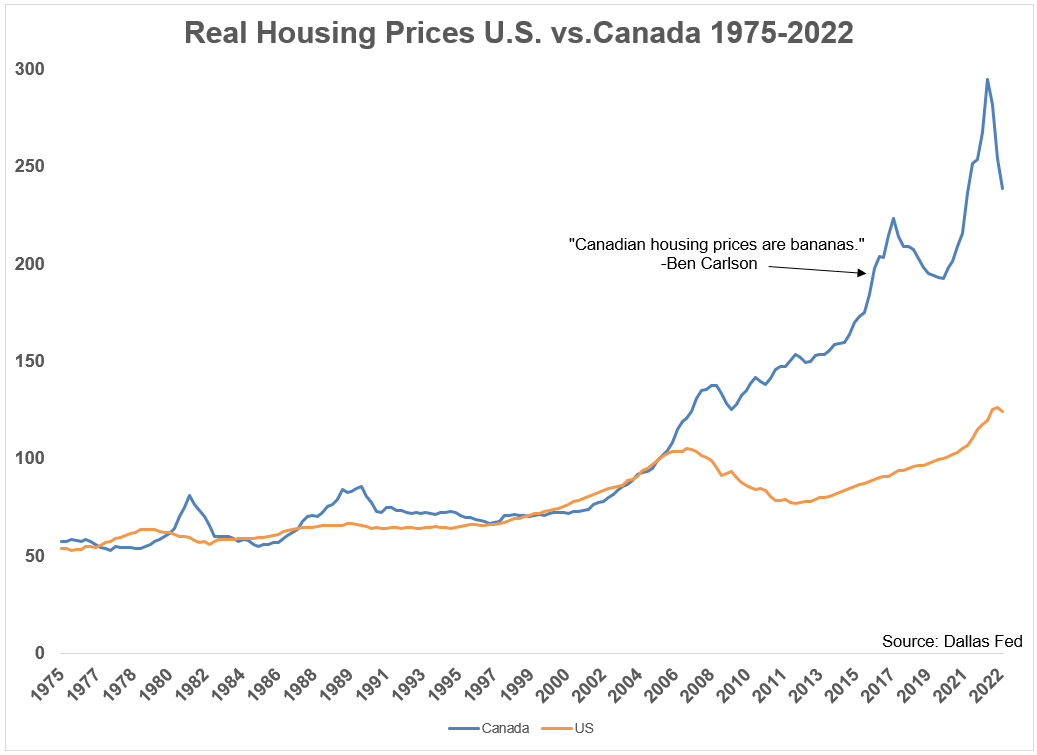

Well, things got even more bananas in the ensuing years.

Here’s the updated version:

Canadian housing prices can remain irrational longer than you can stay solvent or something like that. The crazy thing is Canadian housing prices would have to fall an additional 40%+ from those levels just to get back in line with growth in real U.S. housing prices since 1975.

Since the start of 2005, Canadian home prices are up a staggering 142% on a real basis (after inflation). And that includes a decrease of 19% in the final 9 months of 2022.1 From 2005-2022, U.S. housing prices were up just shy of 26% on a real basis.

Housing price gains in Canada make the U.S. housing price gain look tiny by comparison.

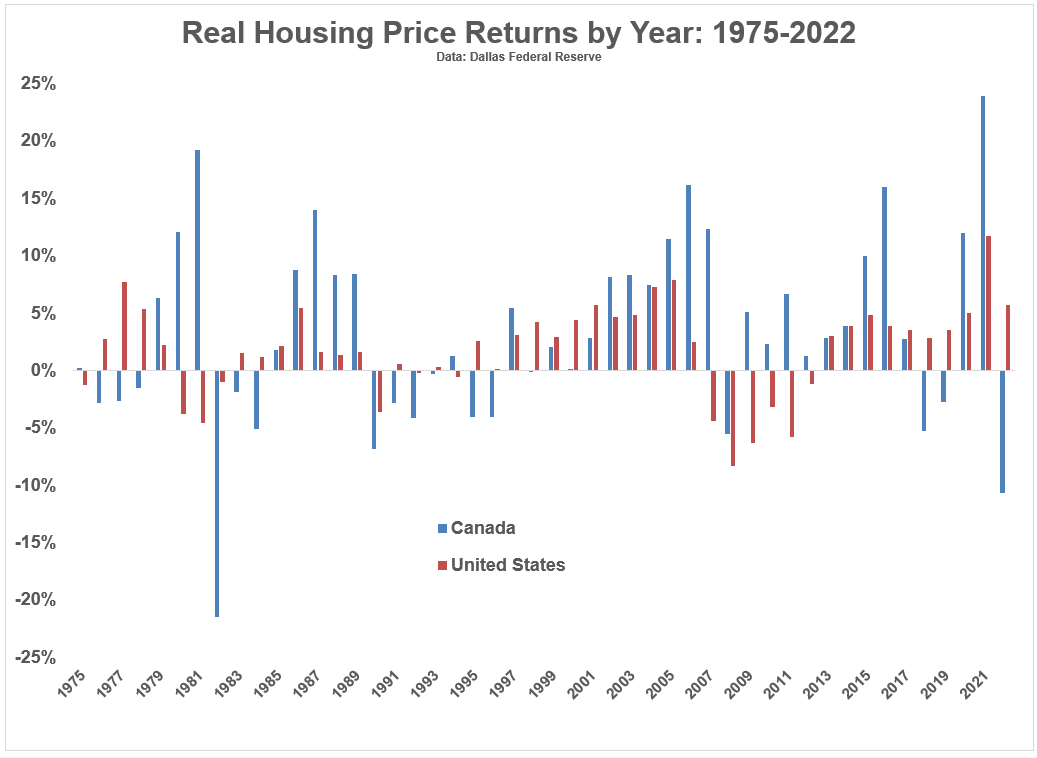

The year-by-year gains and losses stand out here as well:

Bigger gains and bigger losses in Canada. It’s like the S&P 500 versus the Nasdaq 100.

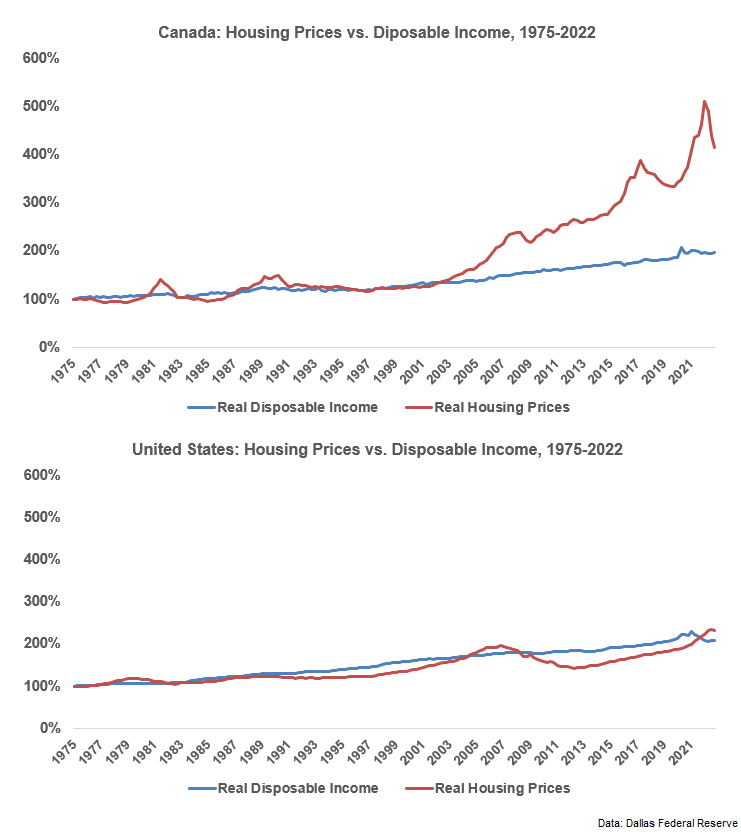

The differences between the two markets look even more stark when you compare the real gains in housing prices to real gains in disposable income over time:

I used the same scale for both to highlight the differences here.

Yes, real housing prices are now growing faster than real disposable income in the United States but that relationship has been relatively stable for the past 50 years or so. Incomes have kept pace with housing prices after accounting for inflation.

But things in Canada have gone completely off the rails over the past 20 years or so. Our kind neighbors to the north are in a completely different stratosphere than we are.

I’m not saying this makes it any easier if you’re looking to buy in the U.S. right now.

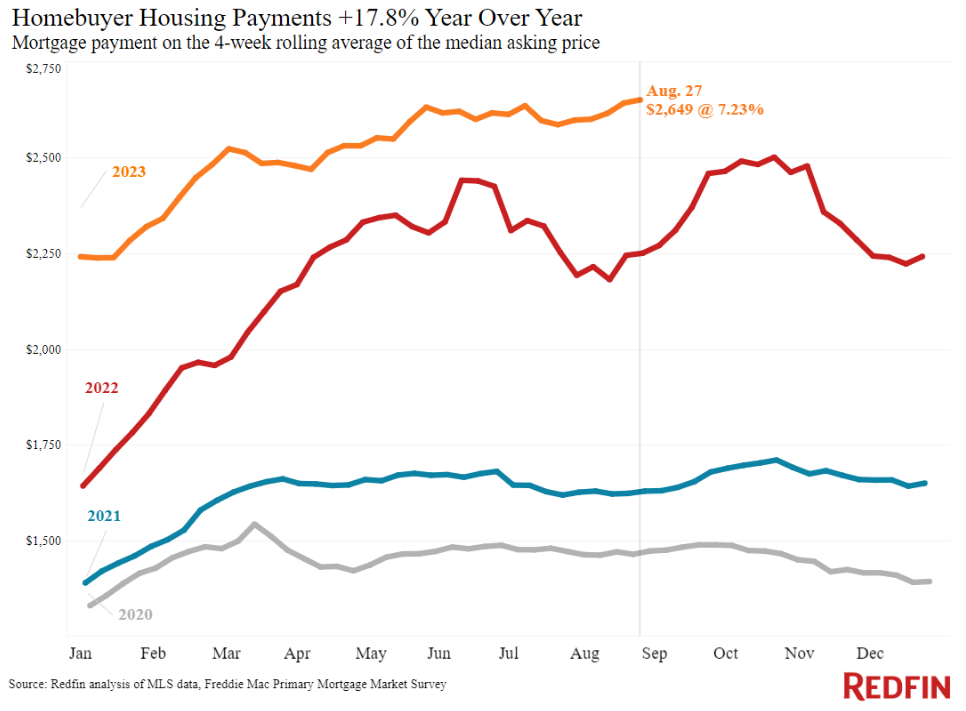

Affordability here is still as bad as it’s ever been. We just hit another new all-time high in average monthly payment (via Redfin):

Just be thankful you’re not trying to buy a house in Canada…it’s even worse there.

Michael and I talked about the insanity of Canadian housing prices and much more on this week’s Animal Spirits video:

We talked about the way the Canadian mortgage market differs from how we do it in the United States on Ask the Compound last month.

Subscribe to The Compound so you never miss any of our wonderful videos.

Further Reading:

Will We Ever See Affordable Housing Prices Again?

Now here’s what I’ve been reading lately:

- What happens if the Lions actually start winning? (The Atlantic)

- 10 million downloads (Reformed Broker)

- Busting 7 common financial myths (Carson Group)

- How to cope with lifestyle creep (Vox)

- Try not to look down the road not taken (Dollars and Data)

- The rise and fall of ESPN’s leverage (Stratechery)

- Who knows how long we have (A Teachable Moment)

Books:

- The Last Good Kiss by James Crumley

- American Prometheus: The Triumph & Tragedy of J. Robert Oppenheimer by Kai Bird & Martin Sherwin

1The Fed doesn’t have updated data through 2023 yet. These numbers are through the end of 2022.