Today’s Animal Spirits is brought to you by Future Proof:

On today’s show, we discuss:

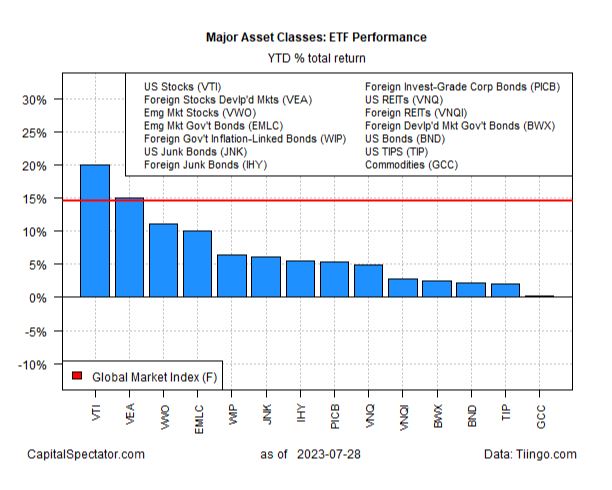

- All major asset classes now posting gains YTD

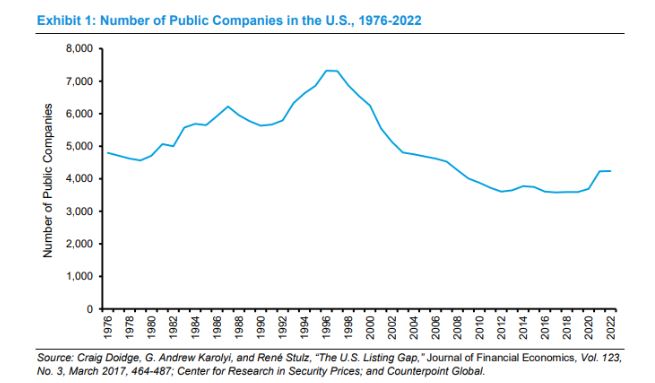

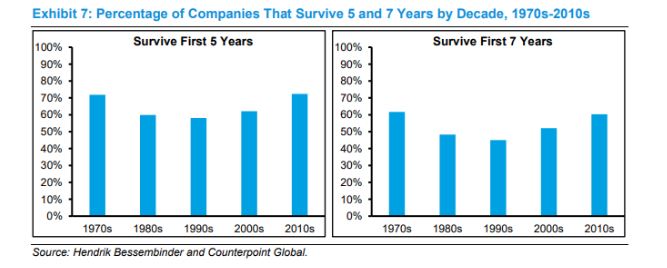

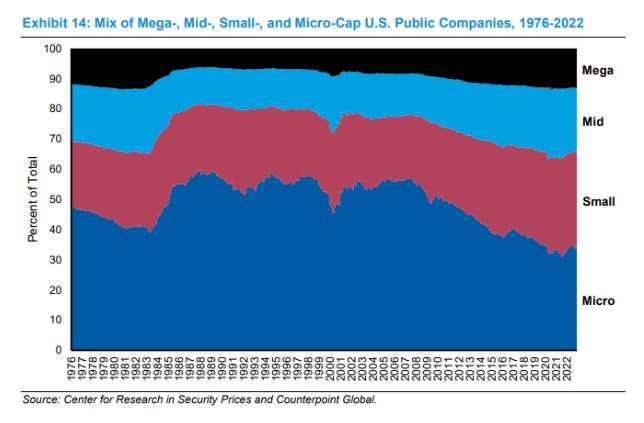

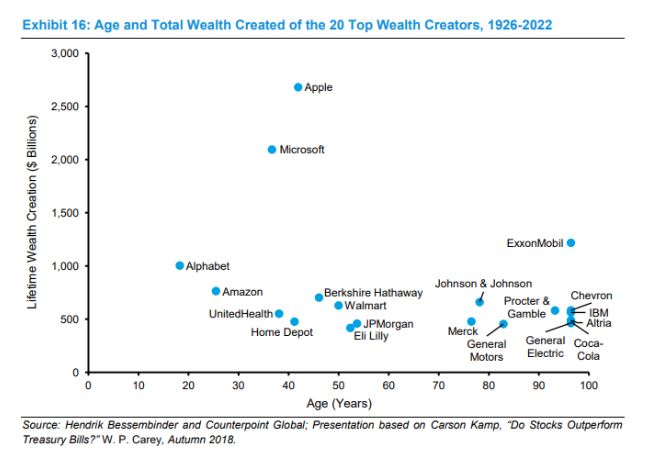

- Birth, death, and wealth creation

- Everyday investors are thriving in a world awash in yield

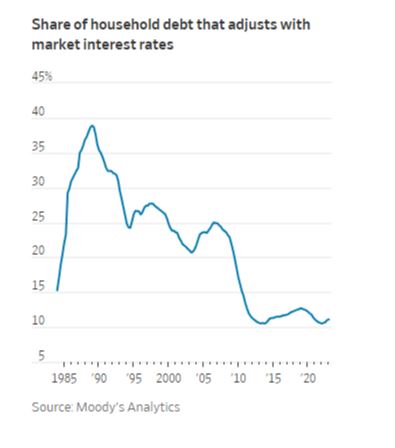

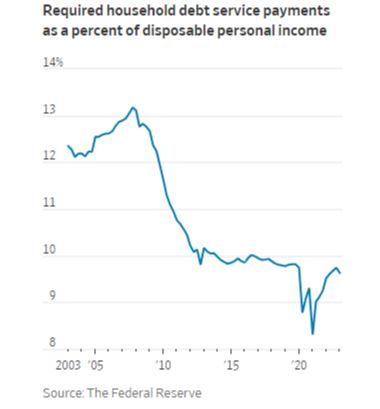

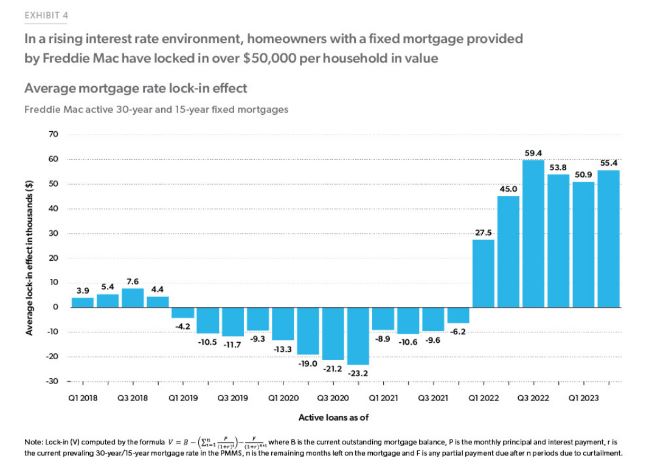

- What Fed hikes? Much of America’s consumer debt is still riding ultralow interest rates

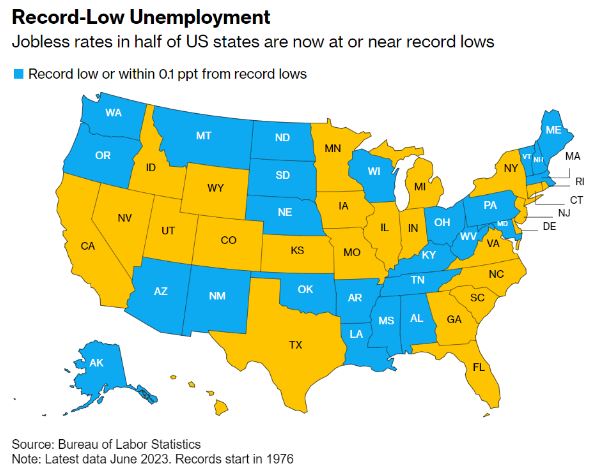

- Unemployment rate at or near record lows in half of US States

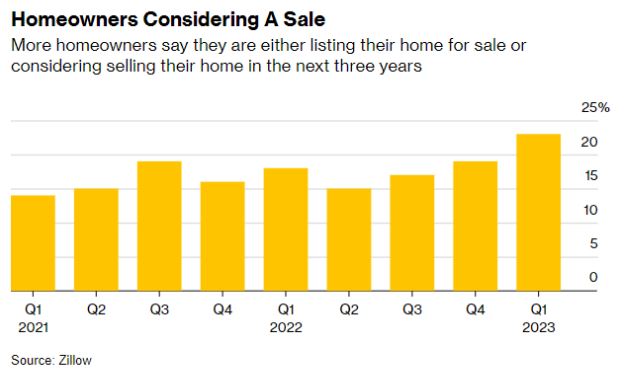

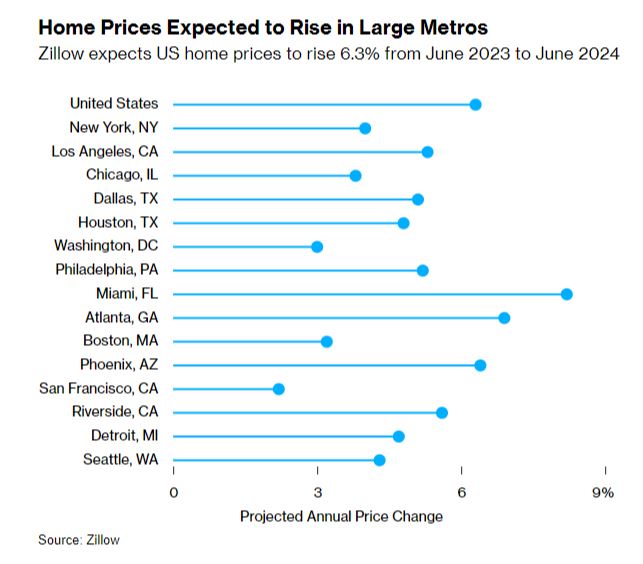

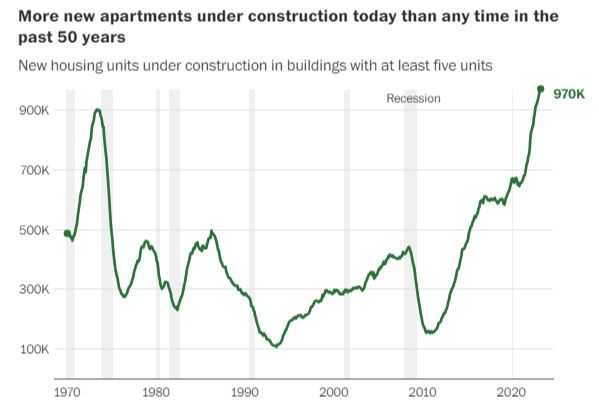

- FreddieMac housing and mortgage outlook – July 2023

- A 5% mortgage rate is seen as tipping point to unlock supply

- Rent is finally cooling, see how much prices have changed in your area

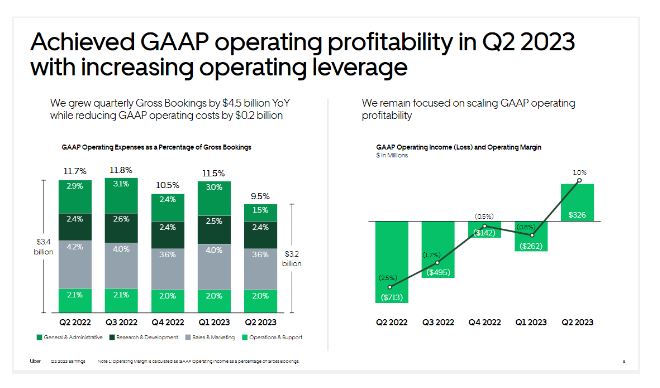

- Uber makes first operating profit after racking up $31.5B of losses

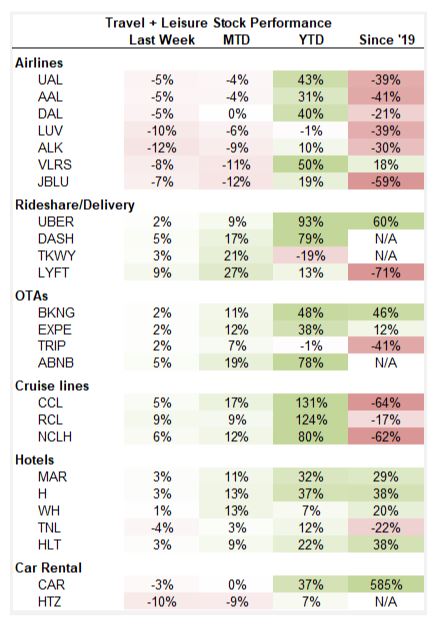

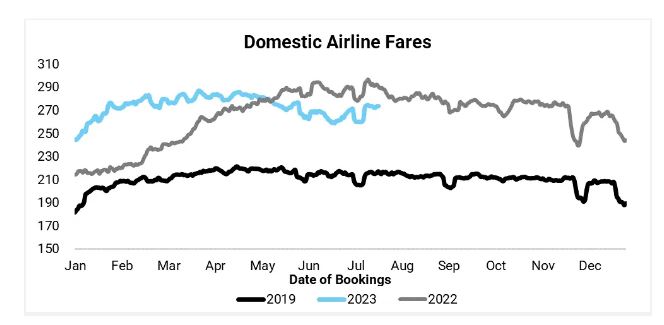

- Travel and leisure demand: Peaking or not?

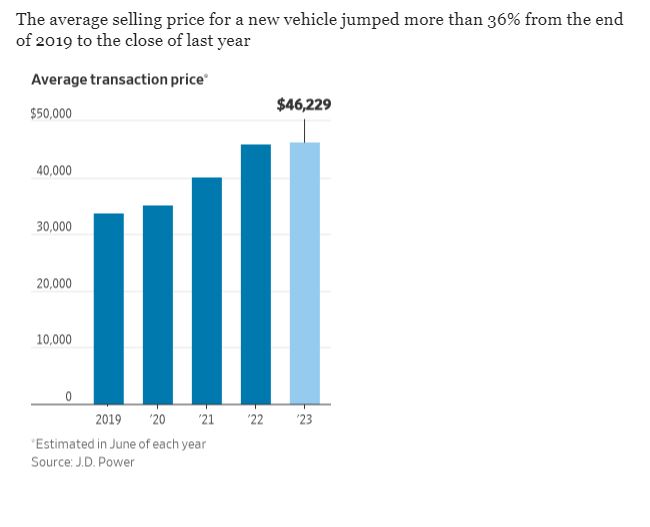

- 5 ways that buying a car has drastically changed

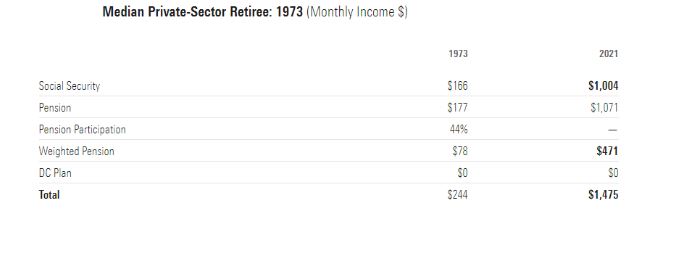

- Retirement in America: Were we better off 50 years ago?

Tropical Bros Shirts:

Listen Here:

Recommendations:

Charts:

Tweets:

Brought to you by @VRGLwealth: @innoutburger at Future Proof!

There are food trucks… and then there are food TRUCKS.

We're bringing the iconic and the best burgers on the West Coast (yeah, we said best) to Future Proof this year.

Drooling yet?! pic.twitter.com/DRCKM55BCo

— Future Proof (@FutureProof_HQ) July 28, 2023

Heading into August, the Nasdaq 100 is up 44% YTD, its best performance through July of any year on record –Dow Jones Market Data

— Gunjan Banerji (@GunjanJS) August 1, 2023

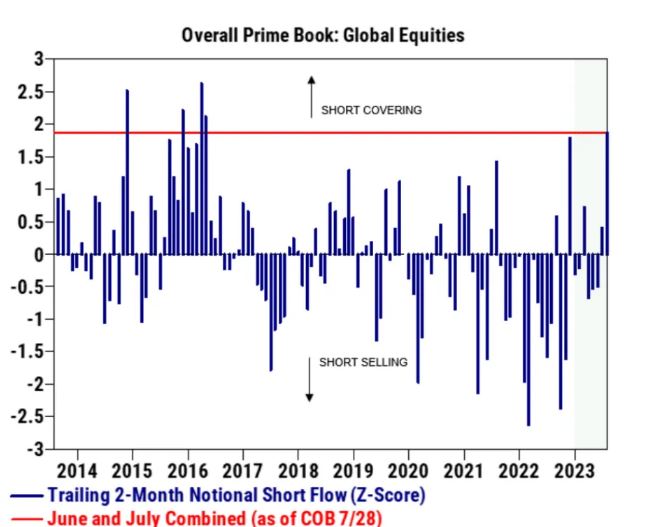

"Fundamental LS managers have experienced 9 consecutive days of negative alpha, the longest period since Jan 2017."

– Goldman Sachs pic.twitter.com/6Kbe4Ej7pk

— Daily Chartbook (@dailychartbook) July 31, 2023

Things that contain an element of truth are often the funniest. pic.twitter.com/VB0hsosaF3

— CMac (@InvestmentTalkk) July 25, 2023

"Buffer" ETFs have taken in over $5b this year, a 23% organic growth rate, now $28b category. BlackRock just launched some too, I underestimated this category, there's clearly a lot of appetite. Innovator (who started them) is on ETF IQ today at 1pm, fyi. pic.twitter.com/9vaoR7AJQA

— Eric Balchunas (@EricBalchunas) July 31, 2023

The US economy has grown by more than $5 trillion since the start of the pandemic in 2020 pic.twitter.com/CAnlcuirFc

— Ben Carlson (@awealthofcs) July 27, 2023

About 0.4pp of Q2’s 2.4% real GDP growth came from construction of manufacturing structures such as factories. The last time factory construction contributed so much to quarterly growth was 1981 Q1. https://t.co/m6EJAOIRSd

— Ernie Tedeschi (@ernietedeschi) July 27, 2023

I'm gonna do takes of Frying Pan Charts in this thread.

here is GDP pic.twitter.com/swXsu03Z8Y

— Alex Williams (@vebaccount) July 30, 2023

The self-checkout at the airport kiosk today asked whether I’d like to tip 15%, 20% or 25%? It is a SELF-CHECKOUT. What is happening?

— Andrew Ross Sorkin (@andrewrsorkin) July 24, 2023

Person A: $500k loan @ 7%, $5000 into retirement per yr. 10% returns. Retirement balance = $822k in 30 yrs

Person B: $500k loan @ 2.5%, $5000 + mortgage savings with 2.5% vs 7% loan into retirement per yr. 10% returns. Retirement balance = $3.5mm in 30 yrs

The Fed wealth divide

— Jake (@EconomPic) July 30, 2023

PE is sitting on a record **$2.2 trillion** in dry powder, which could offset tightening credit –bofa pic.twitter.com/xZ4Z5iuRLb

— Gunjan Banerji (@GunjanJS) July 31, 2023

$SNAP has paid out a total of $8.2 billion in freshly issued stock (SBC) since its 2017 IPO. The company’s market cap today is $16bn, and it has never showed a profit (losing $9.2bn since the IPO).

They invented a literal money printer for themselves. pic.twitter.com/bZj4HneBGl

— Wasteland Capital (@ecommerceshares) July 26, 2023

The Taylor Swift concertgoers spent an average of $1,327 on tickets, costumes, food & drink, and travel pic.twitter.com/9hyKQumR7y

— Kyla Scanlon (@kylascan) July 31, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.