On the first day of my internship working for a group of sellside investment analysts as a senior in college, my boss told me to read the Wall Street Journal from cover to cover every morning.

He said something to the effect of, “You obviously don’t know anything about the markets so start reading…and keep reading.”

Guilty as charged.

He was right. I studied plenty of textbooks in school but essentially entered my final year before graduation with zero real-world knowledge that was applicable to a career in finance.1

I had a lot of catching up to do. Getting a real job made this even more apparent.

So I read every investment book I could get my hands on. Every time I met someone new in the industry I asked them for their favorite 2-3 books on investing. I compiled a list and methodically checked them off one by one.1

I Googled “the 10 best investment books” and read those as well.

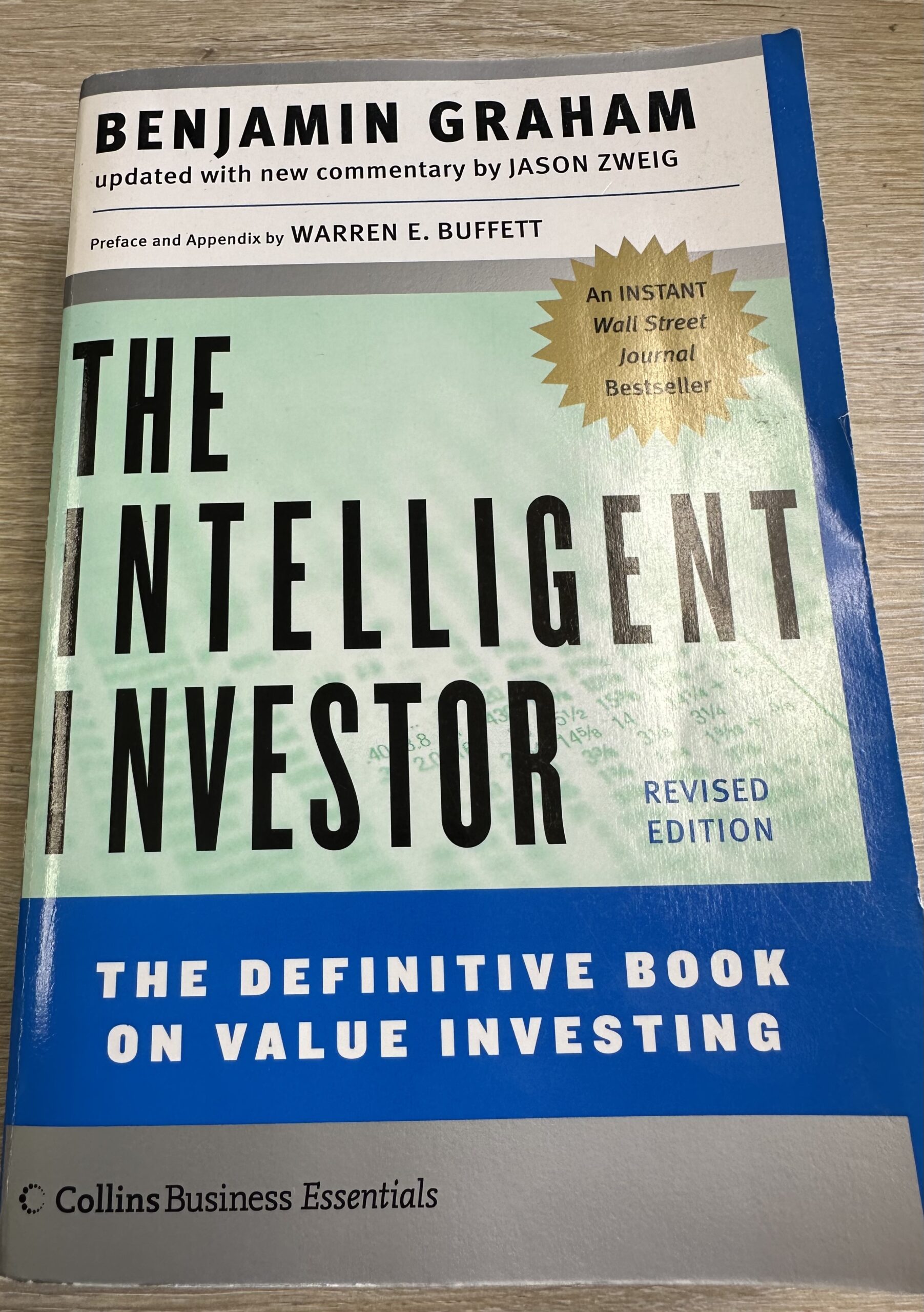

One of the first books I ever bought on Amazon was The Intelligent Investor by Benjamin Graham. I still own that same copy all these years later:

To be honest I probably learned as much from Jason Zweig’s commentary as I did from Graham himself since the book was originally published in 1949.

I didn’t find much use in his talk about railroad stocks but the book was worth its weight in Apple shares for chapters 8 and 20 alone. Graham’s Mr. Market analogy is still one of my favorites to this day and the margin of safety concept applies to so many areas of life beyond investing.

The next logical step after that was reading all of the Buffett books since he was Graham’s protege. Some of my early favorites were The Warren Buffett Way, The Warren Buffett Portfolio, The Making of an American Capitalist and The Essential Buffett.

The biggest problem with reading Buffett when you’re young and impressionable is it all sounds so simple. Just buy good businesses when others are fearful. It’s easy!

It does seem so easy when you read the stories but putting actual money to work makes you realize how hard it is to replicate.

The Graham-Buffett stock-picking bug didn’t last long as Jack Bogle’s message had a much stronger hold over me based on my personality, disposition and actual stock-picking skills (not great).

The thing I liked most about Buffett was not his stock picks or business acumen. Those stories were fun but the thing that really resonated with me about his message was the optimism.

Buffett was constantly preaching about the long-term because he was a big believer in things getting better for corporations and the economy.

I’ve always been a glass-half-full kind of guy so it makes sense his message appealed to me. What’s the point of investing in the first place if you don’t think the future will be better than the past?

It’s also worth noting this was back in the mid-2000s. There were no podcasts or YouTube channels. There were a handful of blogs and newsletters but nothing like there is today. It’s so much easier to learn about the markets today than when I was coming up.

It’s both easier to learn today and easier to go down the wrong path.

There are 3 things you should know about me:

- I’ve never opened a Facebook account.

- I’ve never had a cup of coffee.

- I’ve never been a Zero Hedge reader.

I understand why so many people became so pessimistic following the Great Financial Crisis. A lot of regular people got screwed in 2008 while a bunch of bankers who should’ve gone to jail walked away with millions of dollars.

Unfortunately, the Zero Hedge doomer mentality is so much easier to take for a test drive these days. And not just because it seems more intellectually stimulating, but because those opinions are more readily available.

It’s never been easier to give the end-of-the-world mindset a test drive, especially when you’re young.

Stocktwits had this great tweet recently about a YouTube channel that did just that earlier this year:

I get it.

Millions of new investors entered the market for the first time during the pandemic because people were bored and finally had some disposable income.

Robinhood stated in the company’s S-1 that more than half of the 18 million users on the platform when they went public had opened their first-ever brokerage account with them.

Investing in 2020 and 2021 seemed so effortless. Every stock you bought went up. Every speculative investment vehicle was going bananas.

Alas, the mania didn’t last.

While the stock market went through a run-of-the-mill bear market, investors who went all-in on IPOs, SPACs, high-flying growth stocks and crypto lost 70-90% of their money.

At that point you look for someone, anyone, else to blame. It’s the system or the government or the market or Wall Street that’s the blame. Everything is rigged!

It’s unrealistic to think you can be the next Warren Buffett like so many of my peers did coming up in the investment business. But at least the Buffett message is one based on optimism and the benefits of long-term thinking.

That’s much better than the alternative of going down the rabbit hole of constant crash predictions, pessimism and doom & gloom.

Michael and I talked about Buffett, Graham, doomers and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

9 Underrated Investment Books

- 5 thoughts on career-related things (Young Money)

- Return on hassle (Dollars and Data)

- Is FIRE realistic for young people? (Monevator)

- The pros and cons of buying a Porsche (Money with Katie)

- Imagine going on vacation and being unhappy the whole time (Jared Dillian)

- Is the vibesession over? (Kyla Scanlon)

Newsletters:

Books:

And check me out on the Mind Your Money Podcast with Morgan Housel and Doug Boneparth.

1Realizing how much I didn’t know was probably one of the best things that could’ve happened for my career.