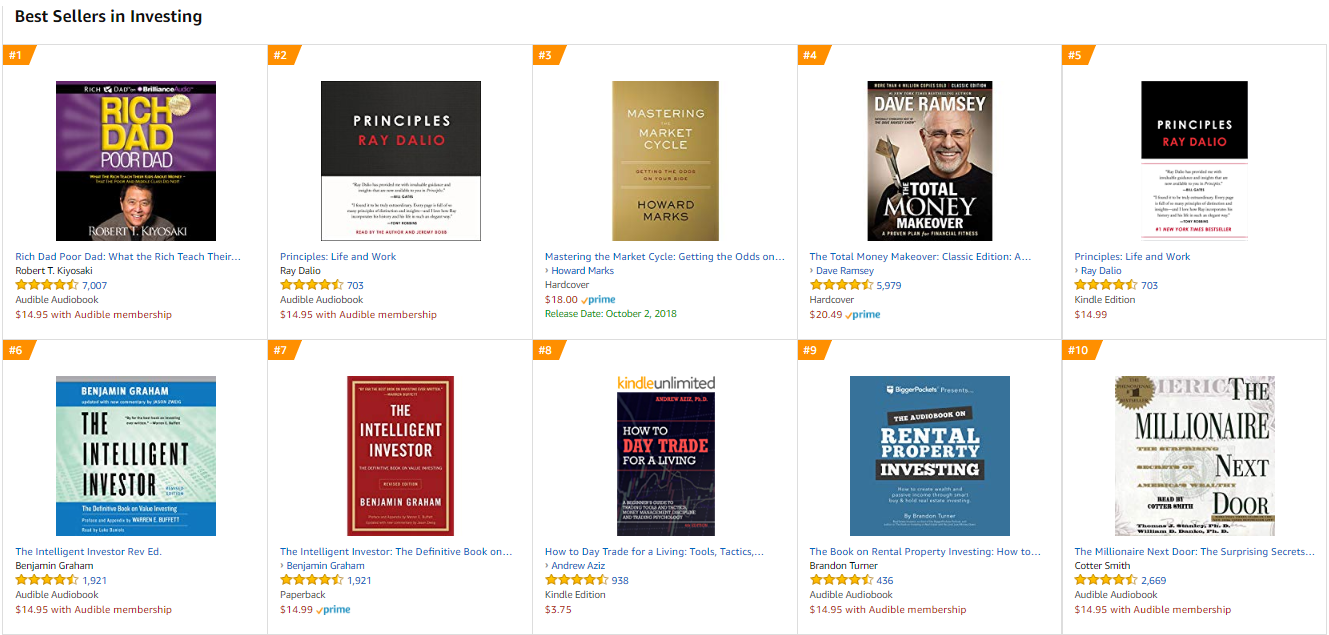

I was looking at the best-selling investing books on Amazon the other day and it always amazes me how old some of the books are on this list:

Rich Dad, Poor Dad was published in the 1990s. The Intelligent Investor was originally published in 1949. The Millionaire Next Door was 1996. Dave Ramsey’s book came out in the early-2000s and even the new Dalio and Marks books are really collections of previous letters or principles they’ve already published.

And who could forget the Warren Buffett classic How to Day Trade For a Living?

Okay, Buffett didn’t write this but the fact that it’s on the list is a good sign the behavior gap will never go away.

It makes sense that the best-selling books in this category would remain the best-selling books because financial advice doesn’t really change over time. But when everyone reads the same exact investment books about being a contrarian it seems to become more difficult to be an actual contrarian anymore.

I’m asked often for recommendations of my favorite investment books. Over the past few years, I’ve tried to shy away from the classics because everyone has already read the classics. With that idea in mind, here’s a list of 9 investment books, in no particular order, that are highly underrated:

1. The Money Game by Adam Smith

I never see this one on the list of investment classics but it should be. It could be because the book came out in 1967, right before a long stretch of horrible market performance.

Adam Smith aka George Goodman is one of the best financial writers I’ve ever come across. This is one of my favorite passages from the book, which ends with a quote many people have used over the years:

A series of market decisions does add up, believe it or not, to a kind of personality portrait. It is, in one small way, a method of finding out who you are, but it can be very expensive. That is one of the cryptograms which are my own, and this is the first irregular rule: If you don’t know who you are, this is an expensive place to find out.

Goodman also stated, “The stock doesn’t know you own it.” The book is filled with stories, anecdotes and quotes like this that help put the markets and human behavior in the markets into perspective.

2. Bull: A History of the Boom and Bust, 1982-2004 by Maggie Mahar

There are plenty of books that focus on the historical accounts of market manias and crashes. But few historical finance books give you a deep dive on the periods of prosperity and calm that can lead to the booms and busts. This is an incredible account of the 1980s and 1990s bull market. Both the stories and statistics in this book do a wonderful job painting the picture of what it was like to be an investor during this phenomenal run in the markets and why it wasn’t always as easy as it looks after the fact.

3. What I Learned Losing One Million Dollars by Jim Paul & Brendan Moynihan

Most business and investing books take a success story and work on reverse engineering that success for you. There’s always a fair amount of hindsight bias in these cases and most of the time it’s impossible to re-create that lightning in a bottle. Stories of failure are far more helpful than stories of success because everyone can learn how to fix or avoid mistakes but not everyone has what it takes to be the best in their field.

This book tells the story of an investor who failed precisely because he won big early in his career. There’s a big focus on the emotions that come with gains or losses in the markets and I love the spin Paul and Moynihan put on the human condition:

Emotions are neither good nor bad; they simply are. They cannot be avoided.

It’s one of the few investing books I’ve ever had a hard time putting down.

4. Investing: The Last Liberal Art by Robert Hagstrom

I first came across Hagstrom through the various Buffett books he wrote: The Warren Buffett Way, The Warren Buffett Portfolio (my personal favorite), and The Essential Buffett. This one is more in the Charlie Munger camp and deals with the idea of building mental models in a number of different fields.

It provides an education at a high level in physics, biology, social science, psychology, philosophy, and literature. There’s also a substantial reading list for big book heads that I’ve revisited a few times over the years.

5. All About Asset Allocation by Rick Ferri

There are plenty of books about stock picking but few that delve into portfolio construction, asset allocation, and risk management. Ferri is wicked smart and explains this stuff in a manner that’s useful to investors of all shapes and sizes. This is one of the best books I’ve ever read on asset class investing.

Here’s a favorite line: “No portfolio guarantees success, but a plan never implemented is sure to fail.”

6. The Investor’s Manifesto by William Bernstein

Bernstein’s The Four Pillars of Investing is probably his most well-known book but Manifesto is just as good. He makes sure to mix personal finance and investing because there’s no way to invest coherently without considering your personal finances. I had never seen the benefits of saving early put quite like this before but this is a powerful reminder:

Each dollar you do not save at 25 will mean two inflation-adjusted dollars that you will need to save if you start at age 35, four if you begin at 45, and eight if you start at 55. Since a 25-year-old should be saving at least 10% of his or her salary, this means that a 45-year-old will need to save nearly half of his or her salary.

7. The Little Book of Behavioral Investing by James Montier

Montier wrote one of the most succinct behavioral finance books I’ve ever read. It’s just a tad over 200 pages but it’s literally a small book so you could breeze through it in a weekend.

Montier has a clear disdain for Wall Street and I love his tongue-in-cheek 3 self-serving principles for stock-broker research:

Rule 1: All news is good news (if the news is bad, it can always get better).

Rule 2: Everything is always cheap (even if you have to make up new valuation methodologies).

Rule 3: Assertion trumps evidence (never let the facts get in the way of a good story).

This book is full of behavioral studies that make you think.

8. More Money Than God by Sebastian Mallaby

I’ve re-read multiple parts of this book over the years. It’s part market history lesson, part history of hedge funds, and part profiles of some of the greatest investors of all-time. I especially enjoyed the stories about Michael Steinhardt and Ken Griffin.

9. Inside The Investor’s Brain by Richard Peterson

This is one you don’t hear too much about when discussing the best behavioral psychology books about investing but it’s right up there for me. I especially love his work on the 5 principles of panic and fear.