Last week Robinhood filed their S-1 to register for an IPO.

Here’s the good and bad of it:

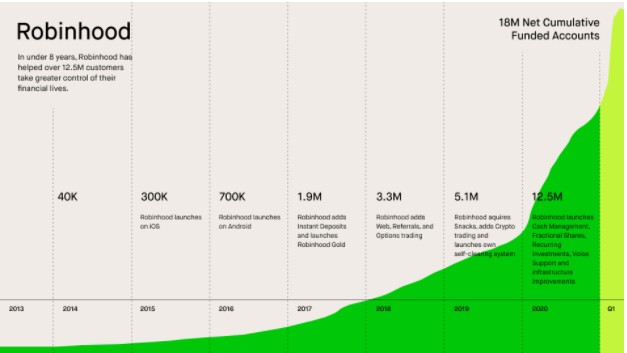

This seems good: Robinhood now has close to 18 million active users on its platform and manages around $80 billion in assets. More than half of those 18 million customers said this was their first-ever brokerage account.

And Robinhood believes close to 50% of all new retail funded accounts opened in the U.S. between 2016 and 2021 were done so on its platform.

Robinhood has gotten millions of young people involved in the markets.

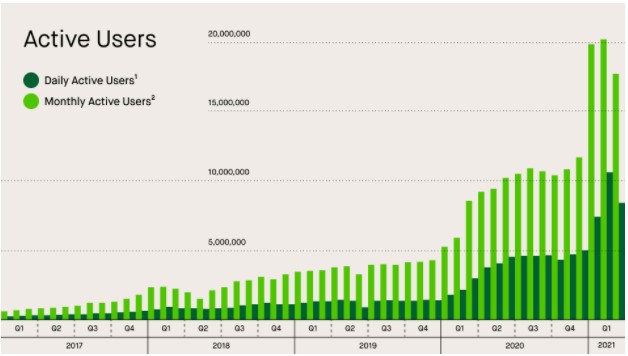

This seems bad: Nearly 47% of those users use the product on a daily basis. That’s basically just below the most successful social media companies.

Among those customers who visted the app on a daily basis, the average number of visits was seven per day.

There’s an old saying that successful investing should be like watching paint dry. I’m not exactly sure you’re supposed to check the dryness of the paint that many times a day.

More than 98% of users use the app on a monthly basis.

This type of engagement and usage is insanely high for an investment product.

This seems good: Robinhood’s customer growth numbers are off the charts in the past 15 months:

There are many reasons for this but people have decided they are now interested in the markets in a big way.

This seems bad: This growth is coming at a cost. Robinhood just paid a $70 million fine to FINRA for outages and misleading their clients, the largest such fine ever enforced.

The company is also subject to 15 putative class action lawsuits at the moment. I would expect that number to grow in the years ahead as their growth outstrips the company’s ability to deal with problems.

This seems good: Robinhood estimates they provided customers $1.5 billion in price improvements and saved as much as $1.6 billion in crypto transaction fees from January 2020 through March 2021.

Thank you free commissions.

This seems bad: Robinhood is making a lot of money on its customer assets. They made $959 million in total revenue in 2020 (up from $278 million in 2019). In the first quarter alone they made $522 million (up from $128 million in Q1 2020).

It’s good for business if Robinhood’s customers trade more and pay higher spreads. This was a risk factor listed in the S-1:

Because a majority of our revenue is transaction-based (including payment for order flow, or “PFOF”), reduced spreads in securities pricing, reduced levels of trading activity generally, changes in our business relationships with market makers and any new regulation of, or any bans on, PFOF and similar practices may result in reduced profitability, increased compliance costs and expanded potential for negative publicity.

The more you trade, the more they make.

Typically, the more people trade, the less they keep.

This seems good: Professional investors keep proclaiming “this won’t end well” but so far Robinhood customers are doing just fine for themselves. Robinhood estimates customers have seen appreciation of $25 billion on their assets through the end of March 2021.

That’s not bad considering there is $80 billion on the platform.

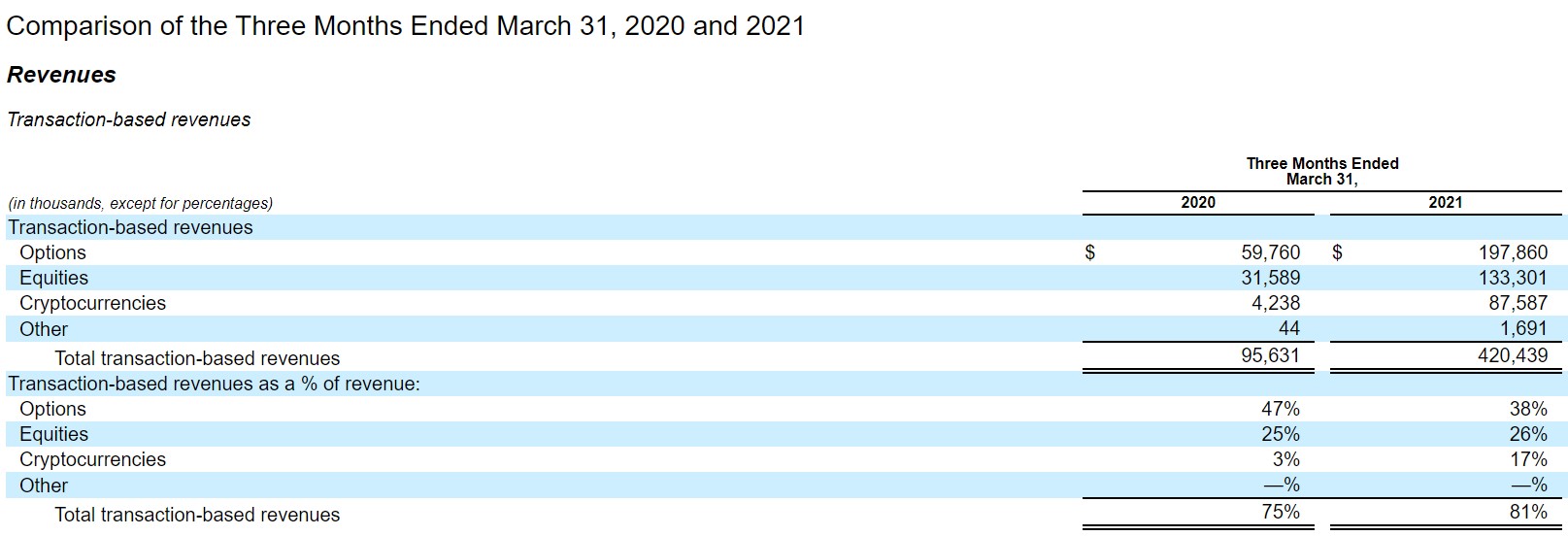

This seems bad: Robinhood is making a lot of money on options. Here is the breakdown for revenues by asset:

Although options make up less than 3% of assets on the platform, they accounted for 47% of transaction-based revenues in 2020 and 38% of transaction-based revenues in the first 3 months of this year.

They are making a killing on options. Never say never, but I’m guessing most of their customers won’t be able to say the same thing over the long haul.

This seems good: When the stock comes public (under the ticker HOOD), 20-35% of shares will be allocated to Robinhood customers. This is a win for the democratization of investing narrative they are playing up.

I’m glad they’re doing this.

This seems bad: This was another risk factor listed in the S-1:

Our customers may be able to purchase shares of our Class A common stock offered by this prospectus from RHF, acting in its capacity as a selling group member in this offering. Any negative experiences our customers have in connection with their participation or attempted participation in this offering may harm our brand and reputation, as well as our business, financial condition and results of operations. In addition, our customers’ participation in this offering could result in increased volatility in the trading price of our Class A common stock.

Basically, if Robinhood messes this up it could present a risk for their stock price. And since Robinhood customers trade a lot it could add volatility to HOOD shares.

Bizarrely, this volatility would actually help Robinhood’s bottom line. Moving on.

This seems good: Robinhood has around $5.4 billion in margin for their clients. That’s less than 7% of total assets, far lower than I would have thought based around the idea that traders generously apply leverage in their portfolios these days.

This seems bad: Dogecoin, the meme cryptocurrency, was actually listed as a risk factor by the company:

A substantial portion of the recent growth in our net revenues earned from cryptocurrency transactions is attributable to transactions in Dogecoin. If demand for transactions in Dogecoin declines and is not replaced by new demand for other cryptocurrencies available for trading on our platform, our business, financial condition and results of operations could be adversely affected.

Ugh.

Robinhood also noted clients held approximately $12 billion in crypto assets yet in the first quarter of 2021, $88 billion of crypto was traded on the platform. That’s an enormous turnover number.

This probably says as much about crypto investors as it does Robinhood clients but that’s not necessarily a good thing.

This seems inevitable: It appears trading on your smartphone is here to stay:

We observe a similar trend in the equity markets, where 30% of retail investors in the United States place orders using a mobile app, according to 2018 FINRA surveys. That number grows to 59% when looking solely at participants aged 18-34. Innovative technology-based companies are challenging traditional norms and engaging people in new ways.

I have mixed emotions about these stats and Robinhood in general.

I am a customer at Robinhood. They do legitimately have one of the best user experiences of any finance company around. It’s so easy and intuitive to use.

But I’m a long-term investor so I don’t use it all that often. I’m not speculating on dog coins or YOLOing options.

Most things in life are about trade-offs.

It’s a wonderful thing Robinhood has gotten so many new speculators investors involved in the markets. And the company single-handedly forced every other brokerage into lowering commissions to zero.

However, people always drink more at an open bar.

Robinhood isn’t forcing anyone to trade options or crypto or stocks all the time. People can make their own choices.

I do worry that Robinhood’s business model is incentivized to nudge their customers into reckless trading strategies that will make the company more money.

Just because you can trade for free doesn’t mean investing should be a free-for-all.

Either way, Robinhood is now a massive company that is only going to get bigger.

Further Reading:

Will Robinhood Become the Facebook of Finance?