Finance is like fashion.

Wait long enough and the same arguments come back in style.

We have the same quarrels about finance topics every few years.

The death of the 60/40 portfolio.

Is this the top (or bottom)?

Another one that’s cropped up again this year is are the market’s gains too concentrated?

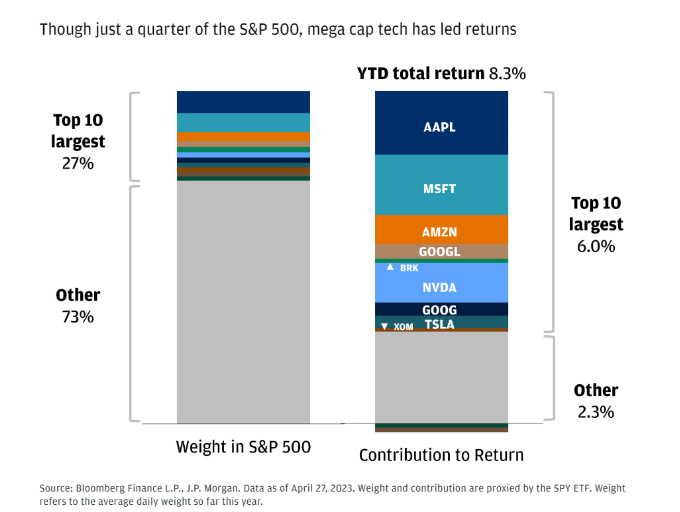

Here’s a look at the outsized impact of mega cap tech stocks in the first quarter courtesy of JP Morgan:

The 10 largest stocks were responsible for more than 70% of the gains through the first three months of the year.

Should this worry you as an investor?

Are this year’s gains a house of cards?

Is this normal?

All legitimate questions.

The S&P 500 has certainly become more top-heavy over the years.

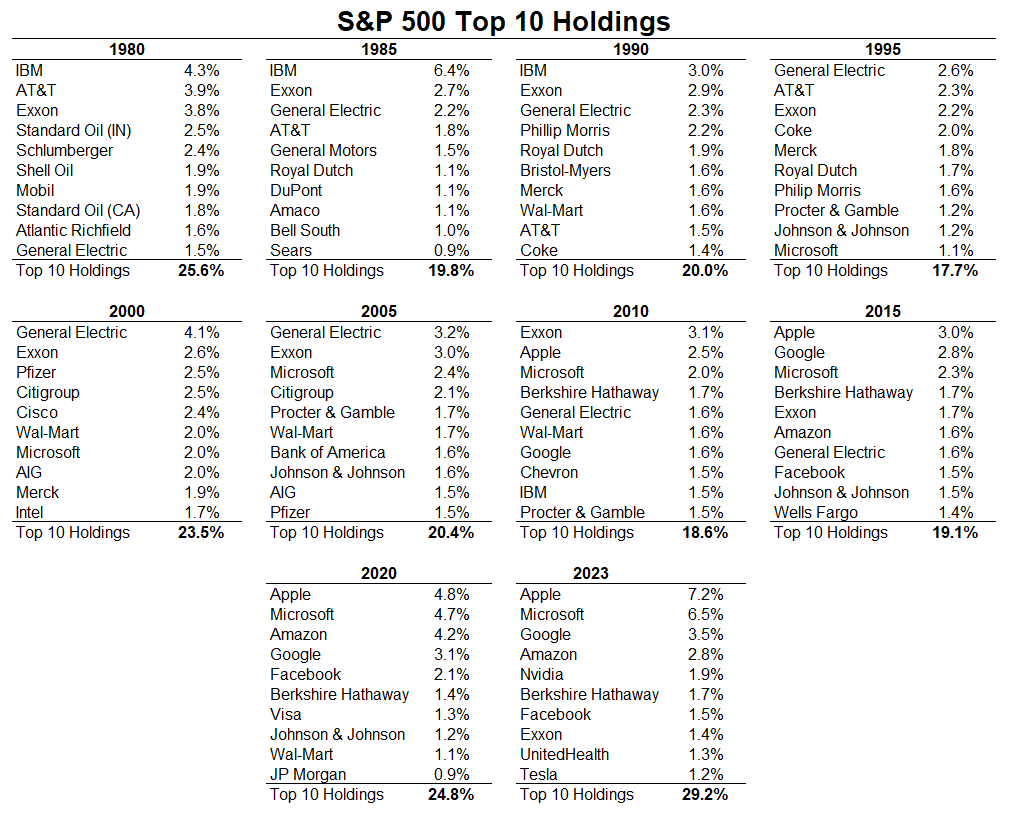

Here are the top 10 stocks by market cap every 5 years starting in 1980 including an update with the current weightings:

These things ebb and flow over time but nearly 30% in the top 10 holdings right now is as high as it’s been over the last 40+ years.

It’s also worth pointing out how much turnover there has been over time. There are a select few stocks that stay atop the leaderboard for multiple decades (GE, Microsoft, Exxon, Wal-Mart) but change is the only constant.

The fact that Apple makes up more than 7% of the index with a market cap stands out as well.

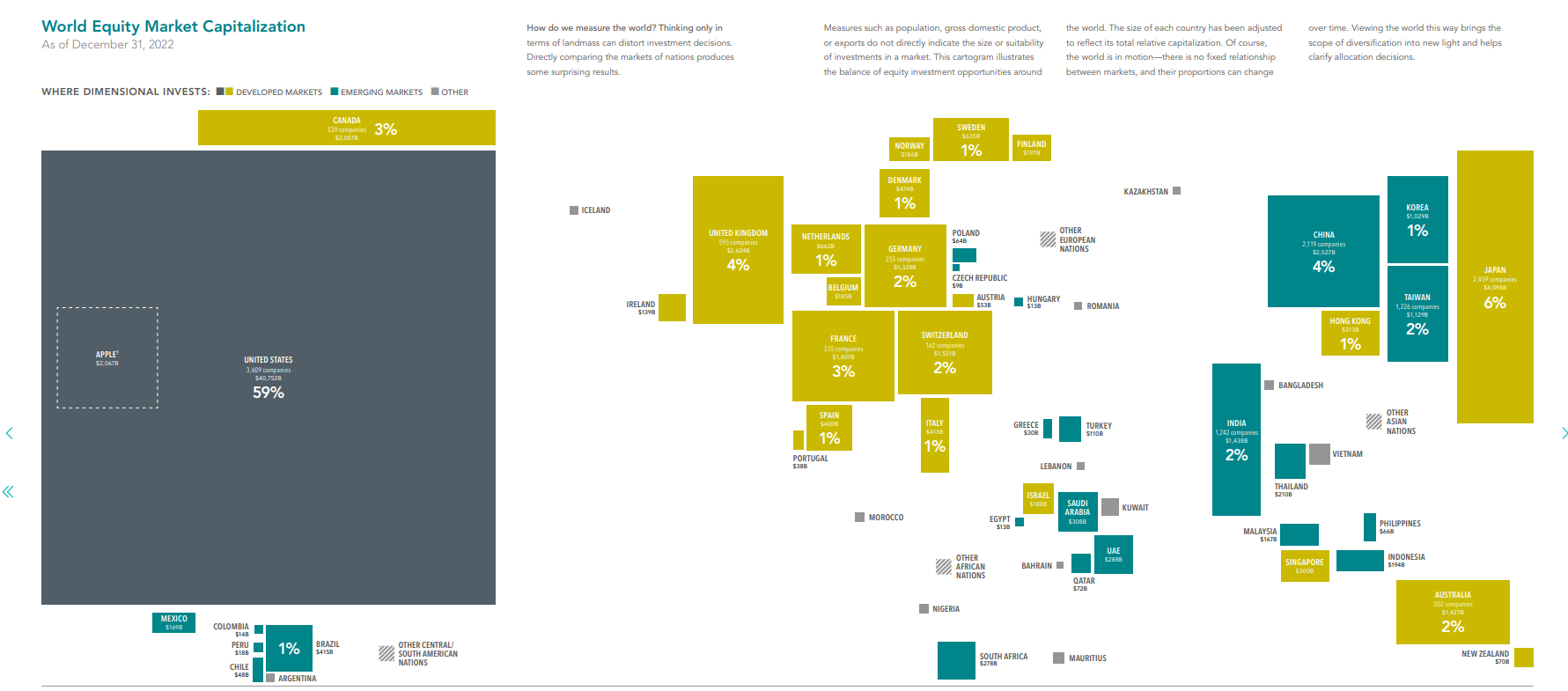

The annual DFA Matrix book takes a look at the market caps of country stock markets around the globe:

To put Apple’s size in perspective, the company’s $2.6 trillion market cap is the same size as the entire UK stock market, which is comprised of 595 companies. Apple has a bigger market cap than Germany’s stock market and is 65% of Japan’s market cap.

Microsoft, at $2.3 trillion, isn’t too far behind.

The market is more concentrated now than it’s been in some time but it’s not out of the ordinary for the biggest companies to dominate the stock market at times.

Jason Zweig once shared that AT&T made up 13% of the U.S. stock market in the early-1930s. General Motors was 8% of the market in 1928 and IBM had a 7% weighting in 1970 (it was close to that again by 1985).

So this happens.

A lot of this depends on how you look at risk.

Is it really risky to have some of the biggest, best companies in the world carrying the stock market?

Would you prefer the smallest, junkiest companies lead the way?

It’s also true that the rest of the stock market is still holding up despite the fact that the biggest stocks are doing so well.

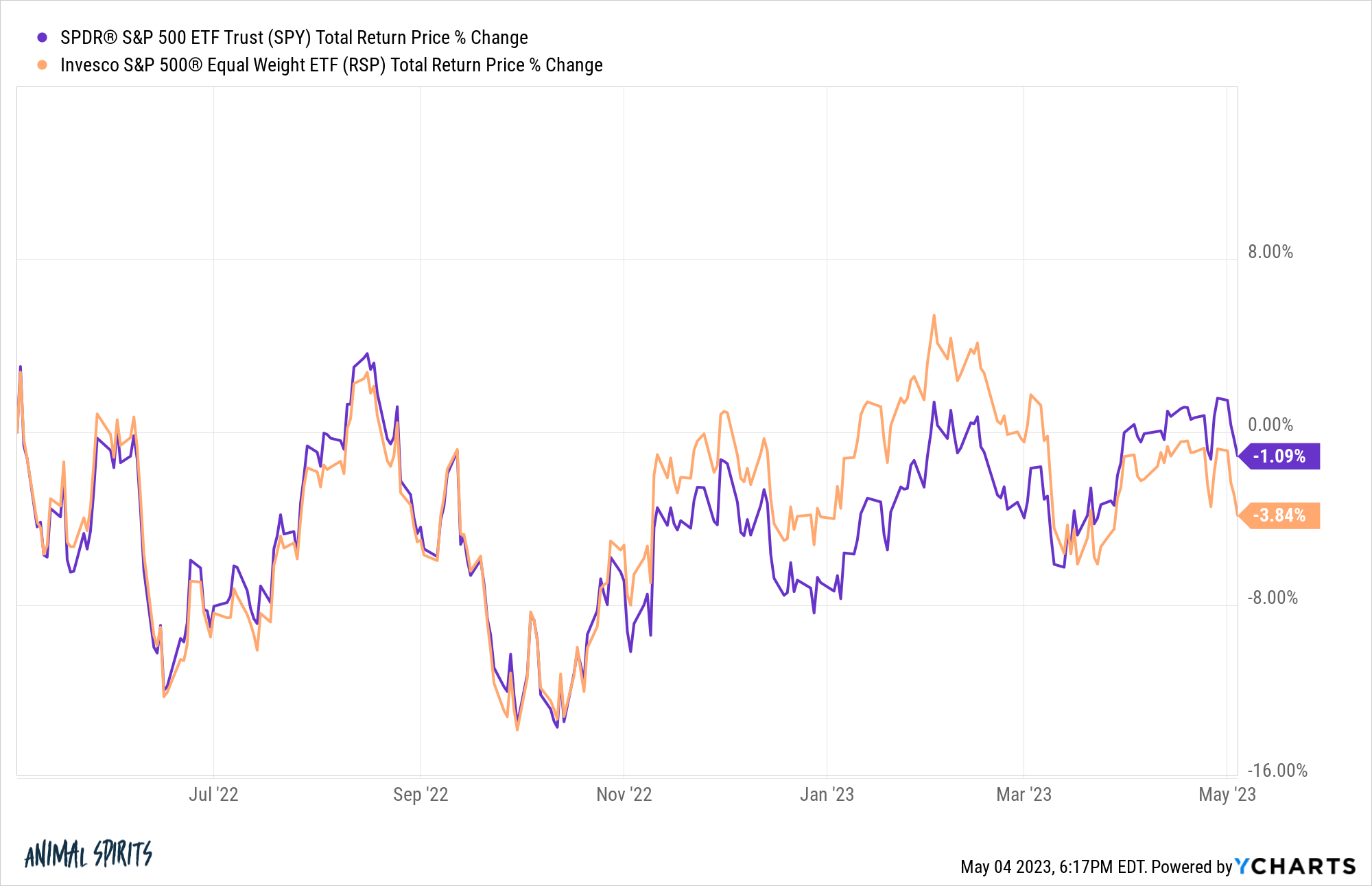

This is a look at the equal-weighted S&P 500 versus the market-cap-weighted S&P over the past year:

The biggest stocks are helping the S&P 500 but it’s not a huge difference.

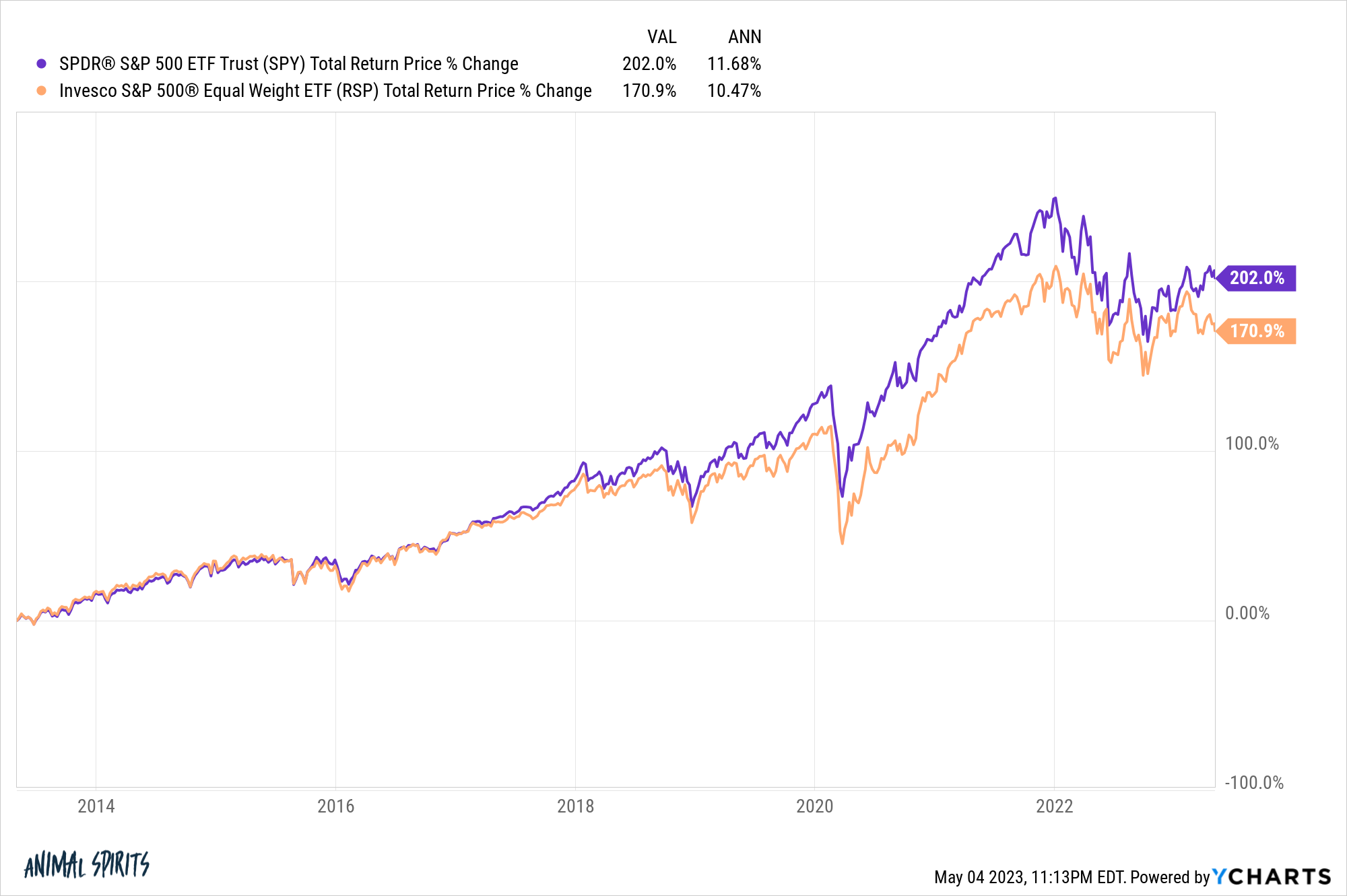

Returns over the past 10 years things are a little more pronounced but still not egregious:

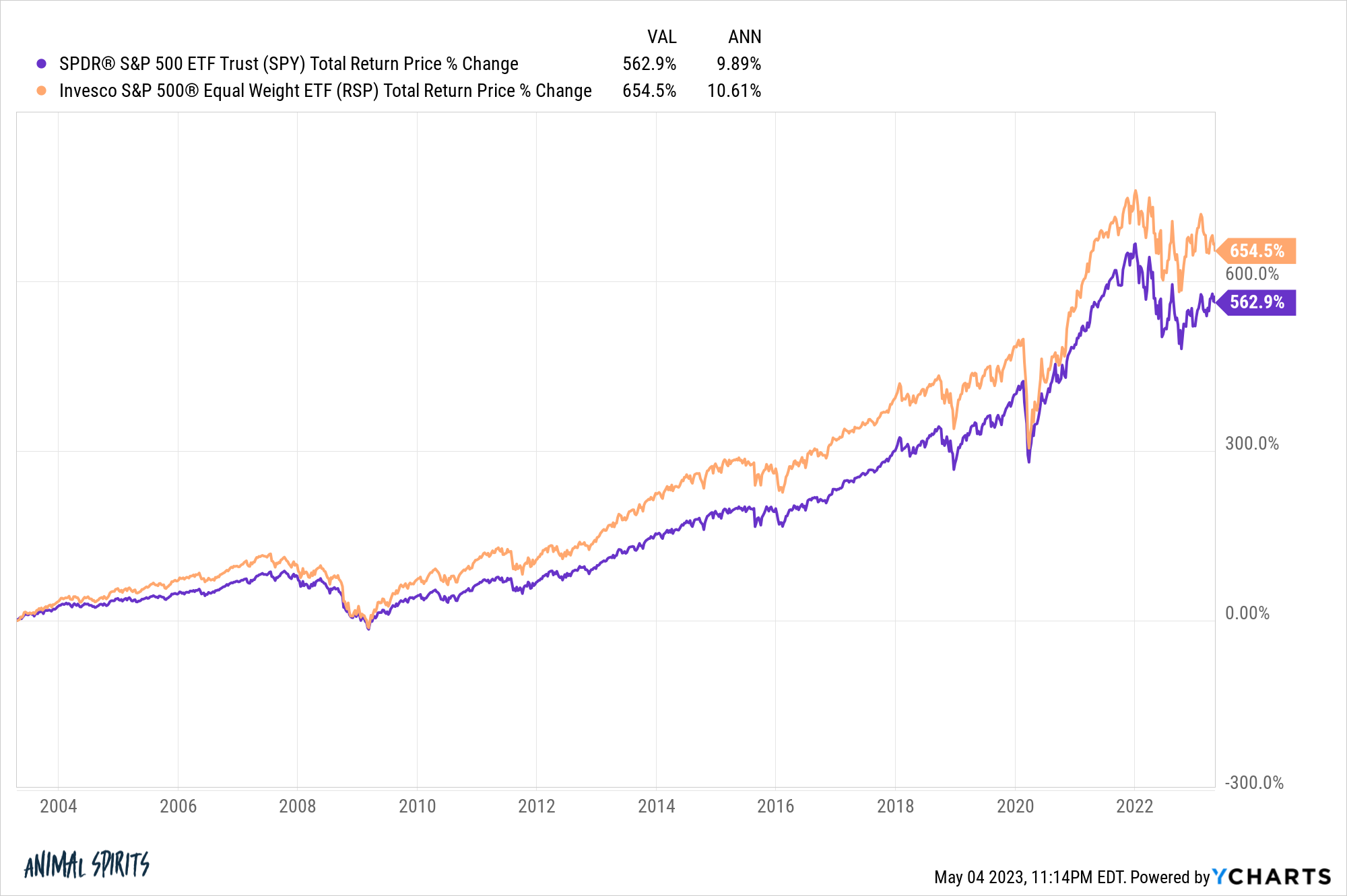

But since the mid-2000s the equal-weighted version has actually done better:

This is a good reminder that you can win just about any argument about the markets by changing your start or end dates but the point is sometimes the biggest stocks carry the day and sometimes it’s a more balanced market.

There’s a big difference between a market-cap-weighted index like the S&P 500 that will always be a little top-heavy and an actual concentrated portfolio.

Gunjan Banerji at the Wall Street Journal profiled a handful of individual investors to pick up some lessons people have learned from this bear market.

This one stood out the most to me:

Do Kim, a 46-year-old accountant in Bucks County, Pa., was all-in on stocks such as Nvidia Corp. and Tesla, building up a combined position in the two companies of more than $2 million, he says. He enjoyed tracking the companies and hung on everything Elon Musk and Nvidia Chief Executive Jensen Huang said. He dove into other stocks, including those of the insurer Lemonade Inc. and Palantir Technologies Inc., while trading options in a bid to juice his returns.

He watched his portfolio skyrocket—until 2022, that is. Throughout the year, he says he was hit with calls from his brokerage firm to post more cash to cover trades he had put on with borrowed money, or options trades that had soured.

Mr. Kim says he ended up losing all of the money he made since the start of the pandemic, accumulating losses of more than $1 million in his brokerage account that even ate into his initial investment. The losses were stressful. At times, he skipped vacations with family to spend time trading and keeping an eye on his portfolio.

“I feel like I lost many years of my life,” Mr. Kim says. “I had so many sleepless nights.”

This is the kind of thing you can’t get from a Warren Buffett or Charlie Munger quote.

Going all-in on a couple of stocks sounds wonderful until you are forced to live with the volatility inherent in concentration.

Sure, a concentrated investment stance gives you a better chance of looking different than the index but that works in both directions.

I’m not sure I’ve ever heard of anyone skipping family vacations because of investments in index funds.

The S&P 500 still has more than 70% of its stocks outside of the top 10 holdings.

And the good news is it’s never been easier to diversify beyond the S&P 500 if you are worried about Apple and Microsoft making up nearly 14% of the index.

Michael and I talked about concentrated positions and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Are 5 Stocks Really Carrying the Entire Stock Market?