Today’s Animal Spirits is brought to you by Kelly ETFs:

See here for more information on Kelly ETFs and here for our prior conversation with Kevin Kelly, Founder, and CEO of Kelly ETFs on CRISPR Technology.

On today’s show, we discuss:

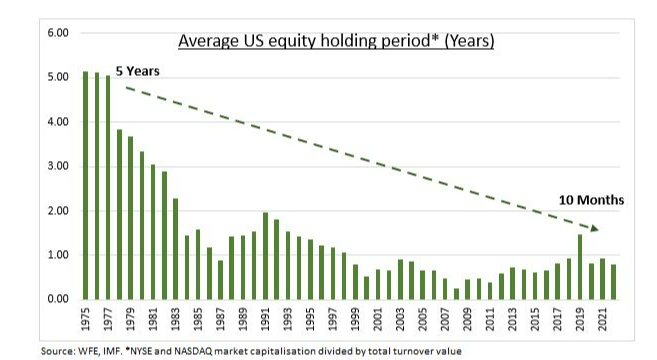

- Rush into meme stocks, zero-day options fuels latest frenzy in the Wall Street casino

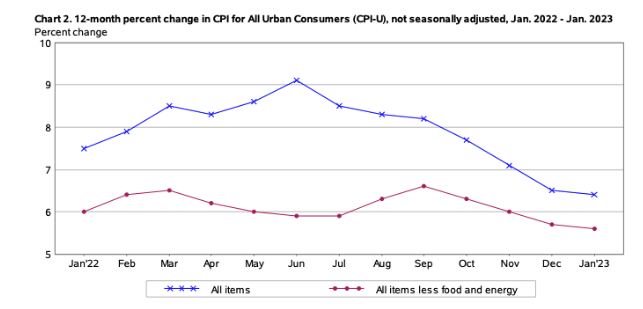

- Why investors are piling into funds that promise not to beat the stock market

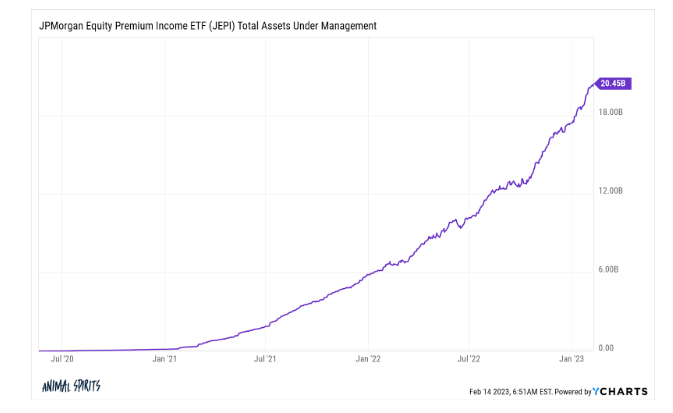

- The costs of rising short-termism

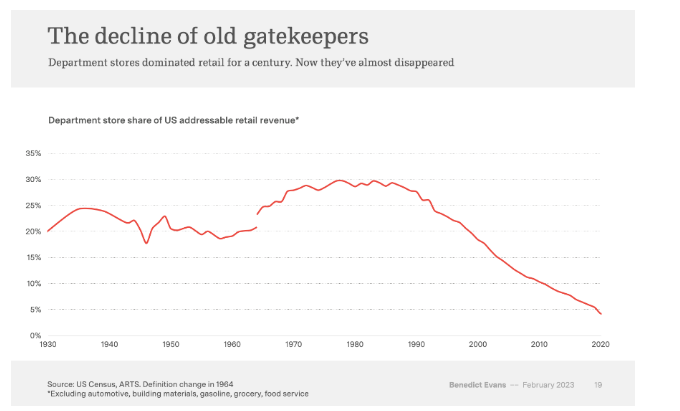

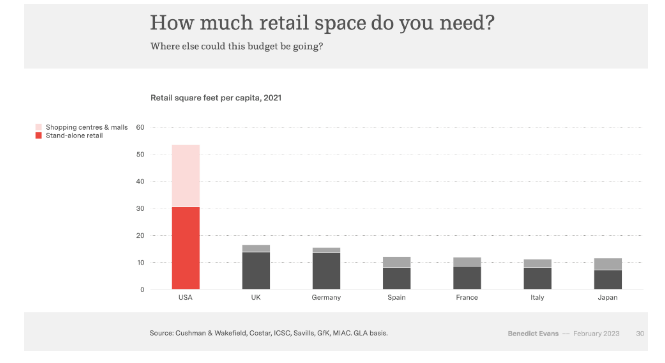

- The New Gatekeepers presentation via Benedict Evans

- Microsofts LinkedIn lays off staff amid hiring slowdown

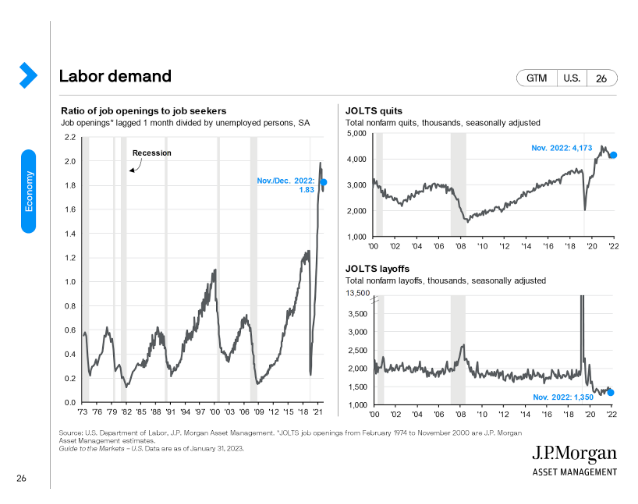

- Mass layoffs or hiring boom? What’s actually happening in the jobs market?

- Kracken down: statement on SEC v Payward Ventures, Inc.

- The secret to financial stability is growth

- When it’s easy to be a landlord, no one wants to sell

- Half in the US say they are worse off, highest since 2009

- The Fleishman Effect

- American cars are getting too big for parking spaces

- Warner Bros. Discrover to keep Discovery+ in strategy shift

Listen here:

Recommendations:

Charts:

Tweets:

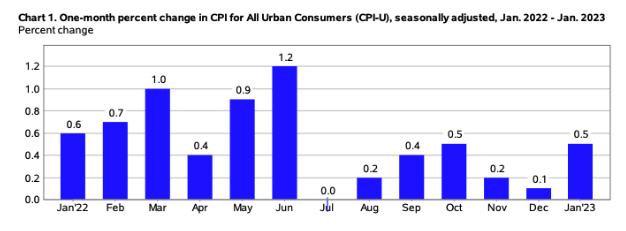

US CPI Contribution to the YoY% Change: pic.twitter.com/1lCE2iHSfE

— Michael McDonough (@M_McDonough) February 14, 2023

Core Services Excluding Shelter on a MoM% basis still stubbornly high: {ECAN} pic.twitter.com/V8TOsBwLhE

— Michael McDonough (@M_McDonough) February 14, 2023

4/4

Best proof is 34% of CPI basket (by weight) is in outright deflation

– 50-yr avg 30%

– Back in 80s, this figure did not rise above 30% until Oct '82

– Guess when Volcker ended inflation war? Hint: Oct '82This figure crossed above 30% in Oct '22…Hint: inflation war over pic.twitter.com/RF3V0X8Rkx

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) February 10, 2023

Just in:

Used car prices officially increased 2.5% in January.

The *largest* month-over-month percentage increase since end of 2021. pic.twitter.com/vSr6YhOK2y

— Car Dealership Guy (@GuyDealership) February 7, 2023

(Reuters) – Walmart Inc. is warning major packaged goods makers that it can no longer stomach their price hikes, pitching its own private-label products to shoppers as less-expensive alternatives to suppliers' name-brand goods.@reuters $WMT #CPI https://t.co/R17zFkRNL0

— Carl Quintanilla (@carlquintanilla) February 10, 2023

NFIB survey: Overall reading 90.3 vs 89.8. Number of firms raising prices in Jan fell to 42% – lowest since May 2021. Plans to raise prices in next 3 months 29%. Inflation still a concern but less so than past 6 months.

— Kathy Jones (@KathyJones) February 14, 2023

"The bear market is over… We see neither a bull nor a bear market, just a market." – Wells Fargo

— Sam Ro 📈 (@SamRo) February 13, 2023

"I don’t recall a flurry like this of Big Tech companies racing to one-up each other in a topic, ever. How fast has this been?"

* Late Nov: #ChatGPT gained mainstream buzz

* Dec 22: Sundar declares a 'code red' ..

* Feb 6th: $MSFT announces it’s hosting an event– B of A desk pic.twitter.com/aEHSsuhcXe

— Carl Quintanilla (@carlquintanilla) February 7, 2023

How many days do we have to endure this AI nonsense. How much money needs to be lost before it's over???

— Jim Cramer (@jimcramer) February 6, 2023

Goldman soft landing basket has been on a tear since the start of the year pic.twitter.com/MFYSIHa9g6

— zerohedge (@zerohedge) February 10, 2023

Bond ETFs having best start to a year in flows, taking in $20b in January. High rates, low rates, don't matter, they take in cash and are now thiiiiis close to doubling their aum since the 'black eye, some worry' days of March 2020 (a call we made & got right) via @psarofagis pic.twitter.com/KLuos4xUUk

— Eric Balchunas (@EricBalchunas) February 14, 2023

“.. speculative fervor from the levered trading community (think YOLO crowd) has clearly crept back into the market .. On Thursday, .. speculative fervor exploded, with Single Stock Call Option volumes notching its highest volume day ever, by a wide margin.”

– Goldman desk pic.twitter.com/Ls6UnnzNeW

— Carl Quintanilla (@carlquintanilla) February 5, 2023

2/3

And what might be driving this vol?

Here is the 20 most trading options today. Highlighted in the name column is the expiration date. All 20 expire today (0DTE) or tmrw (1DTE).

Also highlighted is it implied volatility (IVM col). Some of them are trading at a 90-100 vol. pic.twitter.com/gU2L5XmfIl

— Jim Bianco (@biancoresearch) February 9, 2023

Friday’s jobs stunner helped propel Citi Economic Surprise Index for U.S. higher by significant degree … daily change was largest since June 2020 pic.twitter.com/4yecxnD2kL

— Liz Ann Sonders (@LizAnnSonders) February 7, 2023

Laid off from Meta back in November.

After 3 months, 7 offers are on the table. Accepted an all-cash offer from a startup for $315K, which is $70K above what Meta used to pay. pic.twitter.com/8iUznmrKqS

— Blind (@TeamBlind) February 6, 2023

“…roughly 15% of companies in the S&P 500 have seen headcount increases of 40% or more since the start of the pandemic (Exhibit 4), and only one-fifth of them have announced layoffs so far.” – Goldman pic.twitter.com/tu3eFeZB5g

— Sam Ro 📈 (@SamRo) February 8, 2023

Well this is quite the juxtaposition… pic.twitter.com/kYnIYHaQhY

— Daniel Zhao (@DanielBZhao) February 9, 2023

Yahoo will lay off 20% of staff, or 1600 people https://t.co/HnfOP5oHdf by @asilbwrites

— TechCrunch (@TechCrunch) February 9, 2023

TWILIO TO CUT ABOUT 17% OF WORKFORCE$TWLO

— *Walter Bloomberg (@DeItaone) February 13, 2023

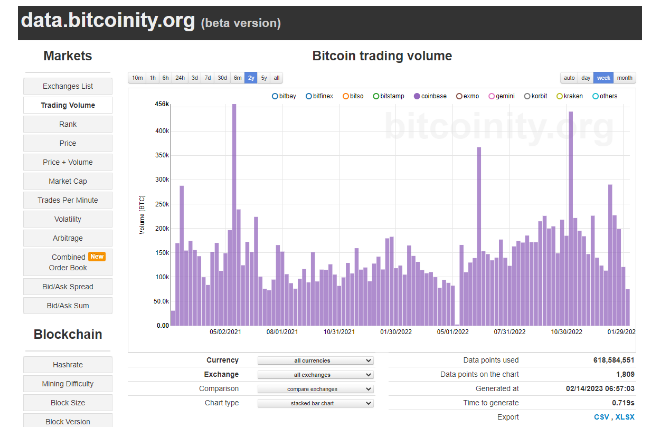

Crypto funds starting to see net inflows. Sentiment starting to change? pic.twitter.com/YT15m8JiJi

— Tom Dunleavy (@dunleavy89) February 7, 2023

I find the SEC’s “all crypto projects have to do is come in and register” line unbelievably insulting.

It assumes there’s this vast quantity of sophisticated securities lawyers advising clients, “nah man, screw the SEC, yolo baby, do whatever you want.” 1/6

— Jason Gottlieb (@ohaiom) February 11, 2023

Homebuyers are defying expectations. And sellers are not eager to sell.

Available inventory of single family homes for sale dropped by 3% this week to only 443k

46% fewer homes on the market than in 2019

We cover all the details in this week's @AltosResearch video 📽️🧵👇

1/7 pic.twitter.com/FzhXhnff5L

— Mike Simonsen 🐉 (@mikesimonsen) February 13, 2023

Among the 150 major housing markets tracked by @JBREC, 24 markets have seen local home prices fall by more than 5%https://t.co/5qVLGQtoGs pic.twitter.com/q2FyTOZ7P2

— Lance Lambert (@NewsLambert) February 8, 2023

San Francisco has already given up 42% of its Pandemic Housing Boom gains.

Chicago has given up just 4% of its Pandemic Housing Boom gains.

The 20 major markets individually tracked by Case-Shiller 👇 pic.twitter.com/9Foe5KdkV0

— Lance Lambert (@NewsLambert) February 13, 2023

1 in 3 US consumers say they have cut down on food delivery. 47% of those cited the high cost of delivery as a reason

A meal delivered can be as much as 100% more than dining in, given higher menu prices, delivery & service 💸https://t.co/UdxnKHpT4t pic.twitter.com/KxJqH4Tj4h

— cristina berta jones (@cristinagberta) February 4, 2023

“.. Last year's national average babysitting rate was $22.68 an hour for one child, .. a staggering 21% increase in just two years ..”@axios @jenniferkingson https://t.co/ITjBVBpmcA pic.twitter.com/6GQkyC2zbT

— Carl Quintanilla (@carlquintanilla) February 10, 2023

BREAKING: Today you'll be able to trade the portfolios of politicians.

The Unusual Whales Subversive Democratic, $NANC, & Republican, $KRUZ, ETFs are live today.

The ETFs follow the disclosed trades of Congressional members & their families.

See more: https://t.co/CyG5ayenoZ

— unusual_whales (@unusual_whales) February 7, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product