We bought our first home in late 2007. Our rate at the time for a 30 year fixed was something like 6.25% or 6.5%. It didn’t seem high at the time but then again we didn’t have 3% rates in the rearview mirror to compare it to.

Housing prices were obviously a lot lower back then as well (and going even lower for a few more years after that).

We lived in that house for 10 years until we outgrew it (twins will do that). Housing prices eventually recovered and we were able to refinance a couple of times after rates fell following the Great Financial Crisis.

I still remember the monthly payment on that very first mortgage payment we made. It was seared into my financial memory.

When we purchased our new place in 2017 I think rates were around 4.5%. So it was a no-brainer to refinance at 3% during the pandemic when mortgage rates fell to the floor.2

Rates got so low during the pandemic that the monthly mortgage payment we now pay is roughly $150 more per month than we were paying on that very first payment back in 2007. That’s despite the fact that the price of our new home was 150% higher than our first house.

We didn’t put a lot down on that first home and rolled the equity from that one into the new house. We’ve paid down the mortgage as well. The taxes, insurance and upkeep are obviously more expensive on our current house. But this shows just how low mortgage rates got in 2020 and 2021.

We were able to lock in extremely low fixed debt costs on our biggest monthly budget item and we weren’t alone.

It’s estimated one-quarter of those who currently carry a mortgage have rates of 3% or lower. Two-thirds of those with mortgage debt are at 4% or lower.

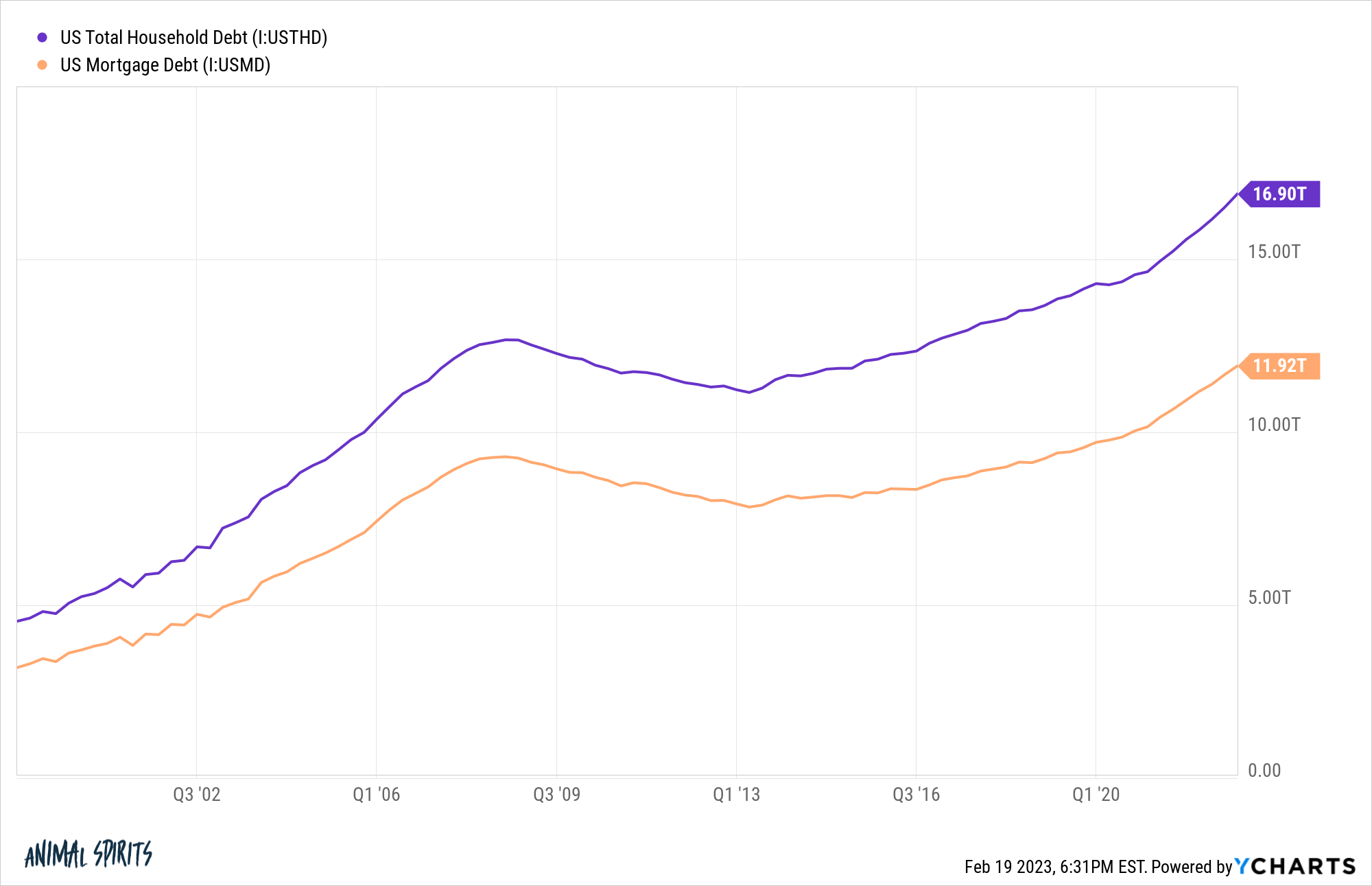

Total U.S. household debt totaled nearly $17 trillion as of year-end 2022. Almost $12 trillion of that total is made up of mortgage debt.

That means mortgage debt makes up a little more than 70% of all household debt in this country.1

The homeownership rate is currently hovering around 66%. Consumption makes up roughly 70% of the U.S. economy.

Inflation has been the biggest story of the economy for the past 24 months or so but I don’t think we’ve given enough attention to the fact that those low rates are still having an impact on the economy today.

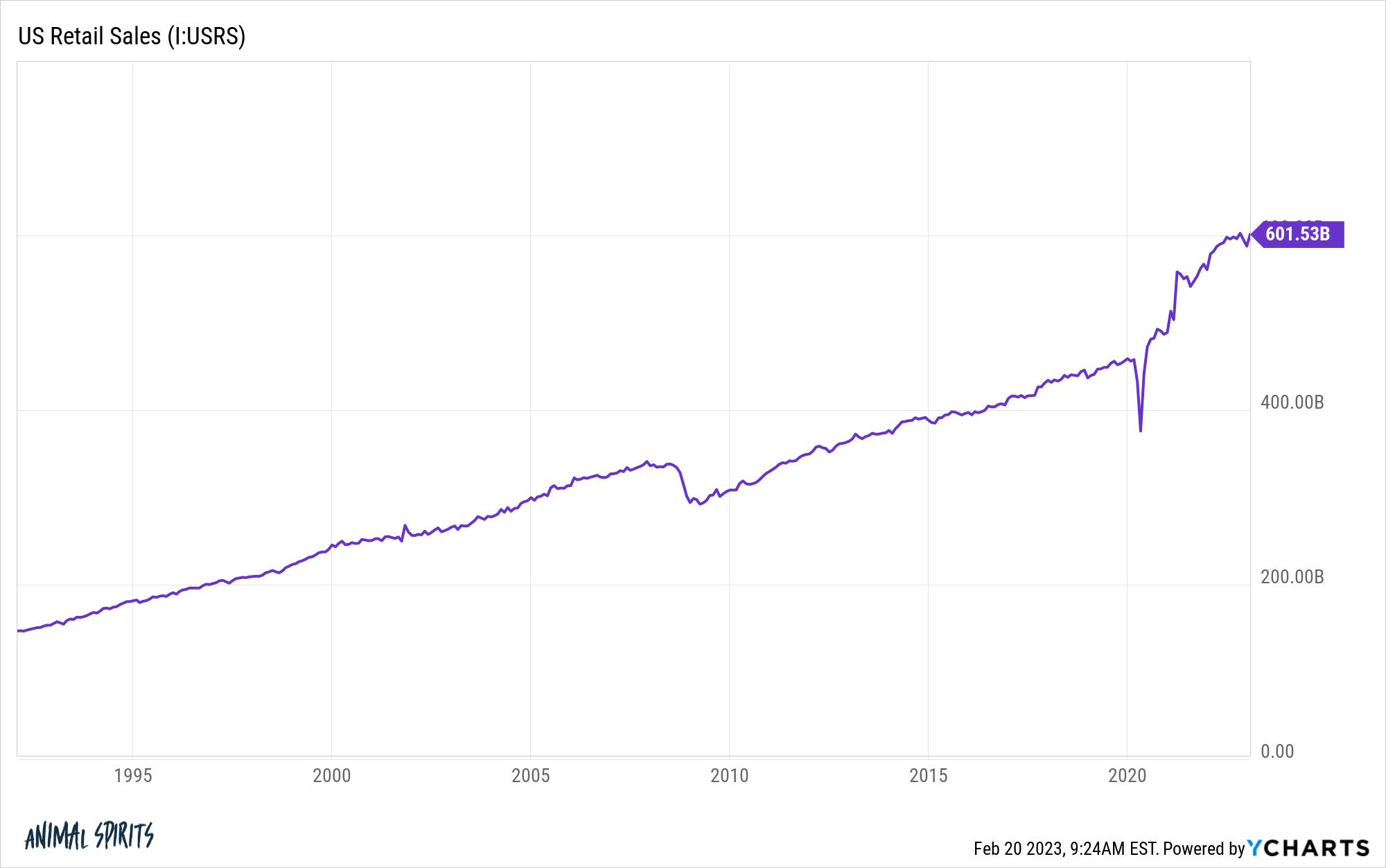

U.S. retail sales is one of my favorite what-the-hell-was-that economic charts from the pandemic:

There was the plunge at the onset of Covid when everything shut down for a month or two and then spending got shot out of a cannon.

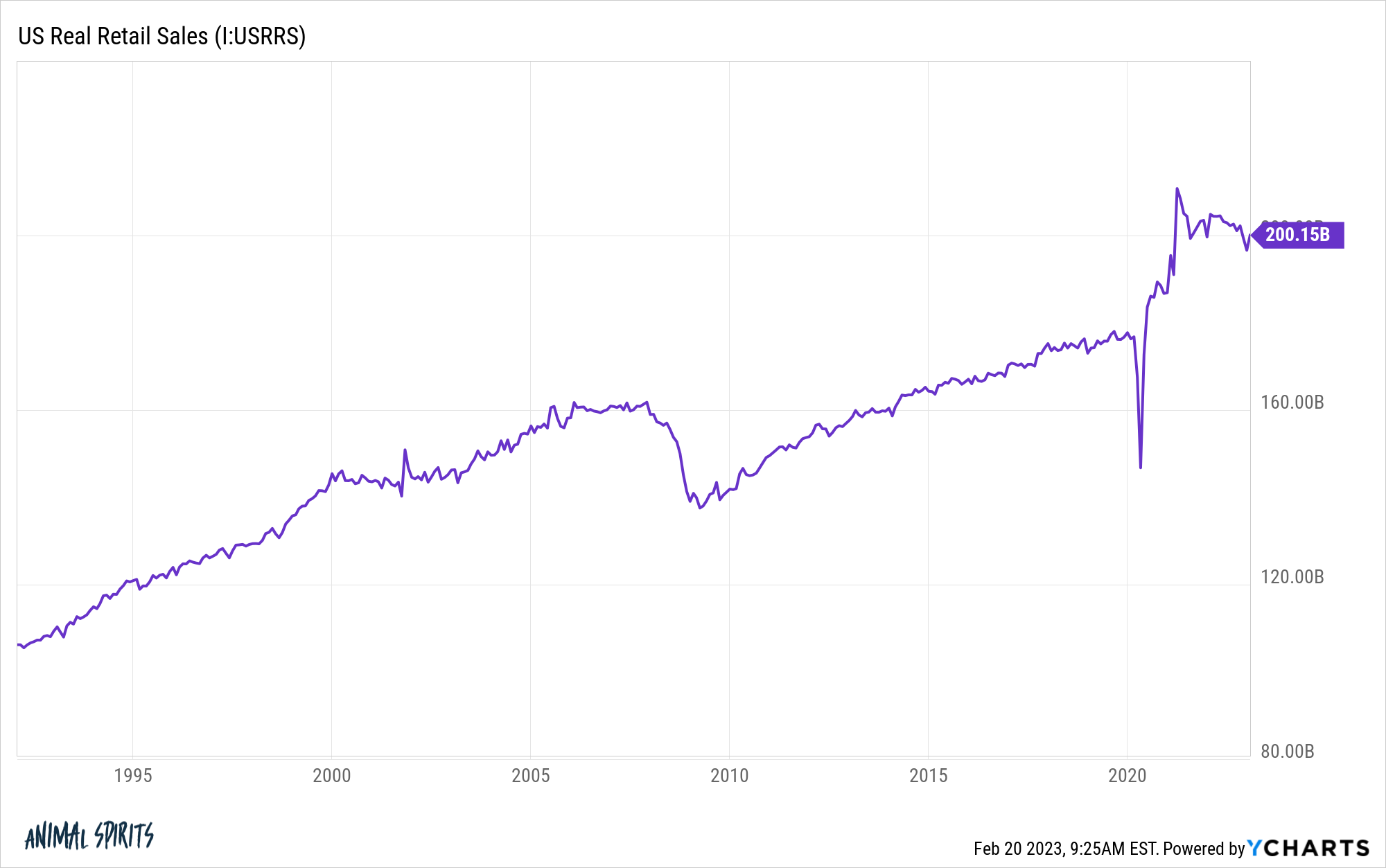

Even if you factor in the inflation adjustment here, we’re still way above the pre-pandemic trend:

There are a lot of reasons for this.

Fiscal stimulus played a large role. So did the fact that people had nothing else to do for a while and nowhere else to spend their money except on stuff.

But those checks for the government were a one-time shot in the arm. The unemployment bonus went away. No more $1,200 checks from the government.

It’s possible we will get some more government spending during the next recession but the inflationary risks will likely cause many politicians to question whether or not it’s worth it.

Unlike that one-time boost from fiscal spending, those who locked in ultra-low mortgage rates are receiving an ongoing form of stimulus. Everyone who fixed their debt costs at 4% or lower has more disposable income on a monthly basis that can be used for spending or saving elsewhere in their budget.

Yes, inflation has been painful for many households but you have tens of millions of homeowners who were able to fix their debt costs and are now seeing wage gains as well.

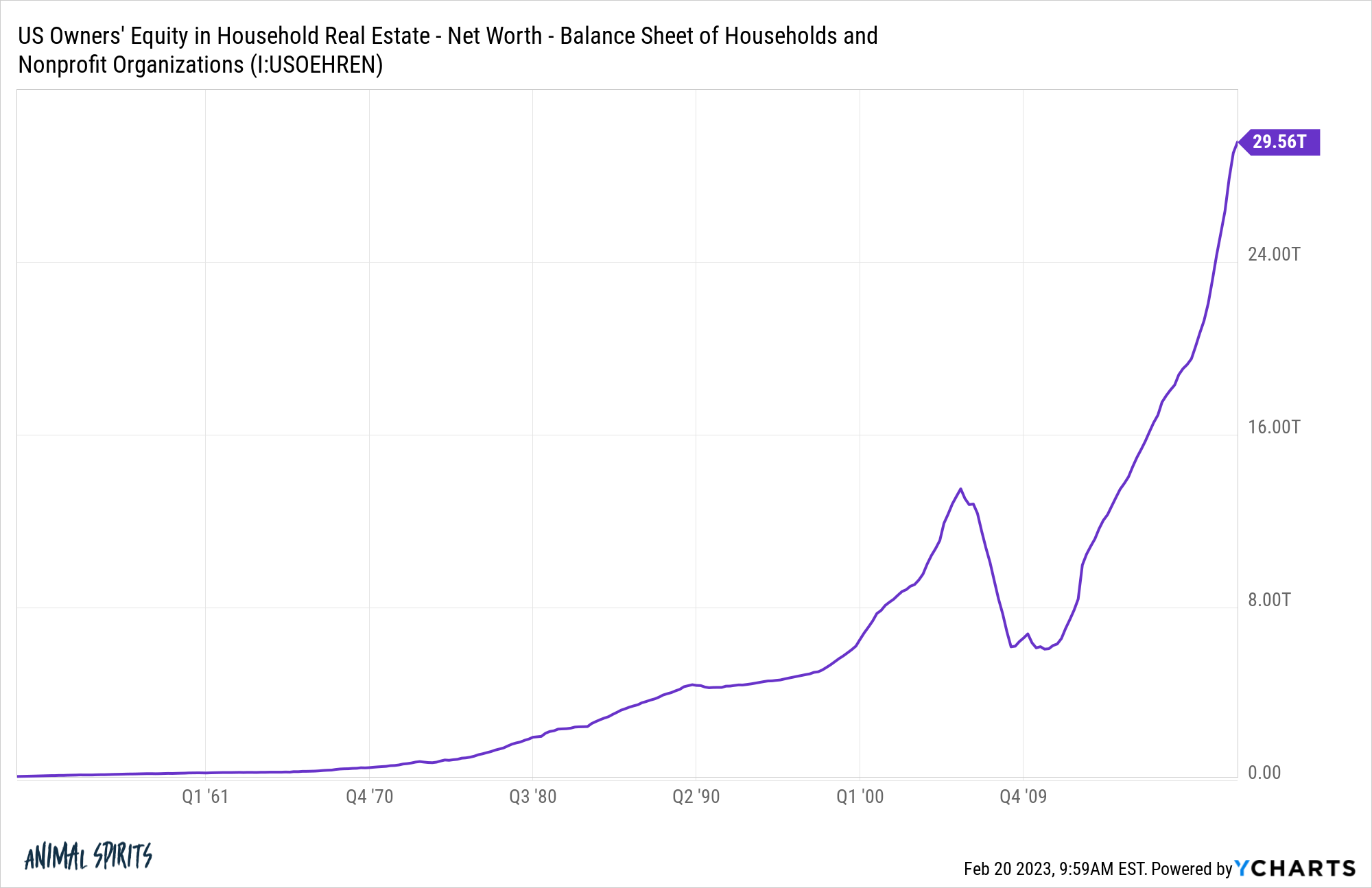

Plus we’ve seen home equity rise by more than 50% since just before the pandemic started:

There are a lot of factors that drive wealth inequality in this country but the simplest explanation for positive vs. negative financial outcomes3 during this cycle can be most easily explained by the following question:

Did you own a home before the pandemic started or not?

We have a period of low mortgage rates, wage gains, a massive rise in housing prices, a surge in rents and the highest inflation in four decades.

This economic environment has been challenging for many households. But it’s been much tougher on those who weren’t able to lock in their housing costs at generationally low borrowing costs with one of the best inflation hedges in all of personal finance.

The worst part about it for those who are now in the market for a house or will be in the coming years is the role of luck and timing in this situation.

I wish I could tell you my move to buy a home in 2007 at depressed prices and refinance in 2020 was because of my financial savvy but it wasn’t. It was luck.

It just so happened that my wife and I became homebuyers during a real estate crash and our family outgrew our first home a few years before the biggest housing boom this country has ever seen.

I don’t know where rates or prices go from here. Higher rates should slow the housing market while lower rates will likely bring back more demand.

I just can’t stop thinking lately that we might be underestimating the impact of ultra-low mortgage rates that occurred during the pandemic as a force that could impact household finances for years to come.

Further Reading:

Luck & Timing in the Housing Market

1The rest is mostly comprised of student loans ($1.6 trillion), auto loans ($1.6 trillion) and credit cards (just under $1 trillion).

2I guess if we would have waited a little longer we could have gotten it down even lower but at a certain point there are diminishing returns on this stuff and I didn’t want to miss the boat on that one.

3There are obviously successful people who don’t own a home and vice versa but you get my point here.