In the past you had to read between the lines to understand the Fed’s thinking about monetary policy and what was coming next.

These days they won’t shut up about what they think and what they’re going to do.

I wouldn’t consider myself a Fed watcher but I’m fascinated with what the Federal Reserve is doing right now.

While not a regular Fed watcher I did watch Jerome Powell’s press conference this week after the central bank raised rates 75 basis points for the fourth time in a row to hear what he had to say about their plans.

His message was crystal clear — the Fed is willing to send us into a recession to bring down inflation and they seem to think it’s our only option.

When asked about the possibility of a soft landing for the economy Powell didn’t sound like they were even trying:

I think to the extent rates have to go higher and stay higher for longer it becomes harder to see the path. It’s narrowed. I would say the path has narrowed over the course of the last year, really.

And I just think that the inflation picture has become more and more challenging over the course of this year, without question. That means that we have to have policy being more restrictive, and that narrows the path to a soft landing, I would say.

In other words, we are going to break the economy to slow inflation.

The Fed’s line of thinking here is if they don’t do something now, we run the risk of inflation becoming entrenched. And if inflation becomes entrenched in our collective psychology it’s going to take an even bigger downturn in the future to put an end to it.

They want us to take some medicine now so we don’t have to amputate an appendage in the future. Fed officials desperately want to avoid a replay of the 1970s.

I don’t think this is a 1970s redux but they don’t care what I think.

It’s hard to believe Powell and company are willing to throw us into a recession on purpose but they seem to think they can always just stimulate on the other side of it.

Powell said as much this week:

If we over-tighten, then we have the ability with our tools, which are powerful, to—as we showed at the beginning of the pandemic episode—we can support economic activity strongly if that happens, if that’s necessary. On the other hand, if you make the mistake in the other direction and you let this drag on, then it’s a year or two down the road and you’re realizing—inflation, behaving the way it can—you’re realizing you didn’t actually get it; you have to go back in. By then, the risk really is that it has become entrenched in people’s thinking.

This feels like a dangerous mindset to me.

While it’s true the Fed was able to rescue the financial system at the outset of the pandemic, going from zero to 60 back to zero back to 60 again is not healthy for the economy.

Constantly switching back and forth between boom and bust makes it exceedingly difficult for households and businesses to plan ahead for the future.

Oh well. We all got the benefits of stimulus on the way up and now we’re going to experience the drawbacks on the way down.

Nothing is ever a 100% certainty when it comes to the markets or the economy but a recession has to be your baseline scenario right now unless the Fed pulls an about-face.

The problem is the labor market is not cooperating.

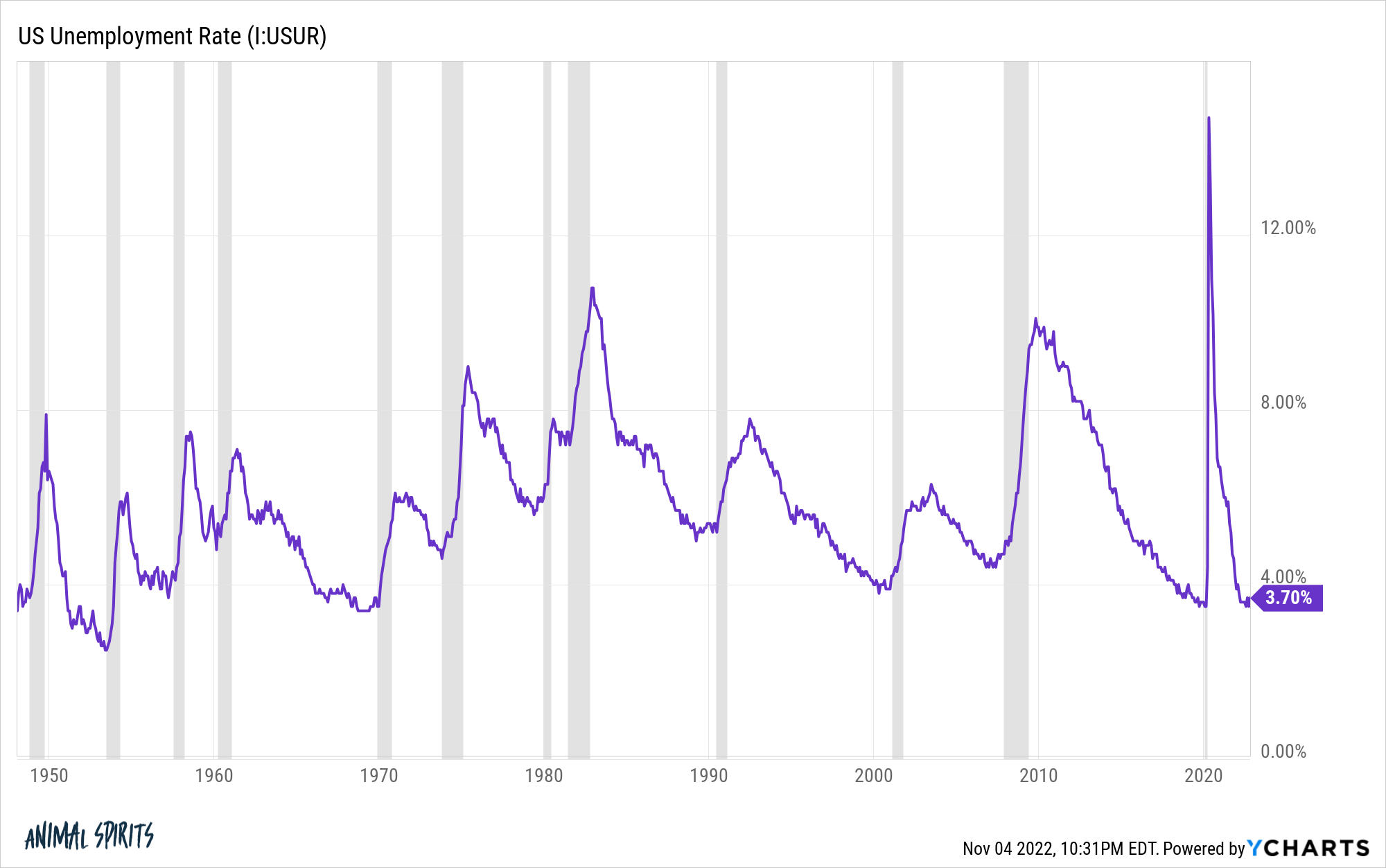

The unemployment rate is still low:

How low is the unemployment rate?

Well, from 1970 through 2017, the unemployment rate was never as low as it is today. Not once.

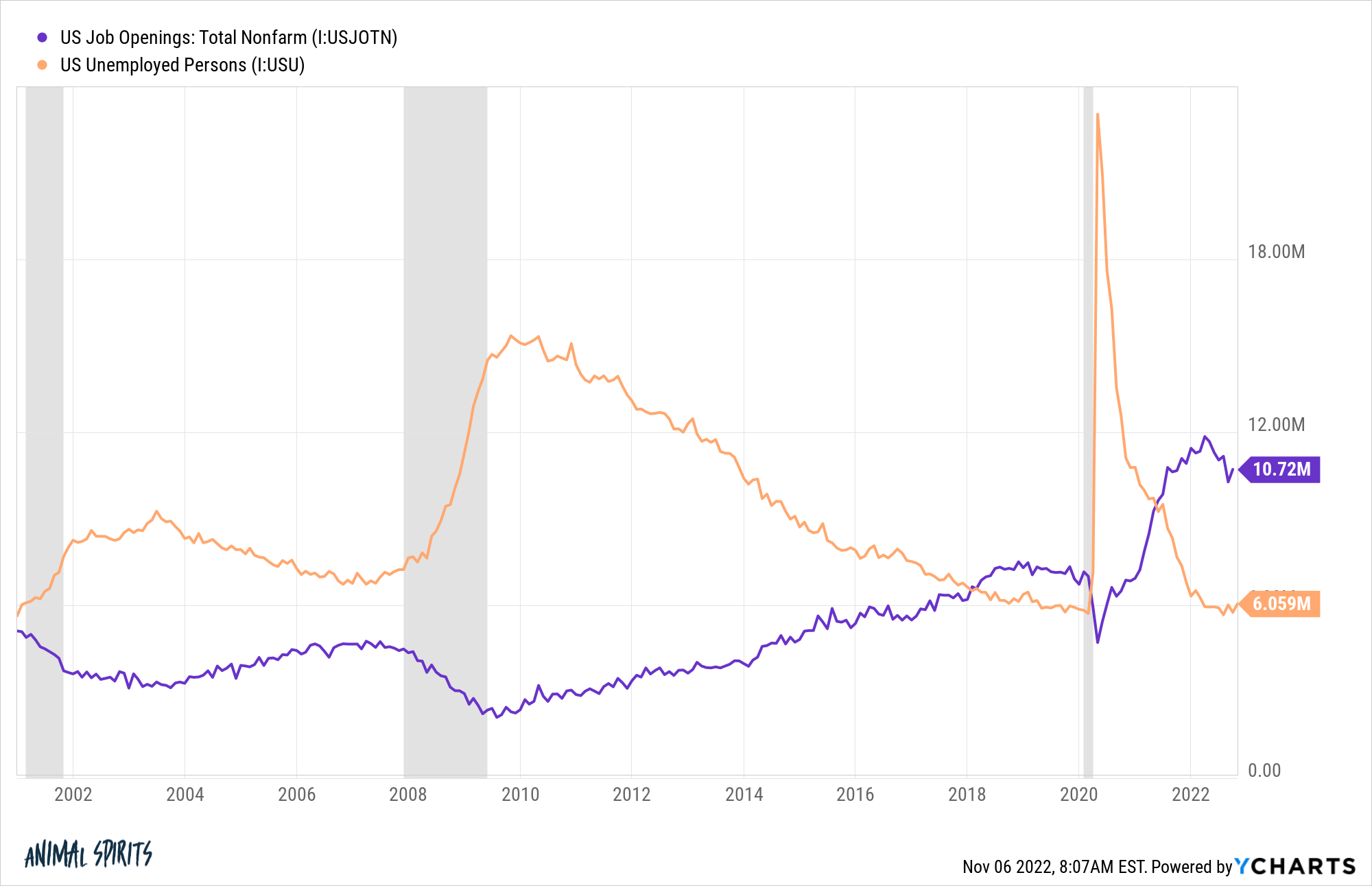

Job openings have come in a little bit but remain elevated, especially in relation to the number of people who are unemployed and actively looking for a job:

This is one of the reasons the Fed is willing to tighten monetary conditions so aggressively. They know they’re leaning into a strong labor market that gives them some slack.

My worry is what happens if they’re able to slow the economy, millions of people lose their jobs, but we still don’t hit their 2% inflation target?

What then?

I imagine things would get very political in that scenario. If we go into stagflation with increasing unemployment numbers many people are going to wish for an environment of low unemployment and higher-than-average inflation.

I guess the biggest takeaway here is there’s no such thing as a perfect economic environment. Someone or some group is always going to be unhappy.

The worst part about the current set-up is the waiting around for a recession. The dopamine hit in our brains triggers more from anticipation than the event itself.

And our behavior is often impacted by whether we think a threat is near or far away.

Neuro researchers performed a study using a real-life game of Ms. Pac-Man where they placed brain scanners on a group of people running through a maze being chased. If they got caught they would get a shock.

When the shock was far away, the brain scans showed relative calm. But as it got closer, the part of the brain that reacts to fear activated and people started to panic.

Everyone has known for some time now that a shock in the form of a recession is likely coming. It’s not guaranteed but there has never been an economic cycle like this where an outcome was being telegraphed to everyone at the same time.

I’ll be curious to see how much panic will develop and how that panic will translate in both the economy and the markets as we get closer to a recession becoming a reality.

Further Reading:

Why Today’s Inflation is Not a Repeat of the 1970s