Things don’t feel so great when it comes to the financial markets right now.

The S&P 500 was down almost 4% on Friday and is now almost 14% off its highs. Other parts of the stock market are down even more.

The bond market is also off double-digits at the moment, meaning diversified investors in a traditional stock/bond portfolio are feeling some pain.

It feels like it’s all bad news right now but the way I look at it is those losses are sunk costs.

The past is the past and all that matters is the path forward.

Let’s take a look at the good news and bad news about what’s going on in the markets right now:

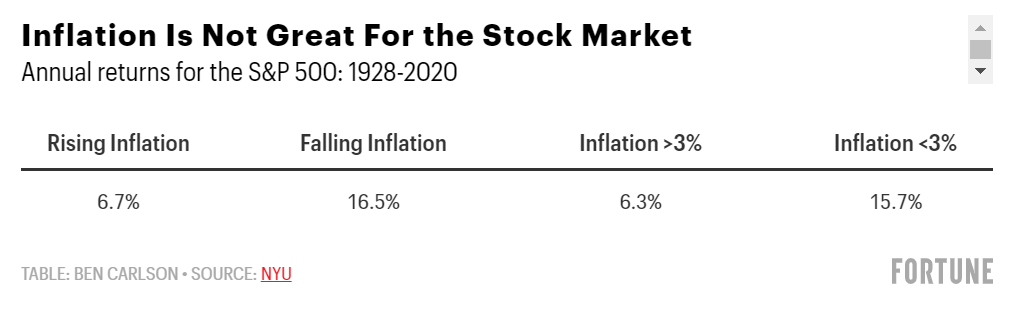

The bad news: The stock market is falling and inflation is high. Historically speaking, the stock market has not done well when inflation is rising and/or above 3%:

Both things are true right now.

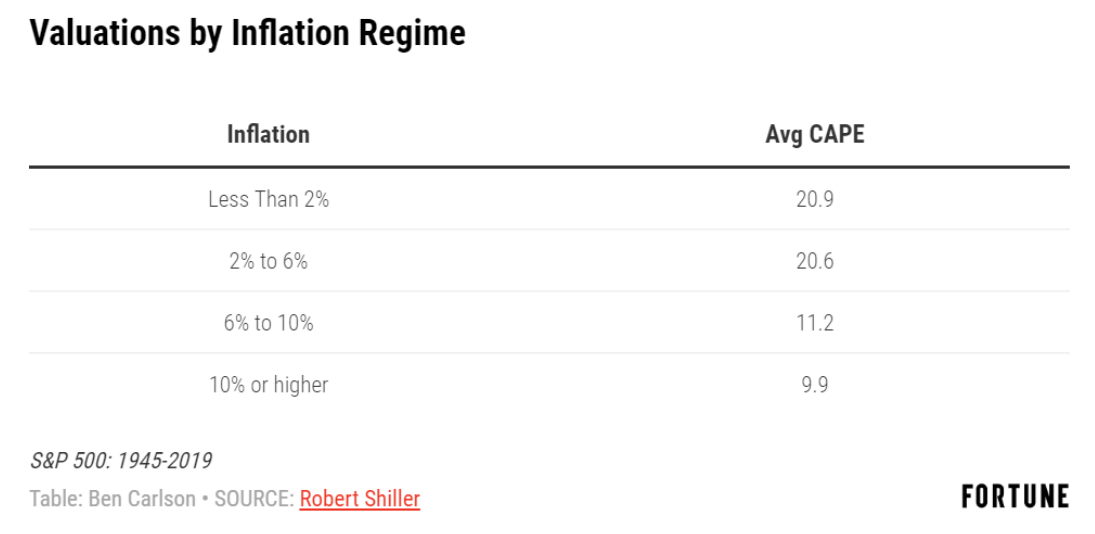

It’s also true that valuations on the market tend to be lower when inflation is higher and vice versa:

Valuations are coming in but still well above historical averages.

I’m not saying inflation is the only reason stocks are struggling at the moment but it’s definitely providing a headwind.

The good news: Inflation is unlikely to stay elevated in the long term.

Look, predicting inflation is hard.

But it’s not like it can stay at 8% or higher indefinitely before something breaks.

The pandemic is (hopefully?) coming to an end. The Fed is slowing things down by raising rates. Fiscal stimulus is off the table so no more PPP loans, no more checks from the government, no more extended unemployment benefits. Supply chain problems can work themselves out as demand slows.

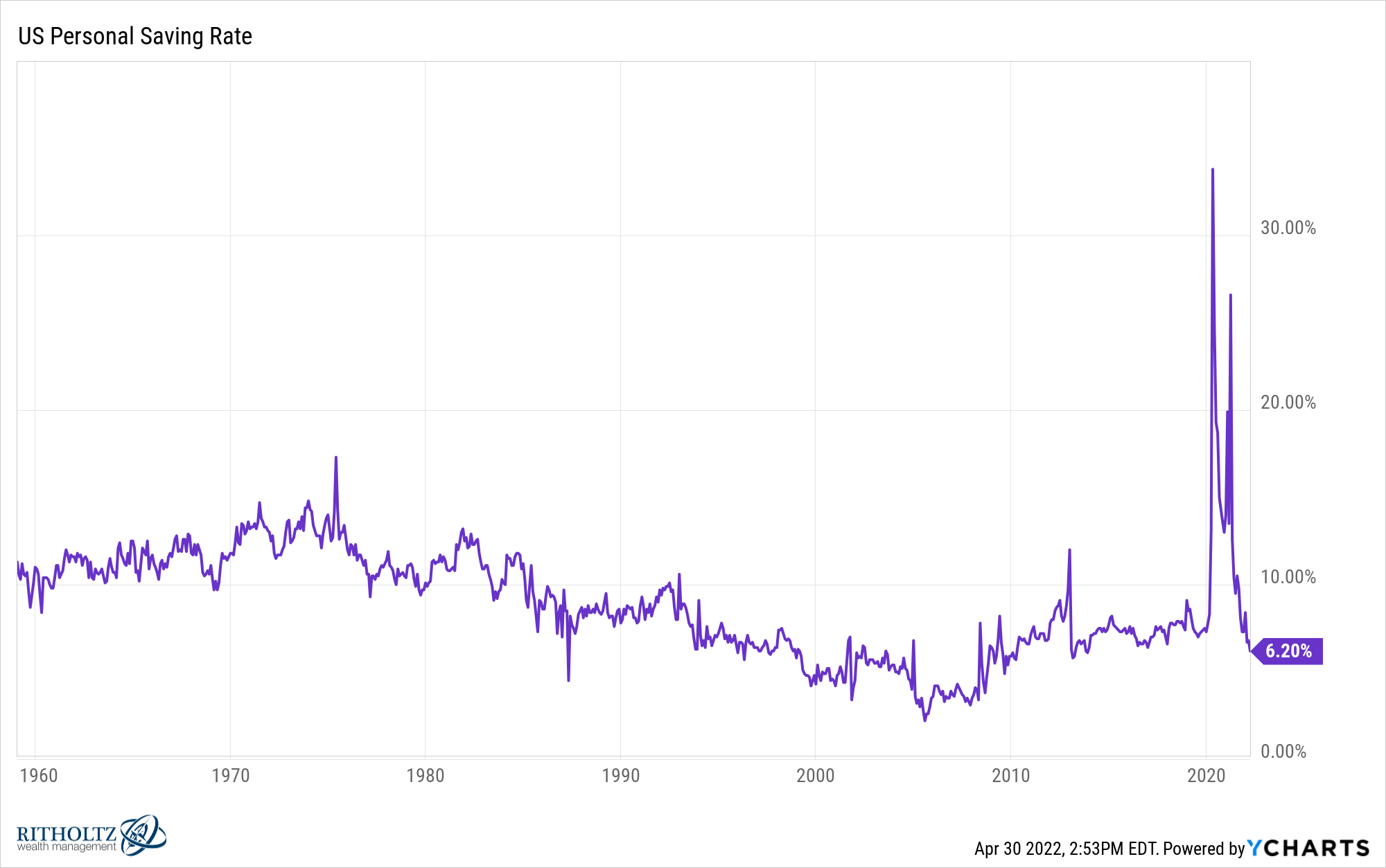

Look at the personal savings rate in the United States:

There was a huge spike as people cut down their spending and built up savings from government payouts. Now we’re back to pre-pandemic levels.

Consumer spending should have a similar trajectory because there are no more savings to tap and it’s becoming more expensive to borrow.

Add in the fact that population growth in this country is slowing, technology is bringing costs down and globalization generally makes things cheaper and we should see inflation fall eventually.

This doesn’t mean it has to go right back to 2% but even a trend towards disinflation should be positive at some point for stocks.

It’s not good or bad that matters for markets but better or worse.

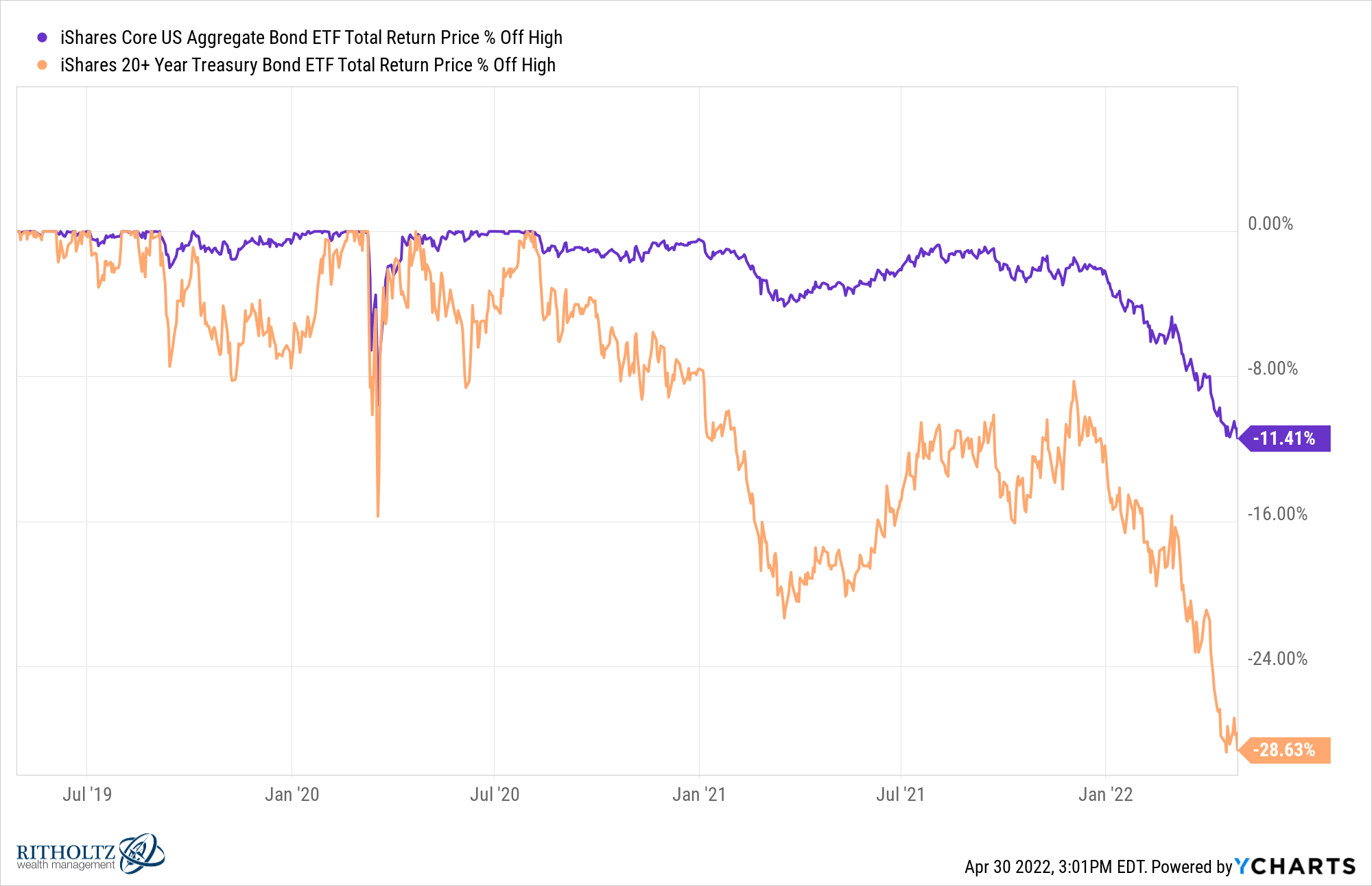

The bad news: Bonds are in the midst of a nasty correction:

If you own a total bond index fund you’re down more than 11% right now since 2020 (and that includes the income from those bonds).

If you own long-term government bonds, you’re down nearly 30%.

If you started investing any time after Ronald Reagan was president, you’ve never experienced losses like this in bonds.

The good news: Expected returns for bonds are much higher than they were in the recent past.

The reason bonds are down is because interest rates are rising. While this is painful in the short-term, over the long-term that means higher returns for fixed income investors.

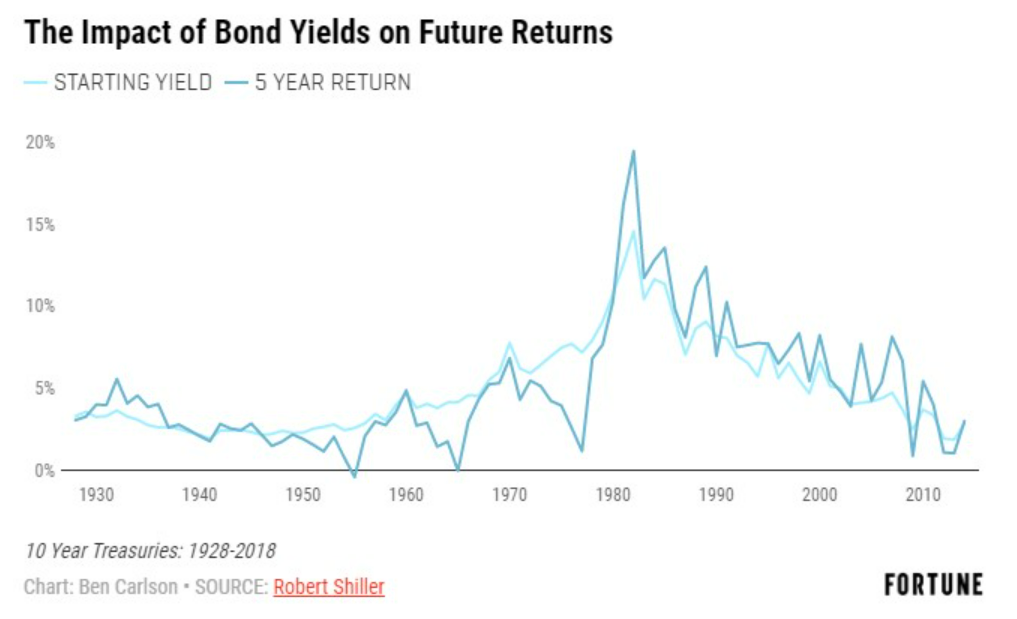

The correlation of starting yields to forward returns for U.S. government bonds is 0.9 looking out 5 years:

Go 10 years into the future and the correlation is 0.95. What this tells us is the starting yield is an effective predictor of future returns for high-quality bonds.

The iShares Aggregate Bond ETF (AGG) currently sports an average yield to maturity of 3.4%. This is not exactly high relative to historical yields but it’s much higher than it was following the pandemic.

These yields can’t erase the losses investors have already suffered but that’s water under the bridge.

Bond investors can finally find some yield on safe assets. This is a good thing.

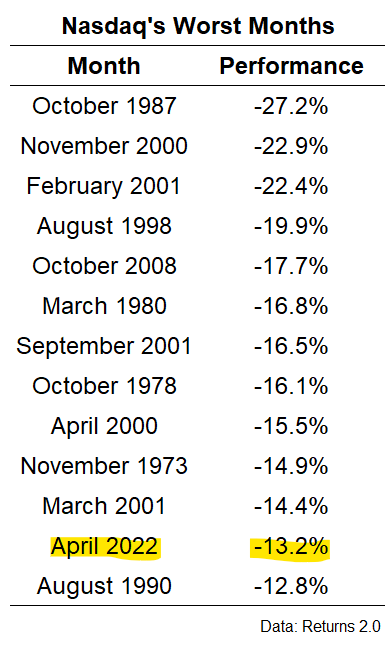

The bad news: The Nasdaq just suffered its worst month since 2008:

It was the 12th worst monthly loss on the Nasdaq since its inception in the early-1970s. The Nasdaq is now down more than 23% from all-time highs.

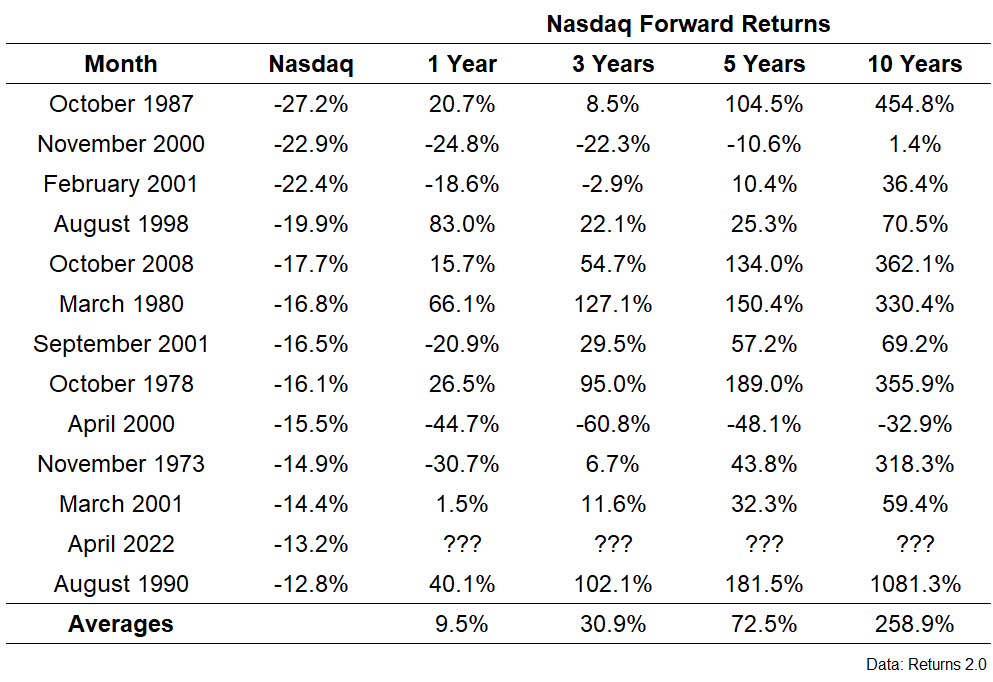

The good news: The forward returns following the worst months on the Nasdaq have been pretty, pretty good in the past:

There were some stinkers in here, most notably those entry points in the year 2000.

But on average, buying the Nasdaq after it’s had a big down month has worked out well most of the time for investors in the past.

The bad news: Sometimes risk assets go down.

The good news: You don’t earn returns on your money without accepting some risk.

The bad news: Investing would be more fun if your portfolio simply went up all the time.

The good news: Those investors who are patient enough to sit through some losses are usually rewarded in the long run.

The bad news: Things feel pretty bleak in the markets right now. Inflation is high. It feels like the Fed might shove us into a recession. Stocks and bonds are both struggling mightily.

The good news: Investing when things feel bleak typically works out if you have a long enough time horizon.

The bad news: I don’t know when things will get better for investors.

The good news: Things will get better at some point.

Further Reading:

What Happens When You Buy Stocks in a Bear Market?