Some questions I’m pondering at the moment:

1. Is inflation offering us a wonderful buying opportunity? Back when the inflation rate was still under 2%, I asked if inflation could give us a wonderful buying opportunity in stocks.

The rise in prices went way higher and has lasted much longer than I was assuming back then but it’s worth re-visiting this question in light of a bear market in stocks.

A lot of people think we could be heading for a redux of the 1970s where inflation stays high for years. It’s possible but let’s look at what’s already happening since the Fed explicitly told us they are going to fight rising prices:

- Interest rates are rising.

- Mortgage rates have basically doubled from the lows.

- All of the speculative stuff like IPOs, SPACs and crypto have crashed.

- Companies that don’t make money are all being punished.

- The Fed is raising rates.

- The government has turned off the fiscal spigot.

Remember, the Fed was easing monetary policy in the early-1970s. Paul Volcker didn’t take over until 1979, eventually raising rates to astronomical levels to slow inflation and pushing the country into two recessions in the early-1980s.

Jerome Powell and company don’t seem too keen on allowing this to last for an entire decade.

Sure, we could go into a recession and stocks could certainly fall even more. But doesn’t it seem like good news at some point if the Fed is able to tame inflation?

2. Why do markets always look so much easier in hindsight? OK, this one is both rhetorical and obvious but it’s also what makes the markets maddening.

You could tell me inflation will be 3% a year from now and the stock market is back at all-time highs again.

Or inflation remains stubbornly high at 5-6% and markets continue to struggle.

What if supply chain disruptions persist or commodity prices continue to rise? What if the Fed can’t stop some sort of wage-price spiral?

Maybe the Fed throws us into a nasty recession or maybe there’s a soft landing.

Whatever happens, it’s going to look obvious in the rearview mirror but it’s hard to say right now what the most likely outcome is.

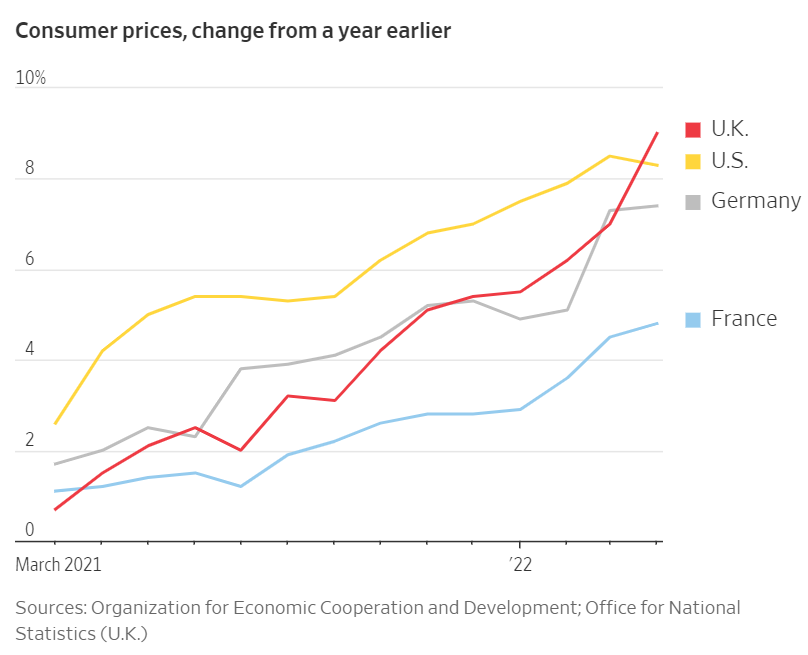

3. Is the Fed really to blame for all of this inflation? The U.K. just reported its highest inflation rate in 40 years at 9%.

Prices are rising in places like France and Germany too:

I understand all of the hate being directed at the Fed. They kept their foot on the gas pedal for too long and now they’re going the other way and slamming on the brakes. There was no reason to continue buying mortgage bonds while the housing market was experiencing its biggest boom ever.

But you can’t blame higher prices exclusively on the Fed.

The pandemic has obviously caused problems in other countries too. Supply chains have been a problem. So have labor shortages. Governments around the globe spent trillions of dollars. Consumers were bored so we started buying stuff.

And now there’s the war.

If the Fed wasn’t the main cause of the inflation can they be the main solution?

I guess we’ll find out in the coming months how high rates need to go to put supply and demand back into alignment.

4. How will rapidly rising mortgage rates impact housing prices? Historically housing prices have held up well when mortgage rates rise.

But the speed of this rate increase combined with the rise in prices in the past two years puts us in uncharted territory.

Bill McBride laid out three potential scenarios this week:

(1) Slow: Single-digit price growth.

(2) Stall: Prices don’t go anywhere.

(3) Bust: Prices fall 5-10%.

McBride says, “The data seems to argue for the slow house price growth scenario, but my view is the most likely scenario is house prices will stall in nominal terms and decline in real terms.”

I know a lot of first-time homebuyers would like to see a bust but even stalling prices would make things far healthier in the housing market than what we’ve seen these past 18 months or so.

5. Is Disney the poster child for the difficulty of stock-picking? Disney owns some of the most recognizable brands on the planet.

My kids have watched every one of their animated movies dozens of times. Those songs are stuck in my head for weeks on end.

They purchased Pixar in 2006. Then they bought Star Wars in 2012. They also bought the only cinematic universe that seems to make any money anymore in 2009 with their purchase of Marvel.

Of the top 20 highest-grossing movies of all-time, Disney owns 12 of the properties.

Michael Eisner and Bob Iger were both visionary CEOs.

I’ve taken my kids to Disney World twice — it’s one of the most magical, crowded, expensive places on earth and people can’t wait to go there year after year.

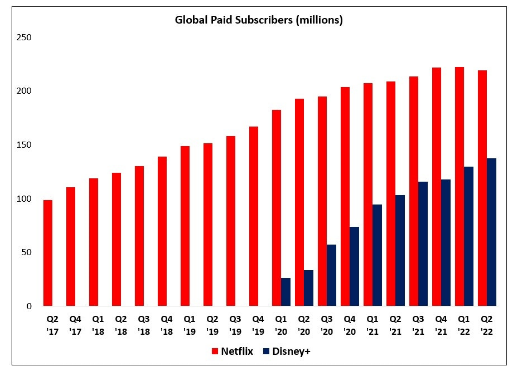

And just look at how quickly Disney+ is gaining on Netflix in terms of subscribers:

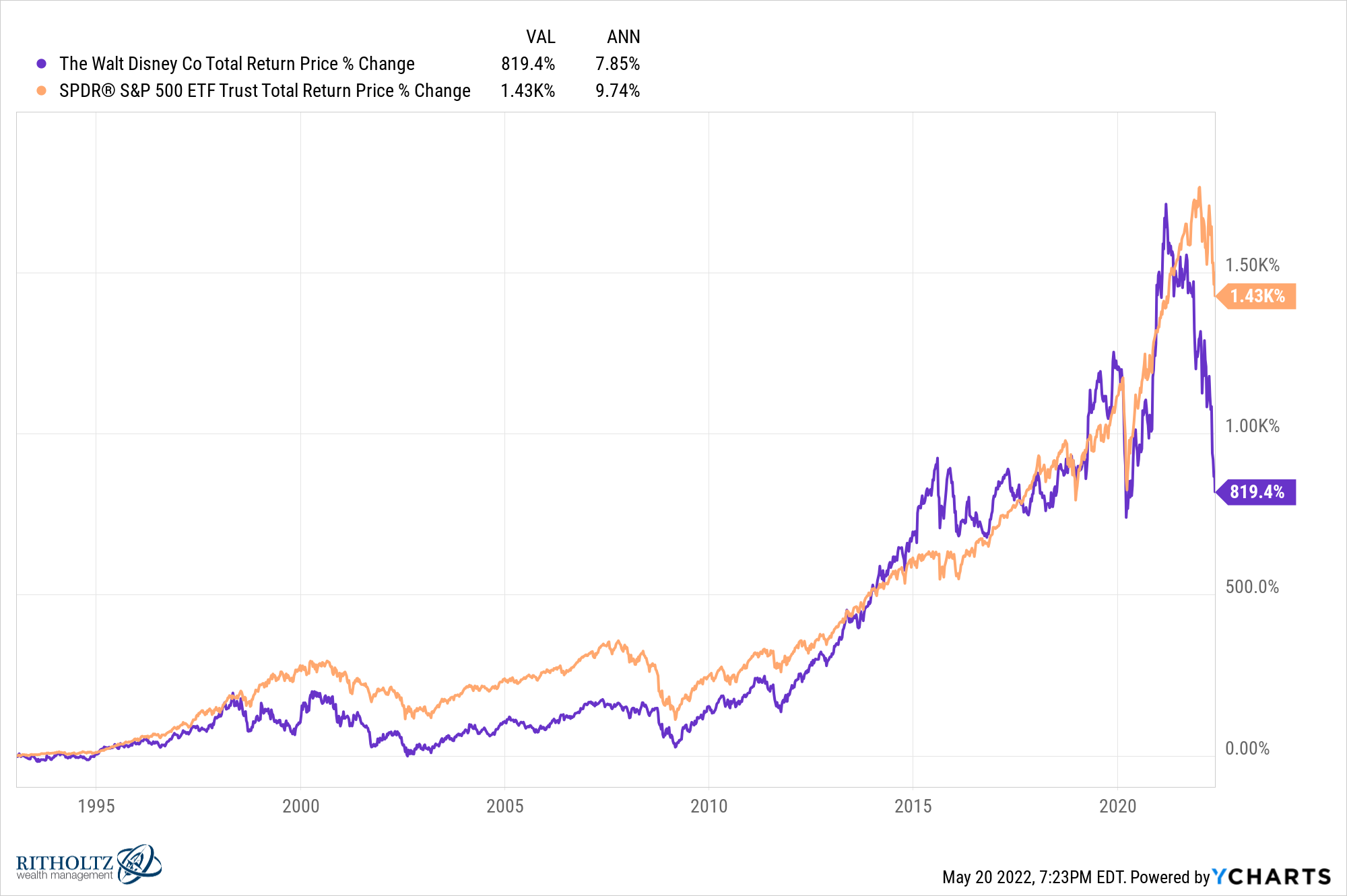

And yet…Disney’s stock price has underperformed the S&P 500 since the inception of the SPY ETF back in 1993:

Obviously, a lot of this underperformance has come in the past year or so. The pandemic didn’t help with the theme park business and Netflix has pulled down the entire streaming complex with their recent struggles.

But this is three decades where one of the biggest name brands in the world has underperformed the stock market.

Investing is hard.

6. Was A Quiet Place Part II one of the best sequels of all-time? I loved the original and watched the sequel when it came out on demand. It’s on Amazon Prime now so I decided to give it a re-watch.

It holds up.

I’m a sucker for alien movies. The first 10 minutes of this movie might be one of the best introductions to extraterrestrials I’ve seen.

Here’s my list of best sequels of all-time in no particular order: The Godfather Part II, Austin Powers: The Spy Who Shagged Me, Back to the Future Part II, Terminator 2: Judgment Day, The Dark Knight and Before Sunset.

I’m not a huge Star Wars fan but I guess you could talk me into The Empire Strikes Back as well.

7. How much further does this bear market have to go? I wish I knew.

Some people want to see more capitulation. Others feel everyone is all beared up right now. Some think a recession is a foregone conclusion. Others feel we could put off a slowdown for a few more years.

The problem with trying to nail the bottom during a bear market is you can throw fundamentals and sentiment indicators out the window.

Emotions are more important than fundamentals in the short-term and sentiment readings are more difficult to interpret than ever since anyone who wants one has a platform to share their opinions these days.

The stock market route could stop on a dime. It could inflict maximum pain and give us a woosh lower. Or it could chop investors up for months and months in a volatile range.

It’s uncomfortable to say “I don’t know” but sometimes when it comes to investing that’s the safest place to be.

Michael and I talked about all things bear markets, Disney, the Fed, inflation and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Every Time Out It’s a Guess

Now here’s what I’ve been reading lately:

- Capitulation playbook (Big Picture)

- Where are we in the cycle? (Irrelevant Investor)

- The YIMBYest city in America (Discourse)

- Bear markets are purifying (A Teachable Moment)

- Bear market playbook (Belle Curve)

- Price anchoring and broken stories (Young Money)

- How much is enough? (Indeedably)