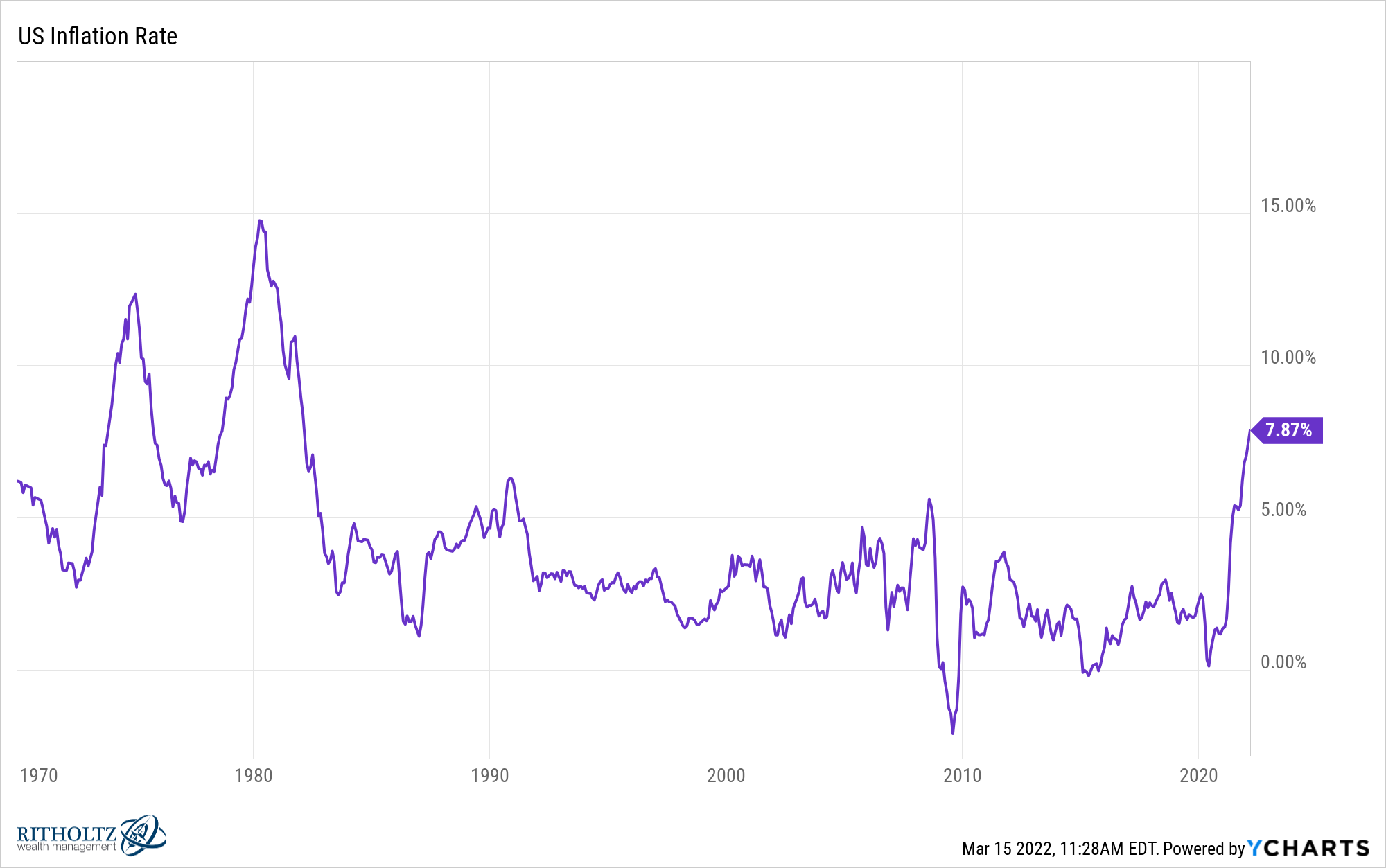

Inflation was already a stone’s throw from 8% before war broke out involving two countries that account for a large share of energy and agricultural commodities throughout the world.

It wouldn’t shock me to see this number as high as 10% in the coming months.

Working in an industry that is obsessed with markets, I find most of the questions people are now asking about inflation come at it from the perspective of their portfolio.

Should I buy commodities?

How about TIPS?

Is it too late to buy Energy stocks?

Have you seen the yields on the Series I Savings Bonds?!

How do I hedge against inflation???

The way I see it the time to prepare for inflation is ahead of time, not while it’s happening.

From 2009-2020, the U.S. stock market was up more than 13% per year over and above the rate of inflation. If you’ve been an investor for the long-term, you were hedging against high inflation before it ever got here.

Regardless of how you’re managing your investments to account for higher prices, there are other ways to hedge inflation beyond your portfolio.

Here are some ideas for the best personal finance inflation hedges:

A Costco membership. Are prices rising at Costco just like other grocery stores? Sure. But buying in bulk is a good way to hedge against further price increases should they come.1

Your Costco membership also comes with slightly lower gas prices, which at the very least pays for your annual membership and then some.

Plus, you can still get a Costco hot dog and a soda for a $1.50, the same price it was in 1985 (I’m only half kidding here).

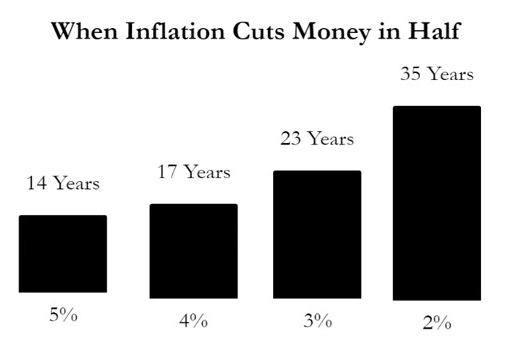

A 30 year fixed-rate mortgage. The whole reason to invest in the first place is to improve your standard of living. If you just buried all of your money in your backyard it would eventually lose its value over time:

You can think of debt in the opposite way. With debt your liability is what loses value over time and that’s a good thing. This is what makes a mortgage with a low interest rate one of the best inflation hedges on the planet.

The median sale price for an existing home in the United States is now around $350k. Assuming a down payment of 10%, using the average 30 year mortgage rate over the past 5 years of 3.7% would give you a monthly payment of roughly $1,450.

With inflation running at 8% over the past year that would mean someone’s $1,450/month payment from last year would now technically be worth more like $1,335. I didn’t net out the after-tax cost of the debt on the mortgage here but you get the idea.

The combination of rising home prices and low mortgage rates has made housing likely the best inflation hedge for the vast majority of Americans over the past couple of years.

Holding onto fixed-rate debt also means you’re not subject to the inflationary pressures on rents.

Unfortunately, if you don’t own a home, you’re taking it on the chin. According to Apartment List, year-over-year growth in rents was almost 18% at the last reading.

The ability to substitute. Last week I found myself in one of the happiest places on earth on a Friday afternoon — the liquor store.2 I like to do my channel checks on trips like this so I asked the owner how inflation is impacting his business.

He told me he’s seeing higher prices across the board but the thing that surprised him the most was a new gas surcharge on his ice delivery. He said they charged him $60 for a $30 delivery of ice.

I’m guessing we’ll be seeing a lot more of this in the weeks and months ahead. Uber just announced they’re adding a fee of $0.45 to $0.55 per trip while Uber Eats deliveries will include a $0.35 to $0.45 surcharge.

I know we’ve all become accustomed to paying for convenience but with higher prices some people are going to have to make different choices with how to allocate their budgets.

Maybe that $20 upcharge for DoorDash isn’t worth it anymore. Maybe you go pick up the pizza instead of paying for delivery. Maybe sacrifice 1-2 nights of going out to eat to make up for higher utility bills.

For people on a tight budget, there are probably going to have to be some trade-offs.

Avoiding lifestyle creep. Inflation tends to hit households on the low end of the income scale the worst because they don’t have nearly as much room in their budgets when the prices of necessities rise.

But the group that’s easiest to take advantage of with higher prices are those with higher incomes.

Last month I wrote about Chanel raising the price of their handbags from $5,200 in 2019 to $8,200 today. These bags are signaling items so wealthy people are willing to pay up.

Avoiding the siren song of luxury goods is a simple way to keep your personal inflation rate from getting out of control.

The ability to negotiate higher wages. This option doesn’t get talked about enough in personal finance circles but this is likely the best environment ever for workers to ask for a pay raise.

There are job opportunities galore, there is a shortage of workers and we are still in a world with pent-up demand from the pandemic. If you provide real value to your employer, now is the time to ask for more money.

And if they don’t value your work, there are plenty of options elsewhere these days. A recent study by Pew Research surveyed people who quit their jobs in 2021. Most were looking for more pay or flexibility (the ability to work from home is another decent hedge against higher energy prices):

At least half of these workers say that compared with their last job, they are now earning more money (56%), have more opportunities for advancement (53%), have an easier time balancing work and family responsibilities (53%) and have more flexibility to choose when they put in their work hours (50%).

Saving money is always helpful but when prices are rising it becomes much harder for many households to set money aside.

Making more money is one of those things no one teaches you how to do but it’s probably your best bet for improving your standard of living over the long haul.

I know putting inflation hedges on your portfolio is the sexier option but you have more control over your personal finances than the markets when it comes to fighting inflation.

Further Reading:

Why Housing is a Good Hedge Against Inflation

1This is when that extra freezer in the garage comes in handy.

2So much excitement in the air about weekend plans.