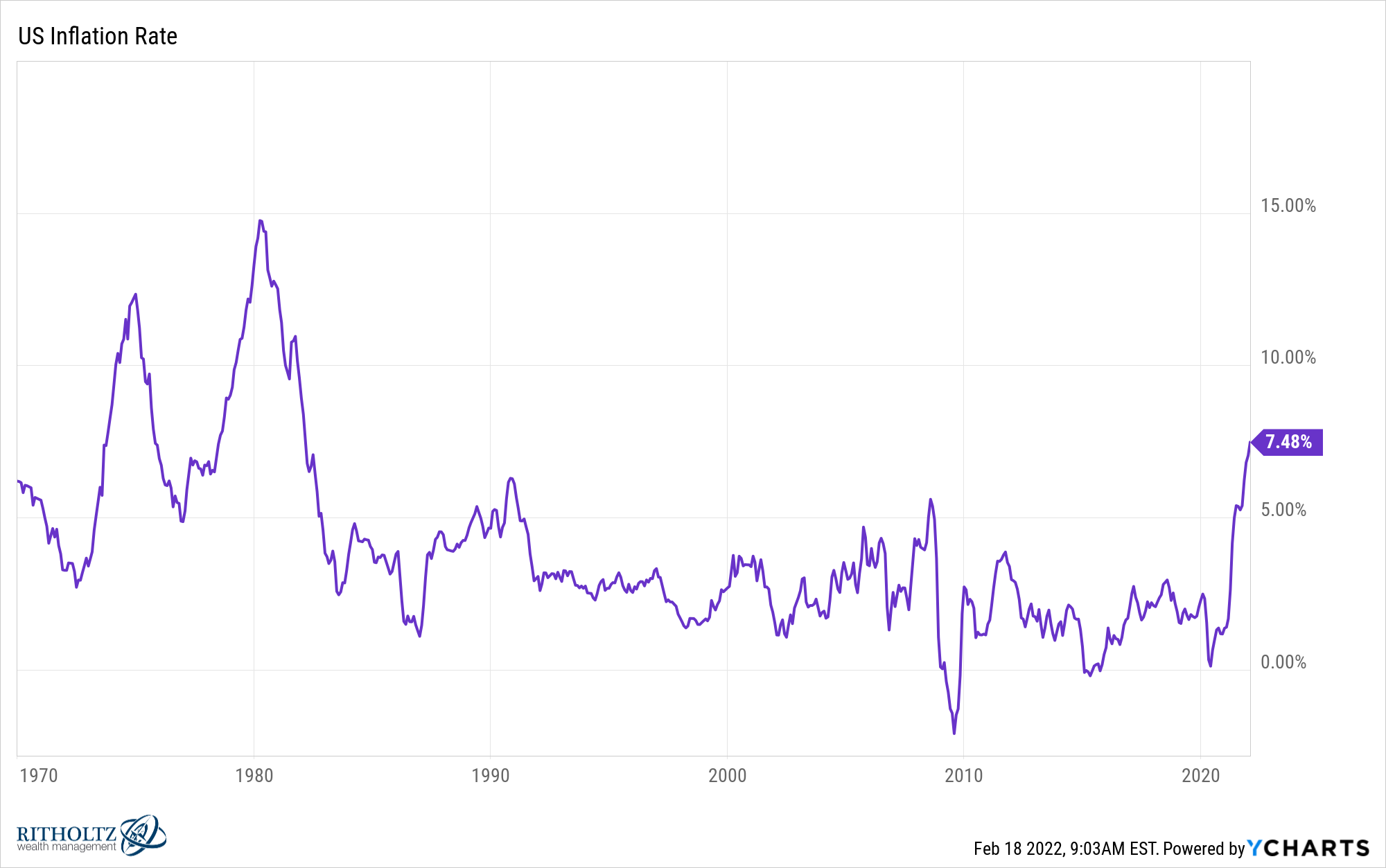

The last time inflation was this high I was still in diapers:

It’s been four decades since we’ve experienced rising prices at these rates so it’s interesting to gauge how consumers feel about all of this.

My first read on this is people HATE inflation.

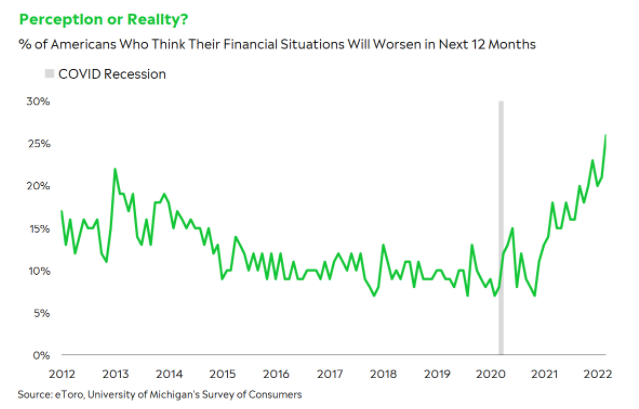

Check out this chart on how people think their financial situations will look like in the next 12 months:

The number of people who think their financial situation will worsen in the next year is the highest it’s been in 42 years.

Economic growth is booming. Wages are rising. Housing prices are through the roof. And it’s never been easier to find a job.

So what gives?

Inflation.

More people are falling behind on a real basis. And since we love spending money in this country those higher prices are staring us in the face every time we swipe those credit cards. Inflation is taking a psychological toll on consumer sentiment.

Everyone wants someone to blame when something like this happens.

With something as complex as the $23 trillion U.S. economy it’s never as simple as a single variable.

Here are the 4 biggest reasons for higher inflation as far as I’m concerned:

1. Trillions of dollars in stimulus. I know there are certain investors who want to blame the Fed for everything but this really is about fiscal policy more than monetary policy.

Governments around the world flooded the system with trillions of dollars to keep the global economy afloat during the pandemic. In the United States alone, we spent something like $7 trillion.

If you’re the political type you’ll probably blame this on the current president (or defend him). But the bulk of the spending came out of necessity and the first spending bill had bipartisan support. It was an emergency situation.

The alternative is still much worse than what we’re currently dealing with but those trillions of dollars have entered the economy in a big way.

2. The pandemic is screwing up supply chains. The New York Times had a story this week about a shortage in garage doors:

Few people had a problem getting them before. Now everyone seems to have that problem. Prices have doubled or tripled in the last year. Lead times have stretched from weeks to months. Homebuilders who would once order garage doors several weeks before finishing a house are now ordering them before the foundation is poured.

“It used to take us 20 weeks to build a house,” said Adrian Foley, the president and C.E.O. of the Brookfield Properties development group, which develops thousands of single-family homes annually in North America. “And now it takes us 20 weeks to get a set of garage doors.”

It seems some combination of a shortage in steel, spray-foam insulation and parts from China have made it harder than ever to ship new garage doors.

New houses all across the country are ready to go but they have no garage door.

Everyone has dealt with this stuff whether it’s appliances or car parts or new cars or some other new place where the supply chain gets disrupted.

Labor shortages and Covid and increased demand for stuff have all wreaked havoc on supply chains.

A shortage of supply when demand remains elevated is a good recipe for higher prices.

3. Corporations are using this to their advantage. Corporations are dealing with higher commodities prices, supply chain issues and rising wages so inflation should be impacting their bottom line.

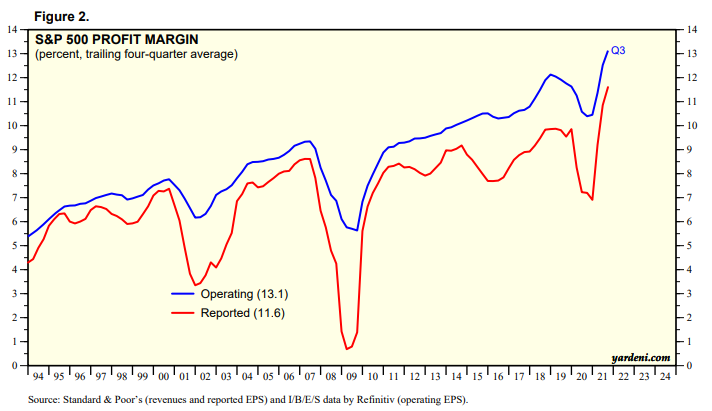

But let’s be honest — most corporations are doing just fine. Look at their margins (via Yardeni Research):

If corporations are having such a hard time with inflation how do you explain rising margins?

Chipotle’s CEO Brian Niccol told analysts the company has raised prices 6% this year and sees little resistance from consumers:

Beef and freight and some of these other things that continue to stay elevated, if we don’t see it abate, we’ll have to take some additional pricing there. So it’s really the last thing we want to do, but we’re fortunate that we can pull it. And we see no resistance to date with the levels that we’re currently at.

These poor corporations. They don’t want to raise prices but consumers don’t seem to care so they have no choice but to continue raising them.

Listen, I don’t blame them. They’re looking out for their shareholders. But this isn’t a tough choice for CEOs.

They love raising prices when they can because even when inflation subsides there’s no way they’re going to lower prices.

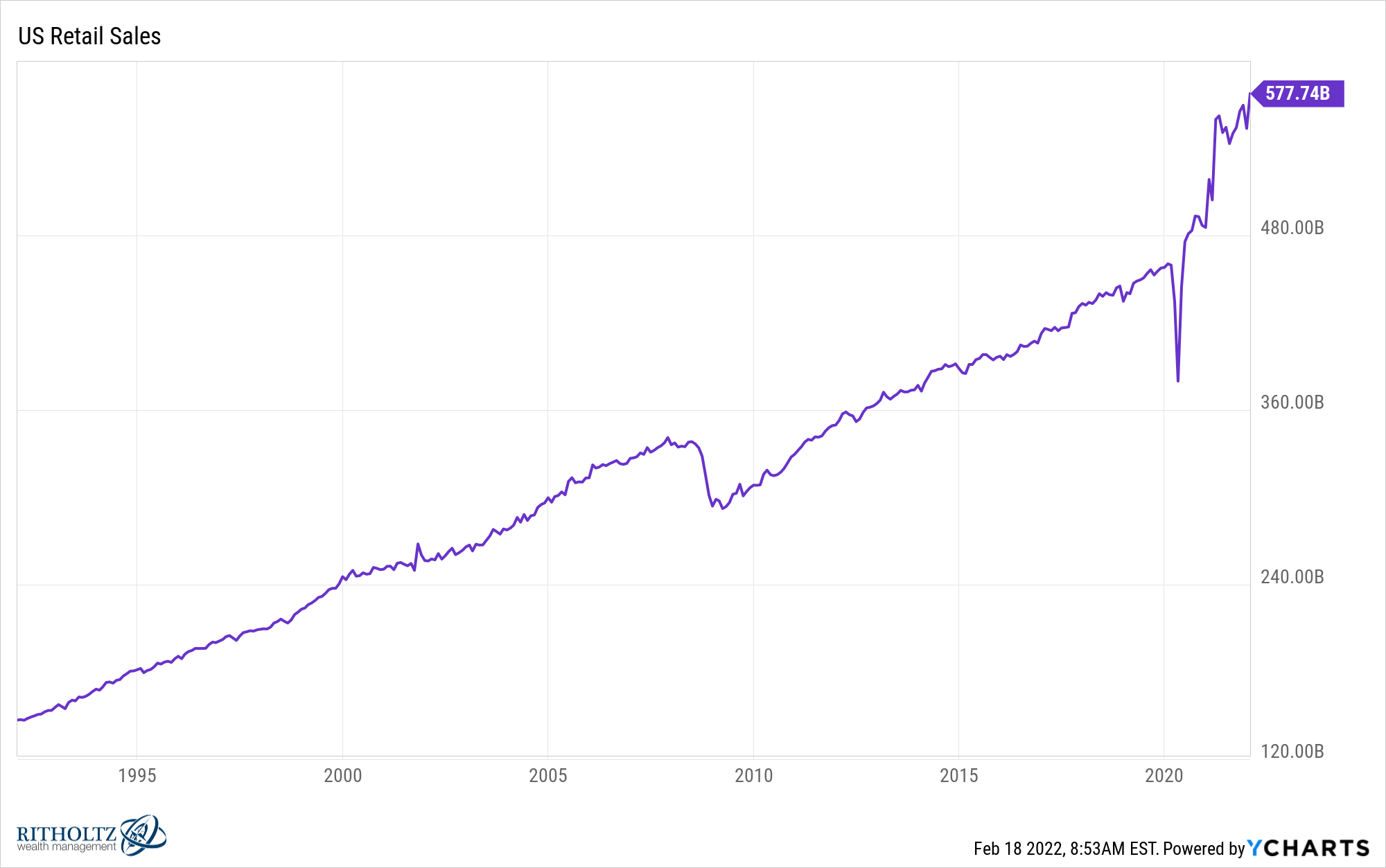

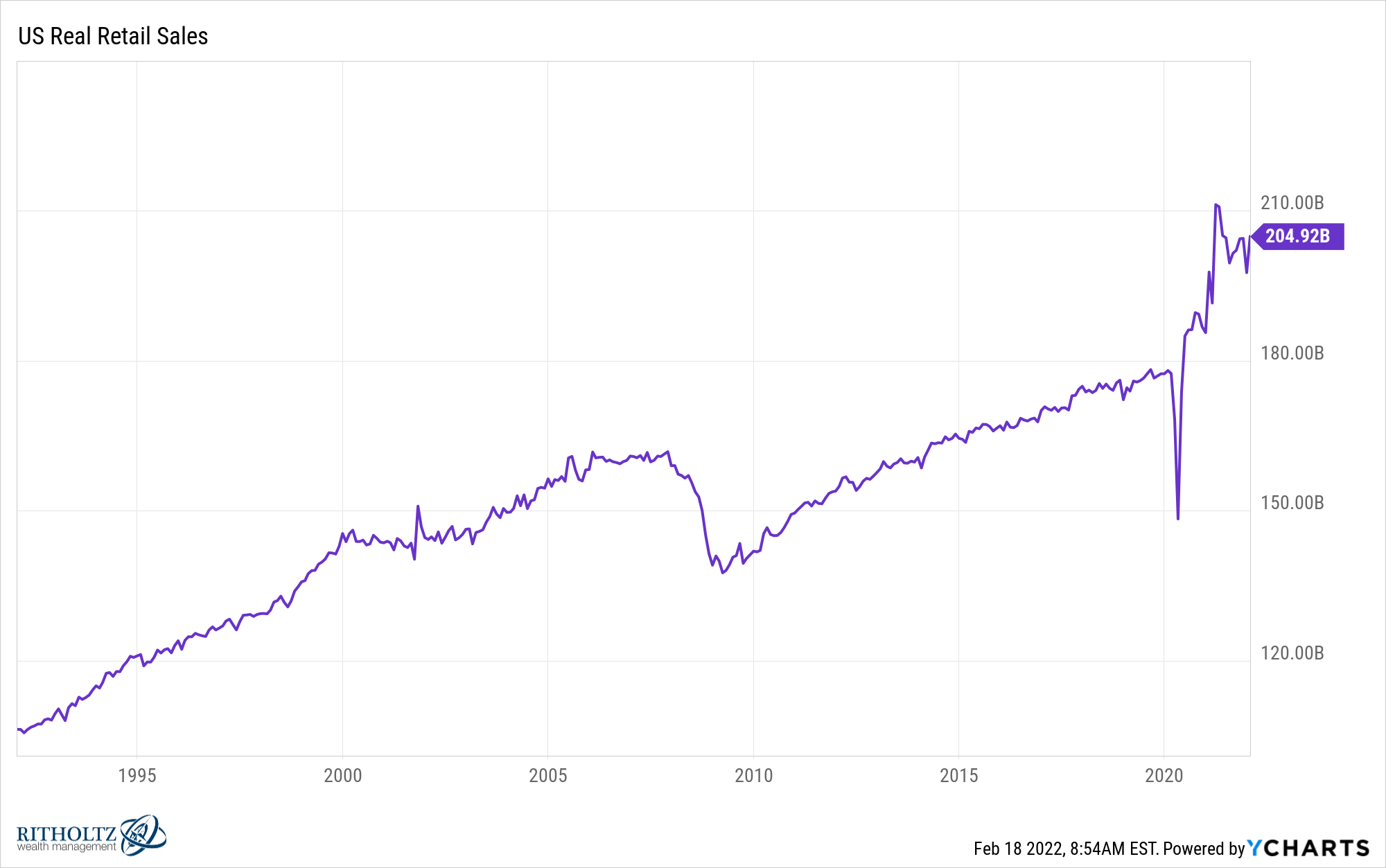

4. Consumers are spending a ton of money. This chart of retail sales is a sight to behold:

Just look at how much higher retail sales are than they were before the pandemic.

But Ben, this is obviously all inflation. What if you adjust retail sales for higher prices?

OK fine, here you go:

Even after adjusting for inflation, these numbers have seen a massive spike since the pandemic.

Basically, we are buying a ton of stuff.

The Wall Street Journal had a story recently about Chanel handbags. These are luxury items that sold for a ridiculously high price of $5,200 for a tiny purse in 2019 before the pandemic.

Seems high but we all have our vices.

I guess it just wasn’t high enough because they raised prices three times last year alone. You can now pick up a Chanel Classic Flap purse for the low, low price of $8,200.

They blame higher production and raw materials costs for the price increases but come on.

They’re charging higher prices because they can!

And consumers are gladly paying up:

“All the luxury industry is raising prices,” John Idol, the chief executive officer of Capri Holdings Ltd., owner of Michael Kors, Jimmy Choo and Versace, told analysts recently. “We’ve seen absolutely no consumer resistance to any of the price increases that we have taken, and there will be more.”

At least they’re being honest I guess?

I have no problem blaming corporations for being greedy but consumers aren’t innocent in all of this.

It helps people have repaired their balance sheets. Households have paid down debt, seen their house prices increase, their 401k balance skyrocket (until this year) and spend money like it’s going out of style.

So we all complain about inflation but most of us continue to gladly pay higher prices anyway.

Everyone is miserable about inflation but we can’t help but pay higher prices because if there’s one thing we do really well in this country…it’s consumption.

Michael and I discussed inflation and more on this week’s Animal Spirits:

Subscribe to The Compound so you never miss an episode.

Now here’s what I’ve been reading lately:

- What to do with an IPO windfall (Belle Curve)

- Mood follows action (The Root of All)

- It’s time to leave the casino (Calvin Rosser)

- The upside of creating something every day (Abnormal Returns)

- How do investors fail? (Dollars and Data)

- Beating inflation, alternative assets and simplifying your finances (All the Hacks)

- The fine line between contentment and ambition (Wealth Found Me)

- A colossal waste of time (Irrelevant Investor)