The current bull market feels ______.

(a) Long in the tooth.

(b) Overdone.

(c) Like it’s on its last legs.

(d) All of the above.

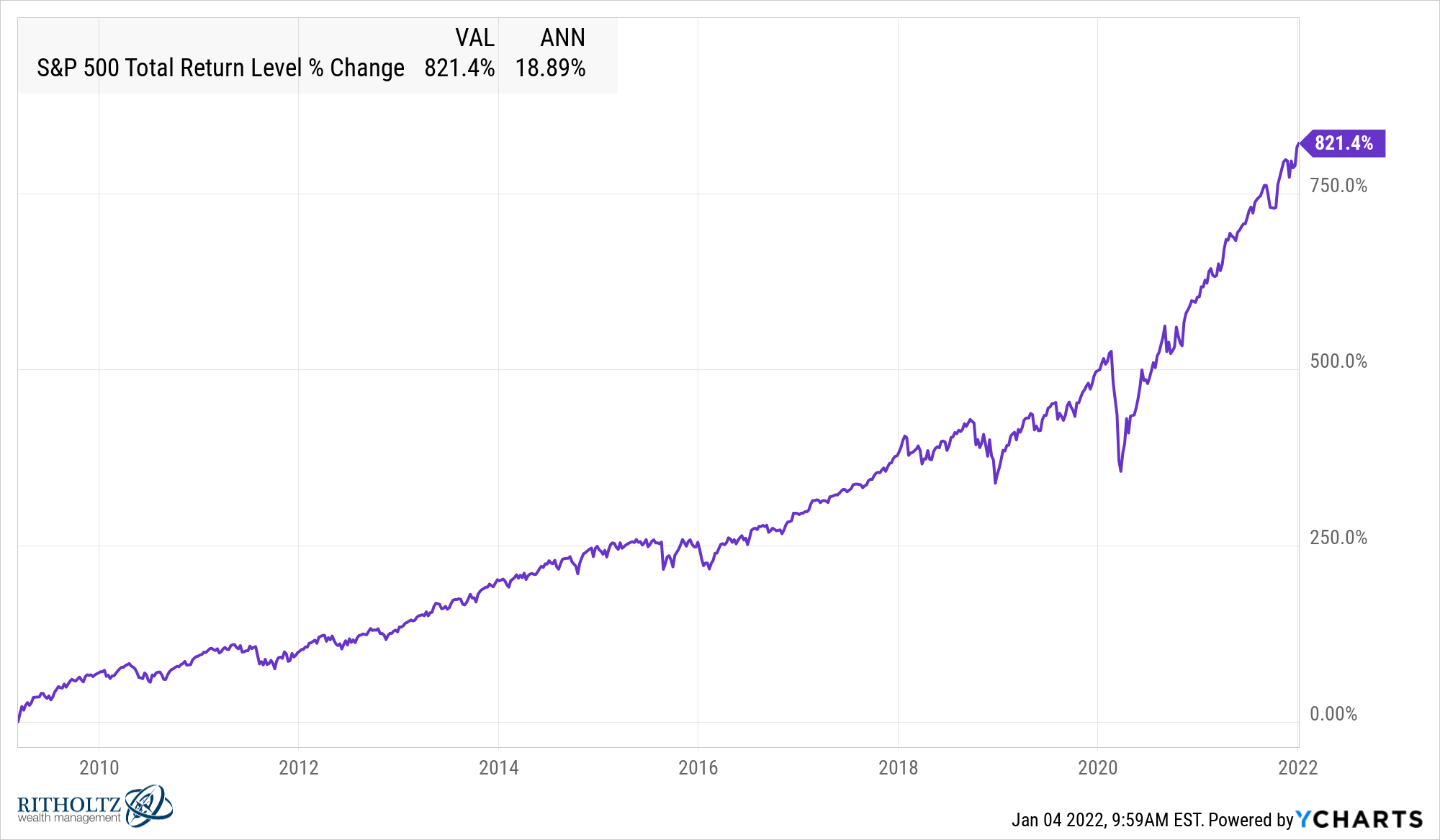

It would be hard to argue with any of these choices when you look at the numbers. From the bottom in early March of 2009 the S&P 500 is now up well over 800% on a total return basis:

That’s nearly 19% per year for going on 13 years now.

There is no way stocks can keep up this clip forever. Eventually returns will be lower and there will be a bear market. I’m certain of that.

But even if returns do slow from here and we experience a handful of bear markets in the years ahead, history shows bull markets can last a lot longer than you think.

Before we dig deep into some market history, I have some caveats. Defining “bull market” is not easy.

Do they start from the bottom of a previous bear market?

Do they start once previous highs have been taken out?

Do they reset when a bear market takes place?

I have my own definition which you will see in the following data. You can quibble with my definition but it’s really semantics. Also, I’ve done some cherry-picking of start and end dates here. The data is the data but I did so to make a point.

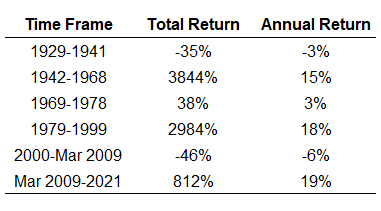

From 1929-1941, investing in the stock market was dead money. Total returns during this 13 year period were -35%. That’s an annual loss of around 3.3% per year.

The experience of the average stock market investor was certainly worse than even those numbers look.

From the peak in September 1929 to the bottom in the fall of 1932, U.S. stocks fell 86%. That was followed by a rally of more than 110% in just 3 months. Those gains were nearly wiped out by a 40% bear market that lasted into early-1933. Stocks then rose another 120% in 1933 only to experience two more 30% bear markets between the tail-end of 1933 and 1935.

And just when people thought the carnage from the Great Depression was over, the 1937 recession hit and stocks crashed 55%. The market finished down 9 out of 13 years from 1929-1941. There is no question this was the worst U.S. stock market environment in history.

It wasn’t until WWII that stocks finally found their footing. From 1942-1949, the market shot up 290%. That’s good enough for annual returns of 18.6% per year. The 1950s really kept the post-war boom going, which still might be the best decade in U.S. market history.

Stocks were up almost 500% or 19.5% per year.

Things cooled off a bit in the 1960s, but stocks still more than doubled in that decade, with 6 out of 10 years enjoying double-digit gains.

It doesn’t have the cache as the 1980s and 1990s boom times but this period might be just as impressive in its longevity.

From 1942-1968, the S&P 500 gained nearly 3900%. That’s close to 15% annual returns over 27 years. Ten thousand dollars invested in the S&P 500 in 1942 would be worth almost $400k by 1968.

The worst calendar year return during this period was -10.5%.

Of course, there were recessions and corrections during this run. There just weren’t any bone-crushing ones.

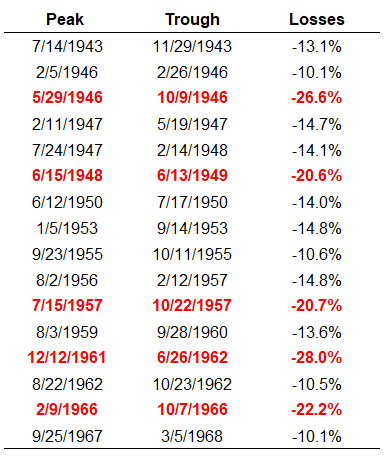

In fact, there were 5 recessions, all relatively mild save for the 1945 edition coming out of the war. There were 16 double-digit corrections in this 27-year span:

The average losses were -16.2%. This bull market was bookended by a 35% crash from 1940-1942 and a 36% crash from 1968-1970 but no 30% drawdowns in-between. That’s nearly three decades with no systemwide market reset.

Then from 1969-1978, the stock market was up just 38% in total. That’s a paltry gain of just over 3% per year. And when you consider inflation was running at 6.5% per year during this 10 year time frame, real returns were negative.

This period also included a brutal recession and bear market in 1973-1974 which saw stocks get cut in half.

Following that terrible, no good decade in stocks, investors were rewarded with sky-high interest rates, low valuations and two recessions in the span of three years from 1980-1982. But the stock market had already started looking past those high rates and inflation.

From 1979-1983, U.S. stocks were up 120%. There wasn’t a single down year from 1982-1989, despite the biggest one-day crash in history in October 1987.

The 1980s saw stocks climb 395% or 17.4% annually.

After a relatively nasty recession in 1990, stocks took off yet again rising more than 425% (18% per year) throughout the 90s.

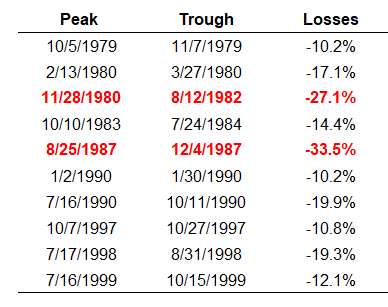

From 1979-1999 there were just two down years for the S&P 500 — losses of 4.7% and 3.1%. Again, there were plenty of corrections along the way but none that decimated the economy or financial system:

Downturns averaged -17.5% during these 21 years.

The bursting of the tech bubble led to the next painful leg down. In the span of less than a decade the stock market would lose more than 50% of its value twice. From the end of 1999 through the bottom of the Great Financial Crisis crash in early March 2009, the S&P 500 was down a total of 46%.

That’s close to 10 years where the market not only went nowhere but also got crushed.

You know what happened next as stocks are now up 12 out of 13 years since the 2008 crash.1

Here’s the summary of this history lesson:

By my estimation, we’ve had long-term six market cycles over the past 100 years or so. There were, of course, mini booms and busts within these longer-term cycles. There will always be cyclical bear markets during secular bull markets and vice versa.2

Here are some takeaways from this exercise:

- The good times and the bad times can both last longer than you think.

- The good times nor the bad times last forever.

- The current bull market could end tomorrow but it could also last another decade-plus.

- Investing in stocks can be painful. Investing in stocks can also be wonderful. Sometimes it just depends on timing and luck.

It’s also worth noting even 100 years is an extremely small sample size when it comes to the markets. The future doesn’t have to look like the past. And because we now know so much more about market history, that’s probably more true than ever.

Studying market history doesn’t necessarily help you predict what’s going to happen in the future.

But it can prepare you for a wide range of outcomes — both to the upside and the downside.

Further Reading:

2021 Was One of the Best Years in Stock Market History

1As a reminder, this bull market hasn’t always been easy.

2 This is really the first secular bull market that started at a market bottom. Stocks languished from market bottoms in 1932 and 1974 which is why I used March 2009 as a start and end point. Is this cherry-picking? Yes, yes it is. So be it.