A reader asks:

The majority of my net worth is tied up in my house and I’m not sure how safe that is. Can you think of some simple ways to hedge out the risk of owning a home?

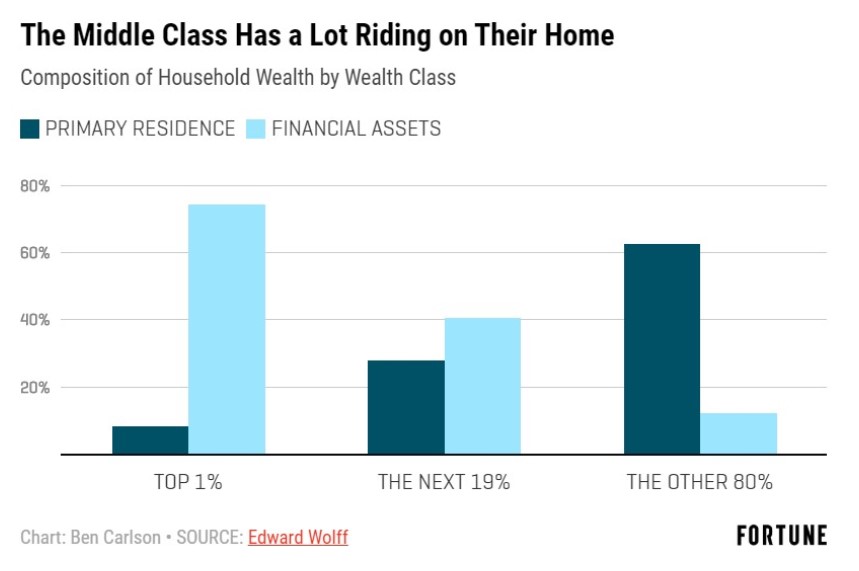

This person is not alone when it comes to having the majority of their net worth tied up in their home. For most Americans, a home is bar far their biggest financial asset:

The bottom 80% in terms of wealth in the United States have nearly 65% of their wealth in their primary residence and just 12% in financial assets.

By contrast, the top 1% has just 9% of their assets tied up in their primary residence and 74% of their wealth in financial assets.

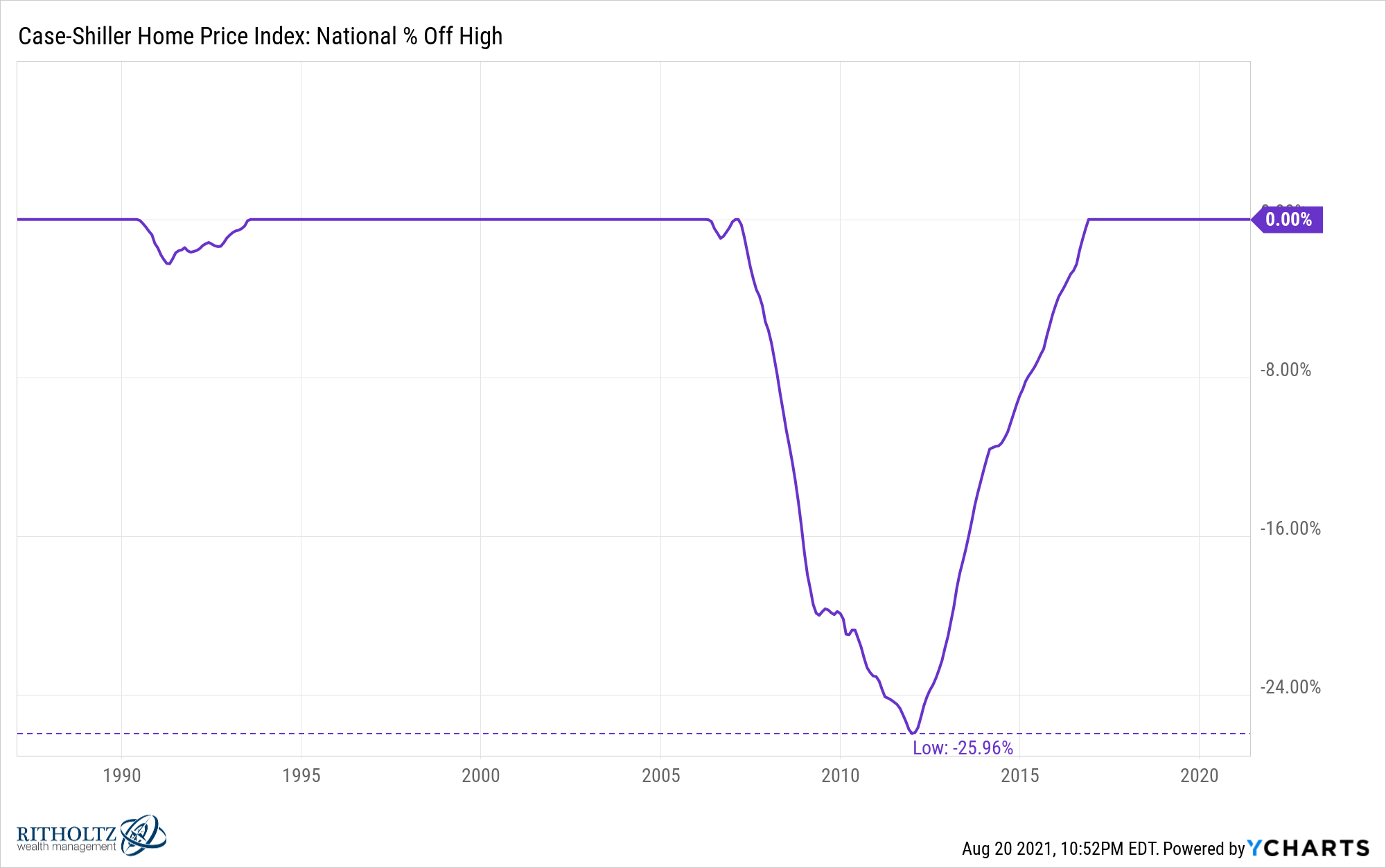

It’s understandable to be worried about having the majority of your wealth in your house. It’s literally the roof over your head. The 2008 crisis showed how damaging a housing crash can be when you go underwater.

The good news is, downturns in the housing market are relatively rare. Since 1987 there have been just two nationwide housing slumps:

In this same time, the U.S. stock market has experienced 15 separate double-digit corrections, including four losses in excess of 30%. The housing market is a different beast than the stock market for the simple fact that panics are rare.

Your house isn’t priced on a daily basis. Turnover is relatively low. It’s more of a scarce asset. And housing has a personal element to it that stocks will never have — people have to live somewhere.

Although housing corrections are rare, so are double-digit returns over a single year nationwide. Many people are worried the housing market could be due for a breather.

I tend to think housing will remain strong for the foreseeable future from a combination of underbuilding, demographics and household formation but you never know with these things.

Here are some thoughts on how to hedge your biggest asset:

Extend your time horizon. The best way to increase your odds of success in the stock market is to extend your time horizon. The U.S. stock market is only up 55% of the time on a daily basis over the past 90+ years but it’s never experienced losses over a 20 year period.

Thinking long-term when buying a house doesn’t guarantee you’ll do better but it does increase your probability of seeing a positive outcome.

Plus the transactions costs are much higher in real estate. There are closing costs, realtor fees, title insurance, the cost of moving and more.

There are always extenuating circumstances but my general rule of thumb is to avoid buying a house you wouldn’t be perfectly comfortable living in for 7-10 years, at a minimum.

Don’t take on more house than you can handle. Low mortgage rates have made it easier for many people to stretch themselves but you can take this too far.

Housing costs are by far the biggest expense item on the budget for the vast majority of households.

This fixed cost can be a great hedge against inflation over the long-term but it can also ruin your budget if you spend too much.

Housing costs also extend beyond your monthly mortgage payments to taxes, insurance, maintenance, upkeep and renovations.

It doesn’t matter how many lattes you skip if you’re housing expenses are more than you can handle.

Diversify your financial assets. The reason so many people have the bulk of their wealth tied up in their house is because homeownership is a form of forced savings.

The simplest way to manage risk is by diversifying into other savings vehicles. That could be a savings account, 401k, IRA, brokerage account or HSA.

Keeping your housing costs reasonable plays a big role here because you don’t want to get to the point where you don’t have the ability to save elsewhere.

Don’t overthink it. I suppose the sexy answer here would be to buy some credit default swaps on the housing market or some other exotic hedge a la The Big Short.

If you’re not a hedge fund manager this mentality is sure to lead to more headaches than solutions.

It was easy to turn into a macro tourist following the financial crisis because it all seemed so obvious in hindsight.

But it’s far more important to think about these decisions on a micro level rather than trying to predict the macroeconomy.

We don’t have any control over when the economy goes into a recession or the housing market cools off or how much the government spends or the level of interest rates.

But we do have the ability to understand our own household budget, how much we spend on housing, how much we save and how much debt we can reasonably handle.

The best hedge against having a big chunk of your wealth tied up in your home is to have enough durability built into your financial plan that allows you to handle any unforeseen risks in the housing market or broader economy.

Further Reading:

The Problem with Timing the Housing Market