I’m a sucker for historical market data.

I know, I know. It doesn’t help you predict the future but it can help shape your expectations to allow you to emotionally prepare for a range of outcomes.

This week someone sent me this Long-Term Asset Return Study done by Jim Reid and team at Deutsche Bank that looks at historical asset class returns going back to 1800.

You have to take any financial market data, call it pre-1950s or so, with a bucket of salt but I still think these numbers can be instructive when thinking about the very long-term for financial markets.

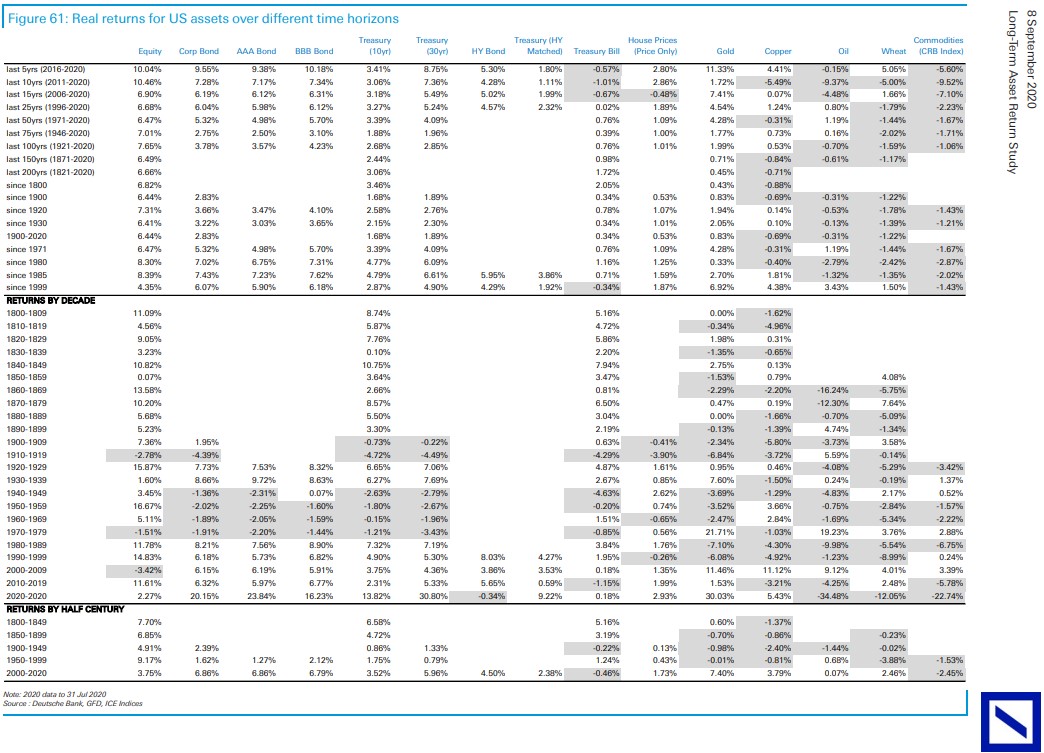

Reid’s research shows the historical real returns on stocks, bonds, cash, housing and commodities over a number of different time frames:

There’s a lot going on here and this might be hard to read for those of you who don’t have better than 20/20 vision like yours truly (not to brag) so let’s zoom in on some of these numbers.

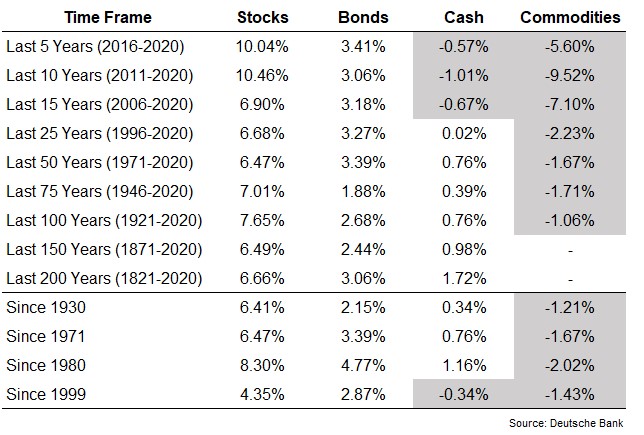

These are the annual real (after-inflation) returns for U.S. stocks, 10 year treasuries, cash and commodities:

Some observations:

Short-term returns for the stock market can be highly unpredictable and unstable. Long-term returns for the stock market have been far more stable. While real returns have been elevated for the past 5 and 10 years, there isn’t much of a difference between returns over 15, 25, 50, 75, 100, 150 or 200 years.

This is comforting even if future returns are promised to no one.

It’s also a good reminder that the high returns in the current cycle won’t last forever. You can’t set your iPhone to it but eventually higher than average returns will be followed by lower than average returns.

Returns have been much higher than the long-term averages since 1980 but you can see the numbers since 1999 are working off some of those excesses.

Interest rates have been on the floor since the Great Financial Crisis but the numbers over the past 5, 10 and 15 years show how the safety of cash over the short run can hurt you over the long run.

Cash and short-term bonds can certainly be helpful when you need to spend your capital in the near-term but if you hope to beat the rate of inflation over the long-term you need to accept some risk in your portfolio.

Sitting in cash will always feel safer than investing in the stock market but the stock market gives you much higher odds of increasing your standard of living.

The performance of commodities may also be surprising to some investors. Commodities have negative real returns over the past 100 years! Now there could be some selection bias here. You can see from Reid’s numbers that gold has a much better track record.

But I look at these results as a positive. It shows progress, innovation and technology as a deflationary force in the world that most commodity prices don’t keep up with inflation.

Many investors want to be invested in commodities today because of worries about inflation. And commodities can have high returns under inflationary environments.

But stocks have a much better track record over the rate of inflation in the long run.

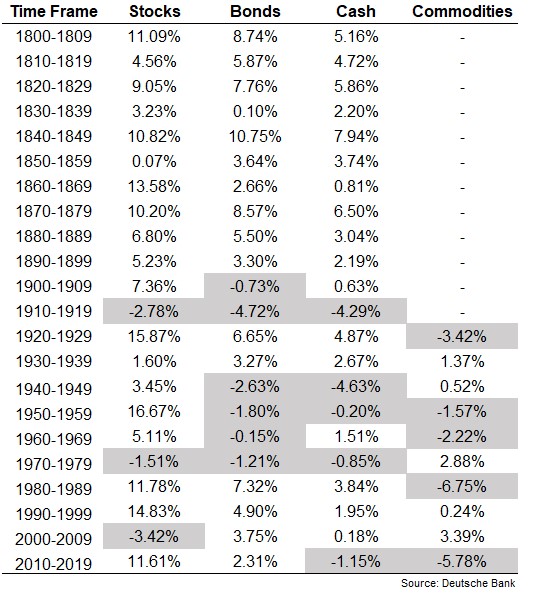

Now here are the annual real returns by decade:

You can probably throw out the returns from the 1800s but I would like to know what was going on in the 1840s to cause such wonderful performance across the board. I guess the gold rush was good for the markets.

A decade feels like a long time but might not be worthy of consideration when it comes to “long-term” for the stock market. In 3 out of the last 11 decades, the stock market has experienced negative real returns.

That’s a lost decade, which is a good thing for savers, but bad thing for investors. The risk of a lost decade is why returns have been so consistently high over much longer time frames. Lost decades are also a good reminder for the importance of diversification. A lot of investment success is predicated on luck and timing.

These numbers also show how good fixed income investors have had it over the past 40 years or so.

There can be negative real returns on bonds for an extended period of time. The four-decade stretch from the 1940s through the 1970s saw negative real returns for bonds.

Cash has had negative real returns in 5 out of the past 11 decades. You can probably expect that to continue from such low rates at the moment.

There is a very good case to be made that returns over the next 50-100 years will be lower than they’ve been over the past 50-100 years. There’s simply more knowledge about the markets now, an implicit backstop from the Fed, lower interest rates and ever-increasing valuations.

On the other hand, costs have never been cheaper, the barriers to entry to get invested have never been lower, there are more investment products available than at any other time in history and continued innovation in financial services.

While gross returns will likely be lower, net returns should be higher for those who are able to avoid behavioral mistakes.

The biggest threat to long-term returns is your behavior in the short-term.

Further Reading:

How Comfortable Are You Holding Stocks For 30 Years?