Last year the stock market was rising when the economy was getting worse.

This year the stock market is falling while the economy is getting better.

Confused yet?

You could blame this upside-down logic on the Fed if you are so inclined. Jerome Powell and company threw the tank at the financial markets and it worked.

On Thursday, Powell confirmed he’s not letting his foot off the gas pedal until the employment and inflation pictures improve:

Today we’re still a long way from our goals of maximum employment and inflation averaging 2% over time.

That’s good for the markets, right? The Fed is sticking with easy money policies and that’s helped since 2009. All clear, right?

Not exactly.

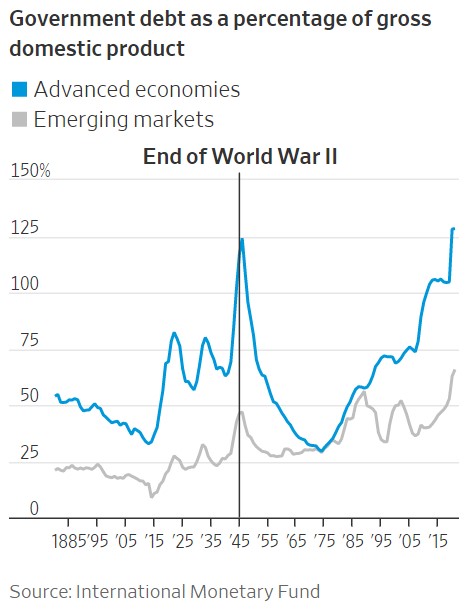

This time around the government has stepped up to the plate and spent a massive amount of money, eclipsing even World War II wartime spending levels:

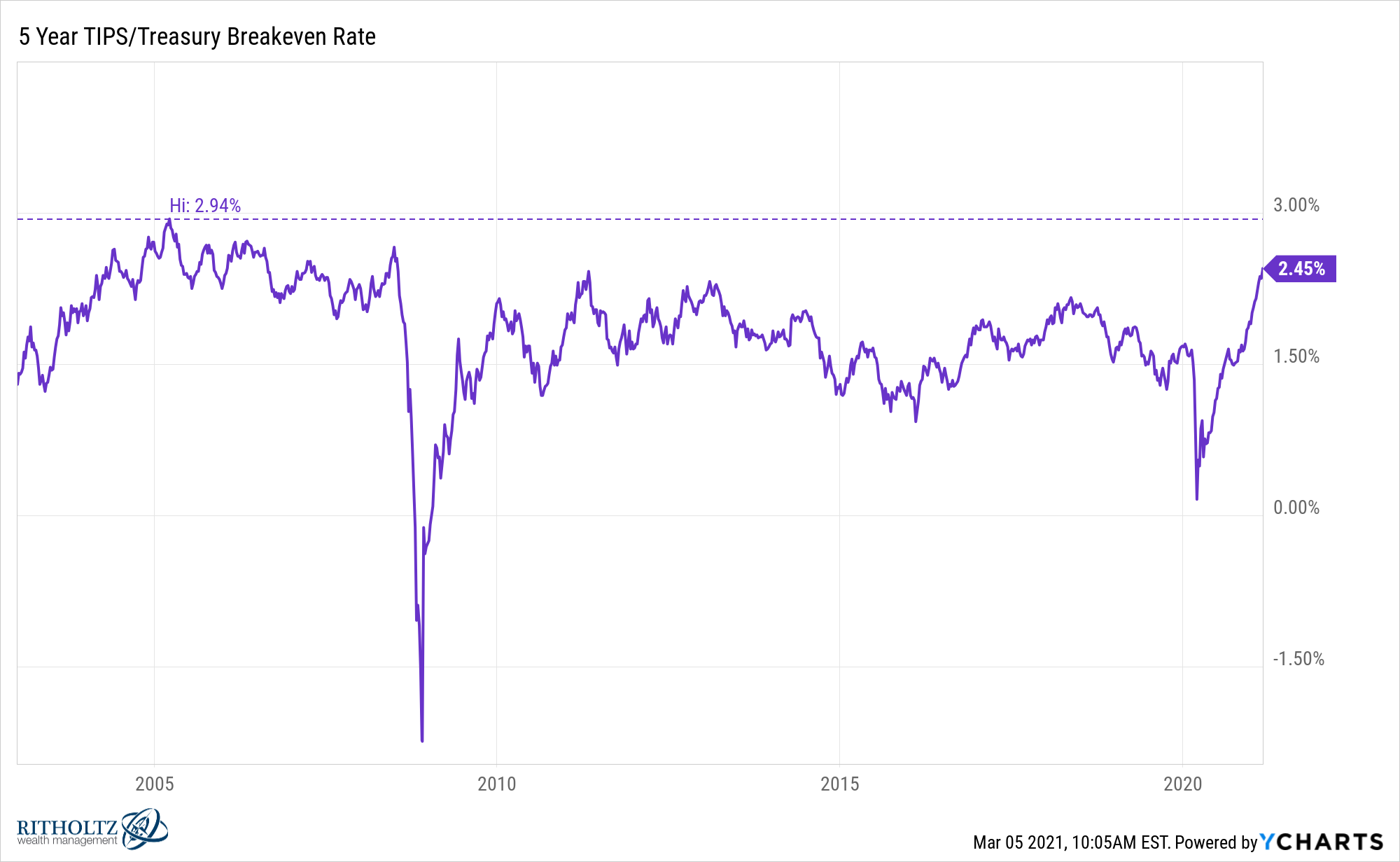

So now interest rates are rising along with inflation expectations, which are now at their highest point since 2008:

So investors are spooked.

Stocks have held up just fine historically when rates have risen but tend to show below-average returns when inflation is rising and above-average returns when it’s falling.

Inflation expectations aren’t the be-all, end-all of course. You can see the last time they were this high the next leg was way lower. Inflation never came to pass following the 2008 crisis.1

But the Fed was never this adamant that it would like to see inflation running a little hot and the markets have taken notice.

I think this could end up being a wonderful buying opportunity for investors if stocks continue to fall because of this.

Why?

I think we could see a one-time pop in the inflation numbers that eventually fades away.

Here’s what Powell said on the topic yesterday:

If we do see what we believe is likely a transitory rise in inflation I expect that we will be patient. There’s a difference between a one-time surge in prices and ongoing inflation.

Obviously, the Fed chair does not have a better crystal ball than the rest of us.2

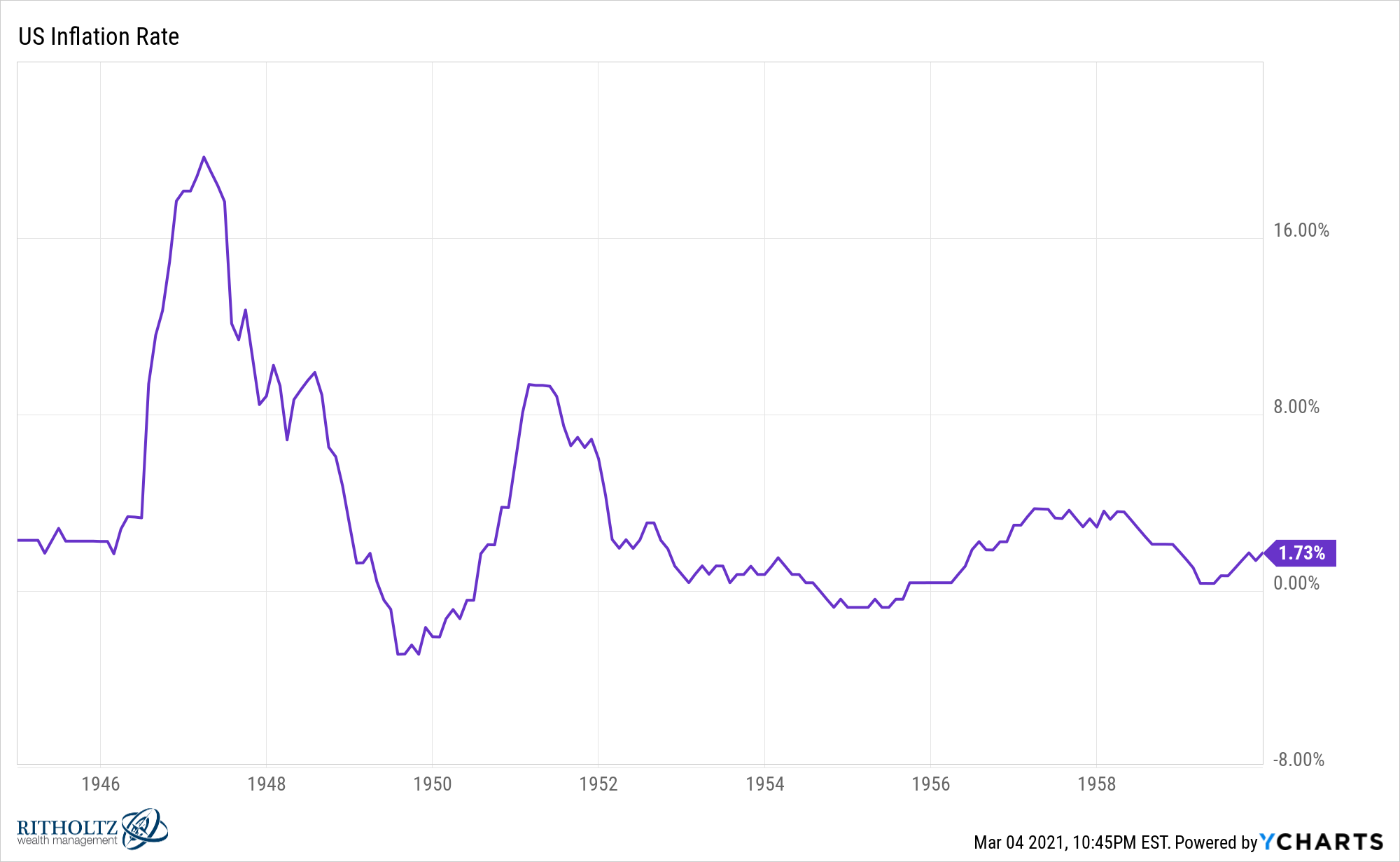

But going back to the WWII analogy, take a look at the inflation profile in the U.S. from 1945 through the end of the 1950s:

There was a massive inflationary spike following the war, which many assumed would lead to yet another depression but it never came. Inflation fell off a cliff after that one-time shock. Then there was another inflationary spike in the early 1950s that also slowly faded away.

There were some minor recessions in this time, with small economic contractions in 1945, 1948-1949, 1953-1954 and 1957-1958. But never any sustained inflation despite a booming economy following the war.

And from 1945-1959, the U.S. stock market returned nearly 17% per year, despite those two huge inflationary spikes.

Now I’m not suggesting we are in for a similar rally.

The stock market and economy were both still working off the remnants of the Great Depression by the time WWII began. The country was overdue for a boom in both.

But I think it’s possible we could get the mother of all inflation head fakes in the coming months. Economic data is going to be red hot in the spring and summer. Inflation worries will almost certainly ramp up if that happens.

That could lead to further selling, especially when it comes to the growth stocks which have gotten crushed over the past two weeks or so.

And if that inflationary head fake leads to a decent-sized stock market correction, it could offer a nice buying opportunity for stocks in the coming year.

Yes, the government has shown they’re willing to spend more money than they did coming out of the 2008 crisis. But this was wartime spending. We can’t be sure this level of fiscal support will remain.

There are other structural headwinds to a 1970s-level of inflation rearing its ugly head again. We still have to see better wage growth for inflation to stick around for an extended period of time. Demographics in this country, and around the globe for that matter, don’t really support the case for a sustained rise in prices. Plus, technological innovation remains at a breakneck pace which is deflationary by nature.

Listen, I’m of the opinion that every market downturn is an opportunity. I’m a long-term investor so how could I not?

So part of me hopes we see a market overreaction to a booming economy. And maybe it’s good for the market to take a breather for a while and let the economy take the lead. All those people who aren’t invested in the stock market deserve a break for once.

I’m always a buyer when stocks fall but an inflationary spike could give savers the opportunity to buy at much lower prices in the coming months.

If it happens, it will be a good thing.

On our Animal Spirits video this week we talked about the psychology of rising rates and higher inflation and the impact it may have on the markets:

Subscribe to The Compound for more of these videos.

Further Reading:

How Would Investors React If We Finally Get Some Inflation?

Now here’s what I’ve been reading lately:

- Venture capital in the 21st century (Institute For New Economic Thinking)

- It’s not different this time (Irrelevant Investor)

- Finance as culture (Luttig’s Learnings)

- Dad, a death sentence and the financial planner who set us straight (NY Times)

- Why are housing prices up and rents down? (The Atlantic)

1Mainly because the government didn’t help enough and there was an overhang from the real estate collapse.

2Remember Bernanke’s “subprime is contained” statement in 2007?