This has to be one of the strangest market environments of all-time.

Let’s walk through the current situation to see why:

The markets are rocking. Stock markets around the globe are at or near all-time highs. And it’s not just big tech stocks this time around — small caps, emerging markets, international stocks, basically everything is going up as of late.

Anything and everything is getting funded these days. SPACs are going nuts. IPOs are screaming higher. Collectibles are selling at record prices. Basically, everything is working right now.

The Fed is still accommodative and has no plans of taking away the punch bowl too early. Jerome Powell has in no uncertain terms made it clear the Fed is not worried about inflation and they are going to do what they can to achieve full employment:

The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, over coming months the Federal Reserve will increase its holdings of Treasury securities and agency mortgage-backed securities at least at the current pace to sustain smooth market functioning and help foster accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

That means low short-term rates and easy money for the foreseeable future.

More fiscal stimulus is coming. In addition to the trillions of dollars in emergency pandemic spending in the spring, the government approved a $900 billion package just before the end of 2020. Another $1.9 trillion is coming down the Pike. And Biden also has aspirations of a $2 trillion infrastructure spending bill.

We’ve never seen anything like this outside of war-time spending.

Strong consumer balance sheets. Although there are still millions of people unemployed and many small businesses who are struggling, the consumer balance sheet las likely never been stronger coming out of a recession than it is right now.

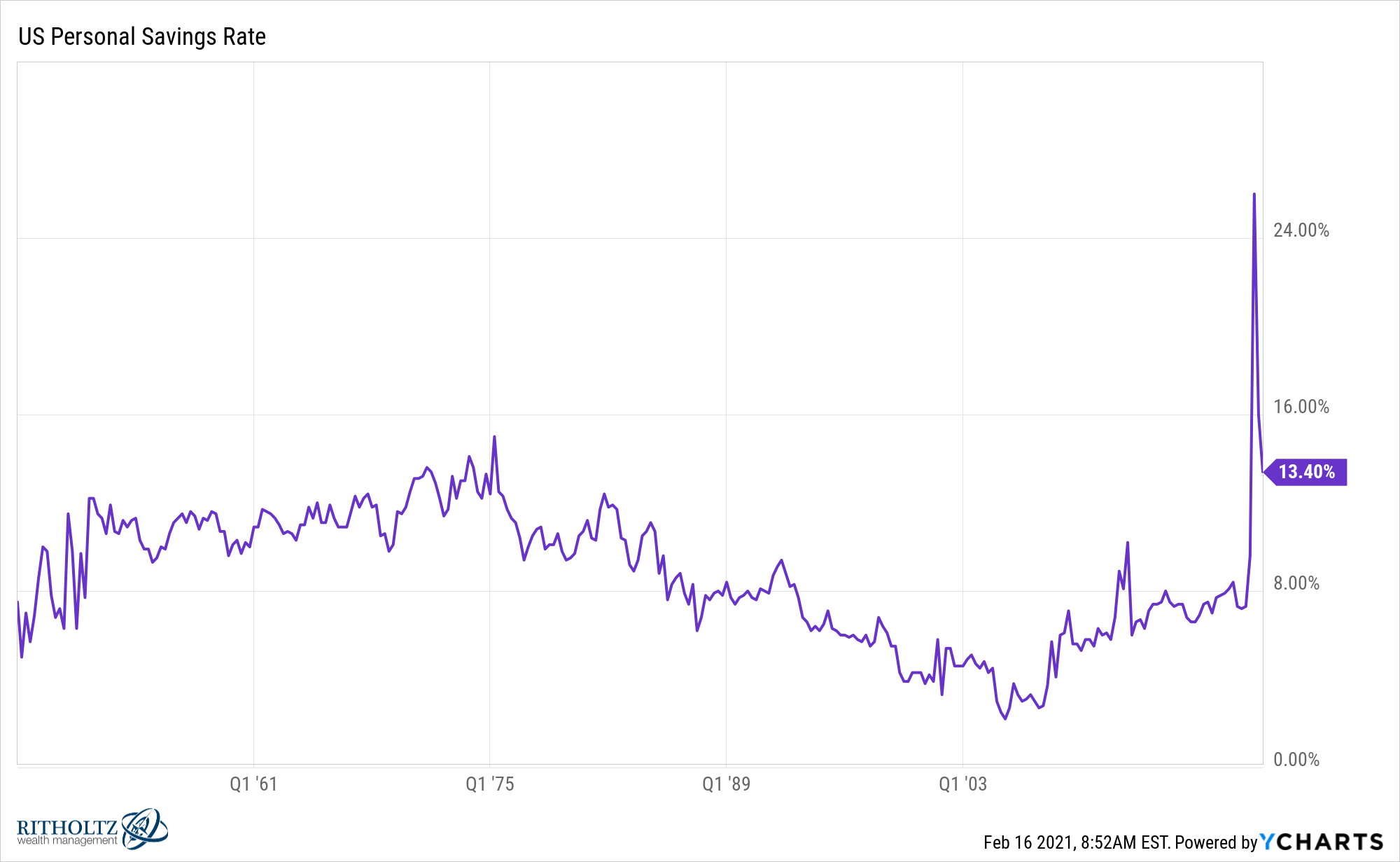

The personal savings rate remains elevated:

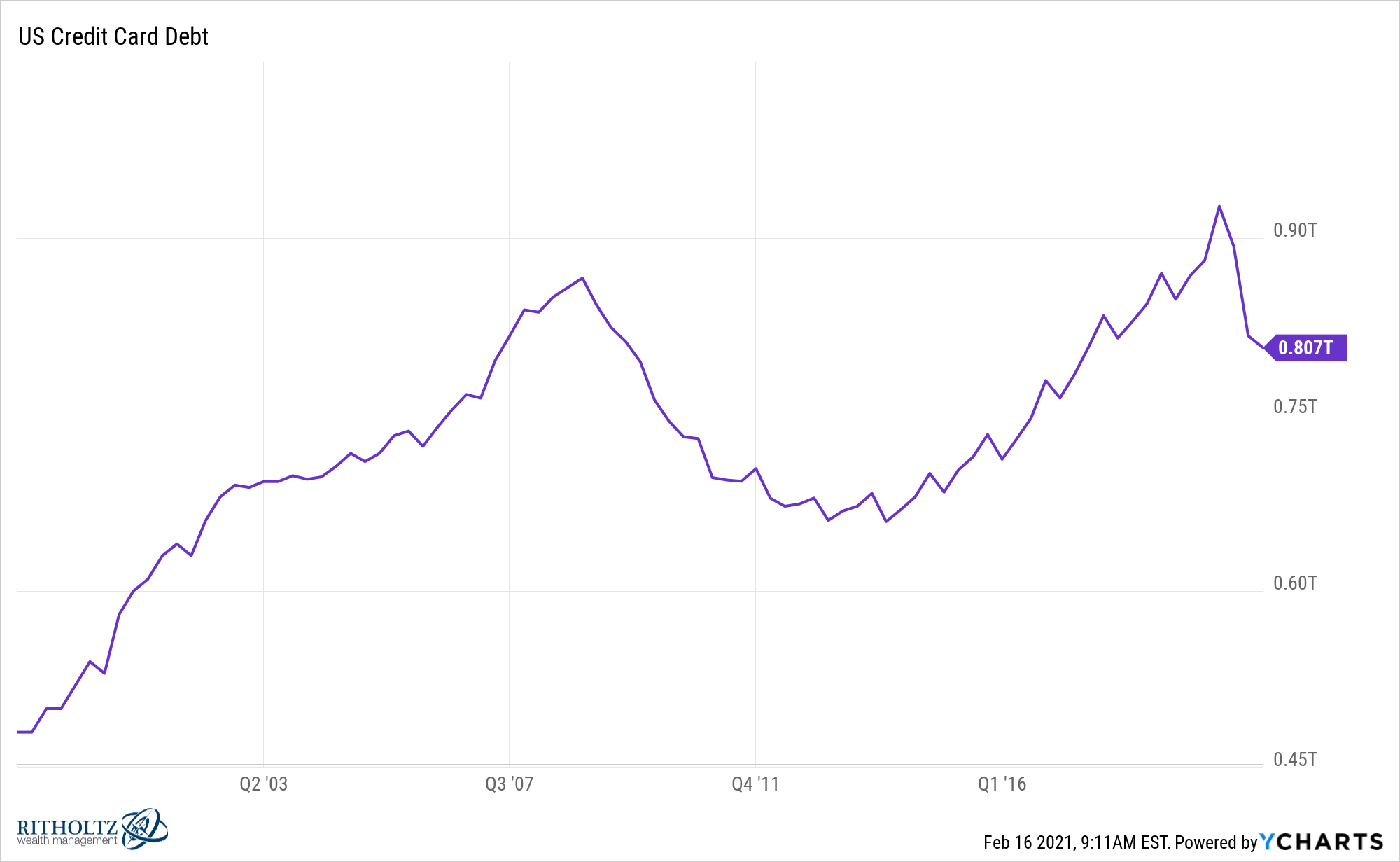

Credit card balances have actually fallen since the start of the pandemic as people have used stimulus money and funds they would have spent elsewhere to pay off debt:

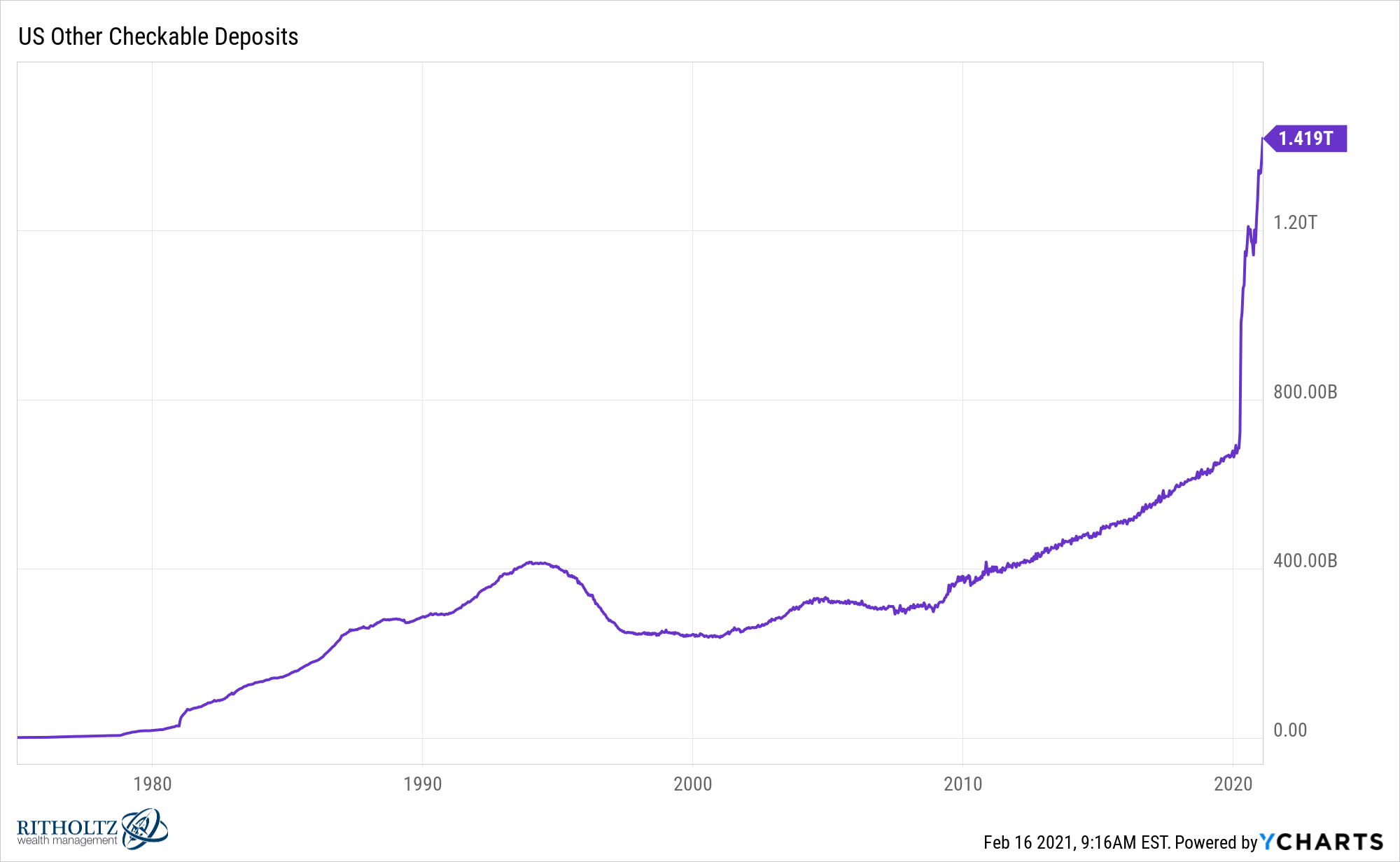

Look at the growth in things like checkable deposits (bank accounts, savings accounts, cash equivalents, etc.):

Consumers are flush with cash and many will see even more in the coming weeks or months once a stimulus deal is passed.

Consumer balance sheets were decimated coming out of the 2008 crash. It’s the complete opposite this time around.

The housing market is on fire. The housing market is scalding hot at the moment, replete with abnormally low supply, high demand, low borrowing rates, rising prices and bidding wars galore. If you bought a home any time in the past few years or earlier you are already likely to be sitting on some decent gains in equity.

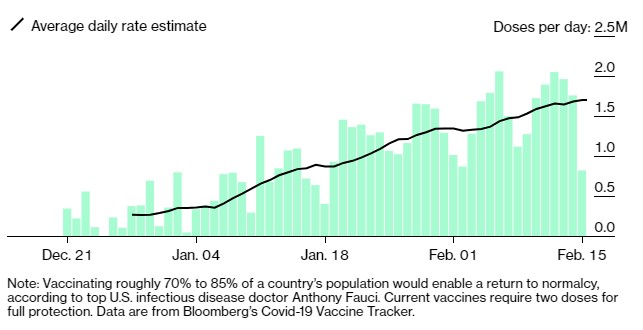

The vaccine rollout is accelerating. It took a while to get out the kinks and things still aren’t perfect but Covid vaccinations are improving by the day:

The U.S. vaccine rollout is now one of the best in the world. There will certainly be some people who are still timid when things start to gradually open up but eventually we are going to see the mother of all experience spending booms to make up for lost time.

In summary:

- Markets are in an uptrend

- Easy money is here to stay for a while

- The government isn’t going make the same mistake it made following the last crisis by pushing for austerity

- The consumer is in better shape even after a pandemic-induced recession

- Housing prices are on fire

- And there is a light at the end of the Covid tunnel.

On the other hand, valuations are stretched, we are coming off a 10+ year bull market that never truly got reset during the pandemic plunge and there is a speculative frenzy among investors that hasn’t been seen since the dot-com bubble.

Markets, in many ways, are insane right now.

This is such a strange environment because we’ve never seen markets overheat so fast with speculative behavior coming out of a crisis but we’ve also never had that speculative behavior combined with an economic backdrop that is about as accommodative as it has ever been.

If you’re asking me to choose between fundamentals and sentiment in the intermediate-term, I’m going to choose sentiment every time.

Never say never in the markets, but your baseline assumption right now almost has to be that valuations won’t matter for a while or investors will simply continue to ignore them.

Yes, fundamentals will always matter eventually when it comes to the markets but the next 18-24 months is setting up to be one of the better economic environments we’ve seen in some time.

Will investors eventually get spooked by the potential for rising inflation or interest rates? Sure.

And maybe the economy outperforms the stock market for a while.

But there is just so much money sloshing around that it seems like any correction will see buyers step in. Robinhood experienced an existential crisis for about 12 hours until they snapped their fingers and raised $3.4 billion basically in an afternoon.

I am willing to have this thrown in my face if I am wrong but I get the feeling valuations, as challenging as they are at the moment, aren’t going to matter for a while.

The Roaring 20s are on the table.

Buckle up.

Further Reading:

How Did We Ever Get to the Roaring 20s?