GMO’s Jeremy Grantham is once again sounding the alarm on a stock market bubble.

Grantham famously warned in advance of the dot-com bubble of the late-1990s and the credit bubble that popped in 2007.

This is what he wrote last week in Waiting For the Last Dance:

The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.

People have been calling for a bubble for a number of years now and frankly, they’ve been wrong. In fact, Grantham himself went bubble-hunting in 2014, predicting the cycle would run its course with a bubble by 2016 at an S&P 500 target of 2,250.

The S&P is currently above 3,800 and up more than 130% on a total return basis since those initial warnings.

It’s possible Grantham’s expertise in predicting bubbles is a case of the old saying that to a man with a hammer every problem looks like a nail. To be fair, the timing of these types of calls is basically impossible.

Bubbles are driven by human nature and human nature is impossible to predict in terms of when it’s going to turn.

Personally, I don’t think the entire stock market is in a bubble right now.

I’ve studied the South Sea Bubble, The Great Depression and the dot-com bubble. This doesn’t feel like 1720, 1929 or 1999 but I can’t be sure about that. Certainly, there are stocks and sectors that are bubbly right now but I’m not sure that means the entire stock market is ncessarily a house of cards.

However, if the Fed keeps rates low for some time like they say, we get a huge stimulus plan and demand comes back online in a post-vaccine world I think a bubble is on the table in the coming years.

Bubbles are a natural extension of the markets, more of a feature than a bug so investors have to prepare for them whether we’re currently in one or not.

Here are your options as I see them:

You could go on the offensive. George Soros once said, “When I see a bubble forming, I rush to buy, adding fuel to the fire.”

You could try to be Soros and ride the wave. Many investors already are by piling into the hottest stocks of the market (and to their credit, mostly with great success thus far).

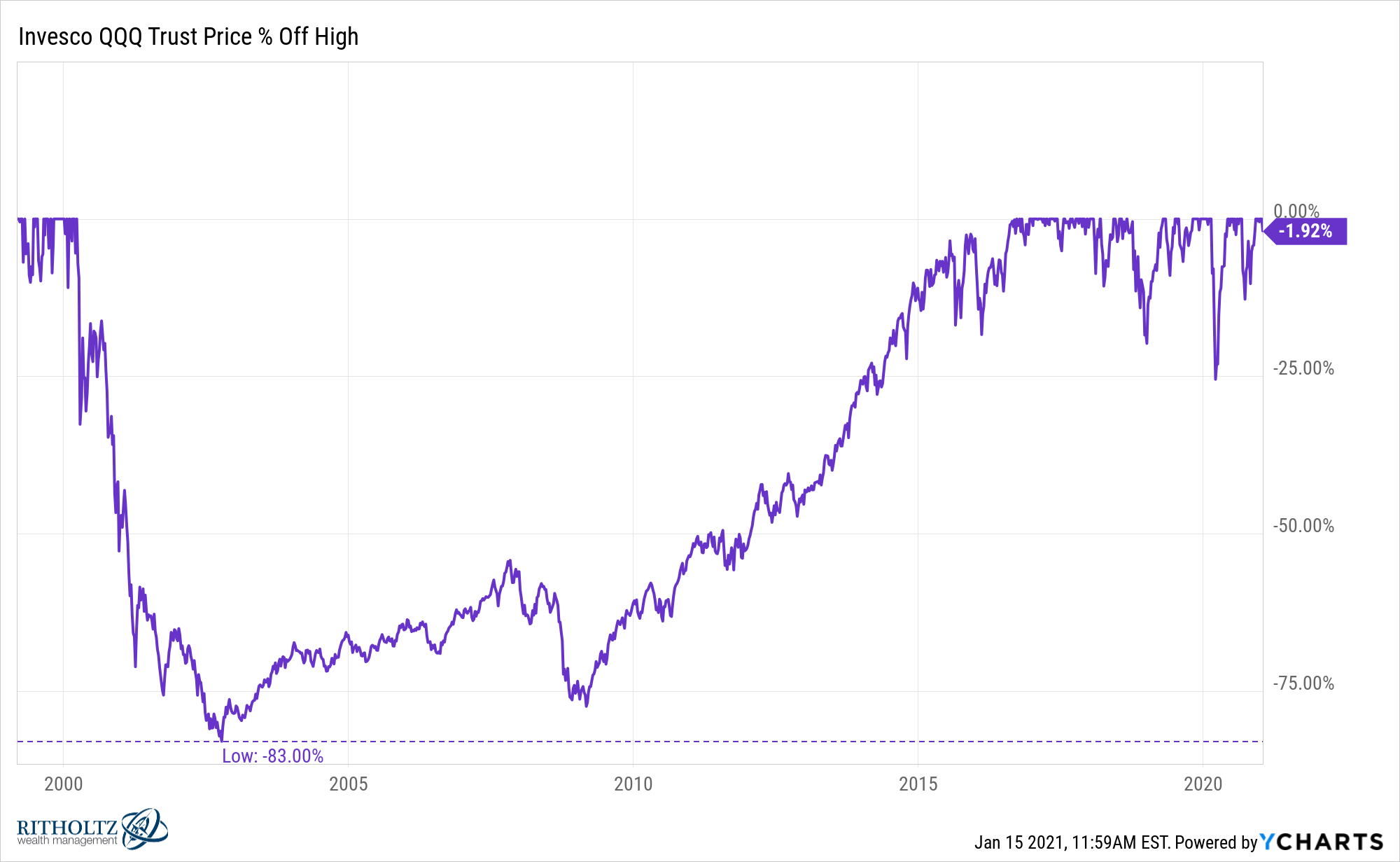

This is the type of strategy that can work gloriously until it doesn’t. The Nasdaq went bananas during the tech boom of the late-1990s but lost more than 80% when it blew up:

I’m not saying this is another tech bubble like the 1990s (it’s not) but there are certain stocks and sectors that could get anhiliated at some point because of the gains they’ve experienced.

Here are some questions to ask yourself if you plan on diving headfirst into a bubble:

- Do I have an exit strategy?

- How do I deal with large gains?

- Can I control my emotions?

You could play defense. Grantham’s strategy for investing in a bubble appears to be value and emerging market stocks:

As often happens at bubbly peaks like 1929, 2000, and the Nifty Fifty of 1972 (a second-tier bubble in the company of champions), today’s market features extreme disparities in value by asset class, sector, and company. Those at the very cheap end include traditional value stocks all over the world, relative to growth stocks. Value stocks have had their worst-ever relative decade ending December 2019, followed by the worst-ever year in 2020, with spreads between Growth and Value performance averaging between 20 and 30 percentage points for the single year! Similarly, Emerging Market equities are at 1 of their 3, more or less co-equal, relative lows against the U.S. of the last 50 years. Not surprisingly, we believe it is in the overlap of these two ideas, Value and Emerging, that your relative bets should go, along with the greatest avoidance of U.S. Growth stocks that your career and business risk will allow.

Playing defense doesn’t always mean putting all of your money in cash or bonds. You can also rotate into places that have been left behind.

If you’re going to completely avoid the best-performing areas of the market and rotate into some of the worst, you have to be willing to look dumb for a while. Maybe a long while because these things can last longer than most fundamentally-biased investors imagine.

Some questions to ask if you’re a defensive-minded investor during a raging bull:

- Will I regret missing out on a potential melt-up?

- Am I comfortable dealing with FOMO?

- How will I know if I’m wrong?

Change your allocation. Even if you’re 100% certain we’re in a bubble, there’s no rule that says you have to go all-or-nothing. You don’t have to push all of your chips to the center of the table in hopes of catching a blow-off top or cash in everything.

You can always over-rebalance your allocation one way or another depending on how comfortable you are with risk in an environment like this.

Some questions for an over-rebalance:

- Is the extra risk worth the potential reward if I increase my allocation to high-flying segments of the market?

- If I turn down my risk dial will I regret it if this thing really gets out of control?

- What is my ceiling and floor in terms of the equity allocation in my portfolio?

You could continue to invest based on your personal risk profile and time horizon. You could also simply choose to ignore market conditions altogether and invest according to your own specific personal and financial circumstances.

Doing nothing is a decision and often the right one for many investors.

You’re not a professional money manager. You don’t have to try to time these cycles perfectly.

“I don’t care” is not the worst place to be most of the time.

Some questions for an apathetic investor:

- What’s the right allocation for my risk profile and time horizon?

- What types of drawdowns would I be comfortable with?

- How to I balance risk and reward in my portfolio?

Michael and I discussed Grantham’s bubble call on this week’s Animal Spirits video:

Subscribe to The Compound to get these delivered to your inbox.

Further Reading:

Could We See Record Stock Market Valuations This Cycle?

Expected Returns & The 7 Year Itch

Now here’s what I’ve been reading lately:

- Introducing The Goldmine (Abnormal Returns)

- Avoiding major blunders in retirement (Retirement Field Guide)

- Just take the money (Dollars and Data)

- 15 easy wins with your finances (Humble Dollar)

- The secret letters of history’s first businesswoman (BBC)

- The risks you can’t foresee (HBR)