This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

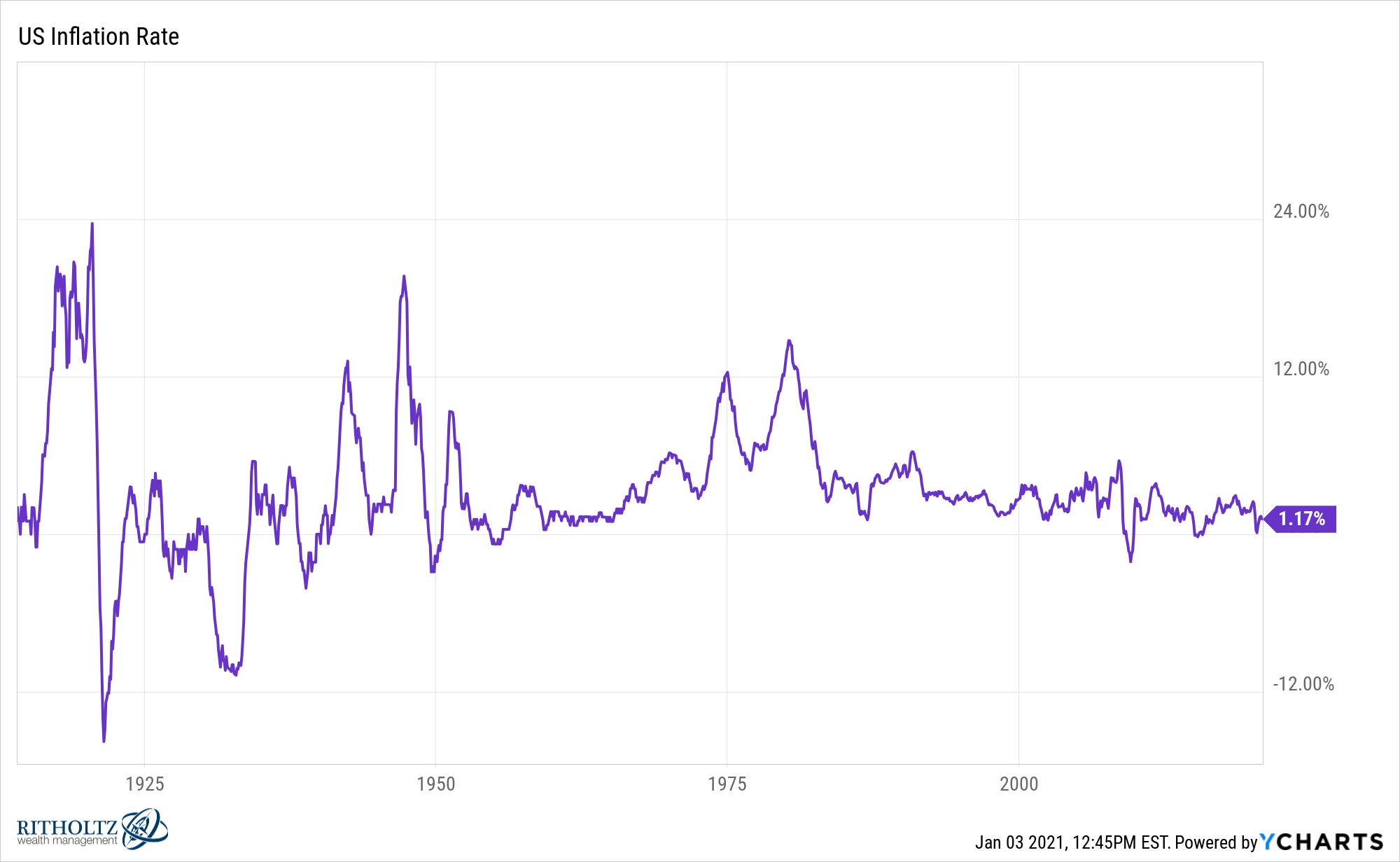

- Is inflation being understated?

- What if it’s actually being overstated

- How the availability bias impacts our thinking around price changes

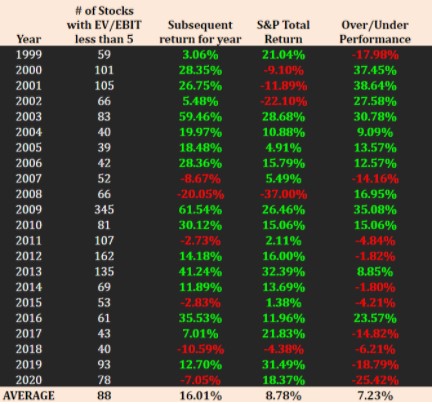

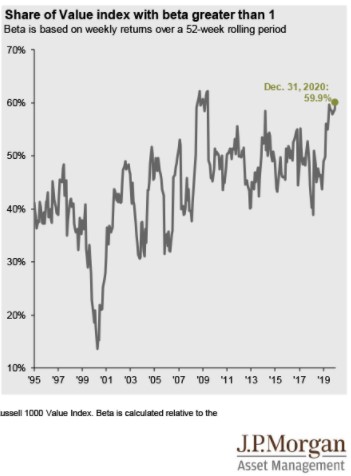

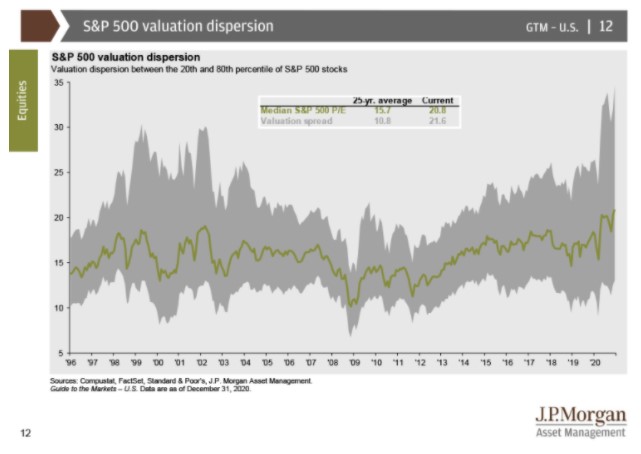

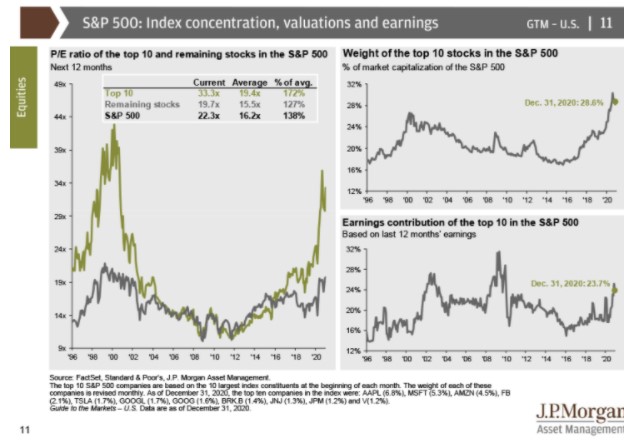

- Is mean reversion the biggest reason growth is outperforming value?

- Do rates need to rise for value investing to work again?

- Why it’s always and never a stock picker’s market

- What’s the case for higher than expected stock market returns?

- The cult status of bitcoin

- Crypto is a call option on human nature

- Is the Fed more important than the president?

- Why are municipal finances holding up better than expected in the pandemic?

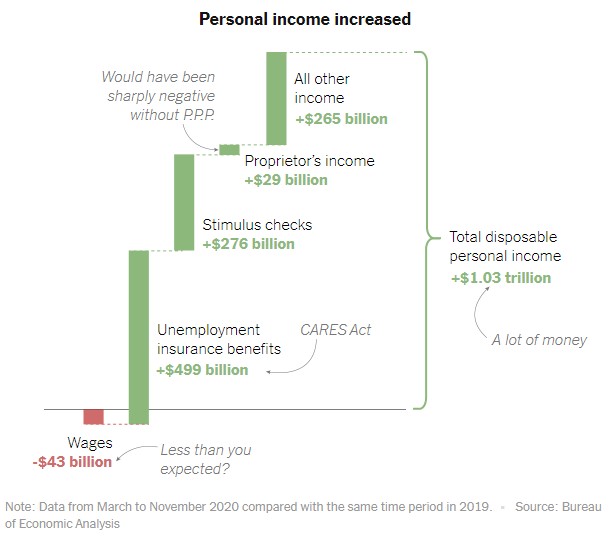

- How can employment be down so much but incomes up?

- Why even wine experts can’t tell the difference between inexpensive and pricey wine

- What happened to Jack Ma?

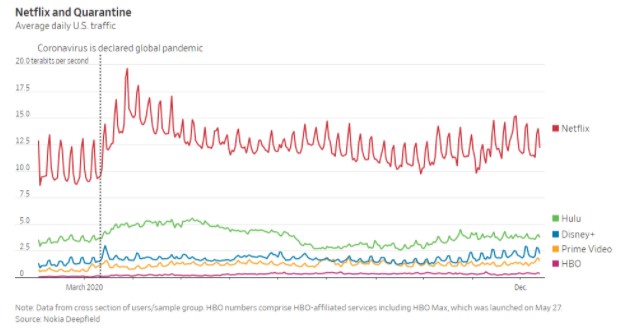

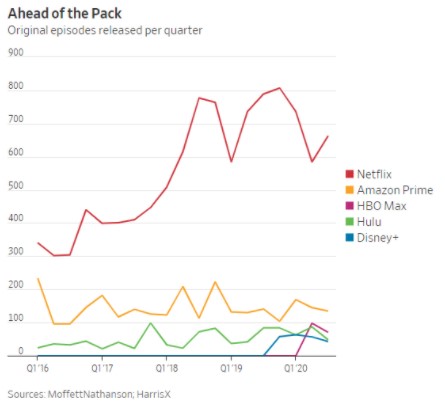

- Netflix is the king of streaming and more

Listen here:

Stories mentioned:

- Inflation truthers

- JP Morgan Guide to the Markets

- Why I’m not selling bitcoin

- Why bitcoin is a religion

- Yellen earned millions in speaking fees after leaving the Fed

- Why is state and local employment falling faster than revenues?

- Why markets boomed in a year of human misery

- Why we can’t tell good wine from bad

- Forget the streaming wars

Podcast mentioned:

Charts mentioned:

Video mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: