On today’s bonus episode of Animal Spirits, we spoke with Leigh Drogen of Starkiller Capital about what it’s like to start a crypto hedge fund.

Leigh has years of experience working with more traditional hedge funds so it was interesting to hear his take on the similarities and differences involved in this new asset class.

On today’s show we discuss:

- What it’s like to start a crypto hedge fund

- The opportunity in crypto in the years ahead

- Why momentum strategies work so well in crypto

- Is it possible to create a workable crypto index fund?

- How does custody work for something like this?

- Why stablecoins could be the biggest crypto asset

- How risk management can help decrease the massive drawdowns and volatility in crypto

- How DeFi could disrupt the financial industry

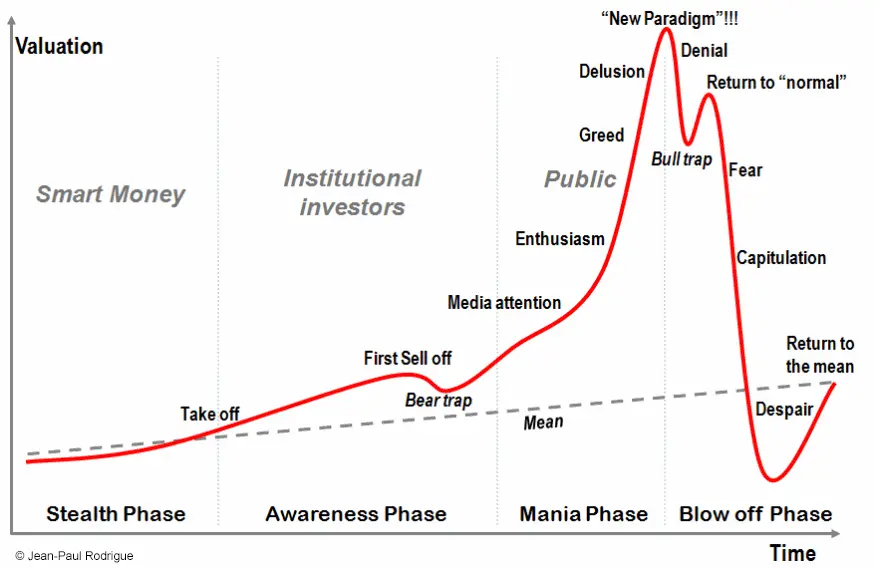

- Why crypto crashes are a feature, not a bug

Listen here:

Links:

- Starkiller Capital

- Starkiller Capital Blog

- Starkiller Capital Twitter

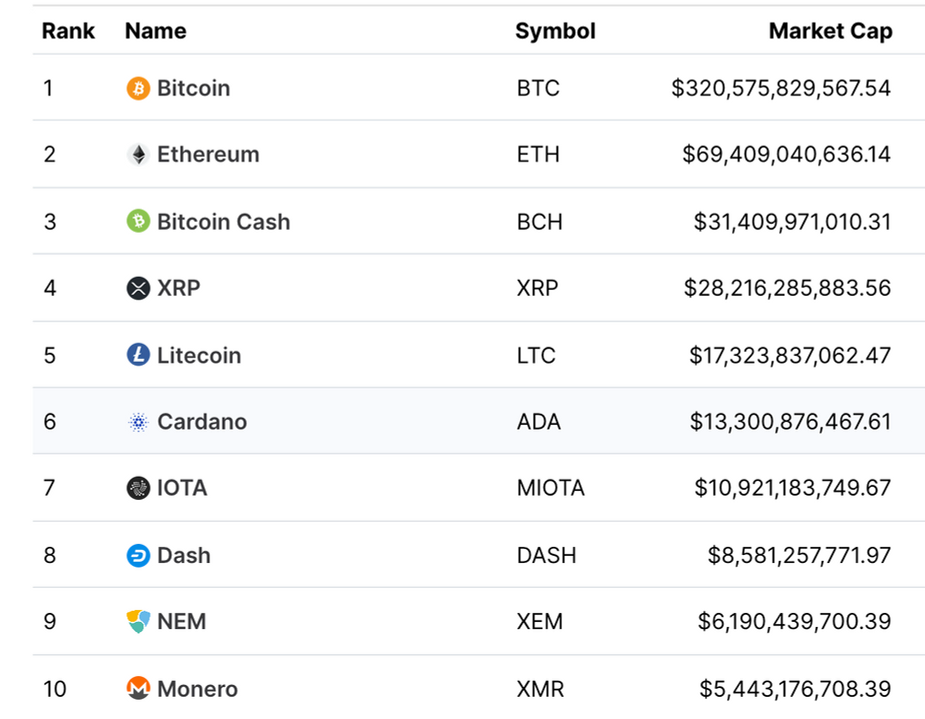

- Is it possible to get passive diversification in crypto?

- You can get crypto right and still play it wrong

- Crypto quant fund manager

Charts:

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: