Today’s Animal Spirits is brought to you by Interactive Brokers. Check out the Impact Dashboard to create a positive impact with your investments.

We discuss:

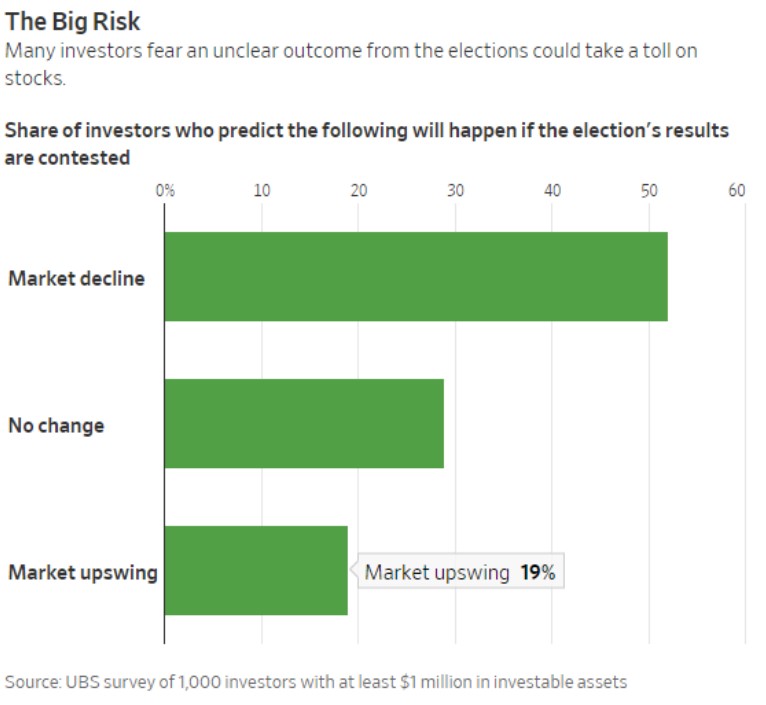

- The presidential election and your portfolio

- How does the stock market typically react after the election?

- What is the contrarian take on the election?

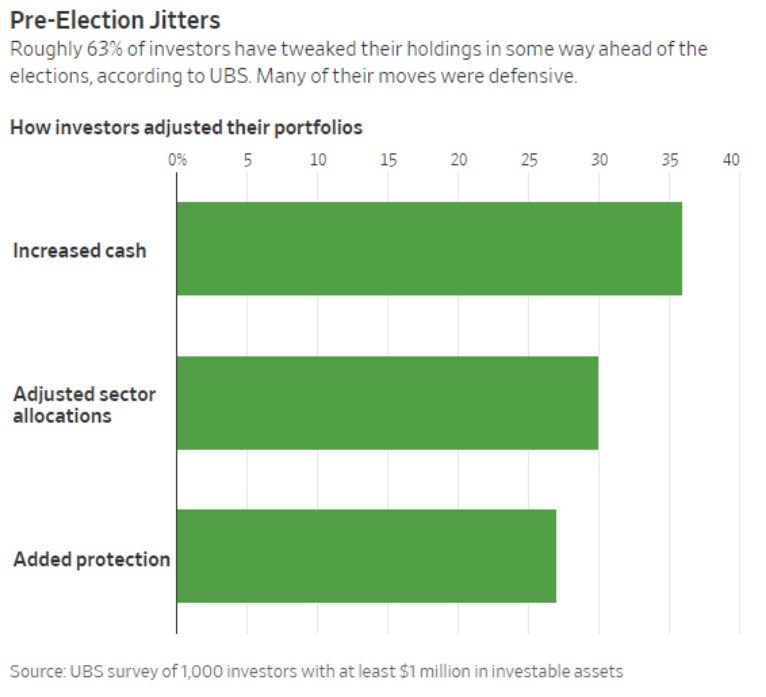

- How many investors made changes to their portfolio ahead of the election?

- Is it finally time to see value outperform growth?

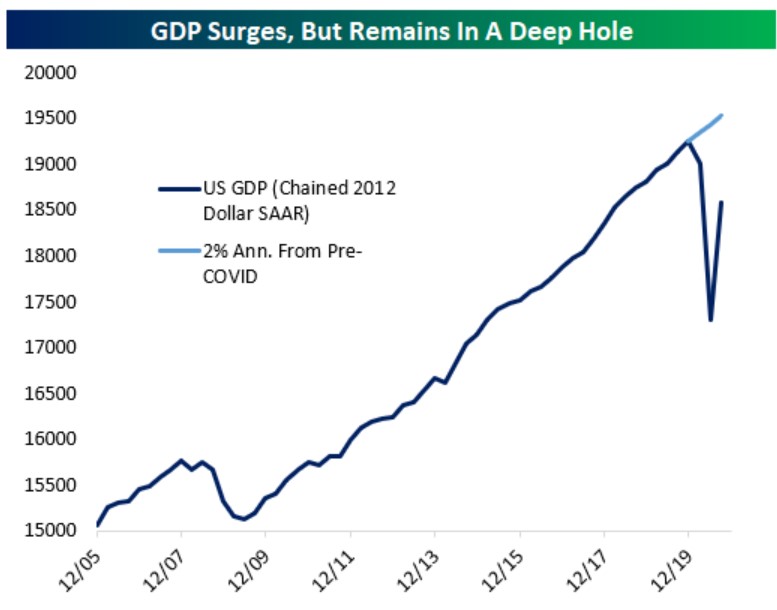

- The resiliency of the U.S. economy

- What if we have a 4-5 month recession before the vaccine gets here?

- Is David Einhorn right about a tech stock bubble?

- Why it’s so hard to change your mind after you’ve been right about the markets

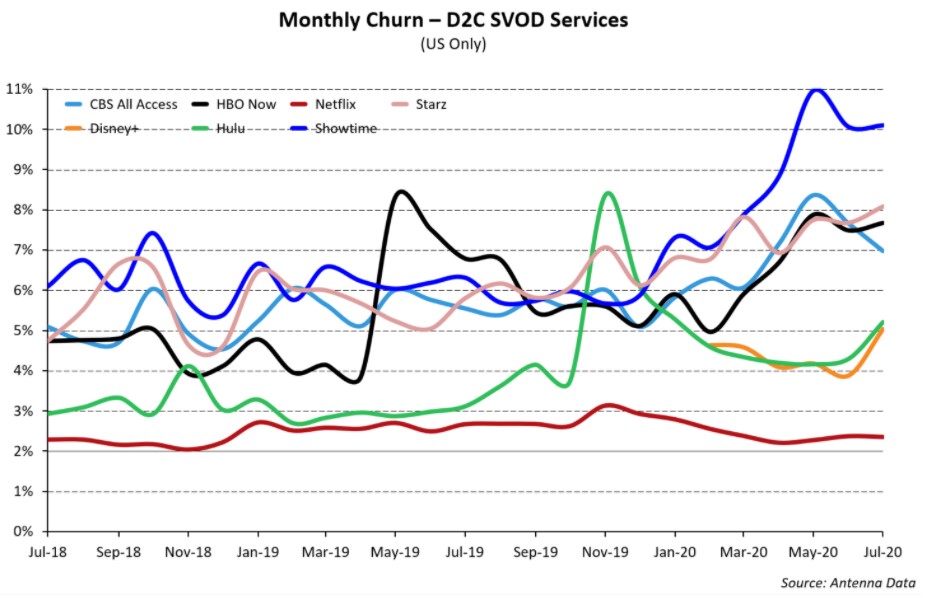

- Why Netflix is far and away the best streaming brand

- Are rentals the next epicenter of a housing crisis?

- Why housing is not just a pandemic story

- Why we need a new Marshall Plan for infrastructure

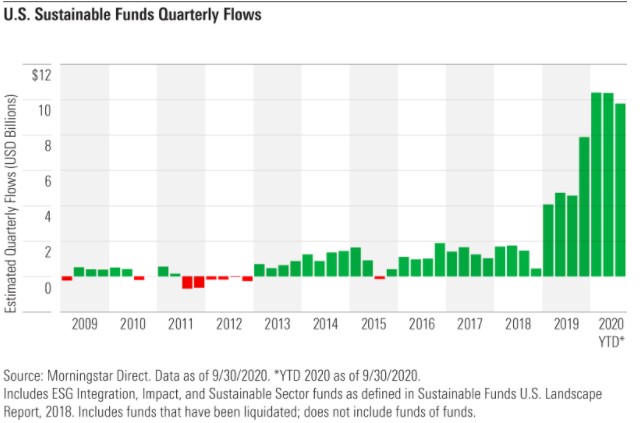

- Will ESG become a new factor for portfolios?

- The drawbacks of some new fintech platforms

- Why people retire earlier than they plan for

- Starting a business with your friends and more

Listen here:

Stories mentioned:

- Who cares?

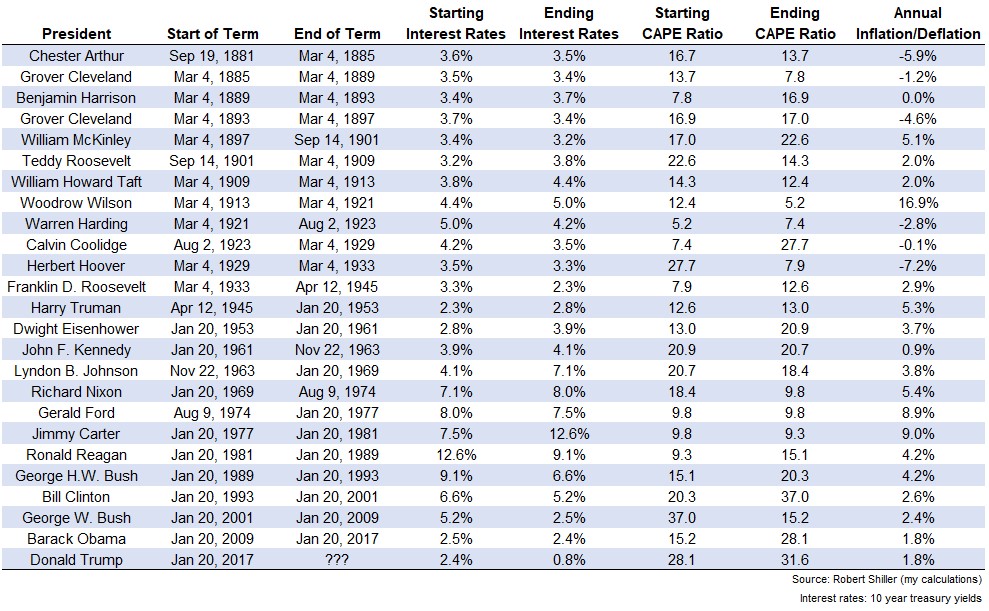

- Presidential terms & market cycles

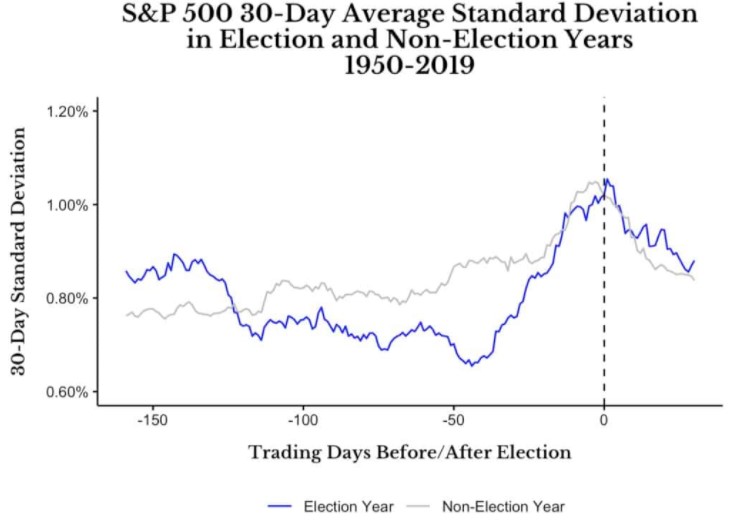

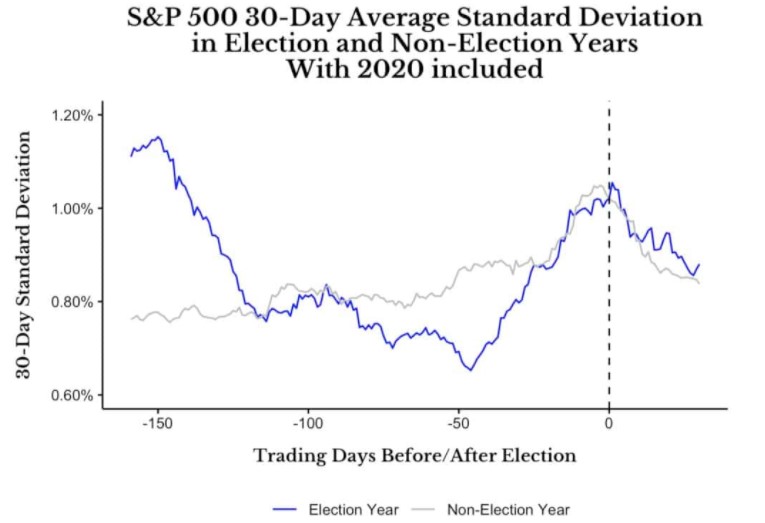

- What does the stock market do around election day?

- The fine line between insistence and insanity in the markets

- David Einhorn Q3 letter

- Tech bubble brewing

- Netflix raising prices

- The only consensus on Wall Street is Tuesday’s election will be felt for years to come

- Struggling rental market could usher in next housing crisis

- Peak suburban housing prices

- U.S. economy recovered significant ground in Q3

- The need for a new Marshall plan

- The economy is down. Why are housing prices up?

- Beam promised higher rates on savings. Now customers can’t get their money back

- What the changes in FICO credit score mean for you

Books mentioned:

- The Price We Pay by Marty Makary

- Fooling Some of the People All of the Time by David Einhorn

- Common Sense by Joel Greenblatt

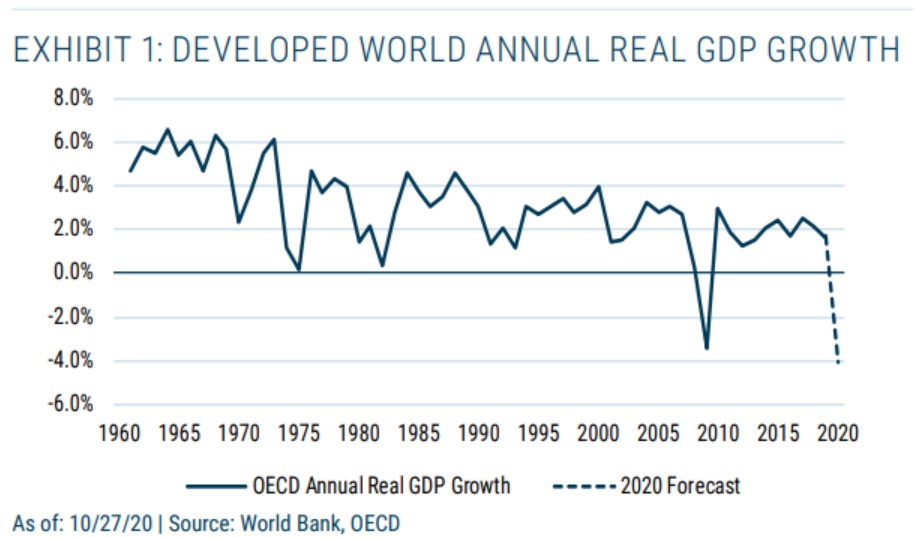

Charts mentioned:

Podcasts mentioned:

Interactive Brokers:

- Interactive Brokers launches innovative sustainable investing tool

- Impact Dashboard

- See how it works

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: