Here are 7 things I can’t stop thinking about in terms of their impact on the markets going forward:

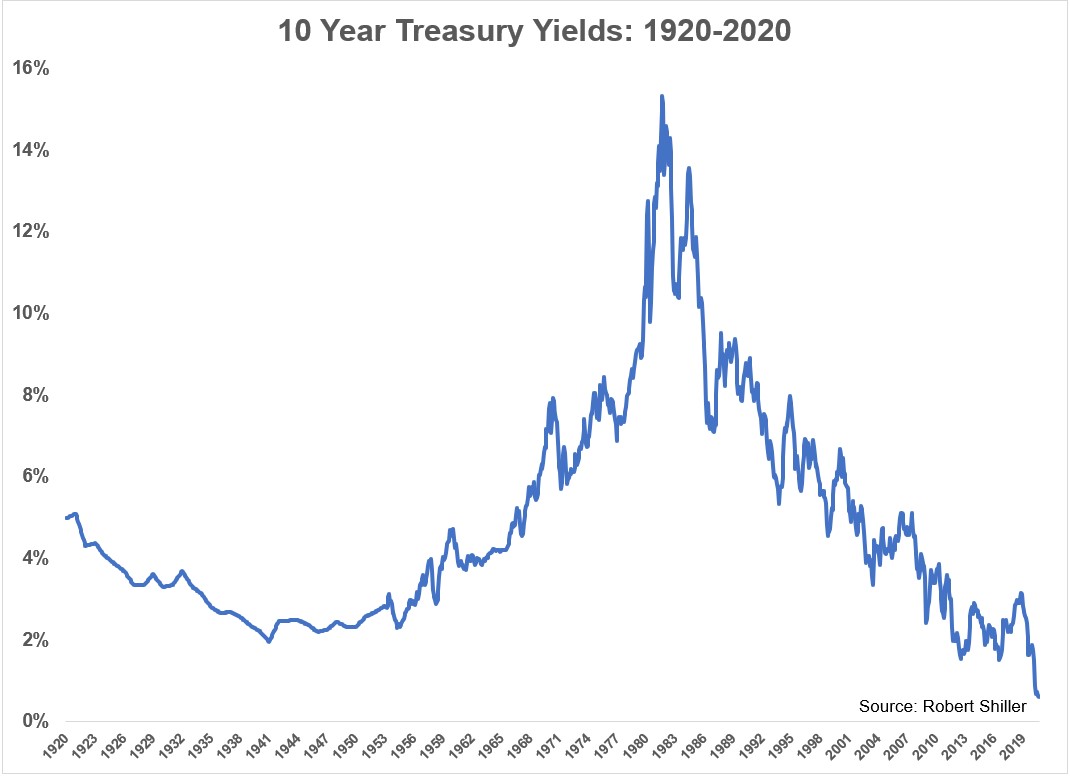

1. Interest rates. There have basically been three interest rate regimes over the past 100 years or so:

The first was a range-bound rate regime from the 1920s through the early-1950s where rates were stuck somewhere between 2-4%

This was followed by a rising rate environment until the early-1980s which saw the 10 year yield go from around 2% to nearly 16%.

It’s been all downhill from there as interest rates have gone from double-digit levels to the floor over the past 40 years.

The problem is rates have NEVER been this low before.

No one knows what the unintended consequences will be or how long it will last or what it means for things like investor sentiment and asset allocation decisions going forward.

One thing I am sure about is there are no easy answers to low bond yields for investors. This is the hardest investing environment ever when it comes to wealth preservation.

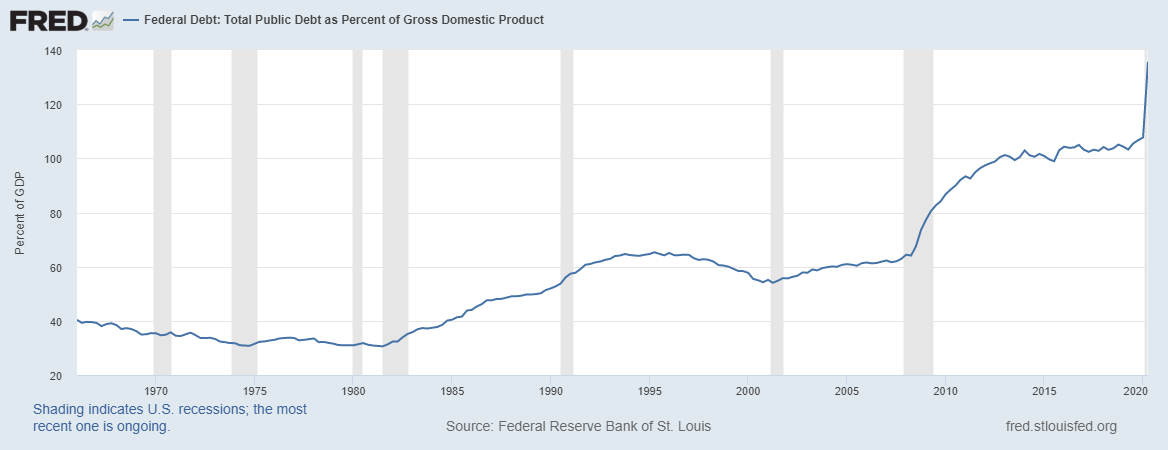

2. Fiscal stimulus. The debt-to-GDP for the United States is a sight to behold:

We were able to perform an experiment in government spending during a crisis in real-time and it has been a resounding success. Retail sales quickly rebounded. The unemployment rate fell. Personal savings rates went through the roof. People were able to repair their personal balance sheets.

And a depression was stopped in its tracks.

I have more questions than answers:

- Will we see this type of government spending during future recessions?

- How would that impact the business cycle?

- Will this change how business owners and investors view risk?

- Will investors and markets respond differently to future recessions?

- Was this year the first step towards a universal basic income?

Politicians have been promising their policies would lead to higher GDP growth for years. None of them have worked. Now they’ve finally found the lever to pull that can conjure growth out of thin air — government spending.

How could any sane politician not use that lever every chance they get going forward?

3. Inflation. People like to complain about government debt levels but people have been doing that since the 1920s and there haven’t been any consequences of the massive growth in borrowing.

It’s not so much the grandkids that are at risk here because that debt is never fully getting paid back. In a healthy economy, you should expect government debt to get bigger over time.

The biggest risk to all of this spending is inflation.

And it’s been a long time since investors have had to deal with the impact of inflation considering we’ve been in a disinflationary environment since rates peaked in the early-1980s.

Plenty of people point to the 1970s double-digit inflation as the bogeyman but the WWII scenario of a massive amount of government spending in a short period of time followed by a one-time spike in inflation is probably more likely.

The biggest risk for bond investors is not necessarily rising interest rates. Rising rates would be a good thing for bond investors eventually because those higher yields would translate into higher returns in the future. The biggest risk for bond investors is higher inflation because it erodes the value of your future fixed-income payments.

I’m not all that worried about inflation as it pertains to the stock market because stocks are the best inflation hedge there is but it could make things even worse for bond investors from such low starting yields.

4. The Fed. In every alien horror movie there always comes a point when the people being hunted by said alien come to realize it’s somehow getting stronger and/or smarter.

The main character of the movie, who typically covered in sweat, mud or blood will say, “It’s evolving.”

The Fed is the alien in this example.

In 2008 the entire financial system was closer to the precipice of collapse than most people realize. Looking back on it now I’m guessing Fed officials regret not going bigger or moving faster.

Jerome Powell and company didn’t want to have that same regret this time around. The Fed met the pandemic with bazookas blazing. They poured trillions of dollars into the system to keep markets functioning, effectively taking the Great Depression scenario off the table.

Markets rebounded across the board in record time.

It’s going to be difficult for the Fed to retract its alien tentacles from the markets. And if investors come to expect the Fed to have their back during every downturn there cold be some misplaced expectations and risk-taking because of it.

5. Automated investing. Josh Brown laid out his relentless bid theory in 2014. The idea is the entire business of investing is becoming more professionalized and automated, thus there is always a willing buyer of financial assets.

Churning accounts to earn a commission has been replaced with asset allocation and fee-based financial planning. Robo-advisors, target date funds, index funds and smart beta are all some form of passive, rules-based investing that are still relatively new.

There are 401(k) investors that put their money into the market into diversified portfolios that are periodically rebalanced with the push of a button. The markets have never been more systematized as they are now.

This has to have an impact on the markets.

It’s also easier than ever to invest. You don’t have to go into someone’s office, fill out paperwork and send a check to fund your account. You can sign up with an app on your phone and trade stocks, ETFs, mutual funds or options 5 minutes later.

And investors simply know more than ever before which is changing behavior.

A year before the crisis hit, Robinhood was trying to figure out why so many people had registered for the trading service but failed to fund their account. They sent out a survey to these people asking what was preventing them from entering the market.

Co-founder and co-CEO, Baiju Bhat said people were looking for a better entry point:

“One of the most common answers we got is that people thought it wasn’t a good time to buy. They thought the market was too expensive,” Bhatt says. And in the last couple of months, that’s changed. “There was this large audience of consumers,” he continues, “that had been looking for an opportunity to jump in at a moment when the market was, according to them, at a better price.”

Every behavior finance book ever written tells us people panic and run out of the store when stocks go on sale. Young people with zero investment experience were waiting for a bear market to start investing.

Human nature is the one constant in the markets but people are learning and automation is helping.

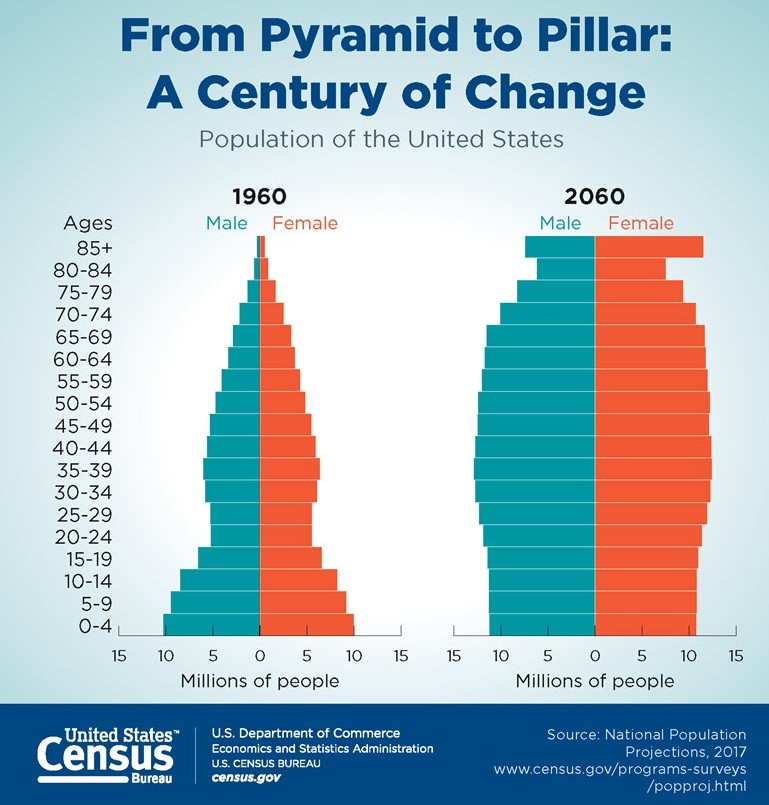

6. Demographics. By the early-2030s every baby boomer will be 65 or older. This will be roughly one-fifth of the population. The demographics in this country are changing in ways they never have before:

By 2060, it’s estimated nearly 95 million people in this country will be 65 or older. In 1900, that age cohort numbered just 3 million.

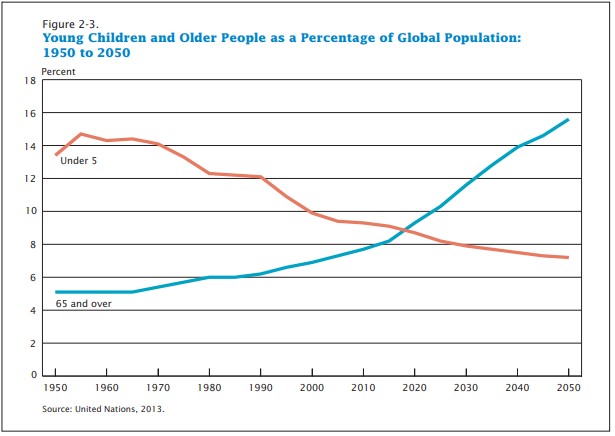

And it’s not just the United States. The entire world is becoming older:

There have never been this many old people who have to take care of themselves financially for so long. Governments and taxpayers have never been forced to care for this many people living such long lives before.

Luckily for the United States there are going to be younger people coming up in the ranks to balance things out. These are the most common ages in the U.S. going out to 2035:

There are something like 71 million baby boomers but 72 million millennials. And the middle child Gen X is projected to outnumber baby boomers by the end of this decade.

Financial advice and healthcare are going to be in high demand in the years ahead as we navigate this shift.

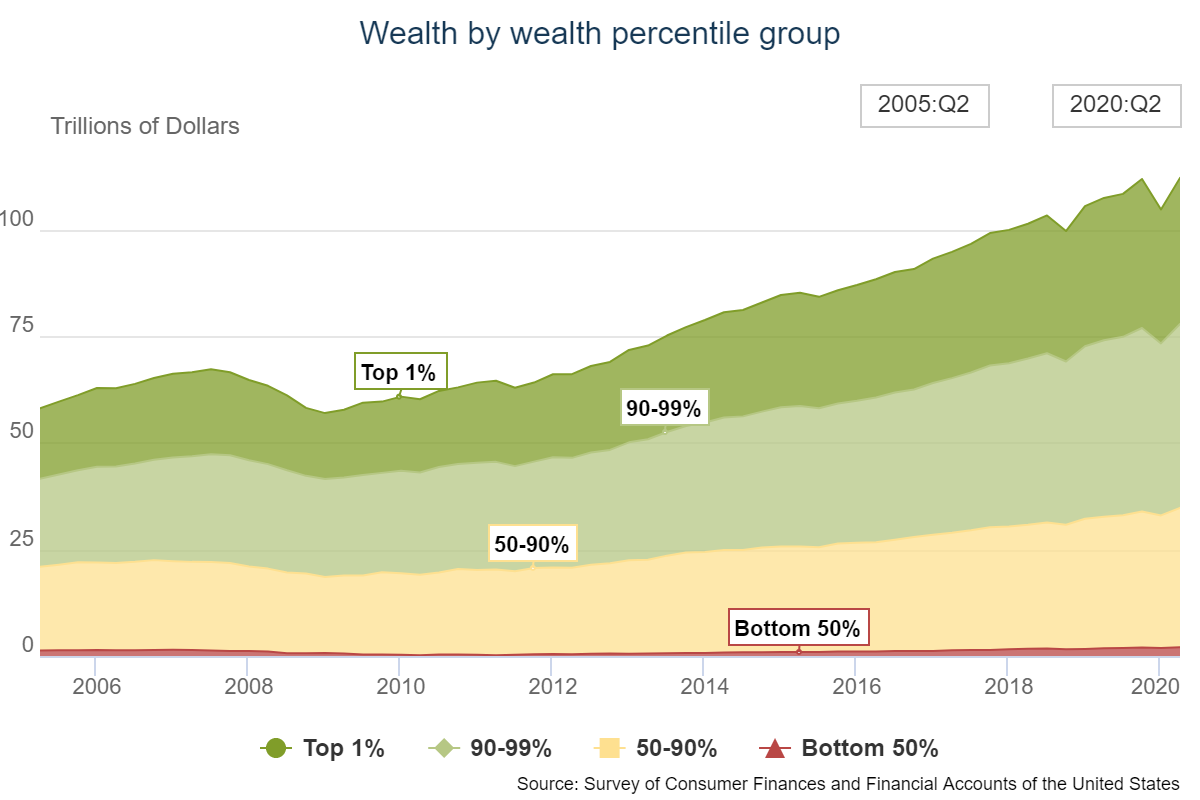

7. Inequality. The top 10% owns 70% of the wealth in the United States:

They also own close to 90% of the stocks held by households.

The rich have more tools at their disposal than ever before. Even if tax rates are raised in the coming years it’s hard to see the bottom 90% put a dent in the ownership of financial assets, which is the main reason the top 10% is wealthy in the first place.

This is also why I’m not worried about baby boomers crashing the market in the years ahead as they retire. The majority of the stocks reside with wealthy people who won’t have to sell all at once, if at all. Much of this money will likely be passed down to the next generation.

Wealth inequality could have a much bigger impact on society at large if the rich continue to get richer while the poorer classes get knocked down a peg every time there’s a recession.

Further Reading:

Why This Crisis is Going to Make Inequity Even Worse

Will Retiring Baby Boomers Crash the Stock Market During Retirement?

My New Theory About Future Stock Market Returns

Why I’m More Worried About the Bond Market Than the Stock Market