We discuss:

- A second wave of worries about the economy

- How do restaurants survive this crisis?

- Could we see multiple economic pullbacks this year?

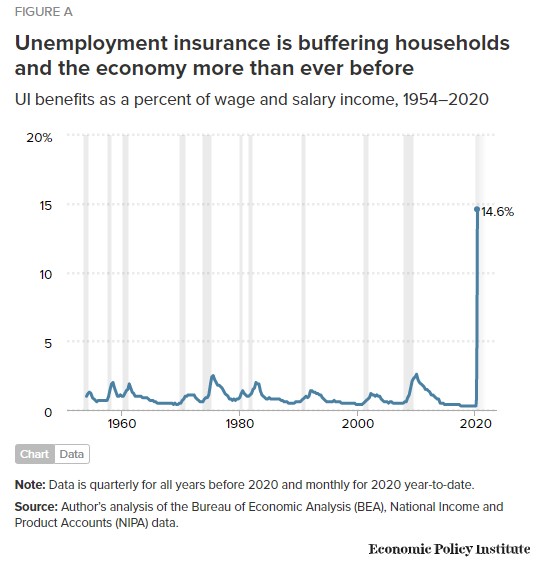

- Why the government has to extend the unemployment boost

- The Fed is worried about the banks — should you?

- What if low rates are here to stay for a long time?

- Why working from home may have legs

- Is New York commercial real estate a big short?

- How bad would things look for Berkshire if Buffett didn’t buy Apple?

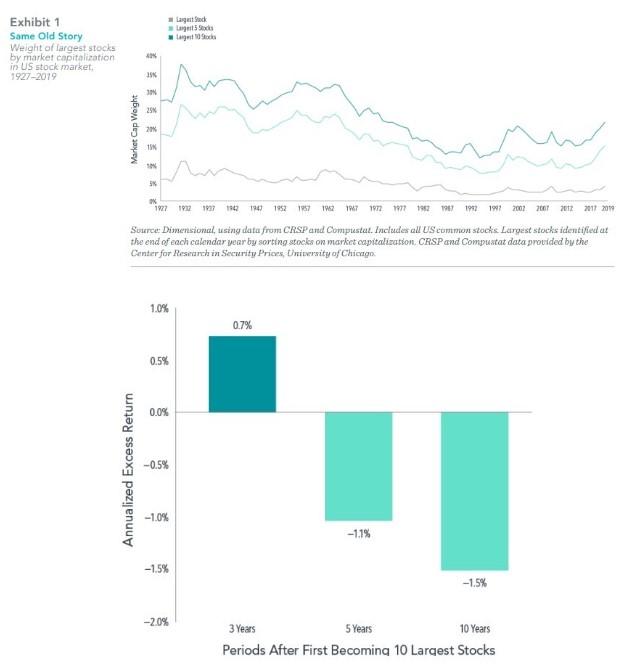

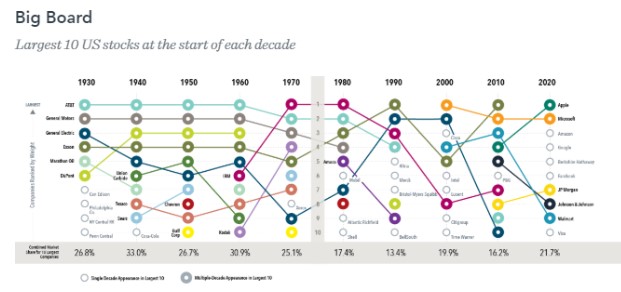

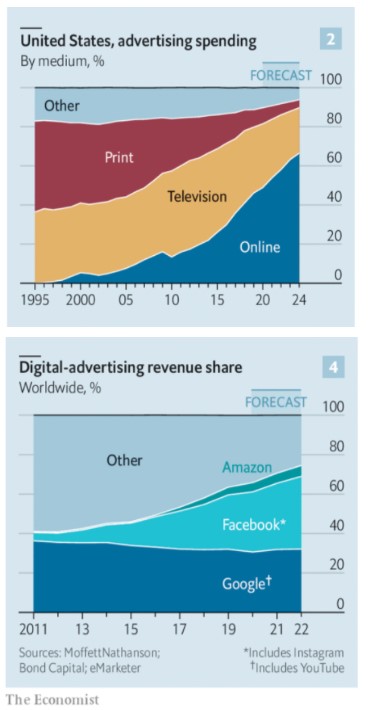

- Concentration in the stock market is the old normal

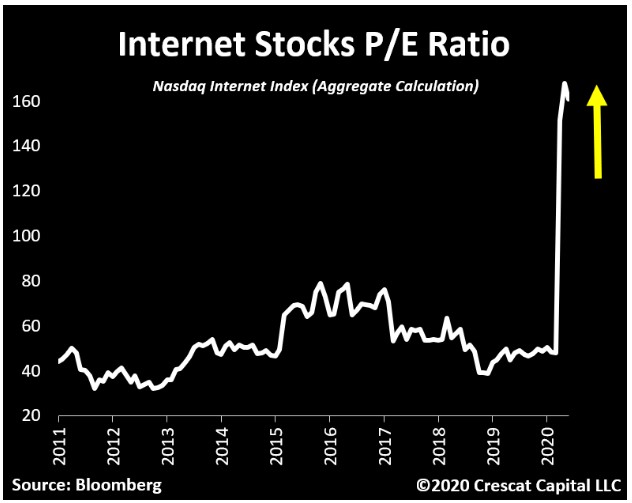

- Why shouldn’t people just put all their money into big tech stocks?

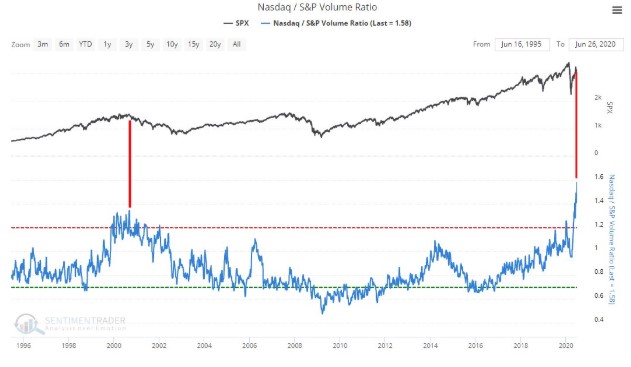

- An explosion in speculation of tech stocks

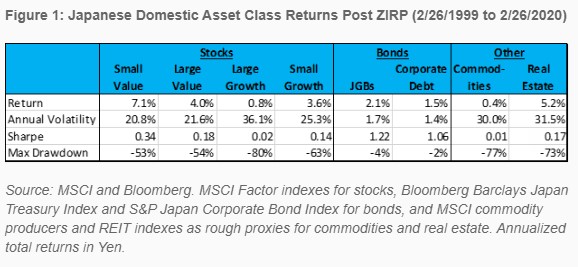

- Now show small cap value in Japan

- Is the travel industry changed forever?

- Is it time to break up the big tech stocks?

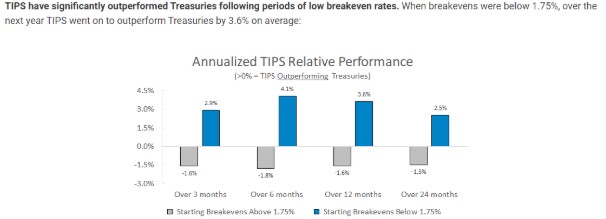

- How do TIPS work?

- Should we replace bonds with CDs?

- Inflationary scars from the 1970s and more

Listen here:

Stories mentioned:

- Grand Rapids restaurants close after employees contract Covid

- How rare is a double dip recession?

- Cutting off the $600 boost to unemployment would be both cruel and bad economics

- Fed caps dividends and bans buybacks on big banks

- Fed looks down under for rates strategy

- Buffett missed out on the crisis

- Hedge fund activist is shorting New York office stocks

- Asset allocation beyond the zero bound

- Airbnb CEO: travel may never be the same

- The nifty fifty revisited

- The origin of TIPs

- The once in a decade bond opportunity

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: