The market gods may strike me down with a bolt of lightning for this one but here goes:

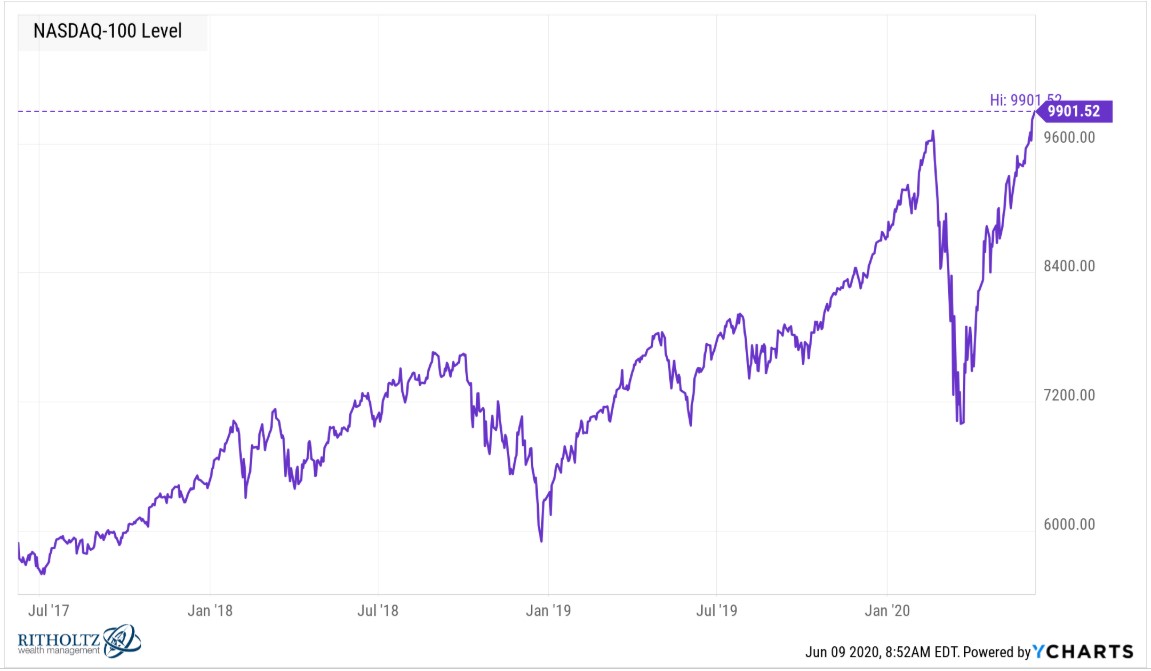

1. New all-time highs in the Nasdaq 100. Technology stocks are once again at all-time highs.

Here’s something you may not know — the Nasdaq 100 Index now has 19 new all-time highs in 2020 alone. Most of those took place before the crash but here we are again.

From a total return perspective, the S&P 500 is just 4% off its highs.

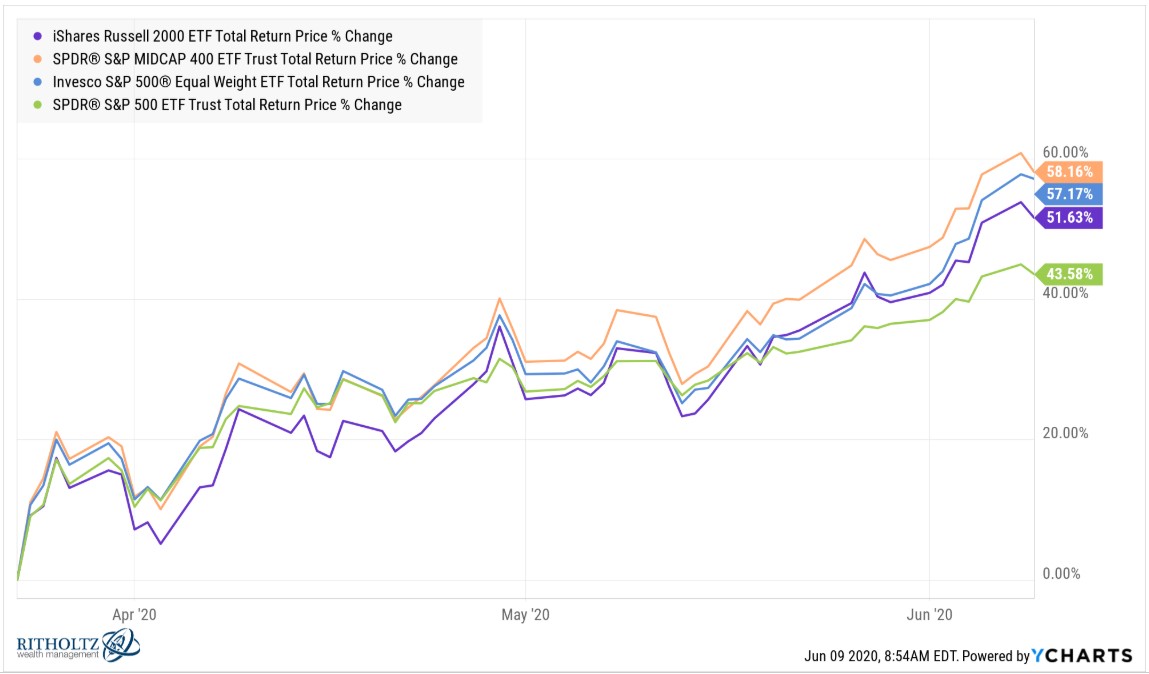

2. Small stocks are outperforming big stocks. Small caps, mid caps and the equal-weighted S&P 500 are finally outperforming the larger cap S&P 500 companies in this run-up in prices:

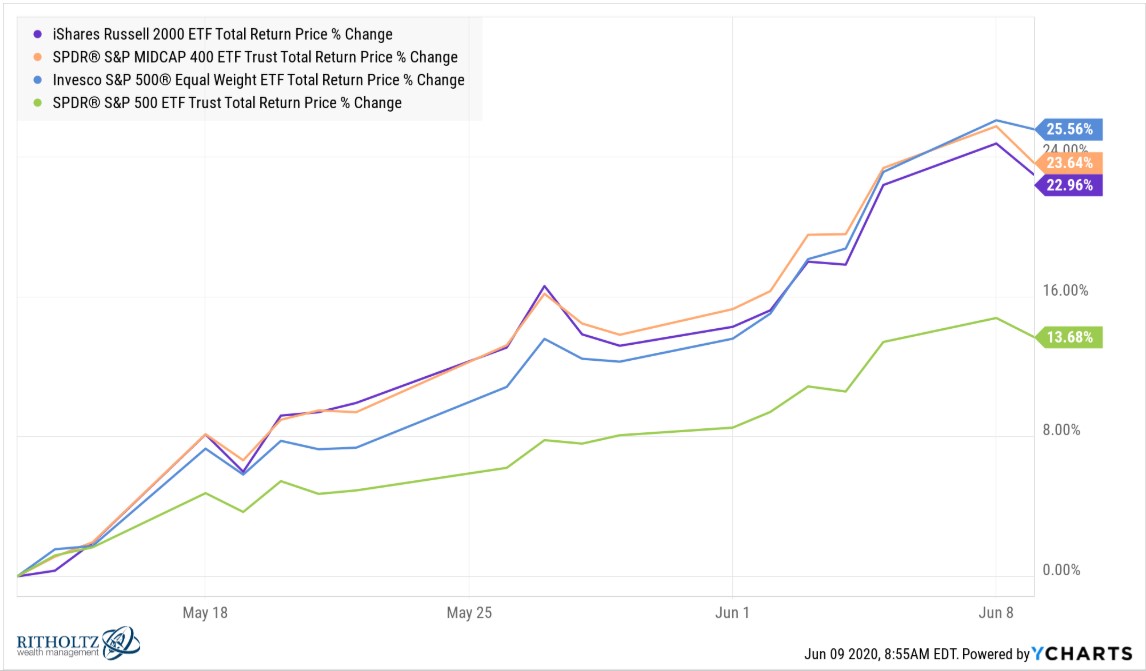

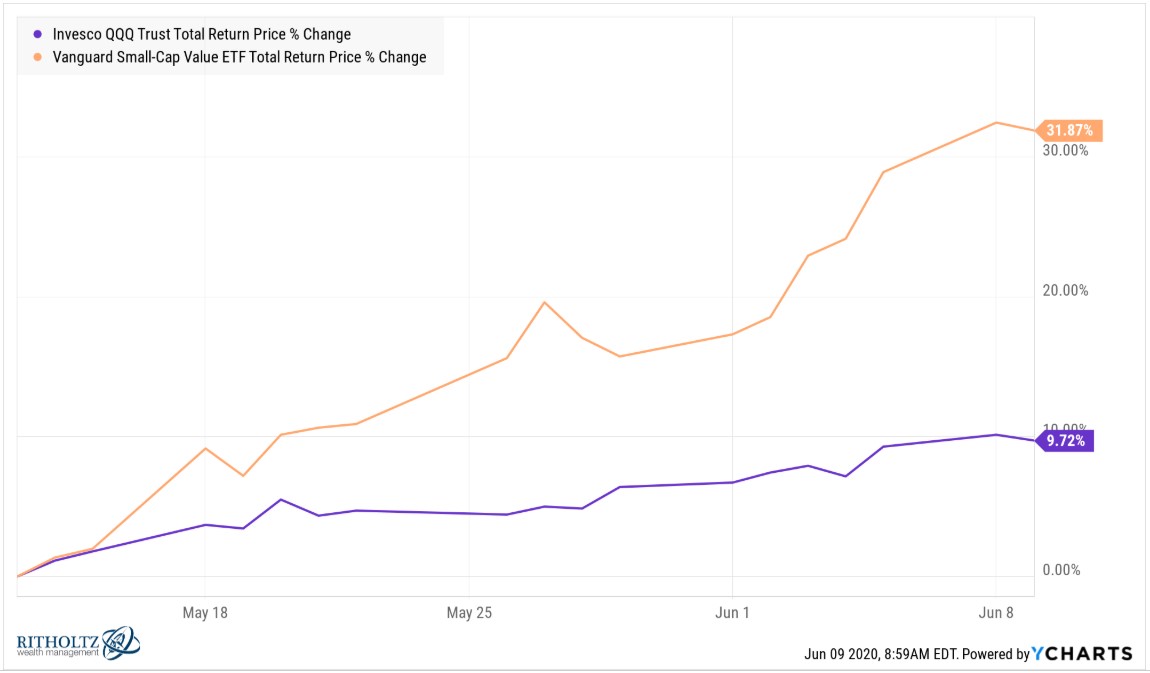

And look at the performance divergence since the middle of May:

Large cap stocks are still beating these other components over the course of the year and have outperformed for some time but I’m sure there are plenty of diversified investors breathing a sigh of relief that these other companies are finally showing signs of life.

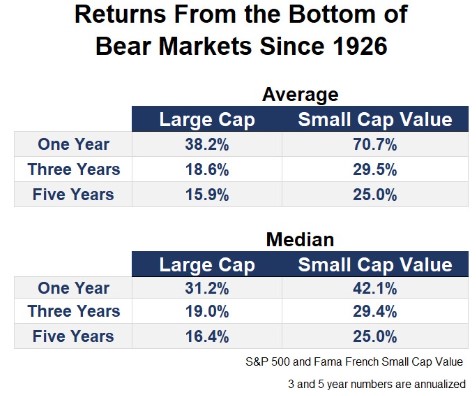

3. Value stocks are outperforming growth stocks. In early April while inquiring What Happened to Small Cap Value? I showed how small value stocks typically do better than large cap stocks coming out of a bear market:

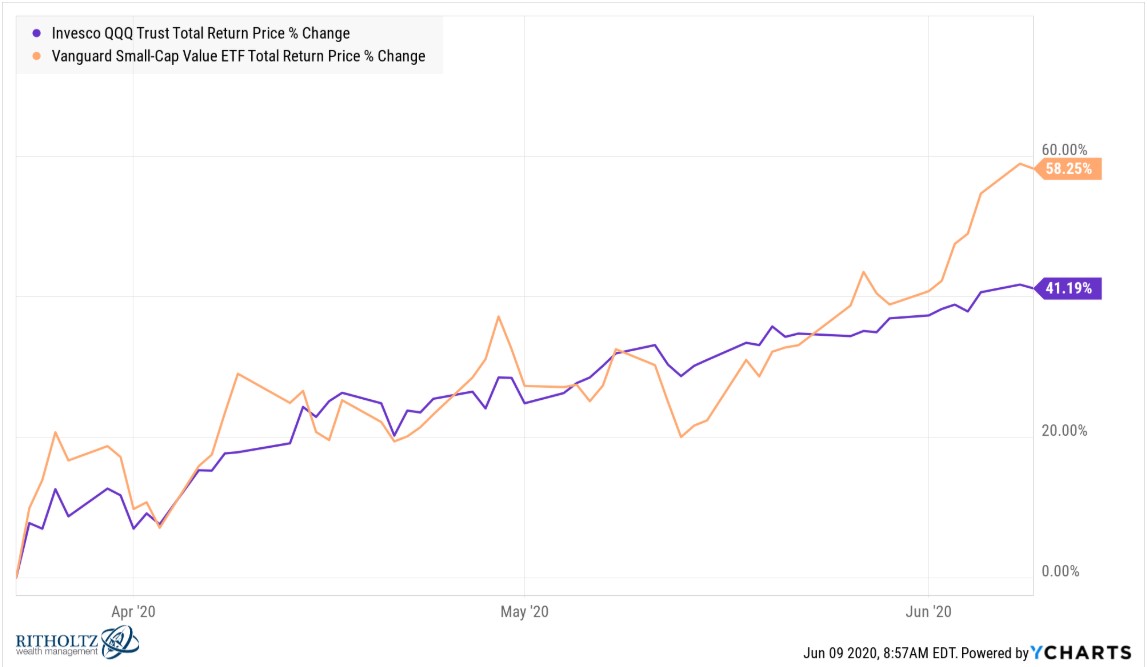

These are the returns from the market bottom towards the end of March for the Vanguard Small-Cap Value ETF (VBR) and the Nasdaq 100 ETF (QQQ):

Tiny sample size but small cap value is finally beating larger cap growth. And you can see the majority of that outperformance has occurred in the past month or so:

The biggest tech stocks were absolutely propping up the stock market during the downturn and when the recovery first began. That is not the case anymore.

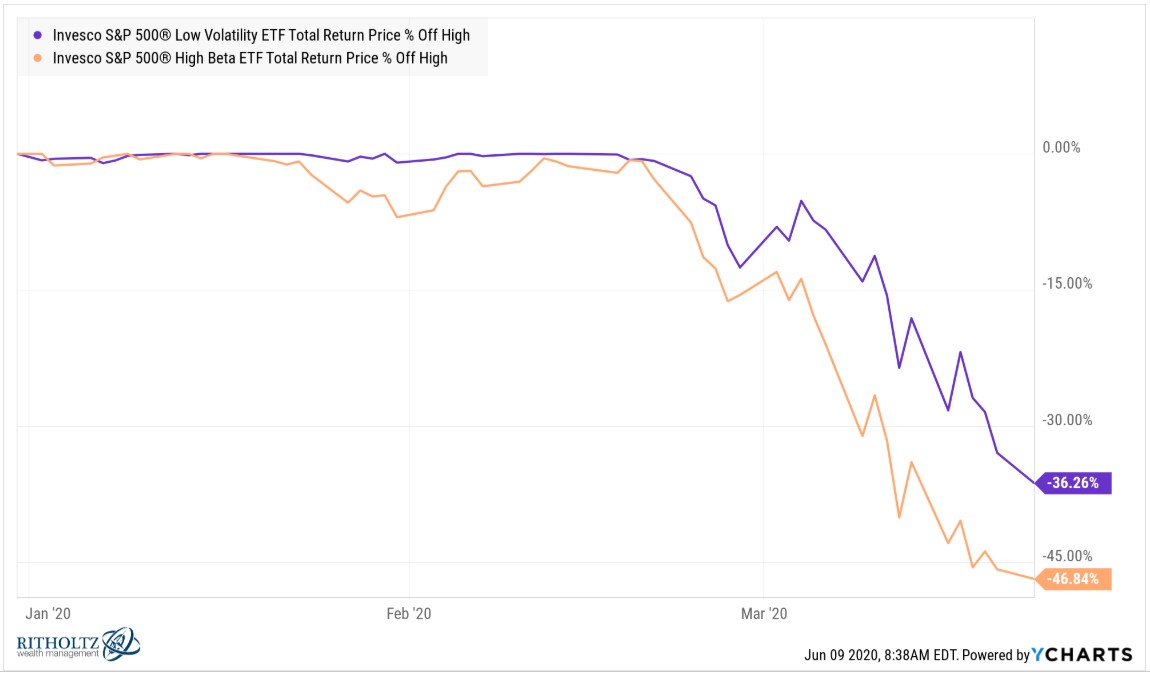

4. High beta stocks are on a tear. This is peak-to-trough drawdowns through the bottom of the bear for high beta and low volatility stocks:

This makes sense since high beta names are typically higher risk stocks while low vol names tend to be higher quality stocks.

This was normal market crash behavior.

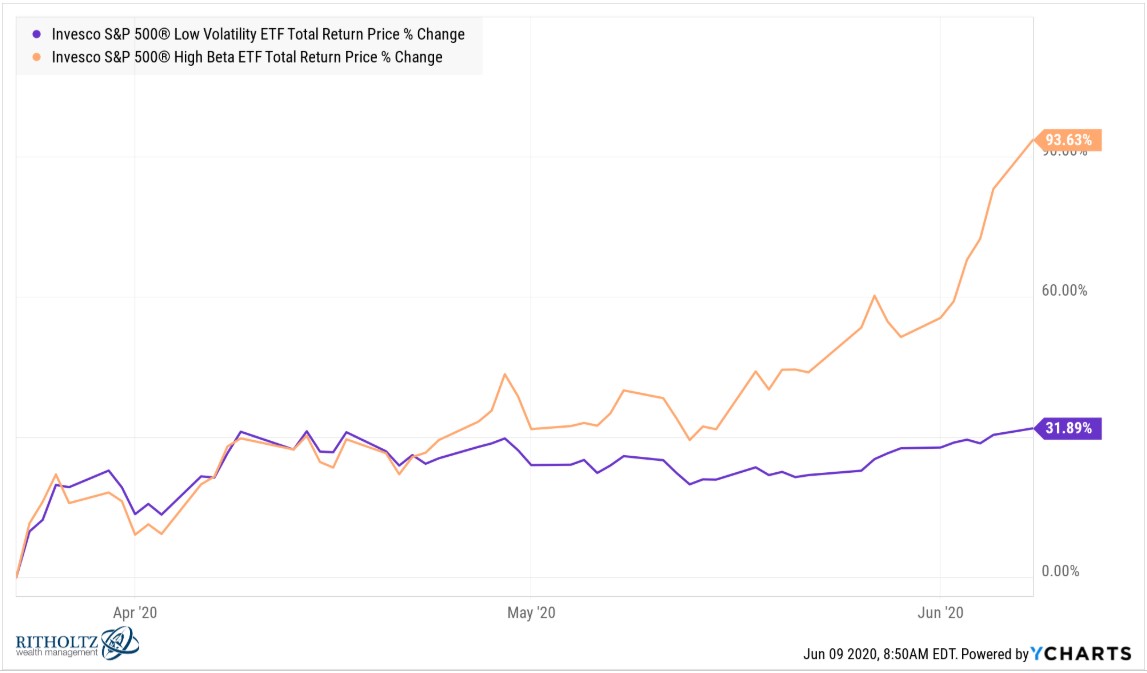

Now look at what’s happened since the bottom:

The riskier (some would say junkier) stocks are going bananas.

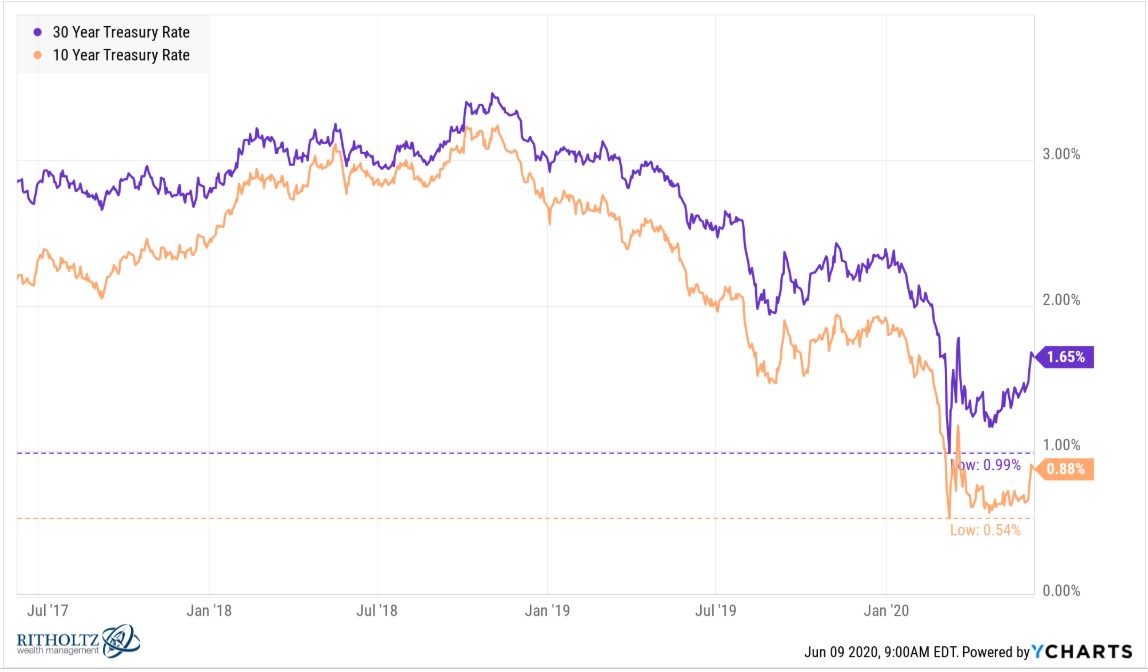

5. Interest rates are rising. Treasury yields fell off a cliff once the crisis began but both 30 year and 10 year rates bottomed in early-March:

That big spike in rates following the low points came when even treasuries sold off at the height of the crisis. Rates then went right back down but have been slowly rising ever since. The last couple of weeks has seen a big jump higher.

Granted, we’re coming off the lowest nominal yields ever in U.S. treasuries so it doesn’t take much movement to see a spike.

There are a number of reasons interest rates rise — supply & demand in the bond market, higher economic growth, rising inflation expectations, government bond-buying programs, etc.

Rates are still unbelievably low by historical standards but well off their crisis lows.

Is this whole thing a ridiculous short-term market comparison?

Of course it is!

But ridiculous market moves are happening with regularity in the short-term this year.

Maybe this blog post will mark the top of a new bear market. Who knows.

There were plenty of investors who assumed the initial bounce was of the dead feline variety. Stocks could certainly still rollover. The market doesn’t care about bull and bear labels.

But this market has been acting like a new bull market may be underway. Imagine someone told you this in March when it seemed like 60%-70% losses were on the table.

Unbelievable.

Further Reading:

The Craziest Charts of the Year (So Far)