A colleague mentioned this week that he looked at his son’s 529 plan and noticed the balance is actually higher than it was at the start of the year because of dollar-cost averaging purchases every month.

So I decided to check the 529 balance for my twins and, lo and behold, the balance was basically the same as it started out the year. This is despite holding the most aggressive age-based fund, which is down more than 10% this year.

This makes sense when you consider I’ve only been making contributions to their 529 plans for 3 years now. I make automatic monthly contributions to these accounts, and although these contributions are beginning to grow, the amount in each fund is still small enough where saving can still trump investment performance.

Allow me to explain.

The asset management industry likes to look at performance numbers using either percentages or ratios (for those who prefer risk-adjusted returns). Percentages are fine and all but normal people only really care about the market value of their portfolio.

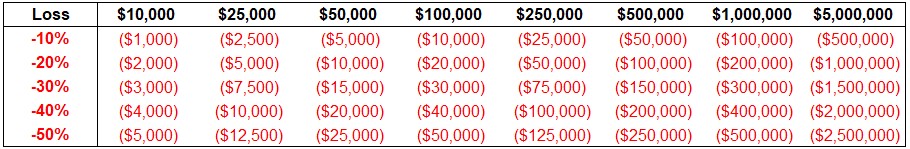

An investor who doesn’t have a lot of money in their portfolio should be able to withstand larger percentage losses because the market value decline will be relatively small. On the other hand, an investor with a lot of money in their portfolio can see a relatively small percentage loss lead to a much bigger loss of dollars. Here are the simple dollar losses segmented by portfolio and loss levels:

As Captain Obvious likes to say, “the bigger your portfolio the more money you lose for a given percentage decline.”

This also works in both directions as the inverse of these losses would show greater gains with larger portfolio balances as well.

When you have a small portfolio that you’re looking to make into a big portfolio, you have the ability to put a dent into your losses by upping your savings rate. We can call this your savings replacement rate.

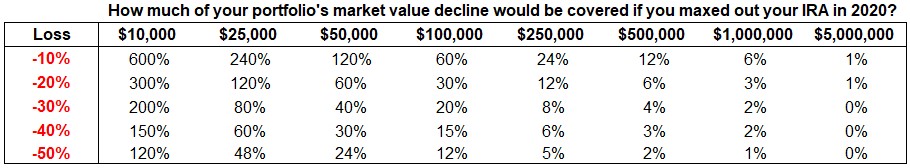

Let’s assume you still have the ability to save during a downturn like the current one.1 The max contribution limit for an IRA in 2020 is $6,000.

Assuming your portfolio value started out the crisis at the same levels listed in the example above, here are the replacement rates for various loss levels based on making the max IRA contribution this year:

A 20% downturn on a $25,000 portfolio would lead to losses of $5,000. If you were to max out your IRA that would more than make up for the market value loss in your portfolio. If your investments are down 20% on the year for that $25,000 portfolio, maxing out your IRA would give you an ending balance of $26,000.

Captain Obvious here again — making retirement contributions doesn’t improve your performance but it can provide a psychological boost in that your balance continues to grow even in the midst of a downturn.

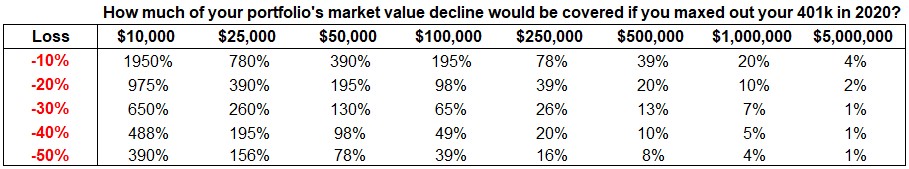

Here are those same results for a 401k if you maxed it out (the max 401k contribution limit for 2020 is $19,500):

If you have a $250,000 401k balance a 20% loss would lead to an evaporation of $50,000. That hurts. Maxing out your 401k would be the equivalent of roughly 40% of these losses (and I’m not even including a company match here).

Again this is more about optics than anything but psychological tricks can be helpful during down markets because behavior is the first thing to go during stressful markets. Sometimes you have to fool yourself into staying the course because the temptation to sell is so great when prices are all over the place.

I’m sensitive to the fact that not everyone has the ability or resources to max out their retirement accounts, especially during an economic crisis. These numbers are for illustrative purposes only. Every little bit helps and if you’re one of those people who is lucky enough to have the ability to continue saving and investing, buying during volatile markets can pay dividends down the road for long-term investors.

These examples can also help you put portfolio gains and losses into perspective. Where you are in your investing lifecycle can and should have a lot of say in how you allocate your assets. Young investors can fairly easier make up temporary losses in their portfolios by saving more or continuing to make regular contributions. Investors with more mature portfolios don’t always have enough time or human capital to make up for losses in the market.

Saving and investing is like risk and reward — they’re attached at the hip.

You can’t expect to earn a decent return on your capital if you don’t accept some form of risk just like you can’t expect to invest your way to riches unless you first learn how to save.

Your ability to withstand losses in the market comes down to a combination of time horizon, risk profile, human capital, stage in life and temperament.

When you’re just starting out, it can also be helpful to trick yourself into offsetting your losses by saving more money.

Further Reading:

When Dollar Cost Averaging Matters the Most

For simplicity’s sake, I didn’t take into account catch-up contributions, which would be an additional $1,000 for an IRA and $6,500 for a 401k if you’re over the age of 50.

*******

Now here’s what I’ve been reading lately:

- Do the real thing (Scott Young)

- The Playing Field (Graham Duncan)

- Value investing is immortal (Reformed Broker)

- How value investing works (Irrelevant Investor)

- Acceptable flaws (Collaborative Fund)

- A viral market update (Musings on Markets)

- What would my Granddaddy say? (Provoking Posts)

1If you’re in this situation you’re doing better than the majority of households right now.