This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

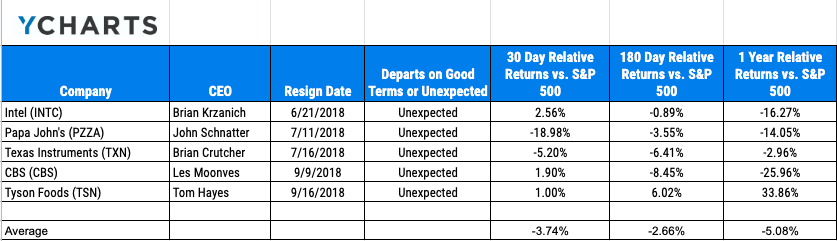

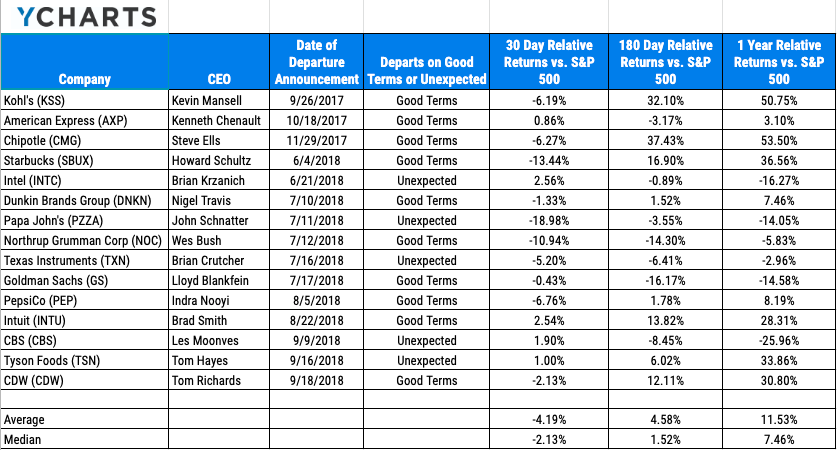

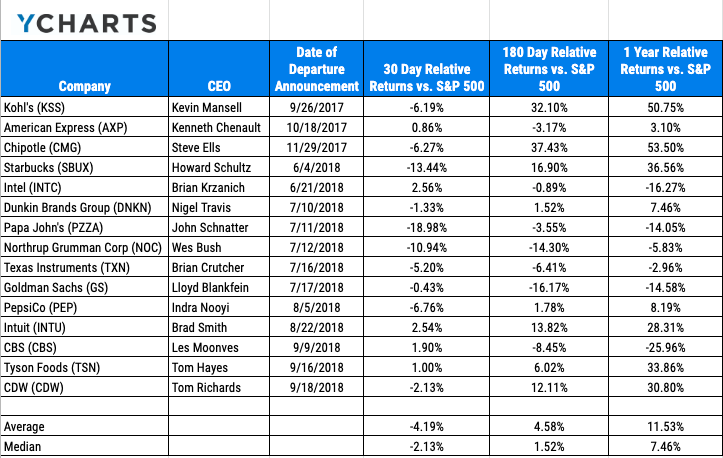

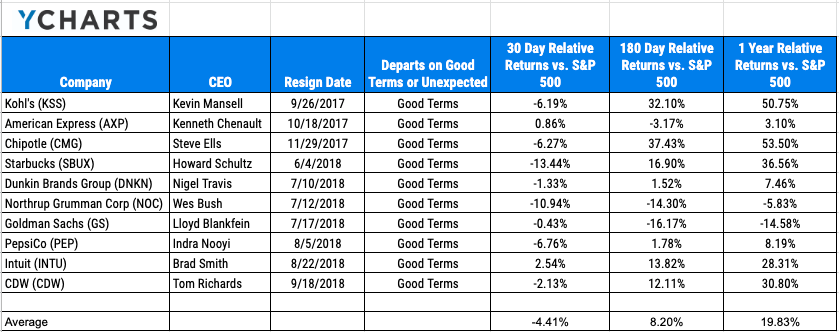

- What happens to stocks that experience and unexpected CEO departure?

- Finance arguments that will never end

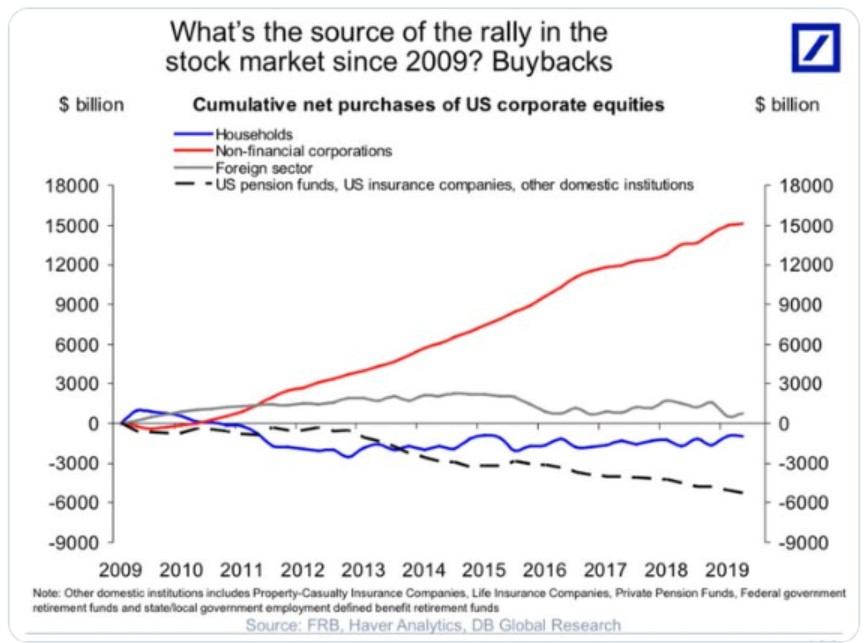

- Pros and cons of banning share buybacks

- Why buybacks make for a convenient scapegoat

- Would it matter if they broke up Facebook?

- Elizabeth Warren’s plans to break up public companies

- Is Tesla a bellwether for risk appetite in the markets?

- Why China matters more to the movie business than the US now

- Does the Rock make movies specifically for a Chinese audience?

- How Rotten Tomatoes works

- Why are real estate commissions so high?

- Misunderstandings in the private equity markets

- Why is everyone so bearish?

- Watch what people do, not what they say

- Do politics really matter to the markets?

- What if paternity leave was mandatory (or available to more workers)?

- Could we ever get another Great Depression?

- Why it’s getting harder to raise money for hedge funds & much more

Listen here:

Stories mentioned:

- Where’s the buyback beef?

- Banning buybacks won’t help

- Yeah, it’s still water

- What about the alternative to buybacks?

- Introducing Facebook News

- Elizabeth Warren wants to remake capitalism

- Hollywood is learning to work in China the hard way

- Rotten Tomatoes, explained

- How to get a better deal from a real estate agent

- Big Money Poll: Bears rise to a two-decade high

- The economic case for paternity leave

- Putting the buy-and-hold gospel to the ultimate test

- Billionaire to shut down hedge fund

- The riskiest investment you can make today

Books mentioned:

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: