We’re closing in on the 10th year of this economic expansion. A few more months and this will officially be the longest economic expansion in modern U.S. history.

The U.S. economy has now experienced 99 straight months with positive gains in the job market. We’re fast approaching 20 million jobs added since the start of this cycle.

The unemployment rate ticked up to 3.9% in the data released today but it looks like the only reason for that is because more people are looking for jobs now that wages are finally rising.

Never ones to rest on our laurels, this type of data makes professional investor-types nervous because the good times can’t last forever.

Lower unemployment rates are typically closely associated with lower forward stock market returns while higher unemployment rates lead to higher forward performance.

This would make sense when you consider higher rates of unemployment tend to come during or after a recession, which is when stocks tend to crash to lower levels. And lower unemployment rates occur when everything is going swimmingly in the economic and most likely the stock market.

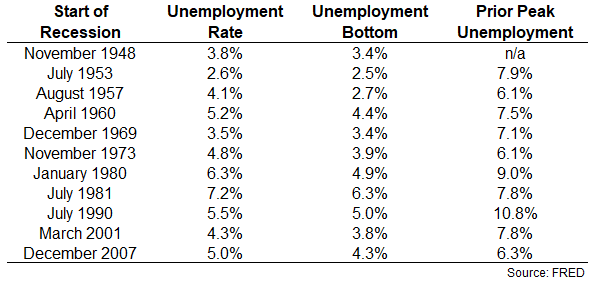

But the unemployment rate alone is not enough to tell us what will happen next. Just look at the unemployment rate heading into the past 11 recessions going back to the 1940s:

There’s no line in the sand or absolute bottom which predicts when the next recession is imminent. You can also see the unemployment rate was rising heading into each one of these recessions. It’s not like there was a bottom tick in the unemployment rate which immediately sent the economy spiraling out of control. There’s also no telling how low the unemployment rate can go before bottoming out. The lows are all over the place.

This is the problem with single variable analysis. Without context, the data is meaningless.

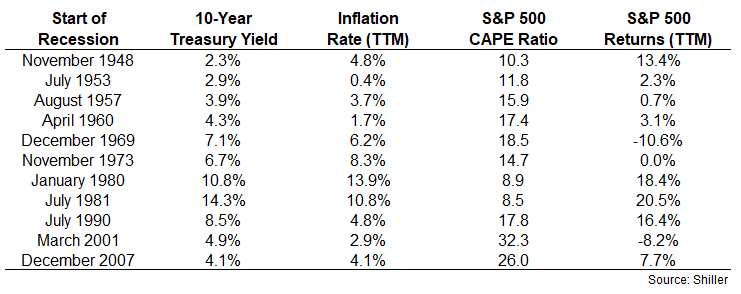

And even if you have more data, that doesn’t always make your job easier as a stock market or economic forecaster. Here are some further data points heading into these previous recessions:

Interest rates and inflation heading into past recessions are all over the map as well. And check out the valuations in 1948, 1953, 1980 and 1981. Fundamentally based investors would kill for those types of multiples but even cheap markets can get cheaper when the economy slows.

And the idea that the stock market is going to tell us when the recession will hit is a pipe dream. Stock returns leading up to a recession are as random as any other 12-month period.

There are no perfect levels which dictate buy and sell signals for economic or stock market data because that would make things far too easy. These are complex, dynamic systems which are constantly changing.

I wish I had a secret formula to predict when the next recession will start and when stocks will react to that recession. The best we can do is look at the overall trends and historical data to put the present into context.

Each recession and market environment is unique in its own way. These things aren’t easy but get used to it. If this stuff was easy everyone would be rich.

Further Reading:

Predicting the Next Recession

Now here’s what I’ve been reading lately:

- The American Dream (Joe Fahmy)

- The rise after the fall (Dollars & Data)

- Anti-resolutions (Big Picture)

- When should you start a 529 plan? (Rad Reads)

- 51 ideas from 2018 (Safal Niveshak)

- Patience & discipline (Prag Cap)