Some random thoughts on the current state of the markets…

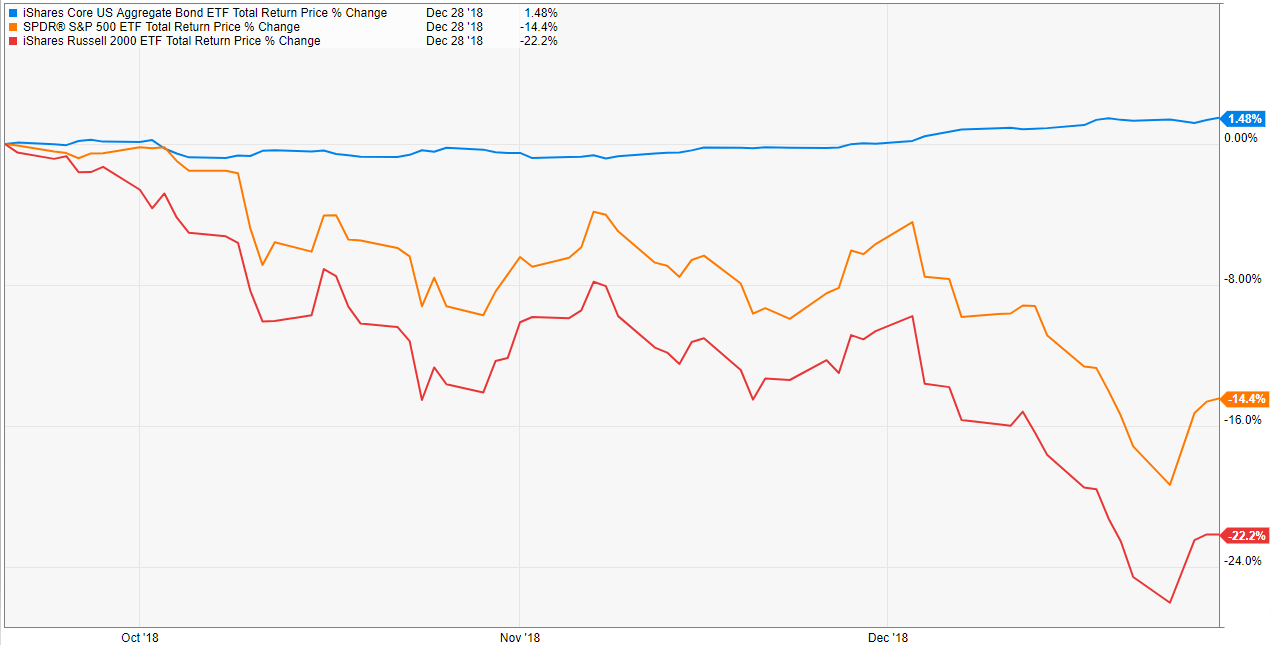

1. This is why you own bonds. Here’s the aggregate U.S. bond market versus the S&P 500 and Russell 2000 ETFs over the past 3 months:

In the past, people probably thought they owned bonds for the steady income stream. That may still be the case for some investors but yields aren’t as high as they once were. Bonds can still earn a place in a well-diversified portfolio for the following reasons:

(1) The can act as a hedge against your emotions when the stock market experiences big losses by reducing overall portfolio volatility.

(2) They can act as a safe place during periods of market turmoil. Remember when the 10-year treasury yield hit 3.25% in October and people said the next stop was 6%? Well it’s now back down to 2.75% as investors rushed into the safe arms of high-quality bonds during a stock sell-off, as they have been known to do.

(3) They can act as a form of dry powder to buy stocks when they’re down or provide a more stable source for cash flow or spending needs during a bear market.

2. The machines didn’t create volatility. When markets go haywire as they have of late it’s easy to look for the main culprit. This week the computers and algos have been getting the brunt of the blame. Guess who created the algorithms? Humans! And it’s not like humans have had trouble drumming up volatility before computer trading existed.

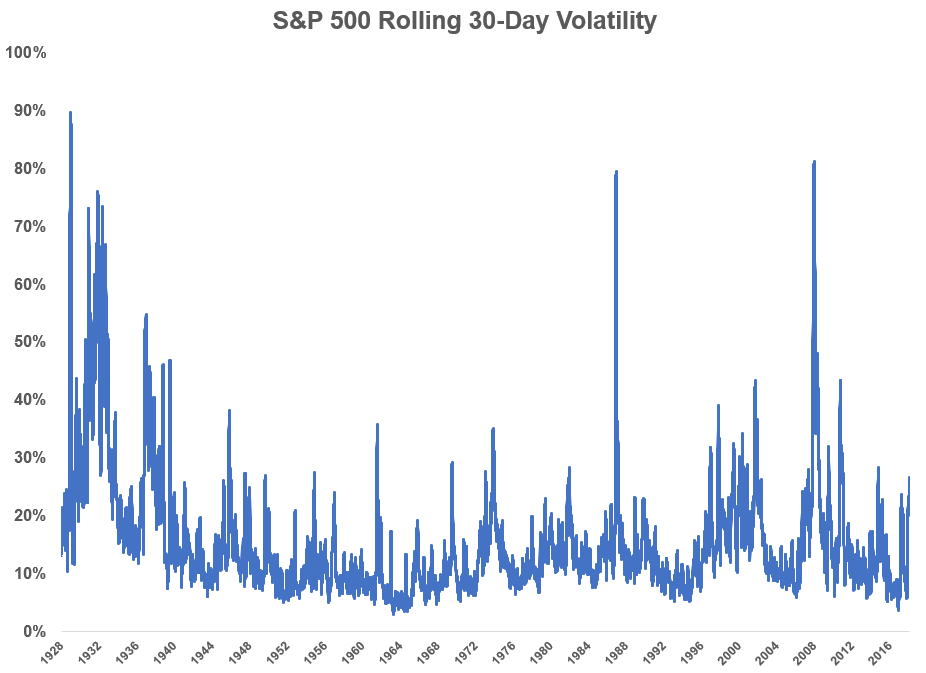

Here’s the rolling 30-day standard deviation of the S&P 500 going back to the late-1920s:

They didn’t need computers in the 1930s, 1940s or 1950s to cause spikes in market vol. Humans are just as good at moving things around with their emotions.

3. Most people probably shouldn’t try to buy low and sell high. Buy low, sell high is investing advice anyone could understand. But it may not be the best advice for the majority of investors. I understand the sentiment but most people have a hard time understanding what constitutes low and what constitutes high. Better advice for most people would be “buy whenever you have savings you don’t need for a number of years and sell never.”1

4. It’s for the best. I hate to be that guy, but stock market downturns like this are a good thing over the long-term. A year like 2017 was unsustainable. We need these washouts to remind investors that risk is the one constant when investing in the stock market. One of the reasons stocks earn a premium over “safer” asset classes like bonds and cash is because they can drop 20% in 3 months with little warning.

And if you’re a net saver over the next few years why would you want prices to continue higher in an uninterrupted fashion? Stocks are on sale and who knows, maybe they’ll get even cheaper?

5. There isn’t just one reason. Narratives about what caused the market correction can be fun to argue about but there’s never just one reason for something like this. The president or the Fed or the tariffs or algorithmic trading strategies or the month of December or Taylor Swift’s deafening silence on the trade war didn’t cause this downturn.

Markets are made up of millions of investors, all with different goals, objectives, time horizons, risk profiles, and temperaments. No one person or office or investment strategy can control these millions of moving parts.

The poet Frank Bidart once wrote, “Insanity is the insistence of meaning.” He may have been talking about the movements of the stock market.

Further Reading:

Buying When Stocks Are Down Big

Now here’s what I’ve been reading this week:

- “Nobody dabbles at dentistry.” (Abnormal Returns)

- The barbershop service model (Wealth Farmer)

- 99 good news stories you probably didn’t hear about in 2018 (Future Crunch)

- The most important decision you can make every day (Dollars & Data)

- 50 reasons it’s hard to invest for the long-term (Behavioural Investor)

- Pros & cons of the FIRE lifestyle (Can I Retire Yet?)

- 8 ways doctors end up broke (White Coat Investor)

- Don’t fall for it (Irrelevant Investor)

- Big investing ideas (Collaborative Fund)

1I would also accept sell when you need to rebalance or well before you need the money to meet your goals but that doesn’t exactly roll off the tongue.