“If you spend 13 minutes a year trying to predict the economy, you have wasted 10 minutes.” – Peter Lynch

Many investors assume that the stock market anticipates economic developments. Or that the latest GDP number has a huge effect on the market’s movements.

Over the long term there is virtually zero correlation between the stock market and the quarterly change in GDP, according to a recent Bank of New York Mellon study.

Sure the economy does eventually have an effect on corporate profits and sales. But trying to use the economic data as a tool to predict your investment results is not a sound strategy.

Forecasting anything out into the future is very difficult. The old joke is that an economist is just someone whose job is to make the weatherman look accurate.

Add to that the fact that economic data points are subject to revisions, changes in formulas, seasonal adjustments and get updated on a periodic basis for a long time after the initial results come out. It is a fool’s game to try to use the economy as a way to forecast your investments.

The last recession that started in December of 2007 wasn’t actually discovered and verified by the National Bureau of Economic Research until December 2008. That was a year later and by that time the recession was just ending. The recession of March 2001 wasn’t officially called until November 2001. And that’s when it ended, although that wasn’t discovered for a number of months either.

The same thing has happened countless times over the years.

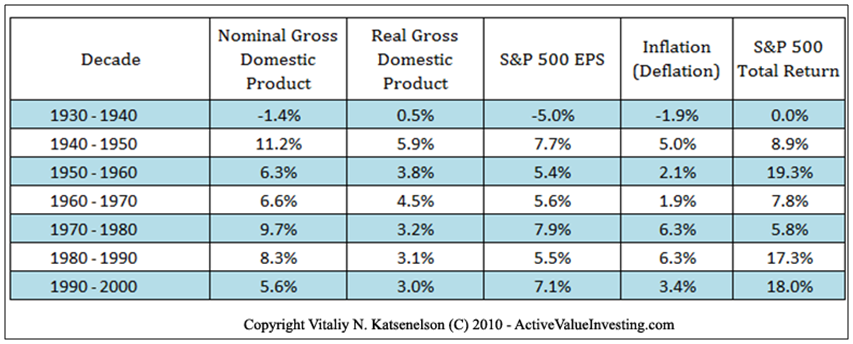

Take a look at the table below that was put together by Vitaliy Katsenelson for The Little Book of Sideways Markets. This is a nice way of looking at the growth of the economy (real GDP), company earnings growth in stocks (EPS), inflation (or deflation) and annual stock returns by decade. What you’ll notice is that the growth of the economy and company earnings is fairly consistent.

Besides the high and low values in the 1930’s and 1940’s (which were skewed for the great depression and WWII), the following 50 years of economic growth was relatively similar in the 3.0% to 4.5% range. And S&P 500 company earnings growth was in a similar tight range (taking out the 1930’s outlier). But look at the corresponding stock returns in those decades. They’re all over the place.

One reason for the lack of correlation between economic growth and stock returns is that countries with higher growth rates can become overpriced. The price and valuation level at the time of your investment are bigger determinants of future returns than actual economic growth.

More capital flows into growing economies but it’s possible investors have already invested years in advance anticipating the future growth. So once everyone piles into the higher growth areas it’s already too late to earn a nice return on your capital because investments have been bid up. The masses show up late to the party just in time for the bubble to inflate and then burst. This can lead to subpar returns.

A recent article in The Economist discussed a study done at the London Business School that looked into this further. A group of professors took the records of 83 countries from 1972 to 2009 and ranked them by GDP growth over the previous five years.

Investing each year in the countries with the highest economic growth over the previous five years earned an annual return of 18.4%, but investing in the lowest-growth countries returned 25.1%.

Another reason for this divergence between stocks and the economy is that expectations and emotions (read: fear and greed) drive stock prices much more than economic growth. You see the same relationship between growth and value stocks. Everyone loves to talk about investing in the high flying growth stock that is massively growing earnings and sales.

But this raises expectations which become harder and harder to beat. In the long run, this causes growth stocks to underperform value stocks that don’t get bid up because they have more modest growth prospects and lower expectations.

Expectations are more important when investing than growth rates. Having a higher hurdle to jump over each year or quarter makes it very difficult to continue to meet expectations. See Apple’s stock performance at the end of 2012 and early 2013 as a good example of jumping over higher hurdles as expectations rise. Their quarterly results were still great relative to the average company but did not meet lofty expectations. So the stock sold off over 30% in just a few short months.

Just look at the period from 2009 until 2012 as a great example. Everyone has been complaining about the economy and for good reason. The unemployment rate has been fluctuating between 7% and 10% since early 2009. There’s a lot of doom and gloom out there. And the economy has seen its slowest recovery since World War II following a recession.

So stocks must have gotten killed over that time frame, right? Wrong. The S&P 500 was up over 72.0% in that time for a return of 14.6% per year. Small-cap stocks have done even better as the Russell 2000 was up almost 80.0% for an annual return of 15.8%. It’s hard to believe that things can seem so terrible in the general economy but still go so well for the stock market. One of the main reasons is lowered expectations. Well, that and the Fed has been printing money hand over fist. But that’s a topic for another time.

To quote Warren Buffett: “If you knew what was going to happen in the economy, you still wouldn’t necessarily know what was going to happen in the stock market.”

Just remember that focusing on the economy will not give you an edge in your investments over the long-term. It’s interesting (for some) to track the economy and its various data points but don’t let this cloud your judgment in looking for places to put your savings.

Focus more of your attention on putting together a solid investment process with a long-term view and an asset allocation plan. Taking the economy out of the equation means you have one less variable to worry about.

[…] impossible to use that information to make investments on a consistent basis. And we’ve seen that stocks and the economy don’t necessarily follow the same […]

[…] the end this is just one more reason why following the economy is not the best way to manage your investment decisions. Focus on the numbers you can control, not […]

[…] The economy and the stock market generally don’t have much correlation over the short or even medium term, so using the economy as a way to gauge your investments is a losing strategy. Business and economic cycles require both ups and downs. That’s how it works. […]

[…] highs? Nominal GDP. So the stock market has hit new highs at same time as total economic output. Stocks and the economy don’t always move together but it’s nice to know both are near their peak at the same […]

[…] Reading: The truth about stocks and the economy More uncertainty […]

[…] Reading: Stocks and the Economy What You Don’t Know About Stocks & The Unemployment […]

[…] Reading: The Truth about Stocks and the Economy Putting Emerging Markets Losses in […]

[…] Further Reading: The difference between a crash and a correction The truth about stocks and the economy […]