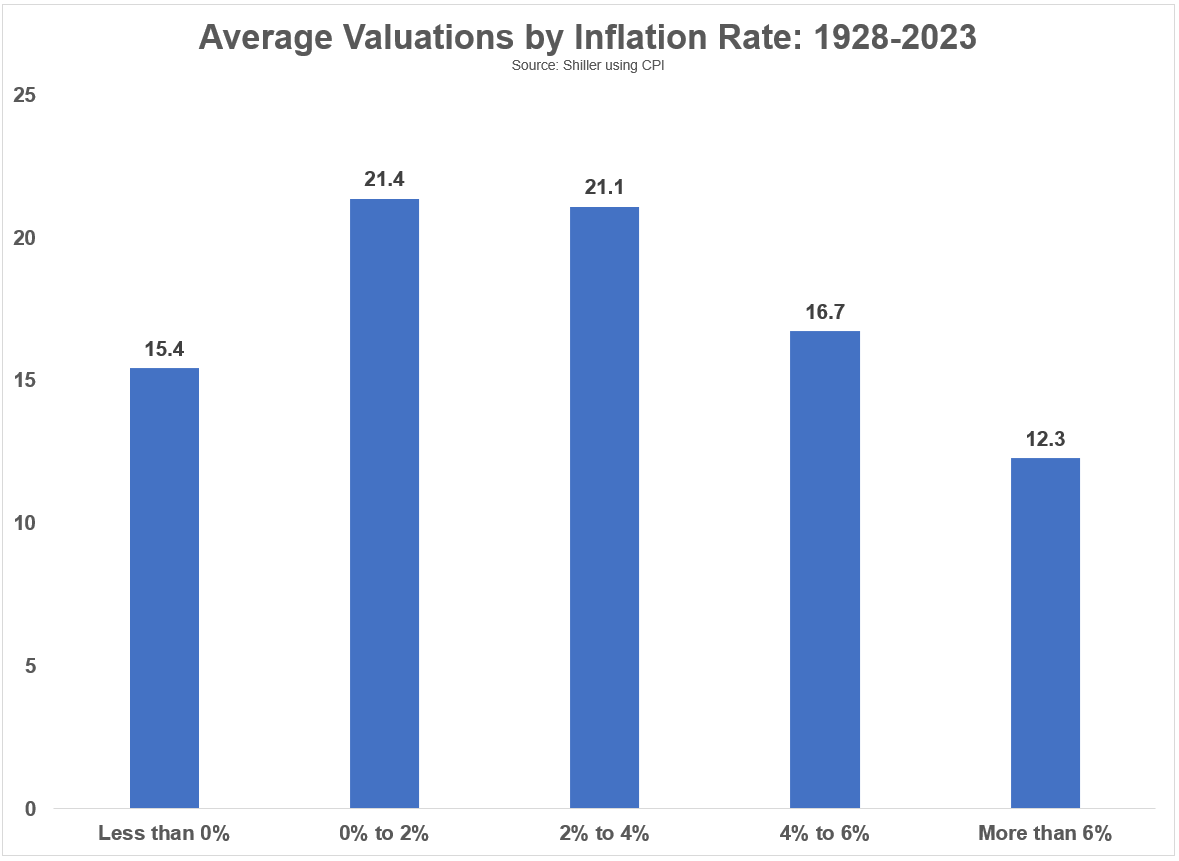

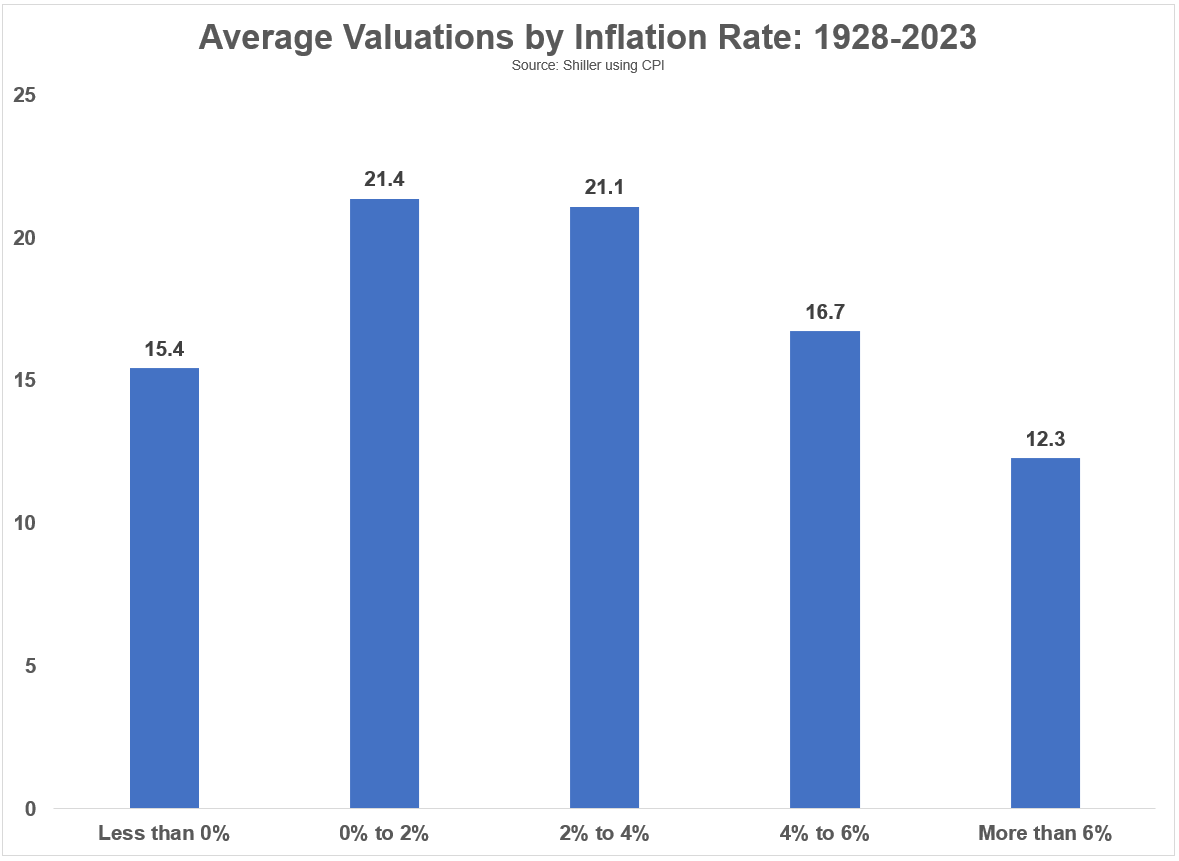

A historical look at valuations by interest rate and inflation levels.

A historical look at valuations by interest rate and inflation levels.

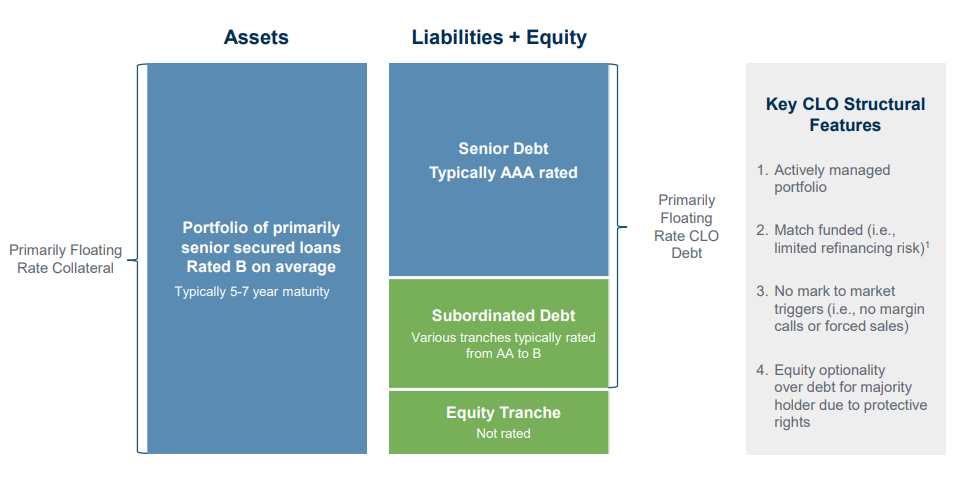

On today’s show, we are joined by Thomas Majewski, Founder and Managing Partner of Eagle Point Credit Management to discuss what a CLO is, the differences between a CLO and a CDO, the 2023 banking crisis, and much more!

How Jerry Seinfeld’s jokes relate to investing.

We need more kids playing sports.

How to tell if you’re spending or saving too much.

On today’s show, we discuss what happens to stocks after a bad year, why foreign stocks are outperforming, why any recession should be mild, how millennials will impact stock market valuations, generational homeownership rates, and much more.

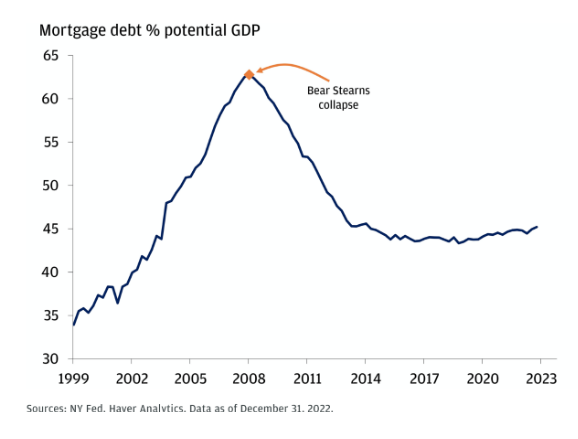

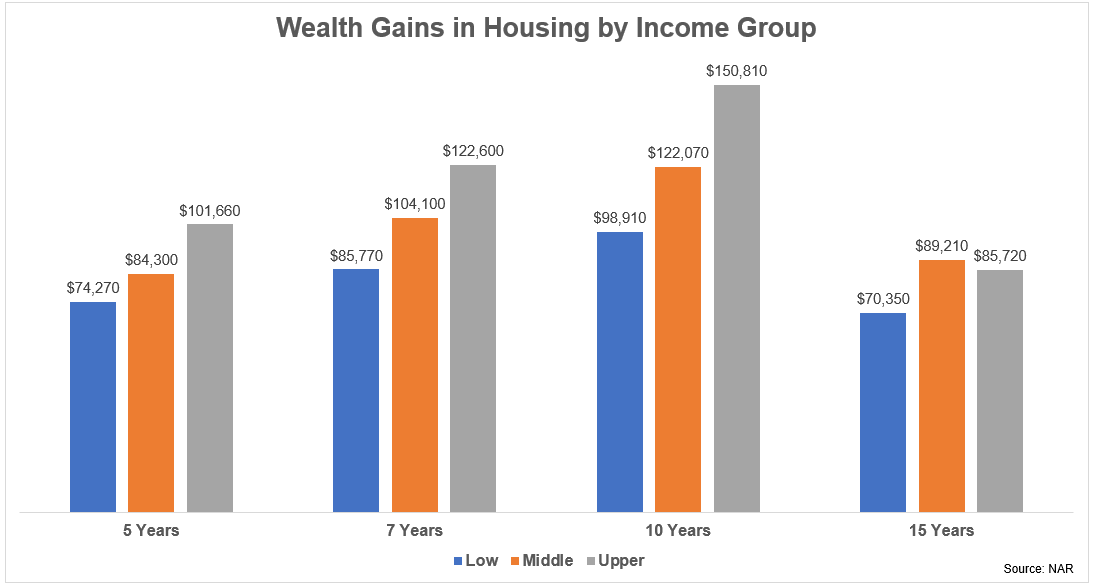

Housing prices are up a ton over the past 10 years.

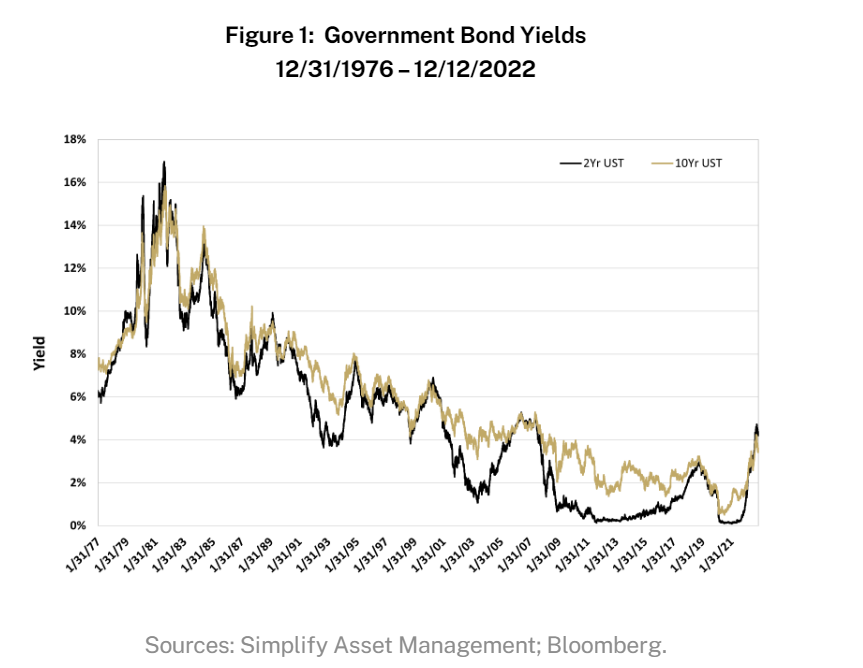

On today’s show, we are joined by Paul Kim, CEO and Co-Founder of Simplify ETFs to discuss how rising yields affect alternative strategies, Simplify’s interest rate hedge strategy, utilizing VIX strategies, and much more!

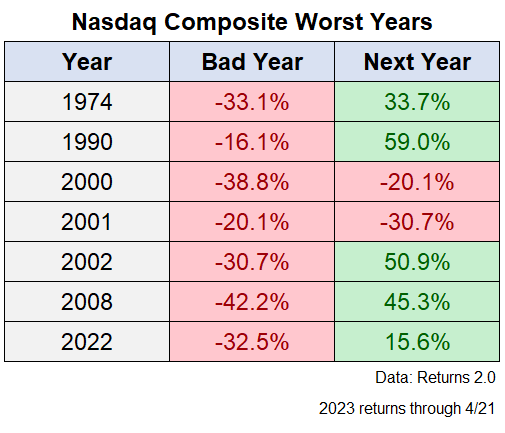

What happens after a double-digit down year for the stock market?

Will millennials and boomers put a floor under the inflation rate?