What would you do if your entire portfolio was sitting in cash right now?

What would you do if your entire portfolio was sitting in cash right now?

On today’s show, we discuss:

– The stock market vs. the Fed’s balance sheet

– Why expectations matter more than fundamentals in the short-run

– The cruel irony of investing

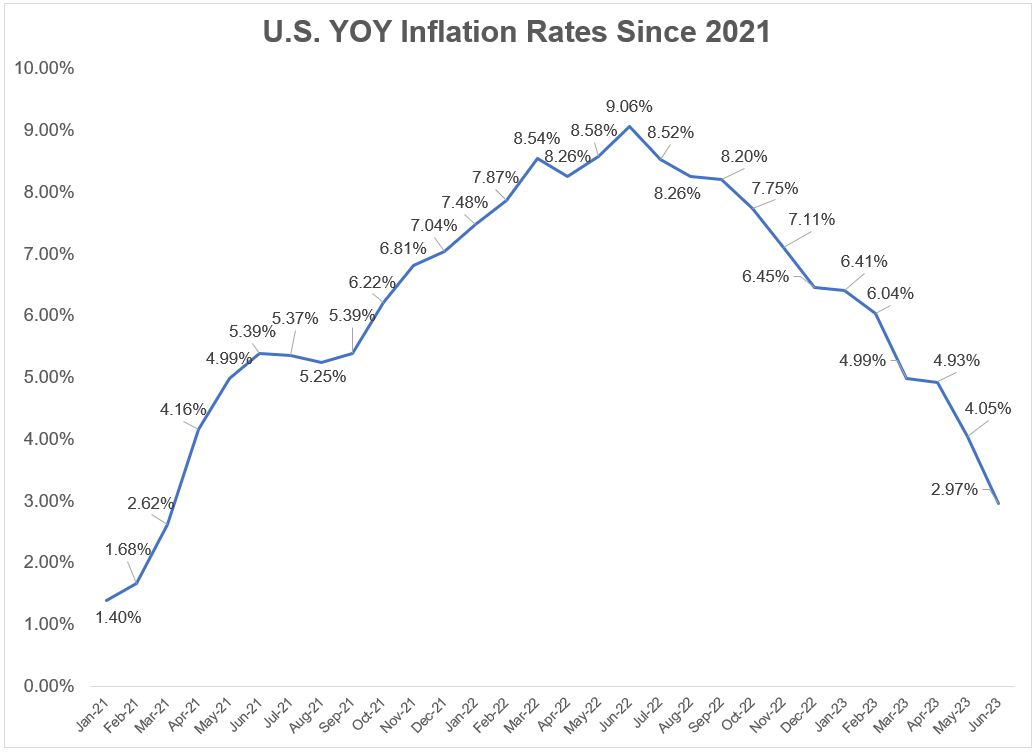

– How to hedge hyperinflation

– Why no one can claim victory on a soft landing

– Why the US economy is so much bigger than the Eurozone

– Dwight Schrute and the human condition

– Movies are back, and much more!

Ways to be wealthy that don’t require a lot of money.

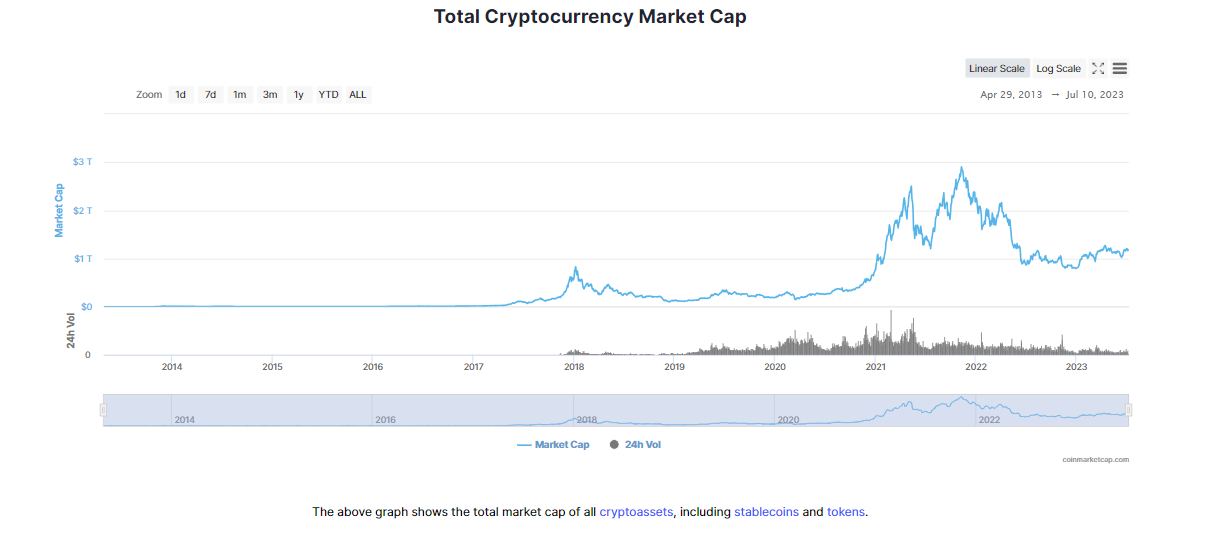

On today’s show, we are joined again by Jack Neureuter, Research Analyst at Fidelity Digital Assets to discuss:

– Knock-on affects of a Bitcoin Spot ETF

– The Grayscale discount

– Bitcoin in Bear Markets vs Bull Markets

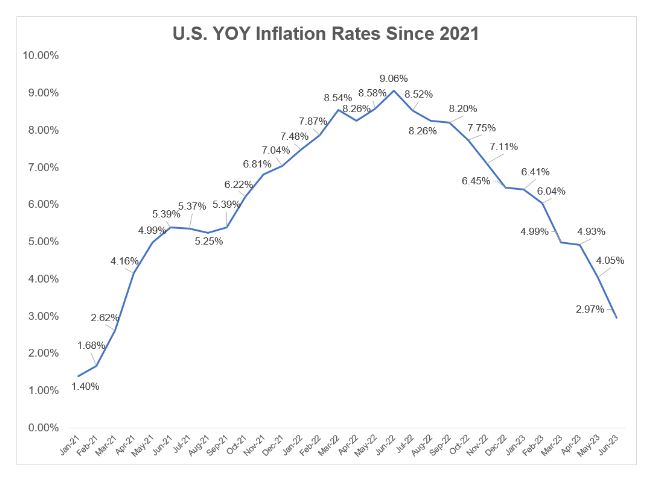

– If inflation falling is actually good for crypto, and much more!

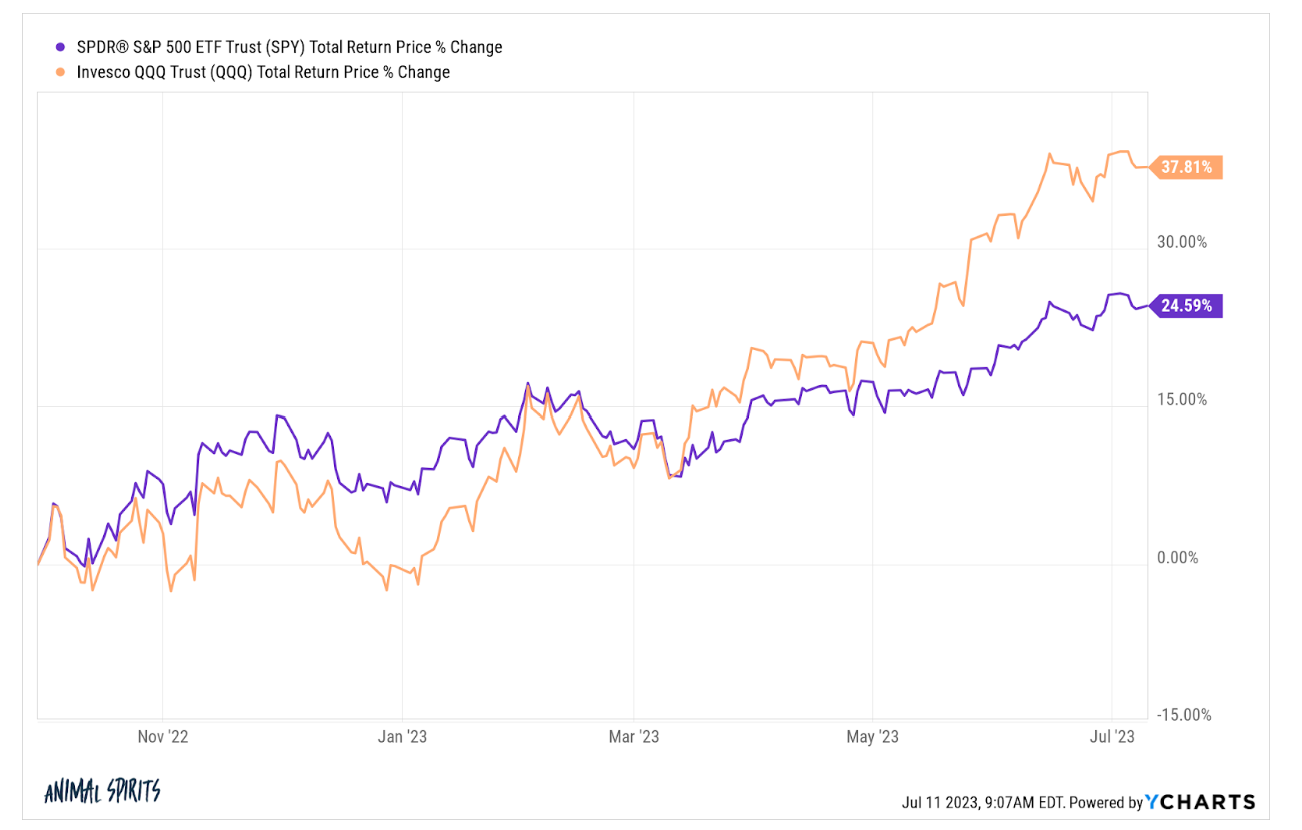

Some thoughts about the current state of the markets and economy.

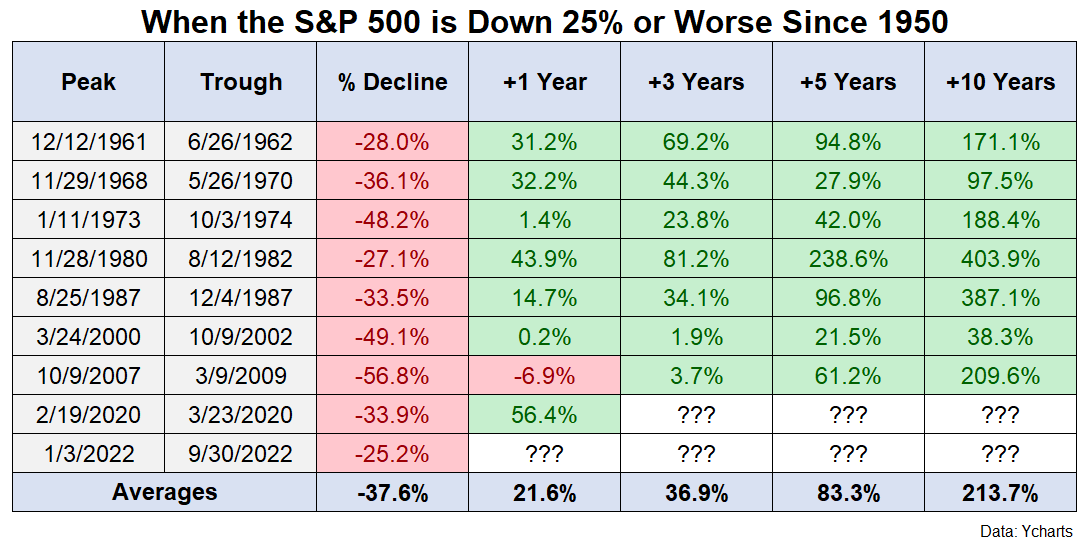

How to think about investing during a bear market.

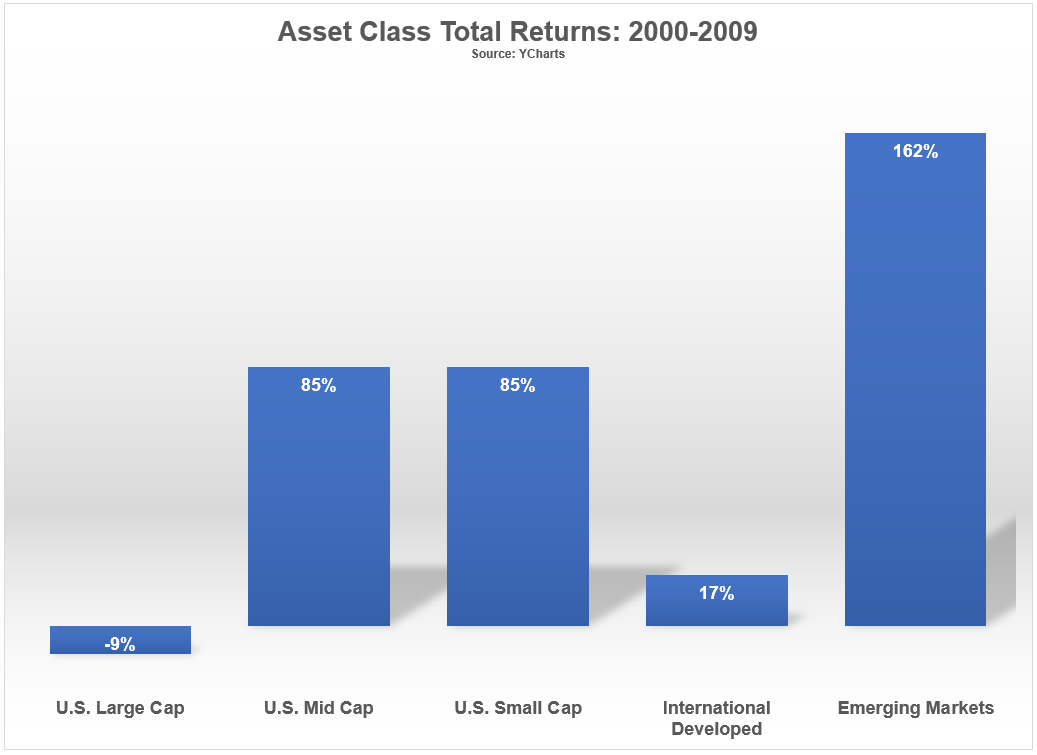

Why diversification is important even if you have all of your money in stocks.

On today’s show, we discuss:

– When to get bullish in the long run

– How to use sell side stock research

– What’s wrong with Disney

– Cruises are underrated

– How the pandemic messed up historical economic relationships

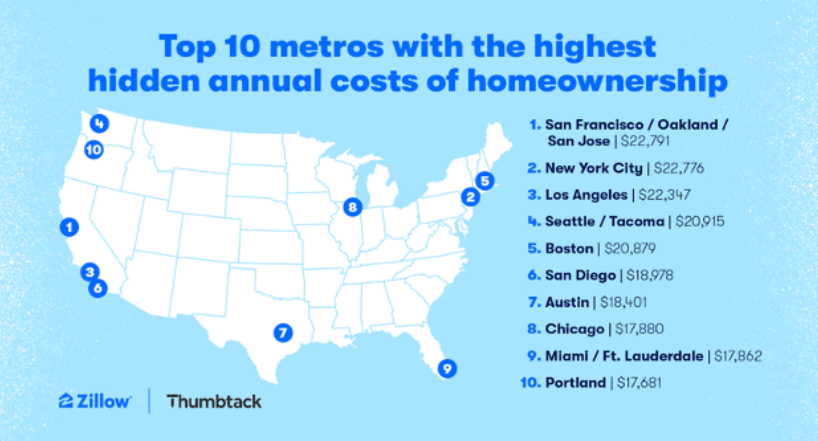

– 8% mortgage rates and 3% mortgage rates

– Why housing prices are still going up, and much more!

Why eff you money is overrated.

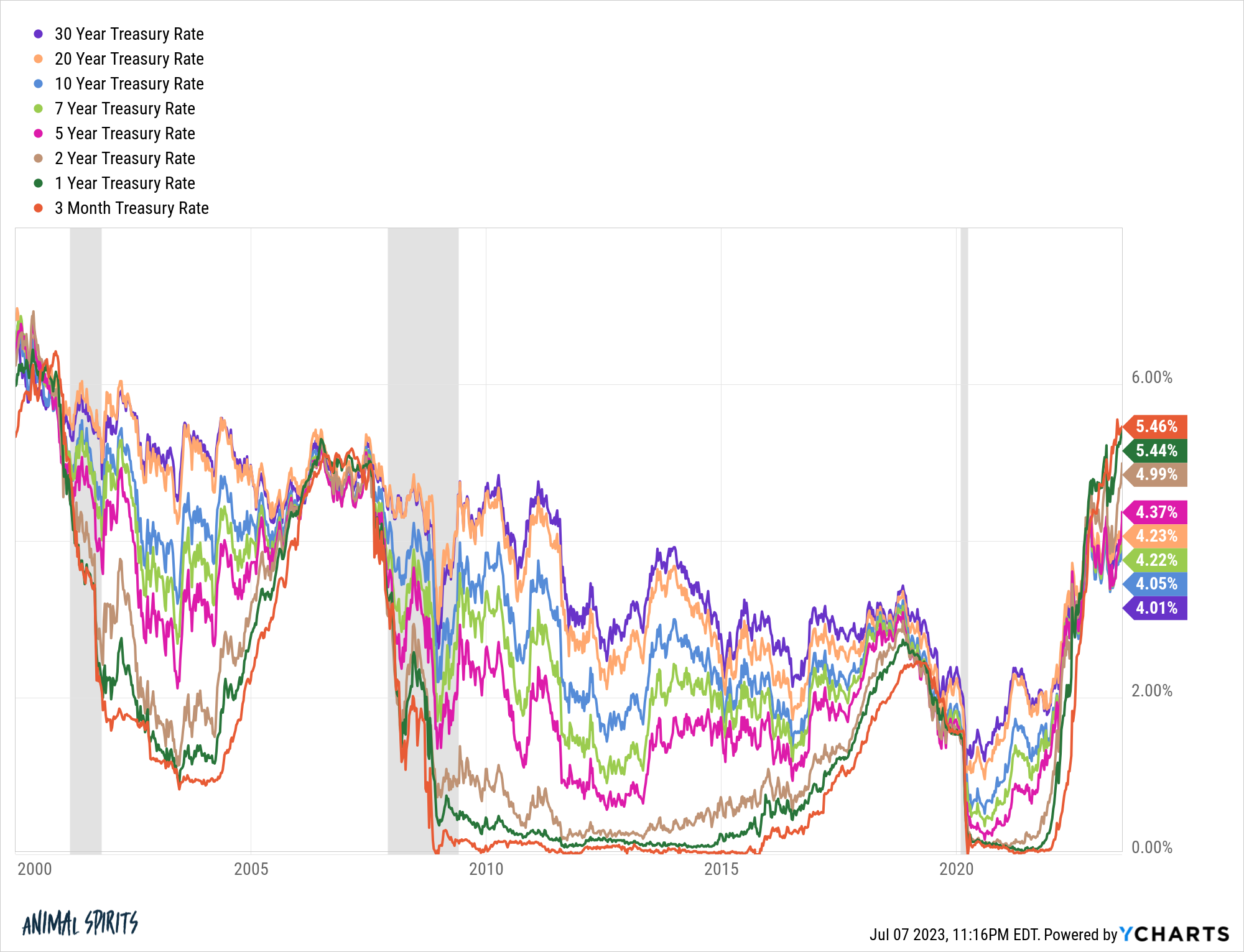

Why aren’t higher interest rates having a bigger impact yet?