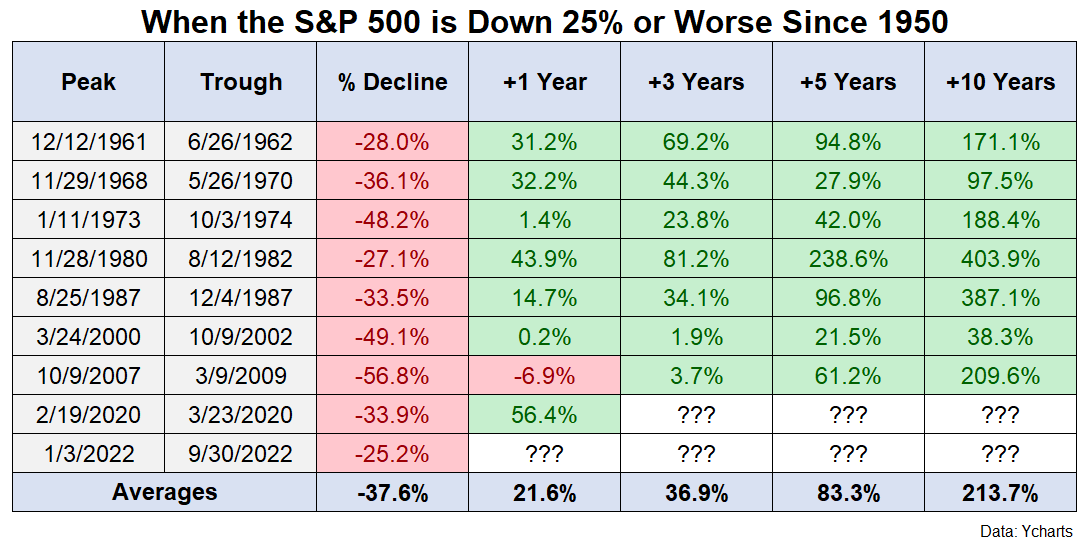

A closer look at the 2 types of bear markets and where the most recent downturn stacks up historically.

A closer look at the 2 types of bear markets and where the most recent downturn stacks up historically.

On today’s show, we are joined by Matt Middleton, CEO and Co-Founder of Advisor Circle to discuss:

– How Advisor Circle was started

– Why conferences needed to change

– Future Proof in 2022, and changes coming for 2023

– What value an advisor can get out of Future Proof, and much more!

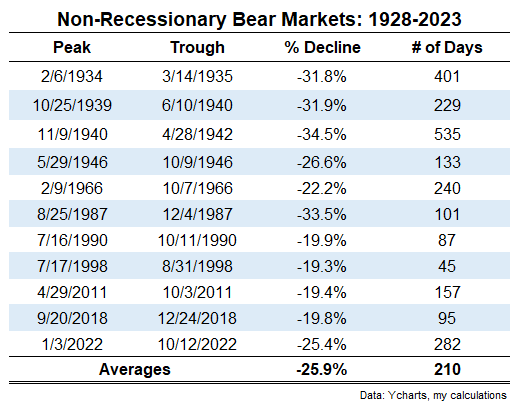

How wealthy people invest their money.

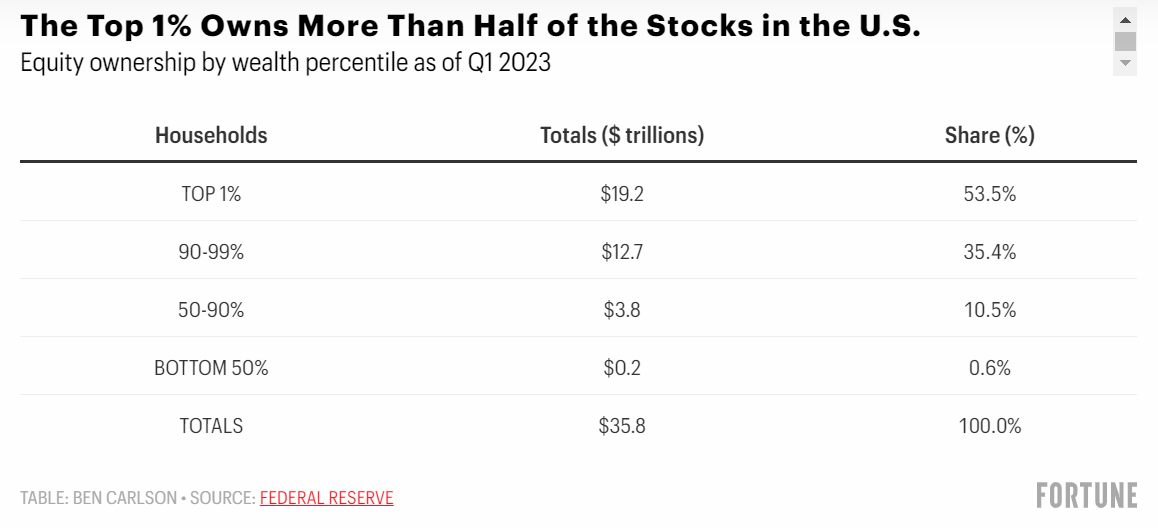

Why haven’t interest rates impacted the economy more?

What would you do if your entire portfolio was sitting in cash right now?

On today’s show, we discuss:

– The stock market vs. the Fed’s balance sheet

– Why expectations matter more than fundamentals in the short-run

– The cruel irony of investing

– How to hedge hyperinflation

– Why no one can claim victory on a soft landing

– Why the US economy is so much bigger than the Eurozone

– Dwight Schrute and the human condition

– Movies are back, and much more!

Ways to be wealthy that don’t require a lot of money.

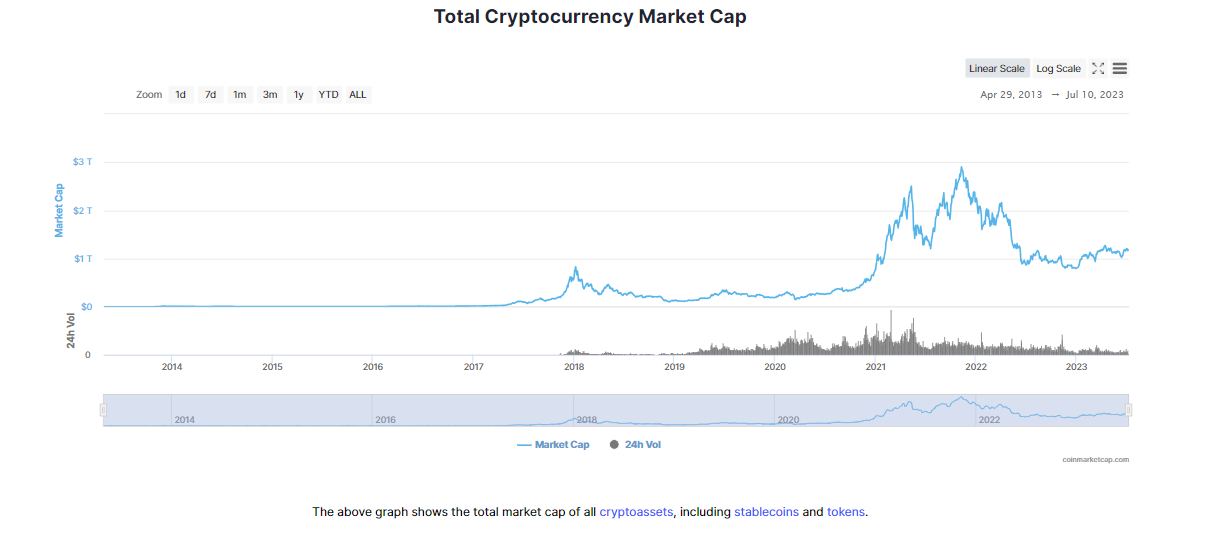

On today’s show, we are joined again by Jack Neureuter, Research Analyst at Fidelity Digital Assets to discuss:

– Knock-on affects of a Bitcoin Spot ETF

– The Grayscale discount

– Bitcoin in Bear Markets vs Bull Markets

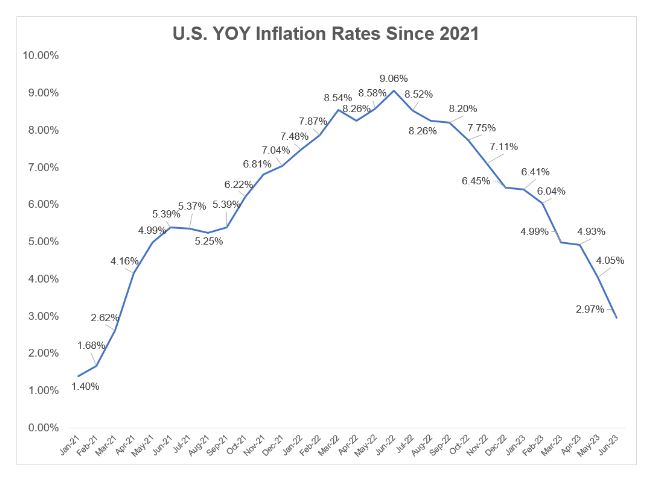

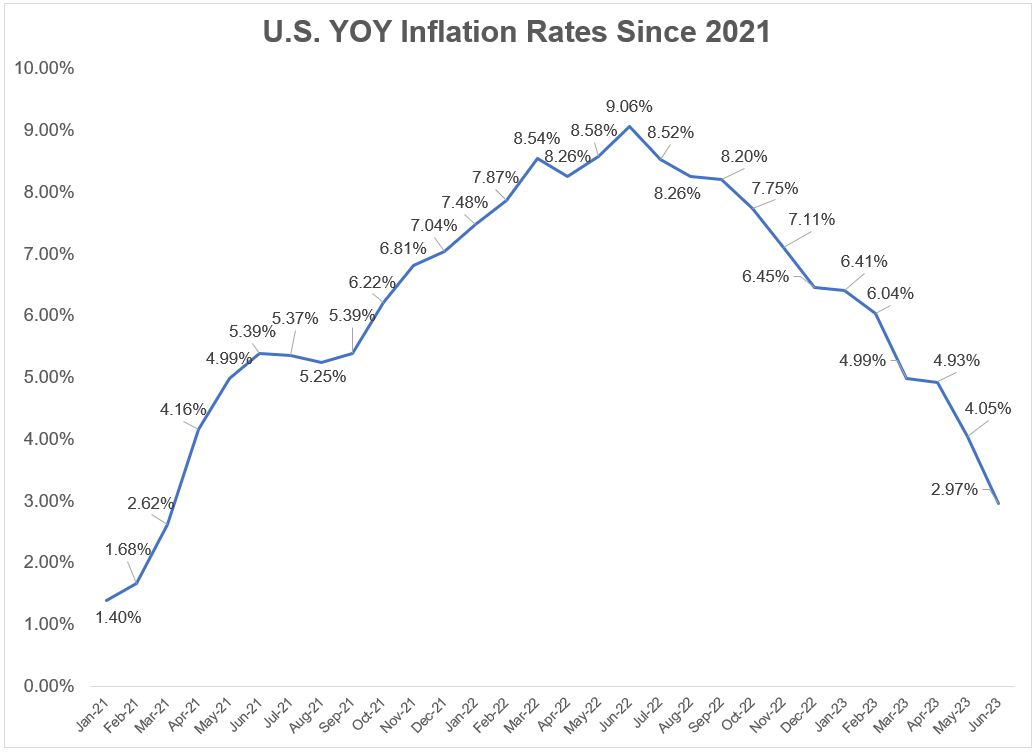

– If inflation falling is actually good for crypto, and much more!

Some thoughts about the current state of the markets and economy.

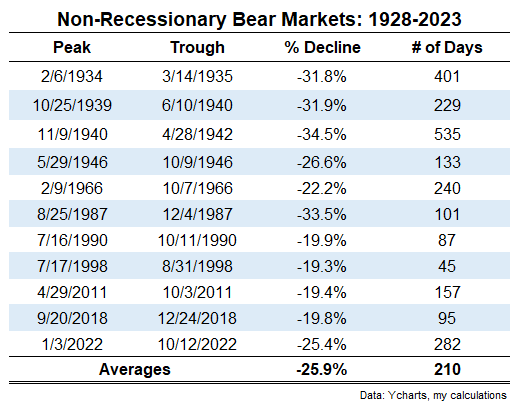

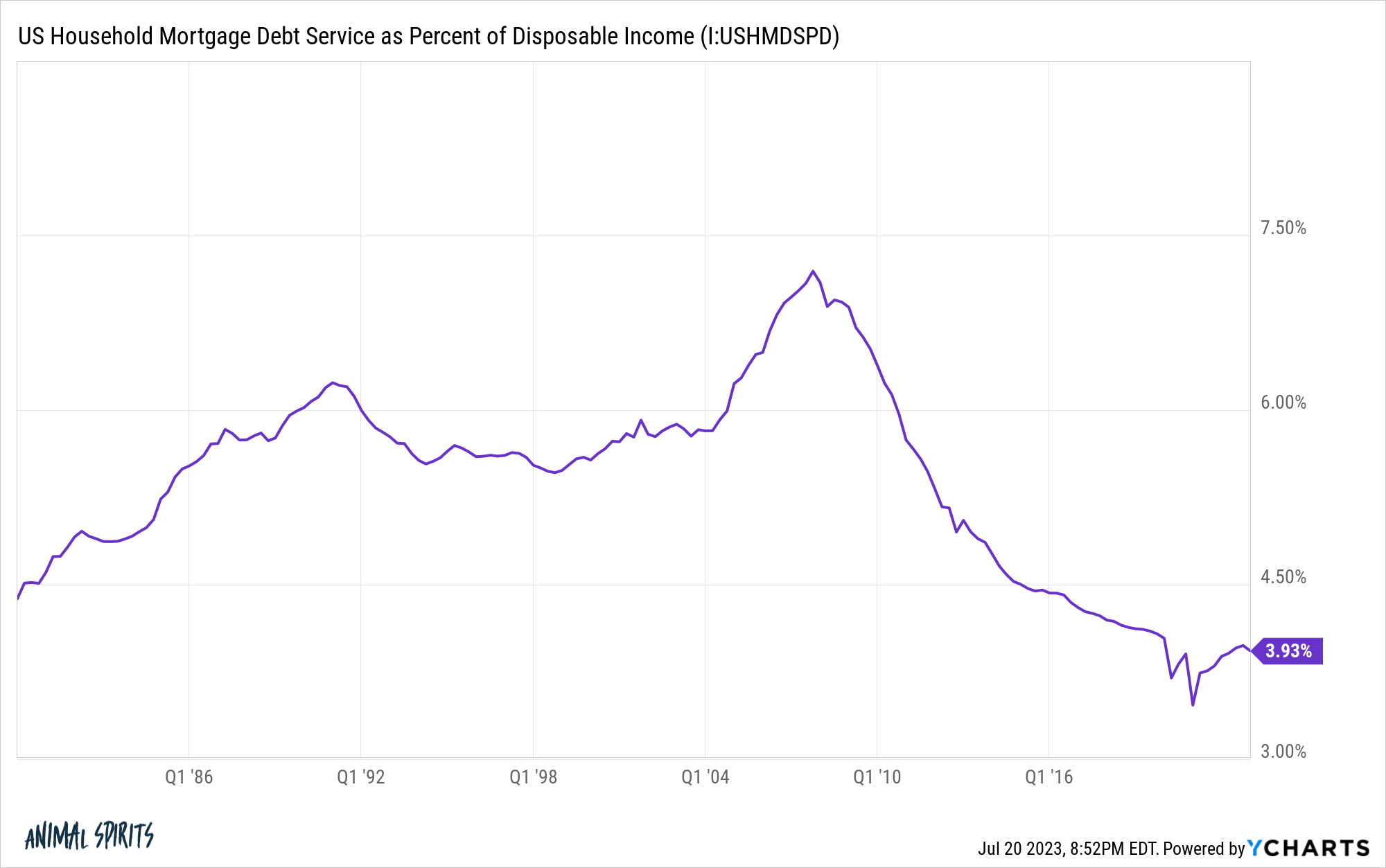

How to think about investing during a bear market.