Last year most economists assumed the Fed raising rates so aggressively meant a recession was inevitable:

Now they’re backing off those predictions:

So why hasn’t the economy crashed from going 0% to 5% in such short order?

There are a lot of reasons.

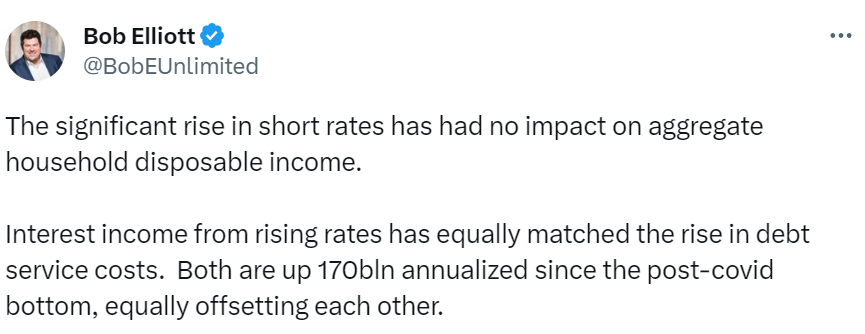

I like this one from Bob Elliott:

If you think about what happened it makes sense higher yields and higher borrowing costs have offset one another.

We went from a situation where it was cheap to borrow but savers couldn’t find yield anywhere. Now savers have higher yields but it’s way more expensive to borrow.

It’s a Lindsay Lohan-Jamie Lee Curtis switcharoo situation.

The savers and borrowers aren’t the same households but consider what’s transpired over these past years to understand why we haven’t seen much of an economic impact from higher rates just yet.

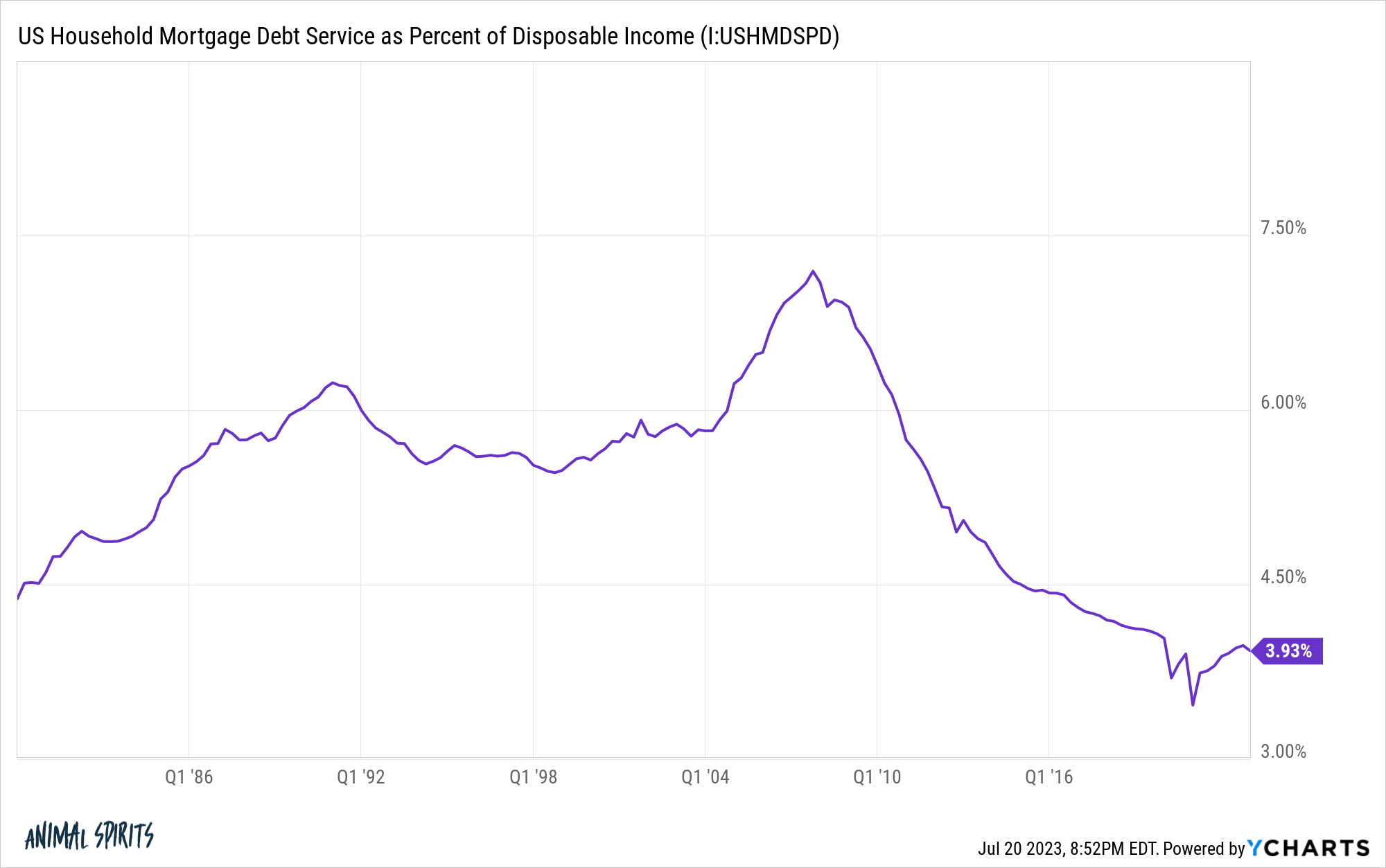

The homeownership rate heading into 2022 (before the rate hikes) was roughly 66%. A lot of people already owned homes and borrowed to buy them. Those households were able to borrow or refinance at extraordinarily low mortgage rates.

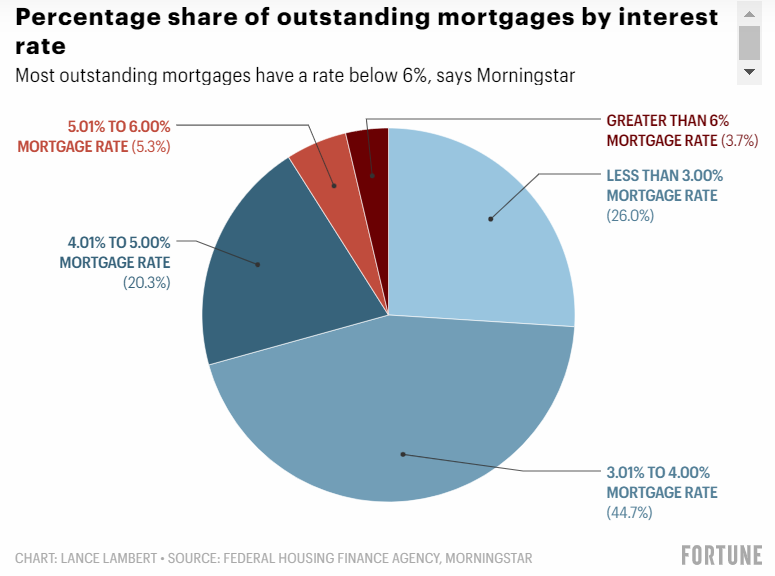

This is why 91% of borrowers have mortgage rates under 5% while more than 70% have borrowing rates at 4% or less (via Fortune):

And these numbers are only for the 62% of homeowners who currently hold a mortgage. According to U.S. Census data, nearly 38% of households have their mortgage paid off free and clear.

Higher borrowing costs aren’t impacting these households where it hurts the most.

And guess who has the financial assets to take advantage of the higher short-term yields on their savings right now?

People who have their mortgage paid off or a 3% mortgage rate!

Can you imagine telling someone in 2019 in the coming years they would have the chance to borrow at 3% to buy a house and then see short-term rates of 5% to park their cash all in the span of 3-4 years?

No one would have believed you.

Plus their stock holdings have now recovered. And they have $28 trillion collectively of equity in their homes.

Obviously, if rates stay are current levels for an extended period of time, eventually, that should have an impact on the investment of capital in the economy.

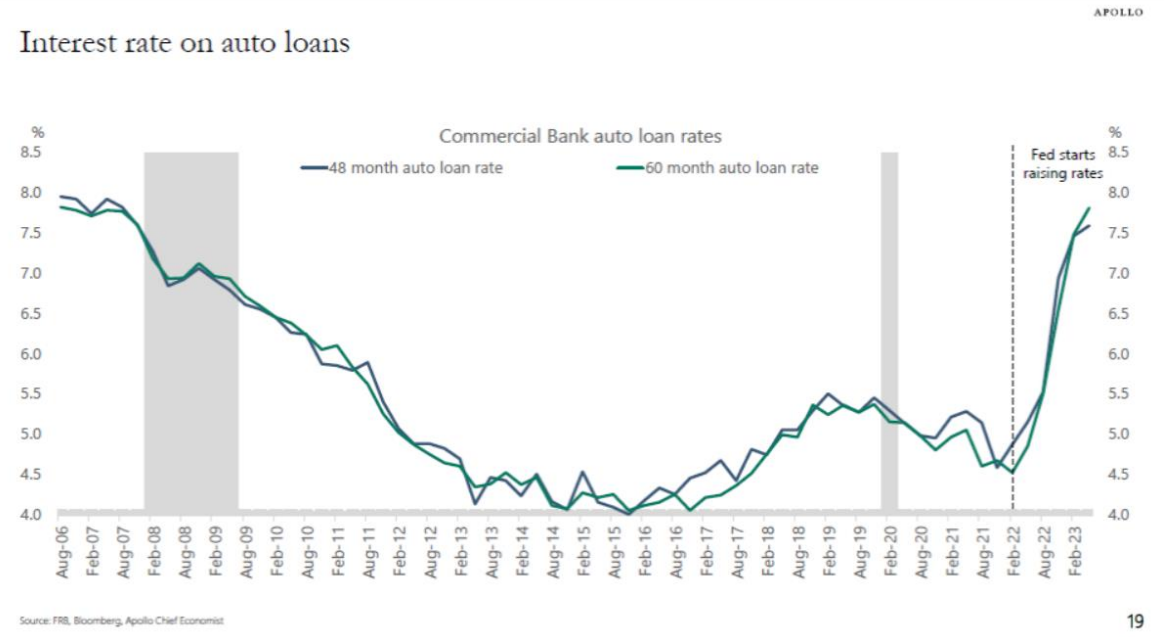

Just look at auto loan rates:

Rates have gone from 4.5% at the start of 2022 to 8% now.

While this makes it more cost prohibitive I don’t think higher borrowing rates impact auto buyers as much as it does for homebuyers.

The average cost for a new vehicle is now something like $46,000.1

Assuming a 10% down payment your monthly payment for a 5-year loan at 4.5% would be roughly $770. At 8% that monthly payment shoots up to around $840.

Now $70 more per month isn’t fun to add to your budget but I’m not sure it’s going to deter many people who really want and/or need a vehicle.

Those much higher rates will discourage some homebuyers but there is far less turnover in the housing market than the vehicle market.

I’m not saying this is a prudent financial move but this is the reality for most households.

I think we all underestimated just how prepared the consumer was for higher rates in the economy.

If you want a good explanation as to why we haven’t gone into a recession it’s probably some combination of excess savings from the pandemic, pent-up demand from not spending in 2020, repaired consumer balance sheets and the fact that we love spending money in this country.

I can’t make any promises as far as how long this will last.

The economy is cyclical just like everything else.

But for now, it’s nice to know we didn’t have to go through a recession and see millions of people lose their job to bring inflation back to more reasonable levels.

There’s nothing wrong with celebrating good news in the economy because it won’t last forever.

Michael and I talked about higher rates, recessions and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

When Will Interest Rates Really Start to Matter?

Now here’s what I’ve been reading lately:

- The cruel irony of investing (Irrelevant Investor)

- The problem with valuation (Dollars and Data)

- How to get rich in the markets (Big Picture)

- What does an inverted yield curve tell us? (Disciplined Funds)

Books:

- The Four Pillars of Investing (William Bernstein)

- Napoleon: A Life (Andrew Bird)

- American Prometheus (Kai Bird & Martin Sherwin)

1Is it just me or does $46k sound like A LOT for the average price of a new vehicle? This is partly due to the pandemic supply chain/inflation and partly due to the fact that people are buying more expensive trucks and SUVs than ever. Either way, it’s high.