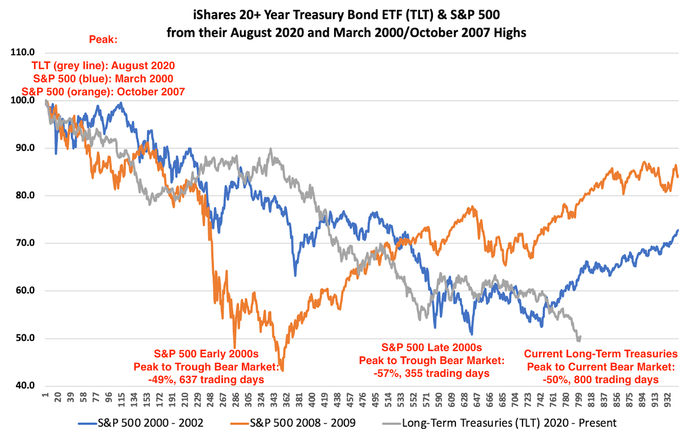

A short history of bond bear markets.

A short history of bond bear markets.

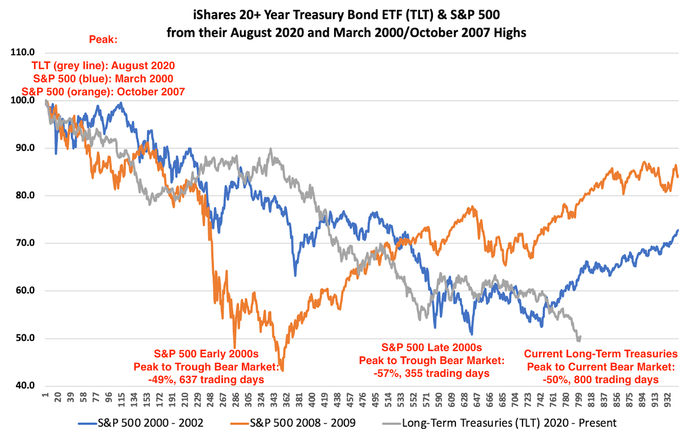

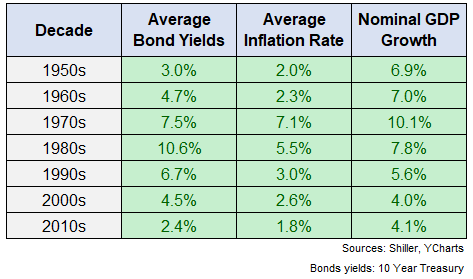

Don’t underestimate the power of compounding over the decades.

On today’s show, we discuss:

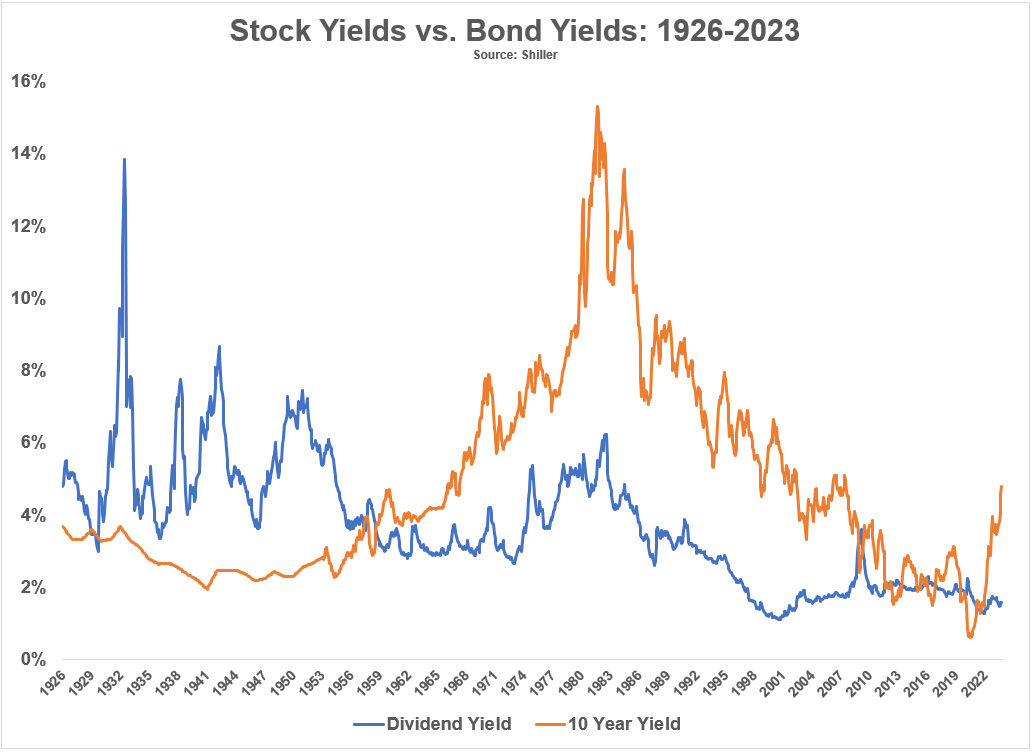

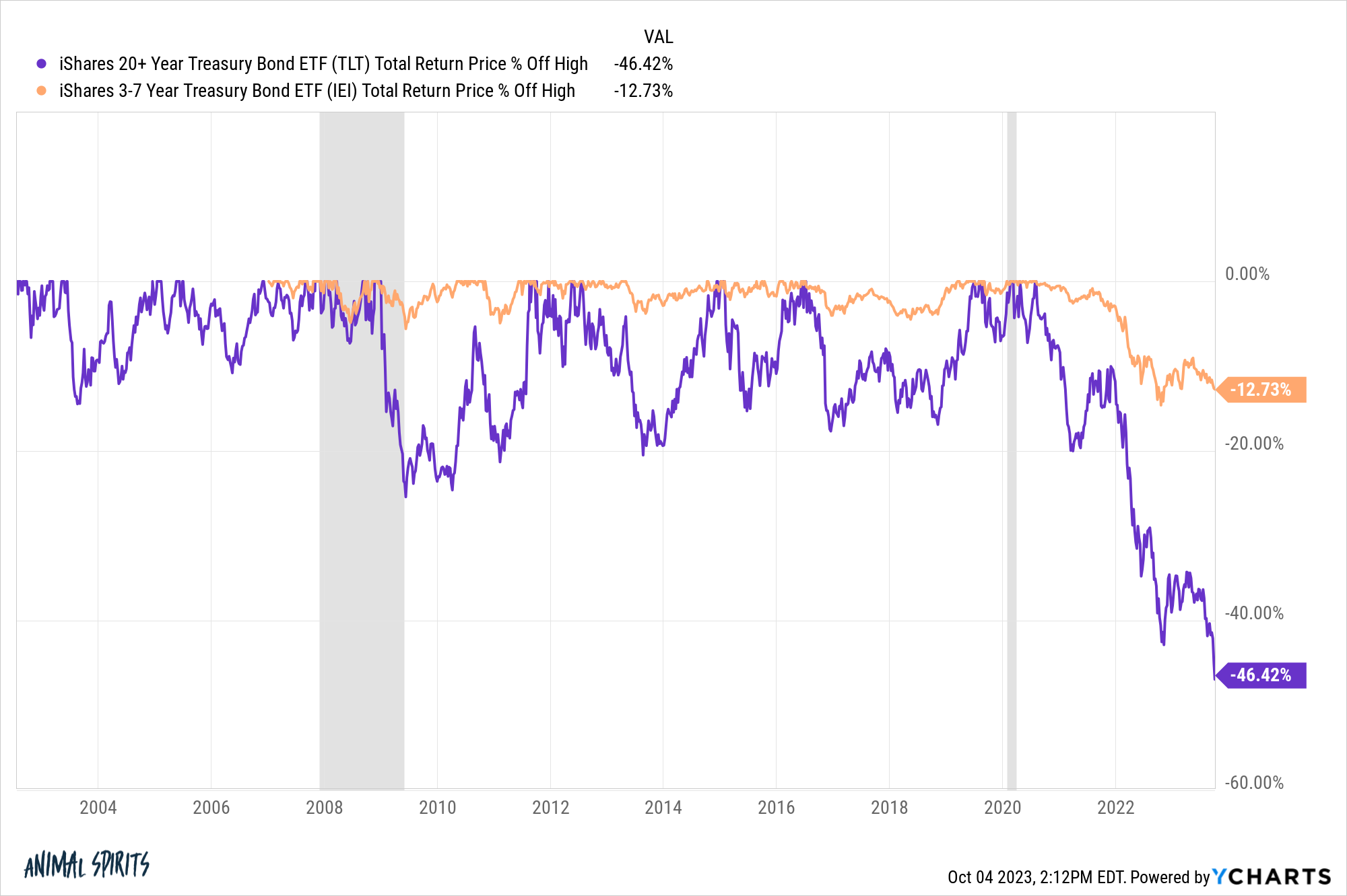

– Why long term bond yields are rising

– The worst bond market sell-off in history

– When good news is bad news for the economy

– Continued strength in the labor market

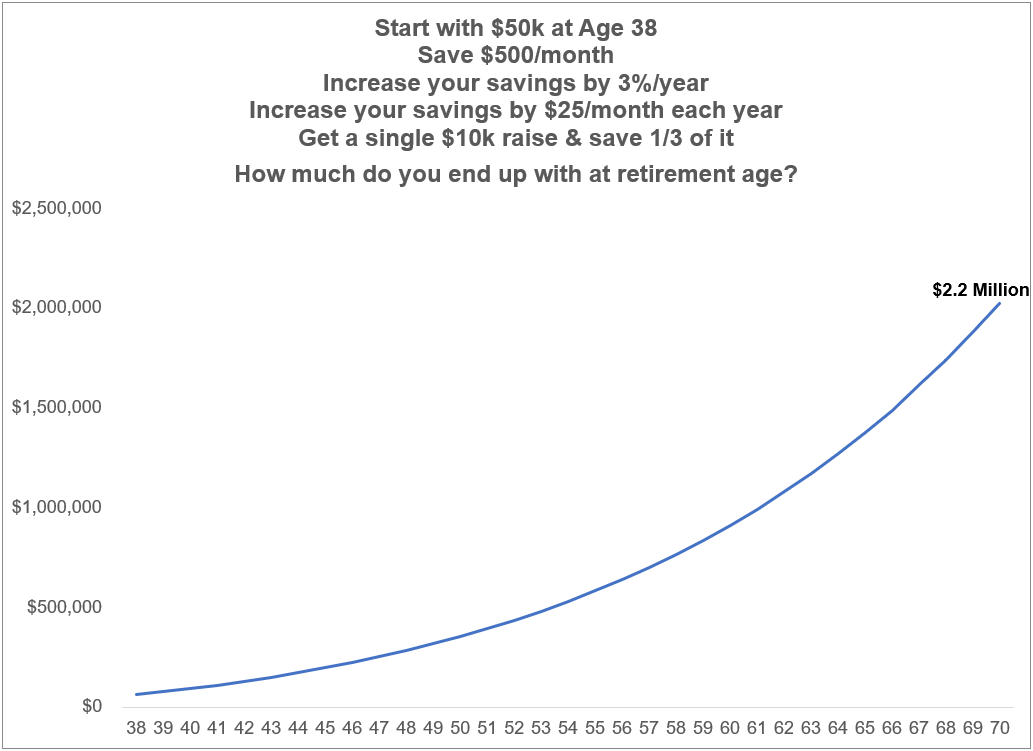

– Boomers are holding up the economy

– Michael Lewis book review

– Why Millennials are more prepared for retirement, and much more!

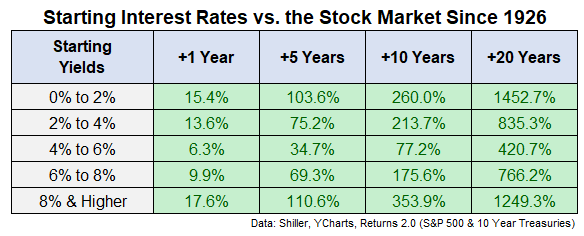

Are bonds cometition for stocks with yields so much higher?

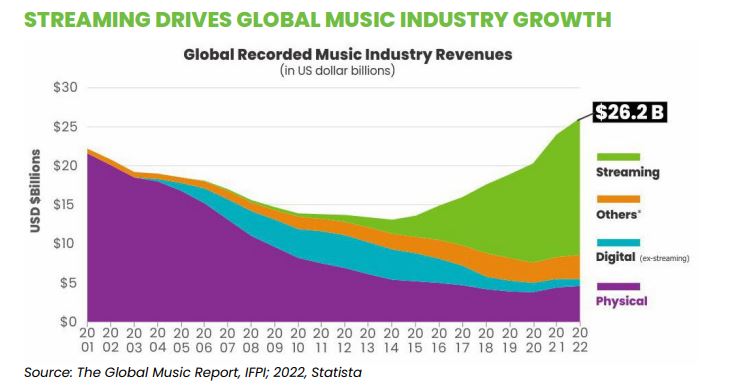

On today’s show, we spoke with David Schulhof, Founder and CEO of MUSQ to discuss:

– What the $MUSQ ETF is comprised of

– How the music industry is mispriced

– The affect Taylor Swift is having on the economy

– How music can be changed with AI and blockchain, and much more!

How many Marvel superheroes take steroids?

Some theories about the crazy move in bond yields.

Are long bonds the most obvious trade in the markets right now?

On today’s show, we discuss:

– Crazy moves in US Treasuries

– How prepared the consumer is for a recession

– More positive data on inflation

– Michael Lewis and the SBF situation

– Dark meat chicken

– The best 80s movies, and much more!

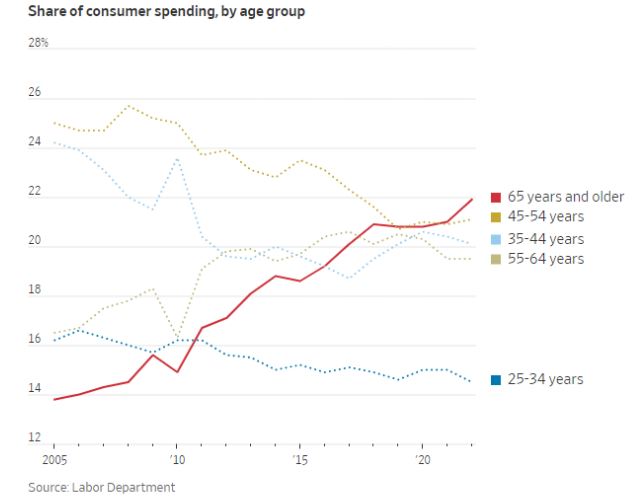

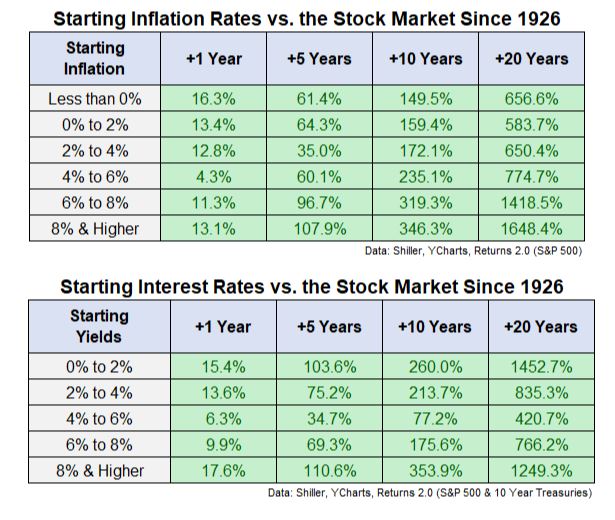

How the stock market has fared in the past from various interest rate and inflation levels.