A reader asks:

Not to brag (just kidding), but I’m 38, make $50k/year and have $10k in Marcus, $10k in an Roth IRA, $10k Crypto, and $10k Traditional 401k. My net worth is about $50k. My expenses are about $40k per year and I can typically save about $500 per month. I live in Los Angeles with my partner. For low earning folks who want to be financially stable what advice do you have? My POV is that I have such a small amount of money and I’m 38 so it doesn’t really matter because the amount of time to compound is shorter and my available monthly investment is low. For lower income folks/listeners, should I just spend it because the reward of compounding takes so long. I feel time is not on my side. I’m not competitive in the labor market (I graduated from Arizona State University lol). Getting an MBA isn’t in the deck of cards. I work as a resident services coordinator for an affordable housing organization in Santa Monica. I have my 6 months of savings locked in and don’t touch it.

You’re selling yourself short here.

The fact that you can afford to live in California and still save $500 a month on your salary is impressive. You have a six-month emergency fund. Plus you have a net worth that matches your income.

And you’re not even 40!

You say you don’t have enough time to allow compounding to work but I don’t think that’s true. People often underestimate the power of compounding over multiple decades because the results take time to play out.

You still have plenty of time.

Let’s look at a few examples to see how things are set up for you currently and how you could improve your situation.

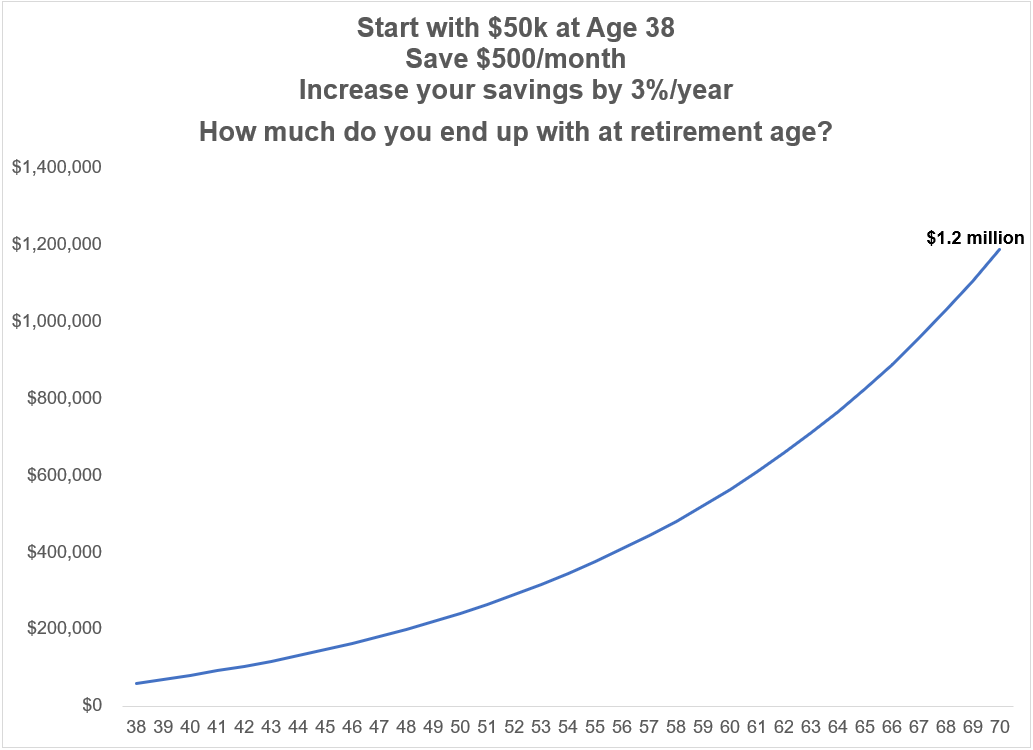

Right now you have $50,000 saved and put away $6,000 a year. Assuming you grow that $50k starting value at 6% per year and increase your savings rate by 3% each year1 to account for inflation, here’s how things would look going out to age 70:

By age 65 you would have more than $822,000. If you waited to retire until age 70 we’re talking closer to $1.2 million.

Not bad, right?

There are a lot of assumptions baked into this analysis but if you stay on the same track you’re on and allow compounding to do the heavy lifting for you, that’s a pretty nice outcome.

I think we can do better than this.

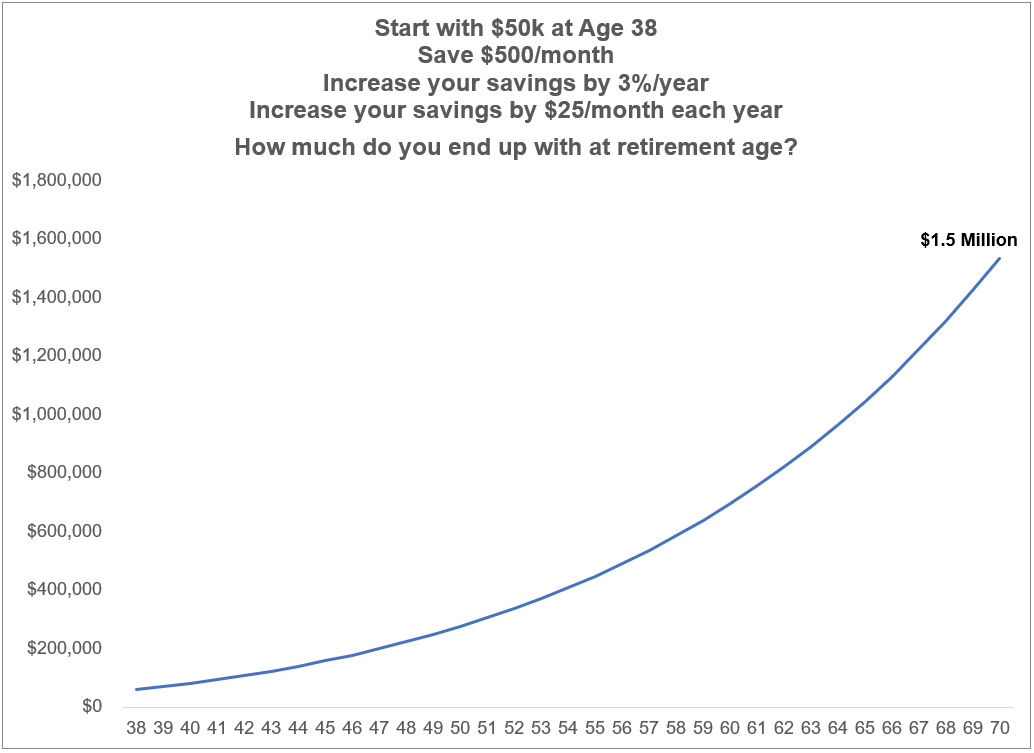

First, let’s see how far some more frugality or some kind of side hustle could take you.

Let’s say you save an extra $25/month each year on top of these assumptions. That’s just $300 more in savings each year on top of what you’re already saving. Now we’re looking at a little more than $1 million by age 65 or $1.5 million by age 70:

Small changes can have a huge impact over multi-decade time horizons.

However, frugality can only get you so far, especially on a lower income.

The dirty secret of personal finance is income is by far the biggest lever you can pull to improve your finances.

Maybe you’re happy with the job you have and don’t care about your income level.

But now is the perfect time to at least explore your options.

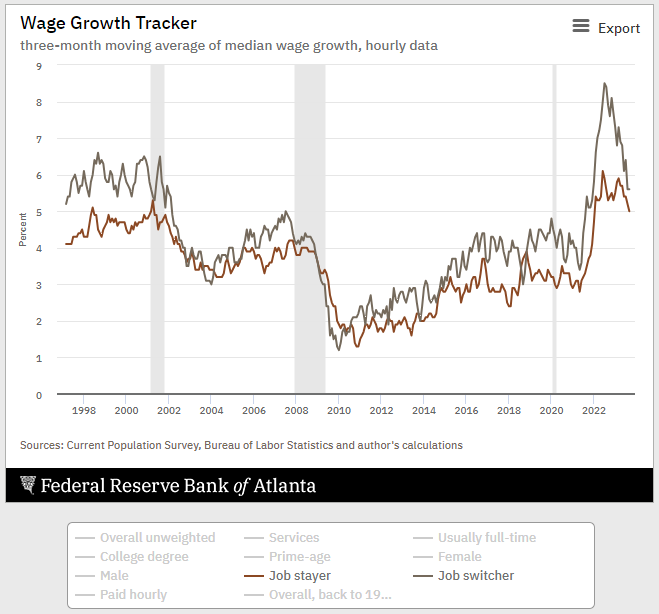

Just look at the Fed data on wage growth numbers broken out by job switchers and job stayers:

Since the start of 2022, people who have switched jobs are averaging nearly 7% annual wage growth versus 5% annualized wage growth for job stayers.

If you ever wanted to test the waters now is the time to do so.

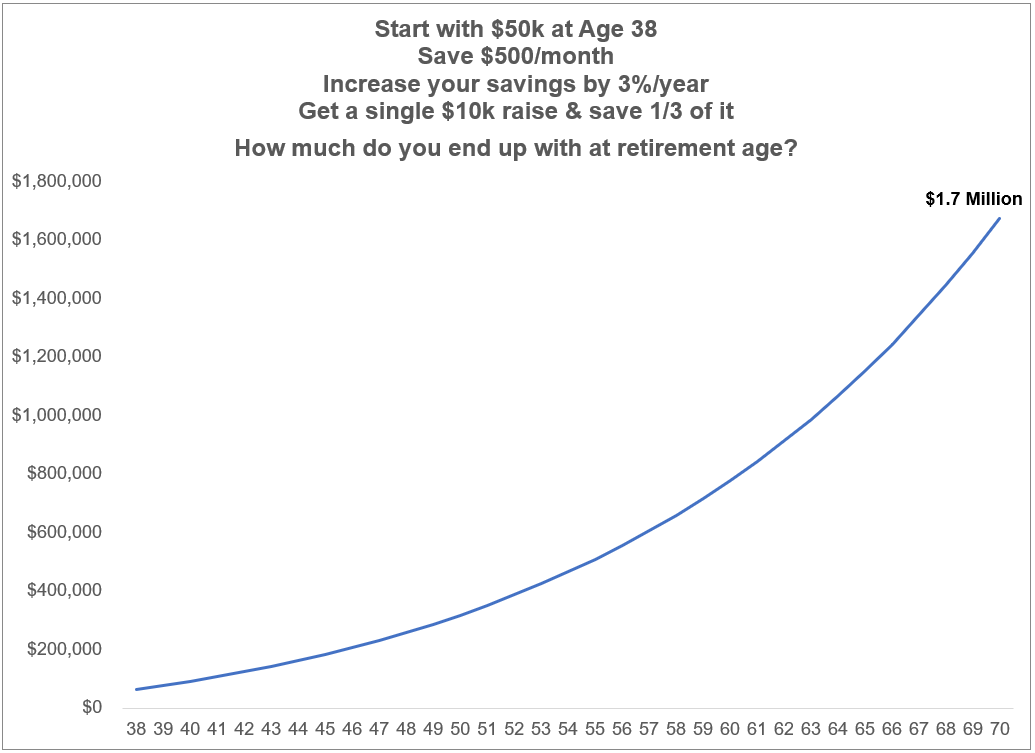

A single raise early in your career can have a massive impact on your finances.

Let’s say find a new job that pays you $10,000 more than you’re currently earning. It might not be your dream job but we’re still in a tight labor market. Let’s also assume you save roughly 1/3 of that raise every year ($3,500). So we go from $6,000/year in savings in year one to $9,500/year (and increase that by 3% each year for inflation).

That pushes your ending value at age 65 to $1.1 million or $1.7 million if you keep saving until age 70:

Again, not bad.

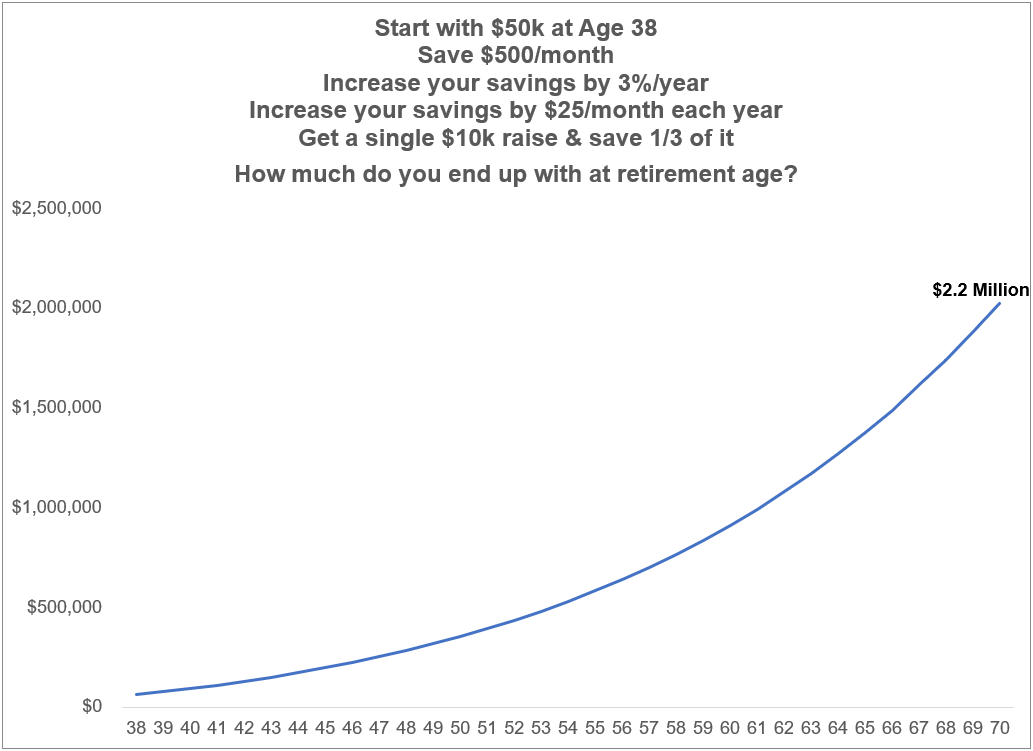

Now, what if we combine the two strategies?

First you find a new job or negotiate a higher salary and bump up your savings by just $25/month each year.

Now we’re talking:

That’s just shy of $1.4 million by age 65 and $2.2 million by age 70.

One $10k raise and $25/month in extra savings could be worth $1 million over a three-decade-plus time horizon.

Obviously, life never works out like a spreadsheet. Some years you’ll be able to save more. Some less.

Your career trajectory may work out better than you expect. Or worse.

Your investment returns might come in higher. Maybe lower.

The main takeaway here is the way to save on a lower income is the same way you should save at a higher income:

- Live on less than you earn

- Automate your savings

- Increase your savings rate each year

- Save a little more money each year

- Increase your earning potential

The good news is you already know how to save. Keep it up and you can still build a nice nest egg.

But there are also ways to improve your situation if you’re willing to work on your career and save a little more money each year.

We discussed this question on the latest edition of Ask the Compound:

Kevin Young joined me again this week to discuss questions ranging from expected returns in corporate bonds, the best month to invest a lump sum, setting up an account to pay for your child’s healthcare costs, where pensions fit into a financial plan and how to allocate assets from life insurance.

Further Reading:

Income Alpha

13% per year might sound like a lot but that’s an increase of $180 the first year (not per month, for the whole year), $185 the second year and $191 in year three. It’s doable especially since your income should also keep pace with inflation.