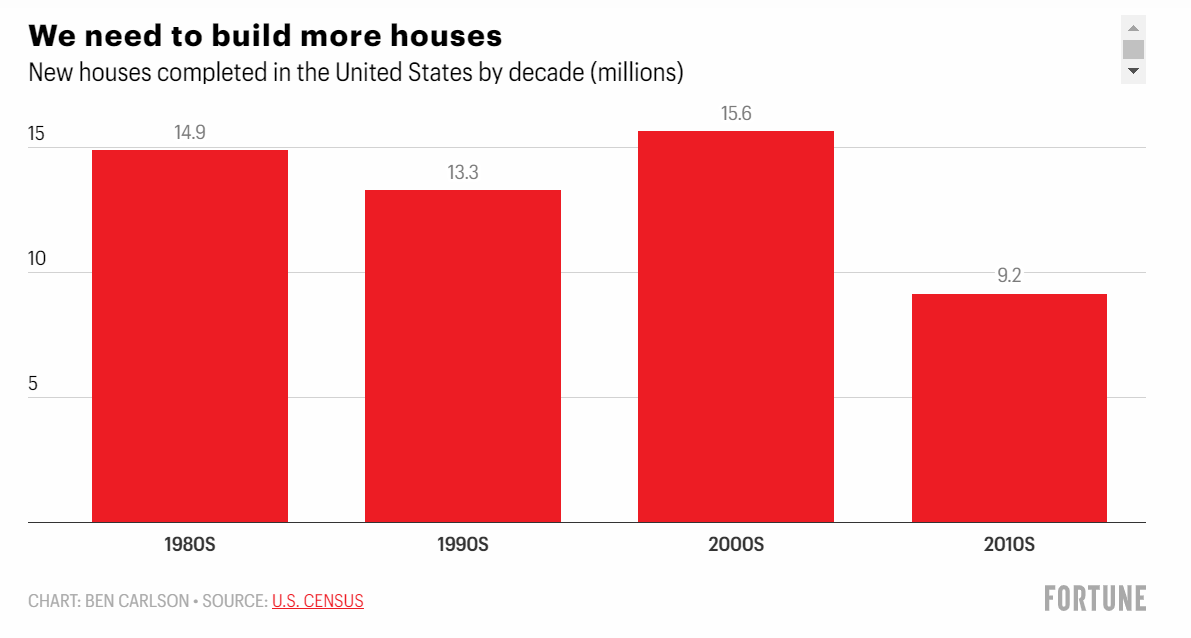

Four reasons the housing market is such a mess right now.

Four reasons the housing market is such a mess right now.

On today’s show, we had Hamilton Reiner, MD, PM, and Head of US Equity Derivatives at J.P. Morgan Asset Management back on the show to discuss:

– How hedging ladders provide downside protection

– The goal of the HELO ETF

– Hedged equity strategies vs traditional 60/40 portfolios

– The impact of volatility on the strategy, and much more!

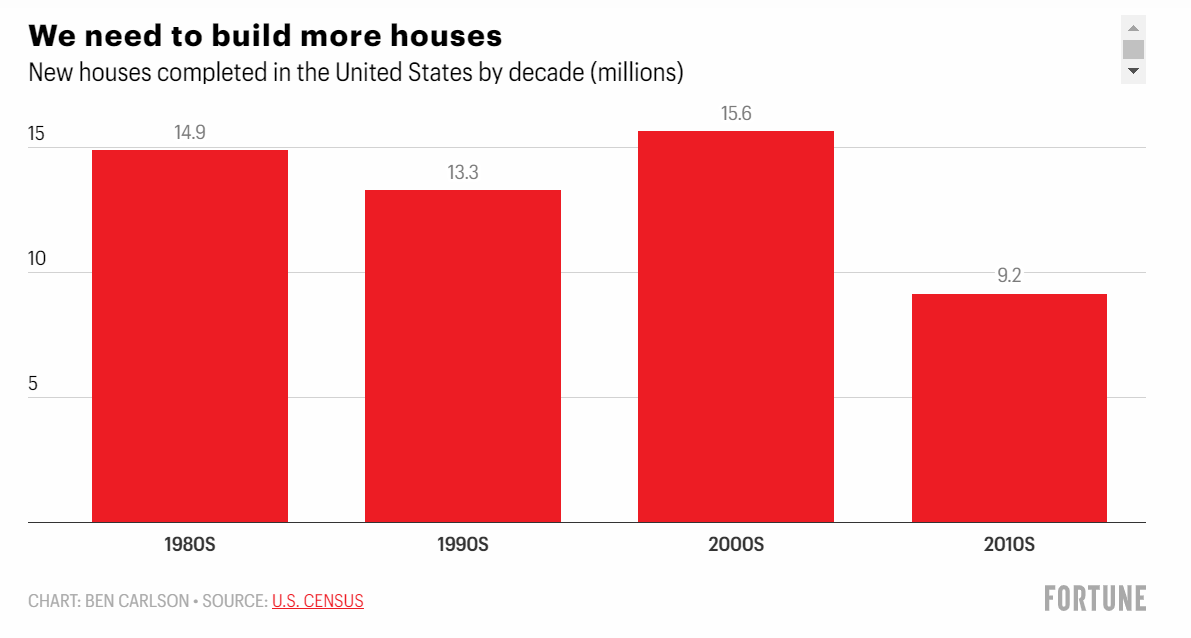

The median real net worth of American households was up 37% from 2019-2022.

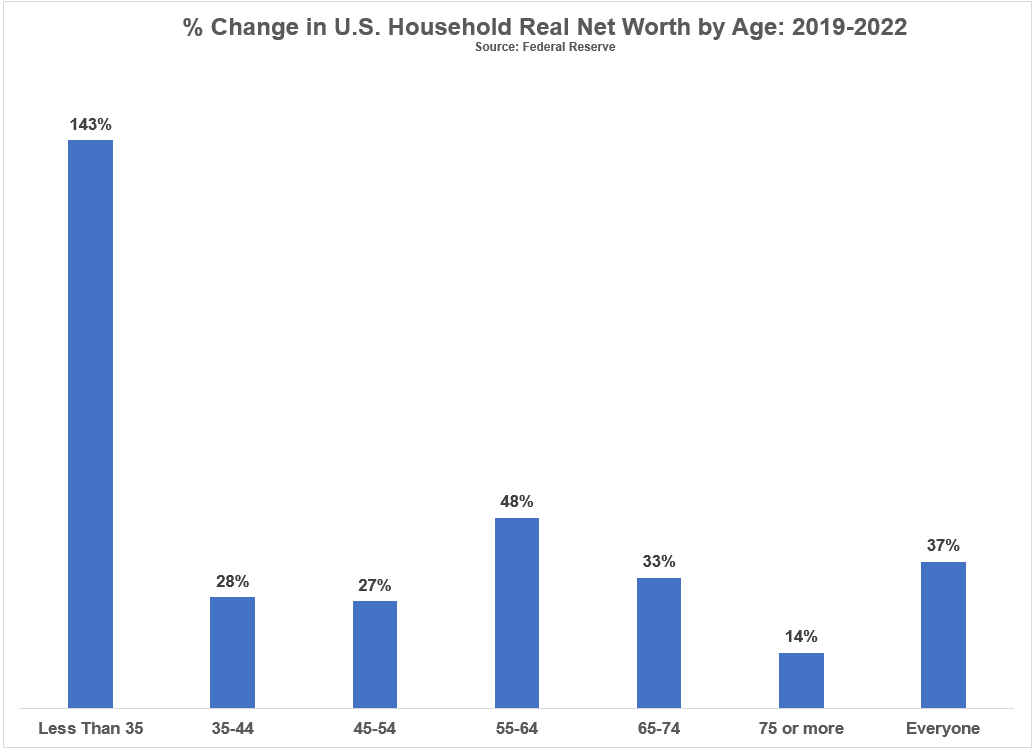

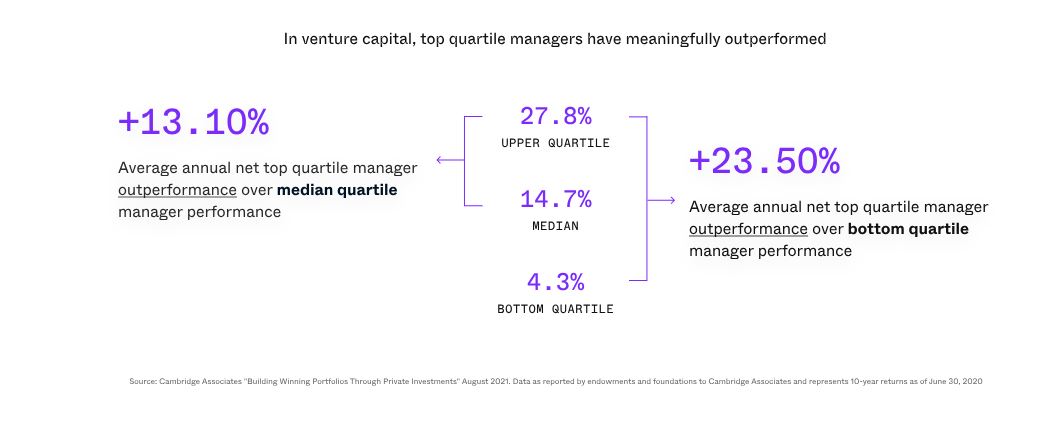

On today’s show, we spoke with Samir Kaji, CEO, President, and Co-Founder of Allocate to discuss:

– What start-up prices look like today

– If the free money era is gone forever

– VC return dynamics and the power law, and much more!

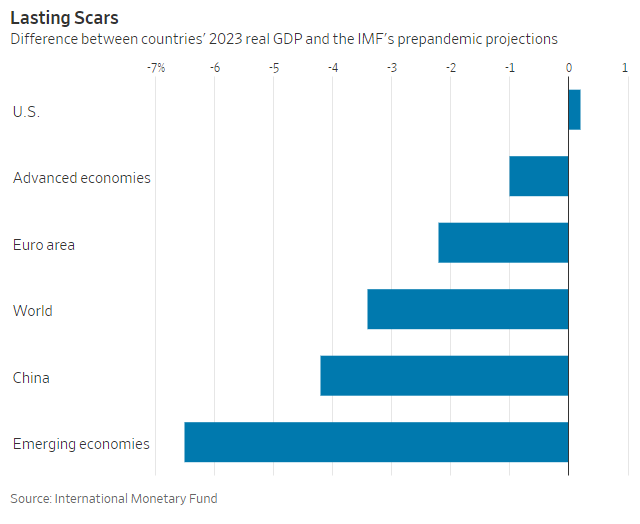

Good luck betting against America.

The best environment for investors just starting out buying stocks.

On today’s show, we discuss:

– Inflation coming down

– The continued strength of the US consumer

– Howard Marks on investing for a sea of change

– The risk-reward in bonds

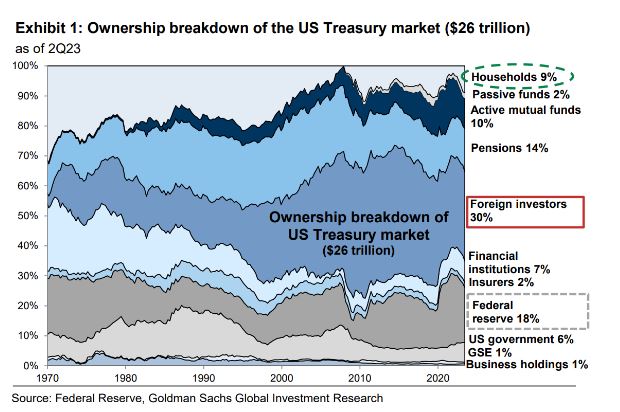

– What would happen if the US government paid off its debts

– EMH in crypto

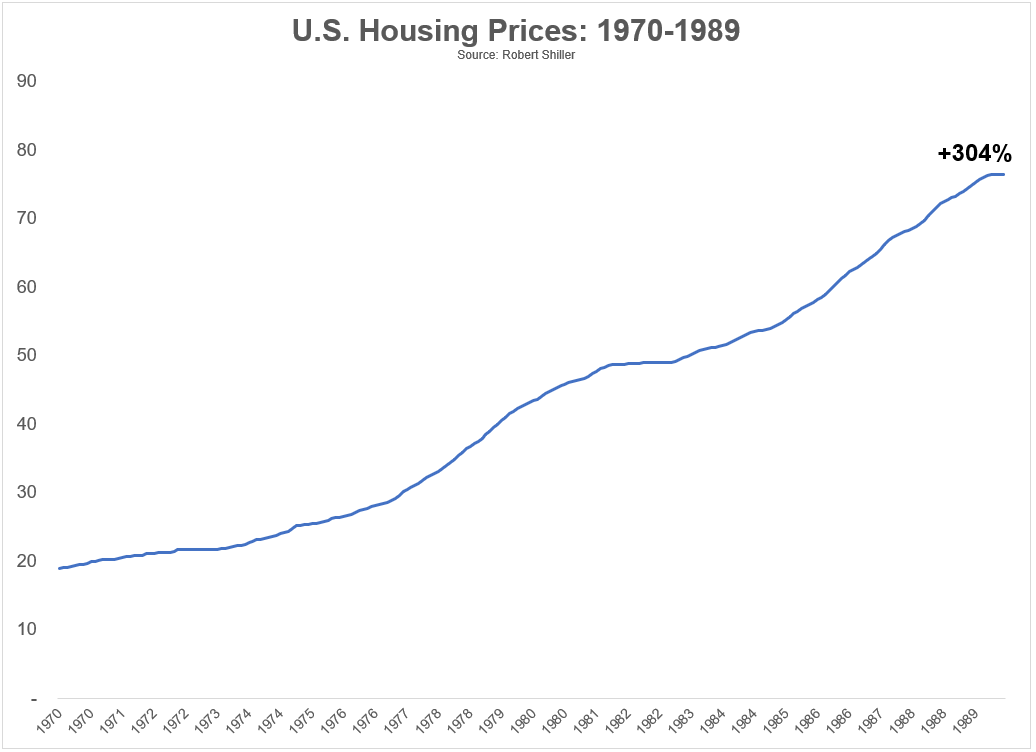

– The worst case scenario for the housing market, and much more.

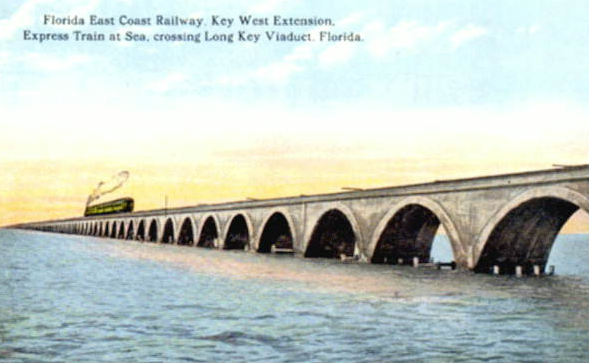

Some lessons from the man who helped build Florida into a destination.

On today’s show, we are joined by Jason Anderson, NMLS# 243209, Regional Vice President of Northpointe Bank to discuss:

– The All-In-One Loan

– How interest rates affect home equity lines of credit

– Who this product may or may not benefit

– The dangers of financial engineering, and much more!

Why a housing market crash would be better than the alternative in the housing market.