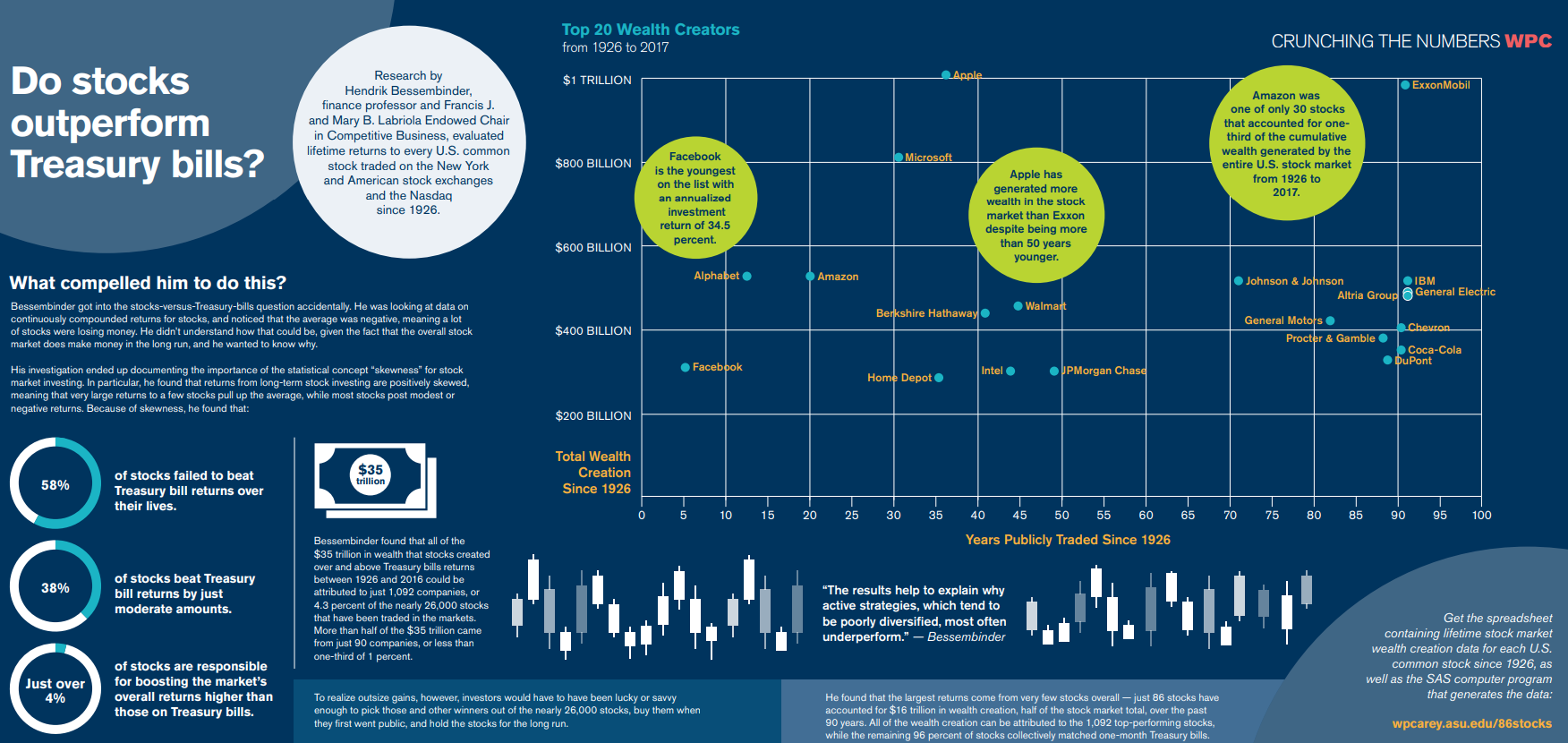

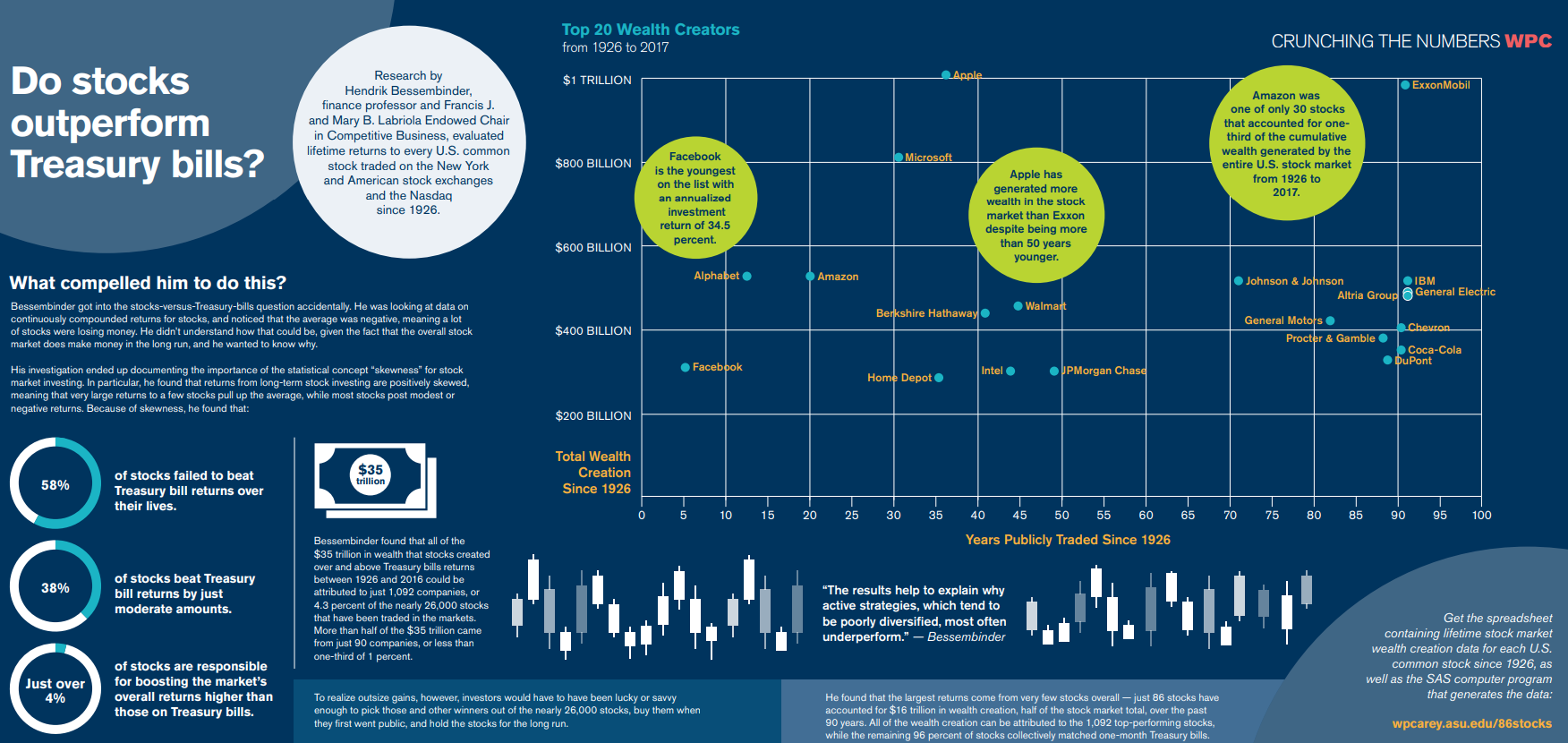

Concentrated gains in the stock market are nothing new.

Concentrated gains in the stock market are nothing new.

On today’s show, we discuss:

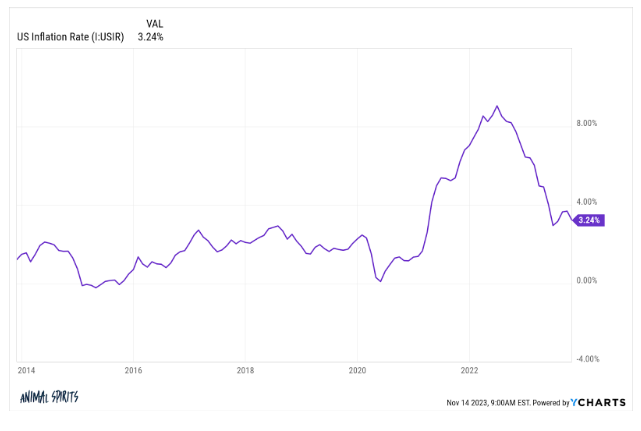

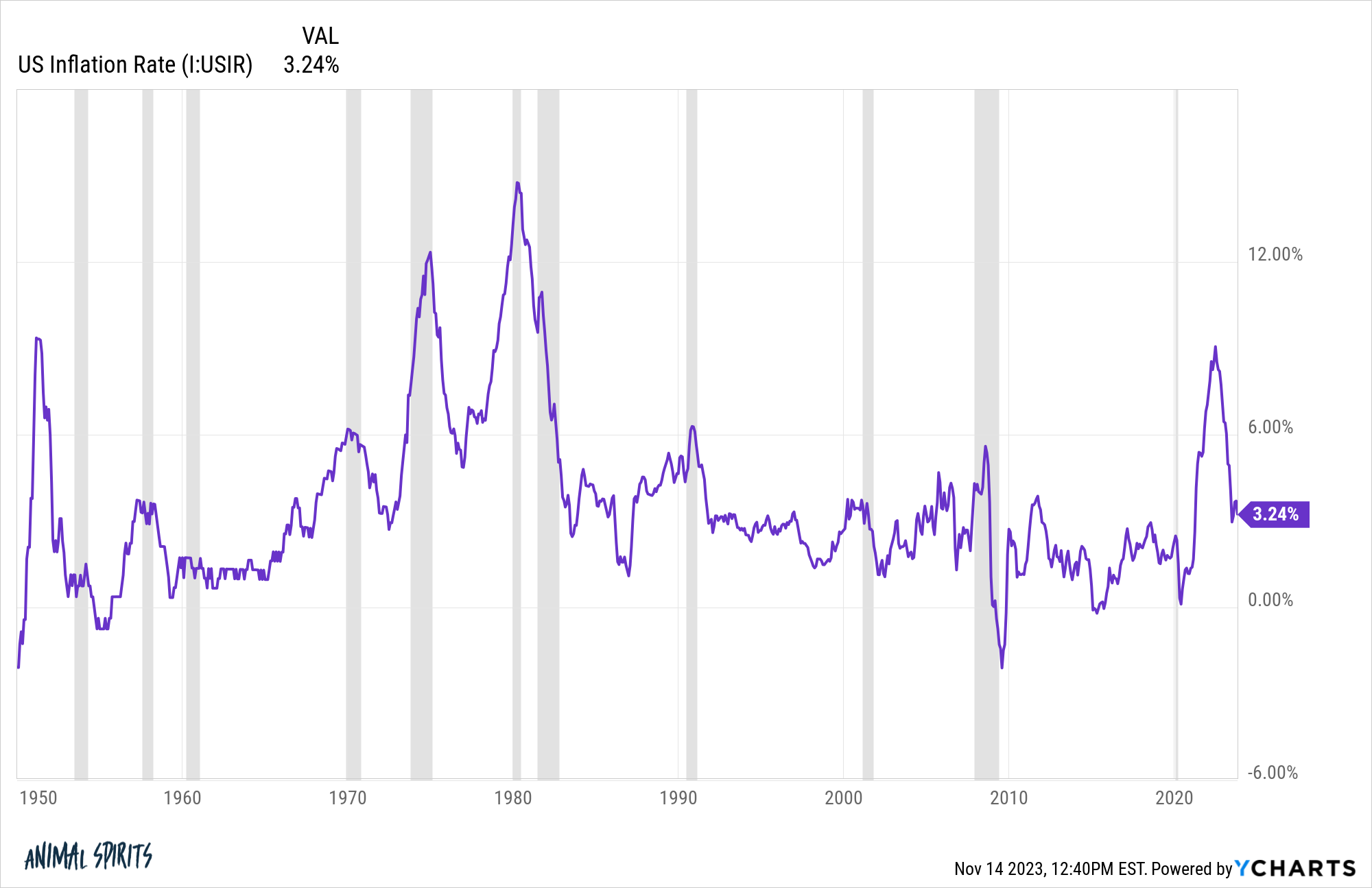

– The Feds victory over inflation

– What Americans get wrong about inflation

– The price of iPhones is actually going down

– When we get the first Fed rate cut

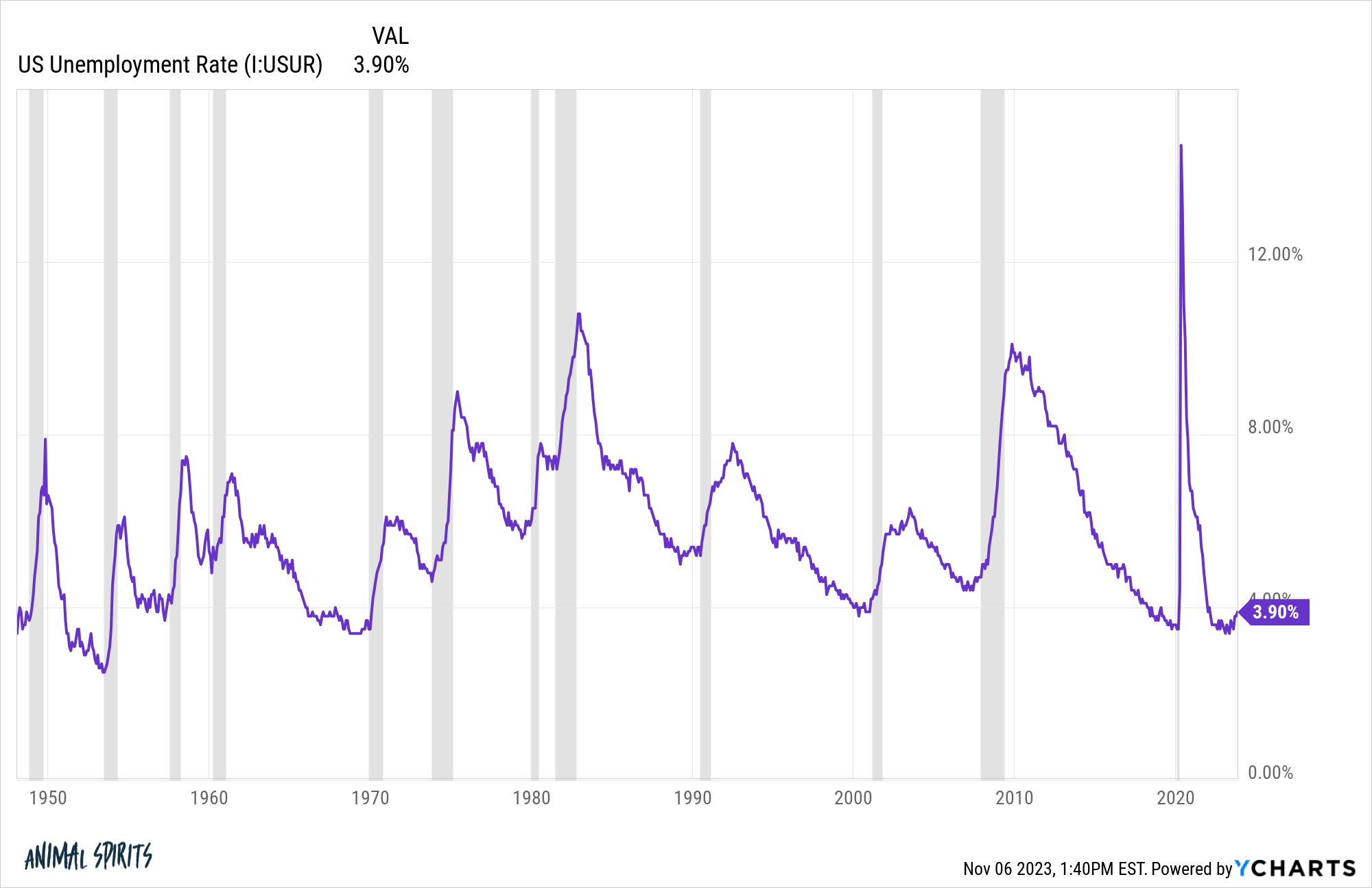

– The rising unemployment rate

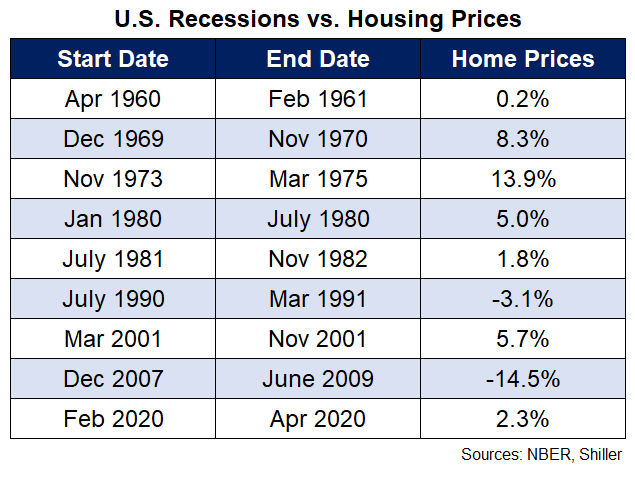

– Housing prices vs. recessions

– Netflix movies

– Vests are overrated, and much more!

Inflation is the lesser of two evils.

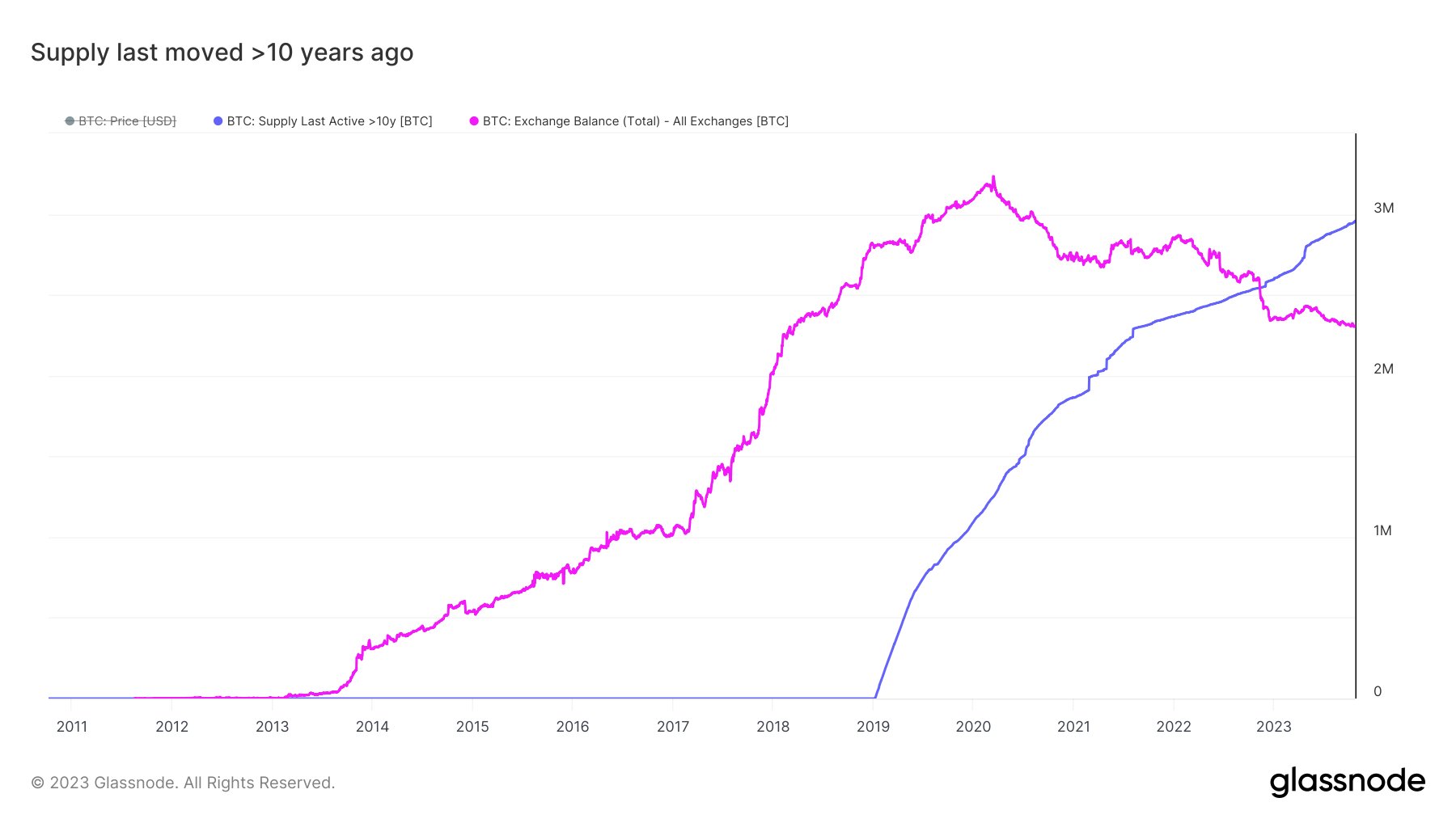

On today’s show, we are joined by Chris Kuiper, Director of Research at Fidelity Digital Assets to discuss:

– Fundamental reasons Bitcoin is outperforming in 2023

– Illiquid Bitcoin values and supply/demand affects on digital assets

– What Ethereum’s different layers represent, and much more!

A historical look at hosing prices vs. recessions.

Money market funds are one of the most important investment innovations of the past 50 years.

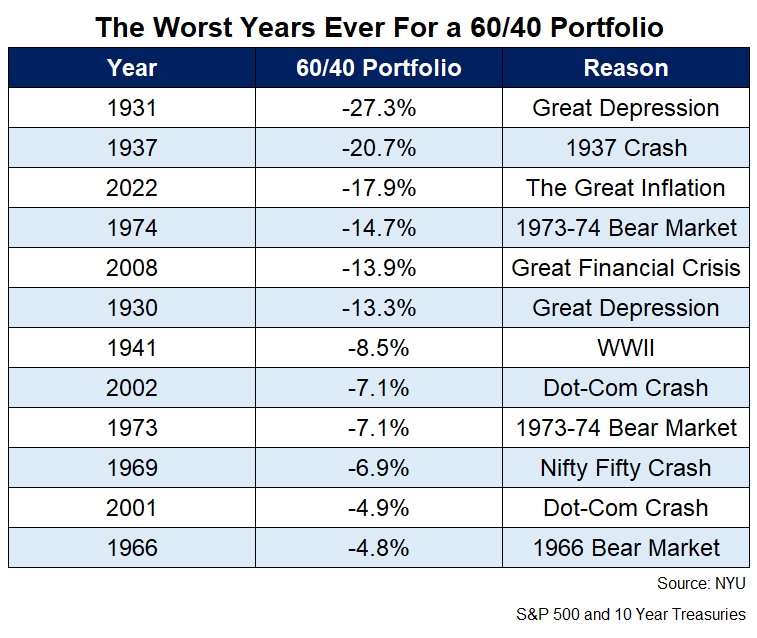

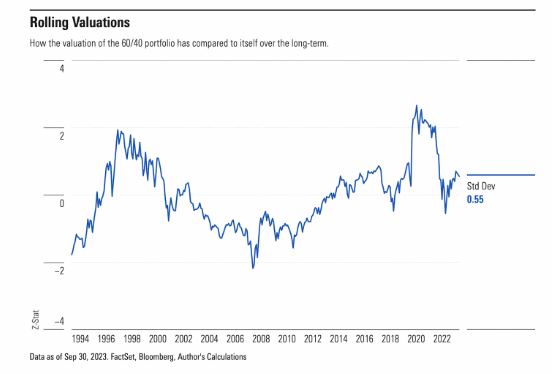

Why does the financial media hate the 60/40 portfolio so much?

On today’s show, we discuss:

– The cooling labor market

– Why the 60/40 portfolio looks more attractive now

– Why the Fed is in a tough spot

– Why everyone hates this economy

– How to become a millionaire

– Realtor commissions

– Reclining your seat on a plane, and much more!

Cognitive dissonance in the economic discourse.

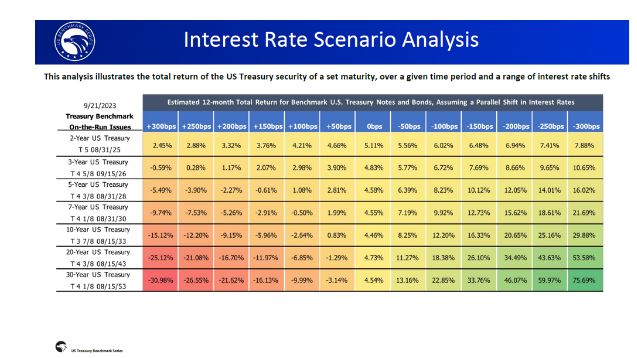

On today’s show, we are joined by Alex Morris, Co-Founder and CIO of the US Benchmark Series to discuss:

– Making bets on duration

– Risks on the short and long end of the treasury curve

– Finding asymmetries in the fixed income market, and much more!