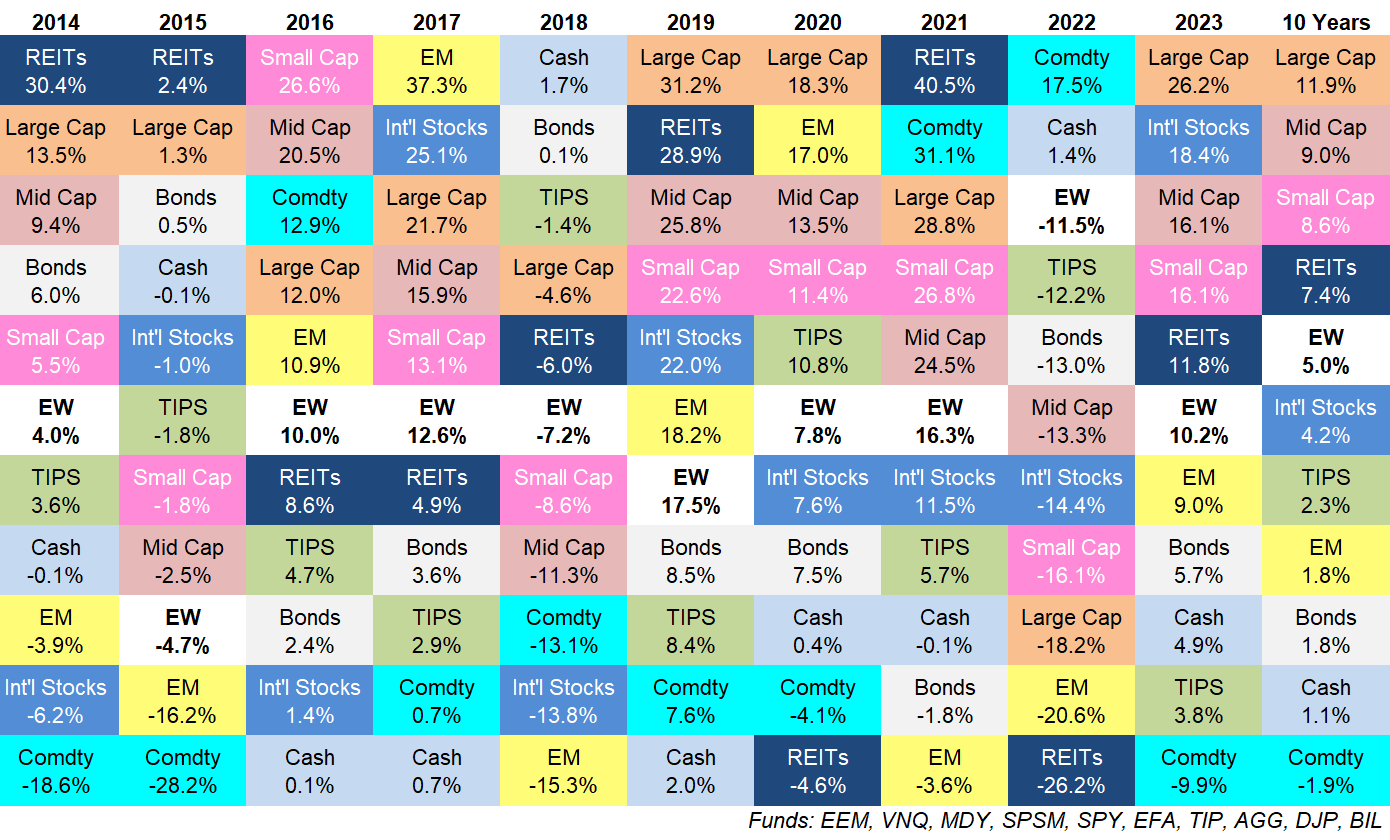

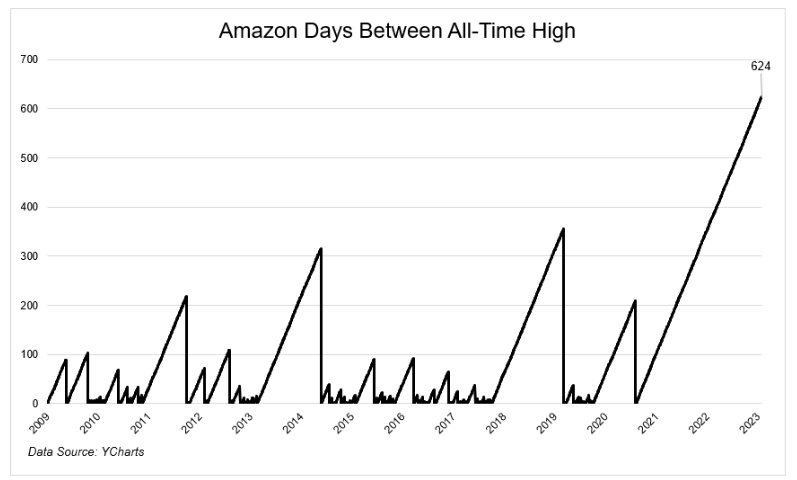

Asset class returns for 2023.

Asset class returns for 2023.

Why it’s easier to change your financial habits than your diet and exercise habits.

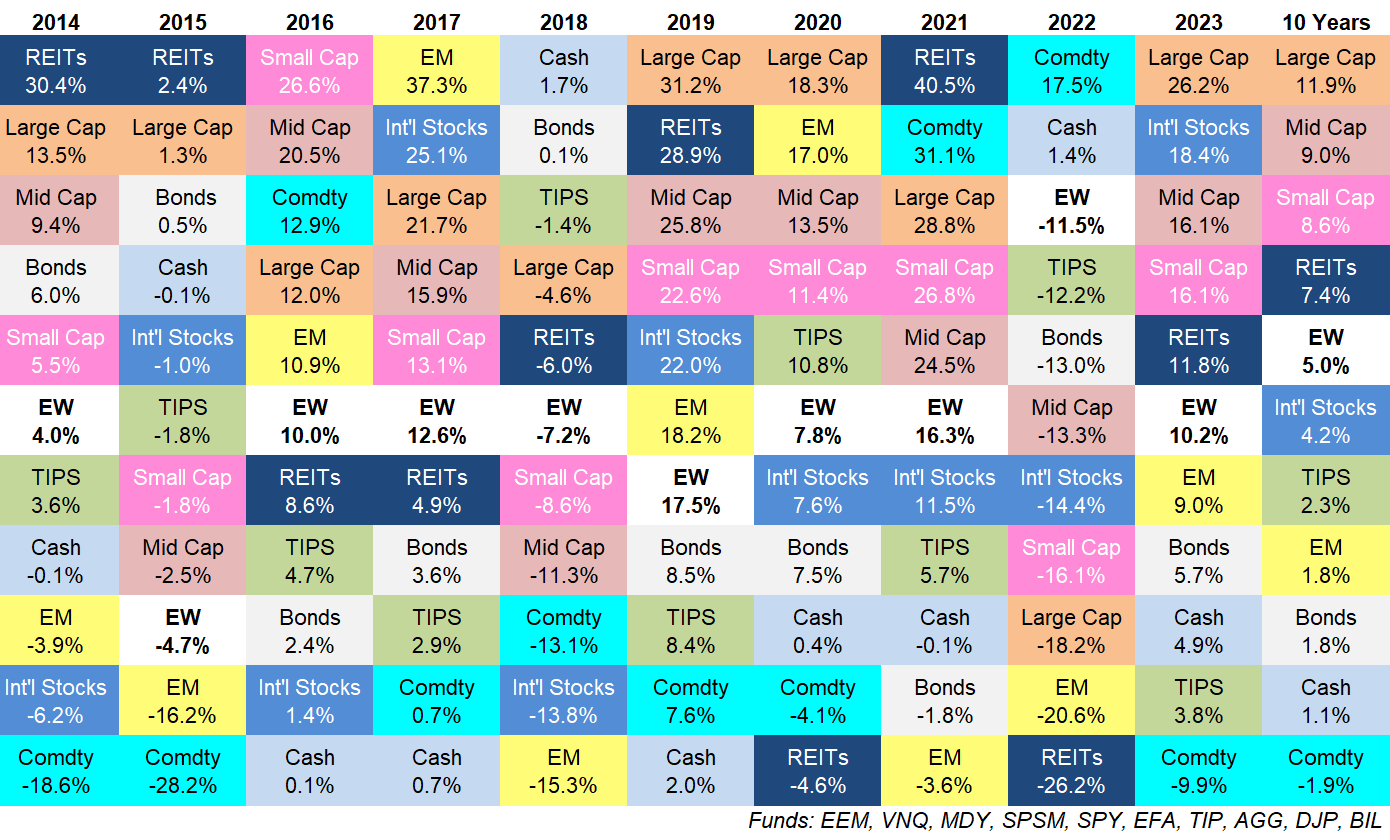

Some thoughts on the coast FIRE movement and how to think about retirement planning from a young age.

On today’s show, we discuss:

– 2023 market performance

– A bunch of 2024 predictions

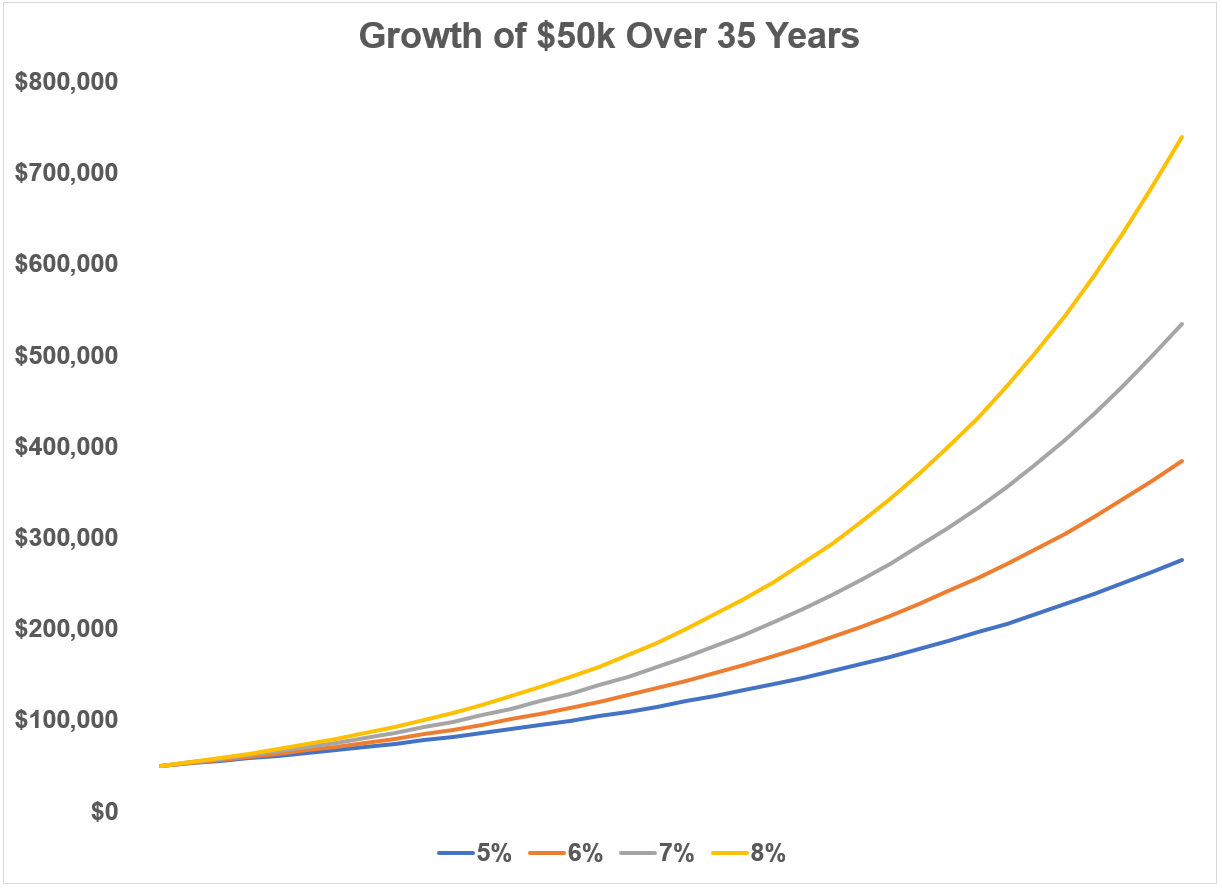

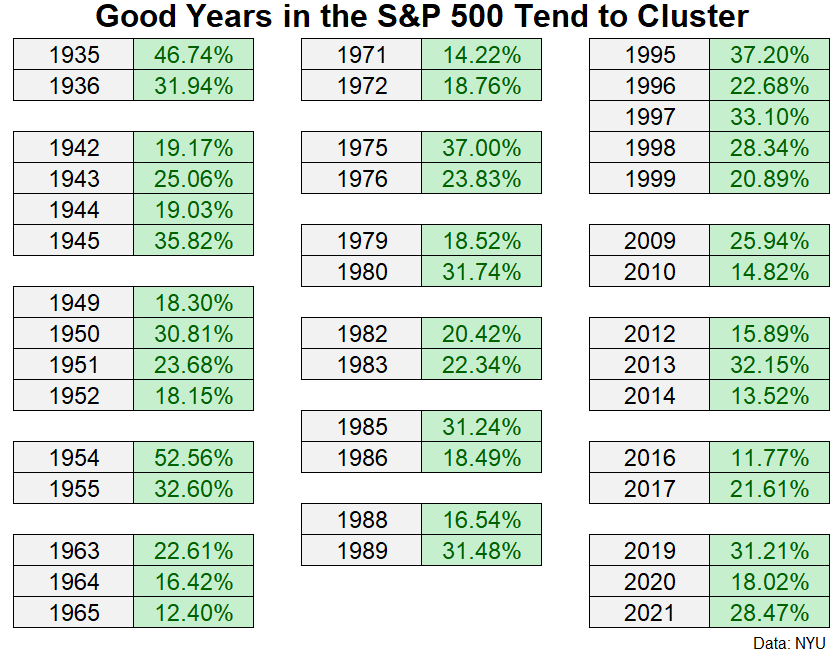

– Our favorite historical stock market return series

– The high quality of restaurants

– Paying off your mortgage early

– The downsides of behavioral finance

– Bens most cynical take of the year, and much more!

A historical look at what happens after a 20%+ gain in the stock market the next year.

A look back at 2023 returns for stocks and bonds.

Investing for 40-somethings.

10 questions I’m thinking about heading into a new year.

On today’s show, we discuss:

– Christmas arguments

– Green shoots in prices

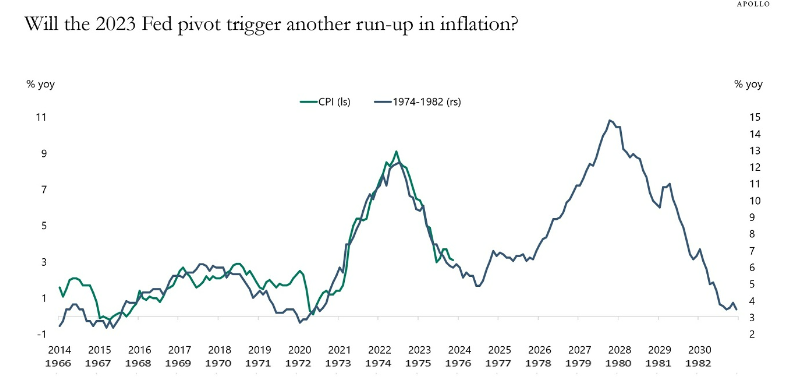

– 1940s vs. 1970s inflation

– Why we’re not worried about index funds

– How to save and invest in middle age

– Why Bitcoin is the most extreme asset

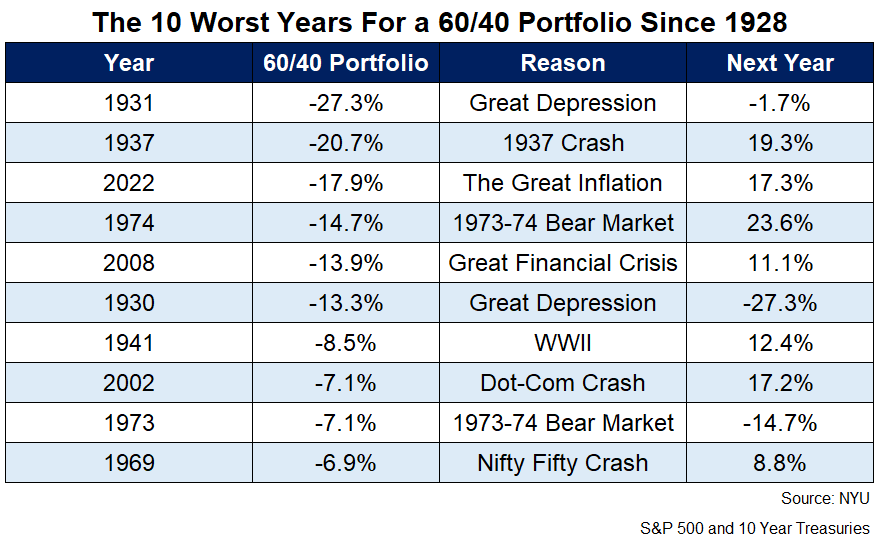

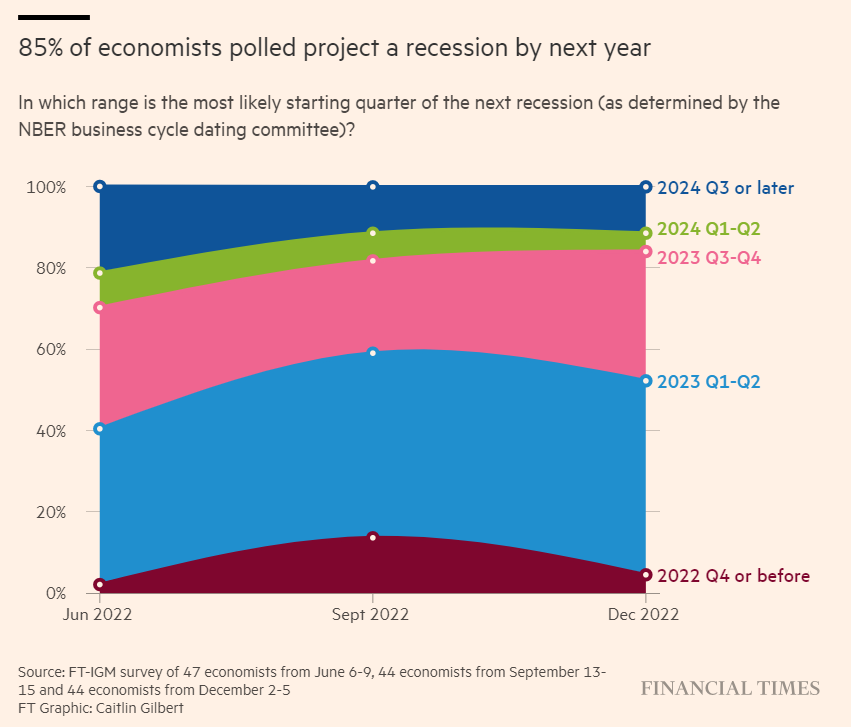

– Celebrating no recession in 2023

– Why the U.S. economy is more resilient

– Some Christmas movie recommendations, and much more!

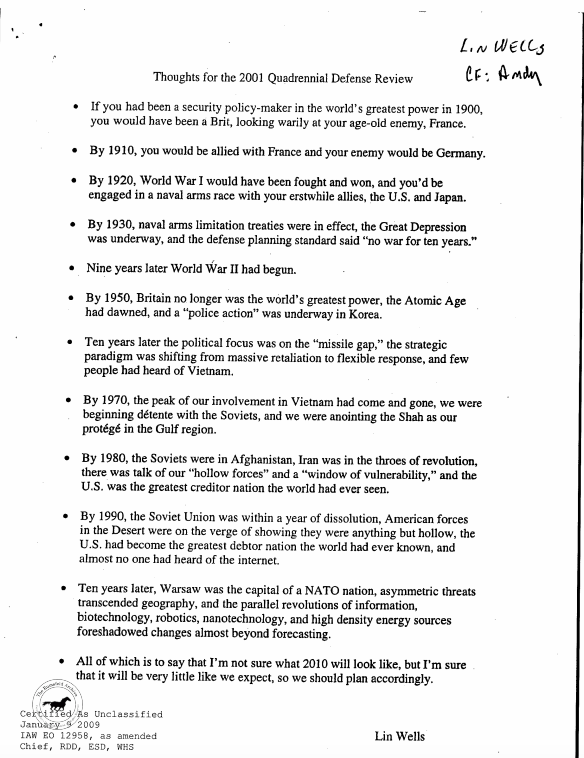

The good and bad of forecasting the future.