The pros and cons of overconfidence.

The pros and cons of overconfidence.

How do you build and preserve generational wealth?

On today’s show, we discuss:

– The people you see on every vacation

– The cure for the loneliness epidemic

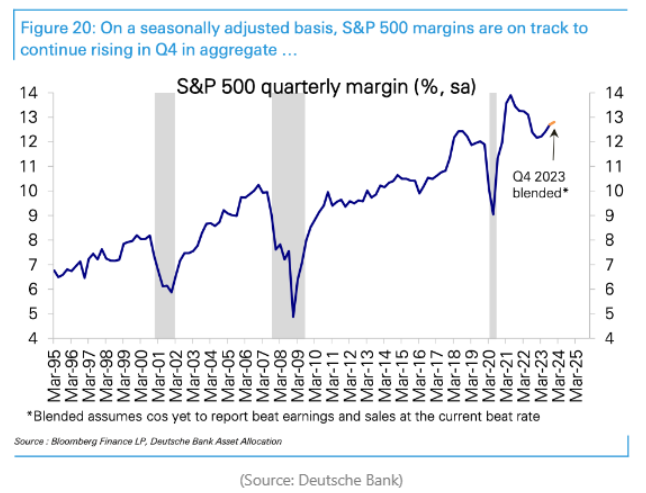

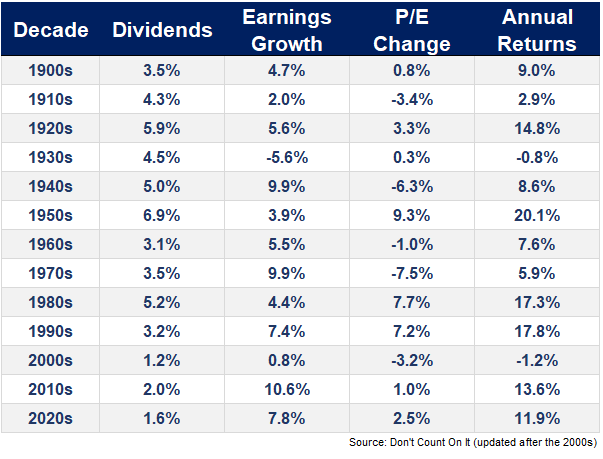

– The biggest driver of stock market returns

– The John Bogle expected returns formula

– The best returning stock might surprise you

– Bitcoin ETF flows

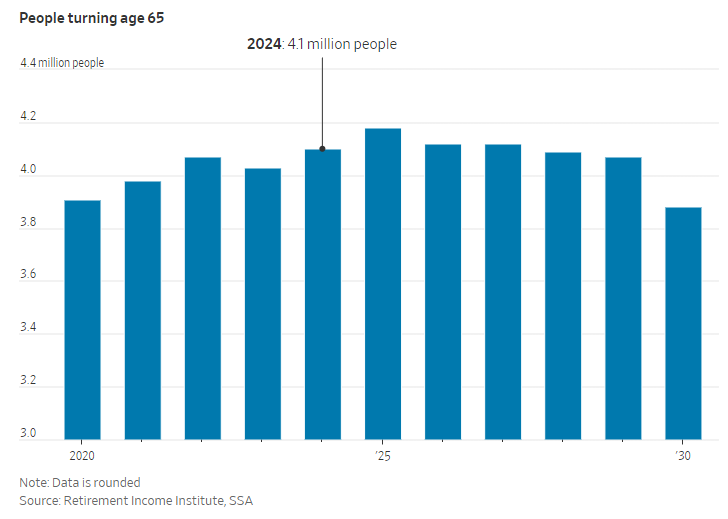

– Why there won’t be a baby boomer retirement crisis, and much more.

My solution to the lonliness epidemic.

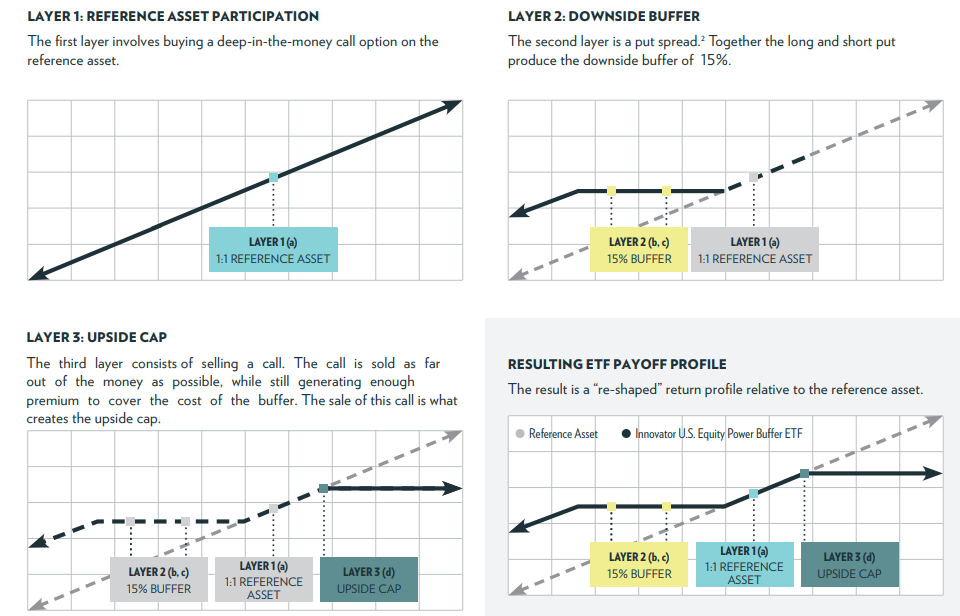

On today’s show, we are joined by Bruce Bond, Co-Founder and CEO of Innovator Capital Management to discuss:

– Behavioral finance, and the popularity of defined outcome products during bull markets

– How equity floor ETFs work

– Innovators latest defined income ETF solutions, and much more!

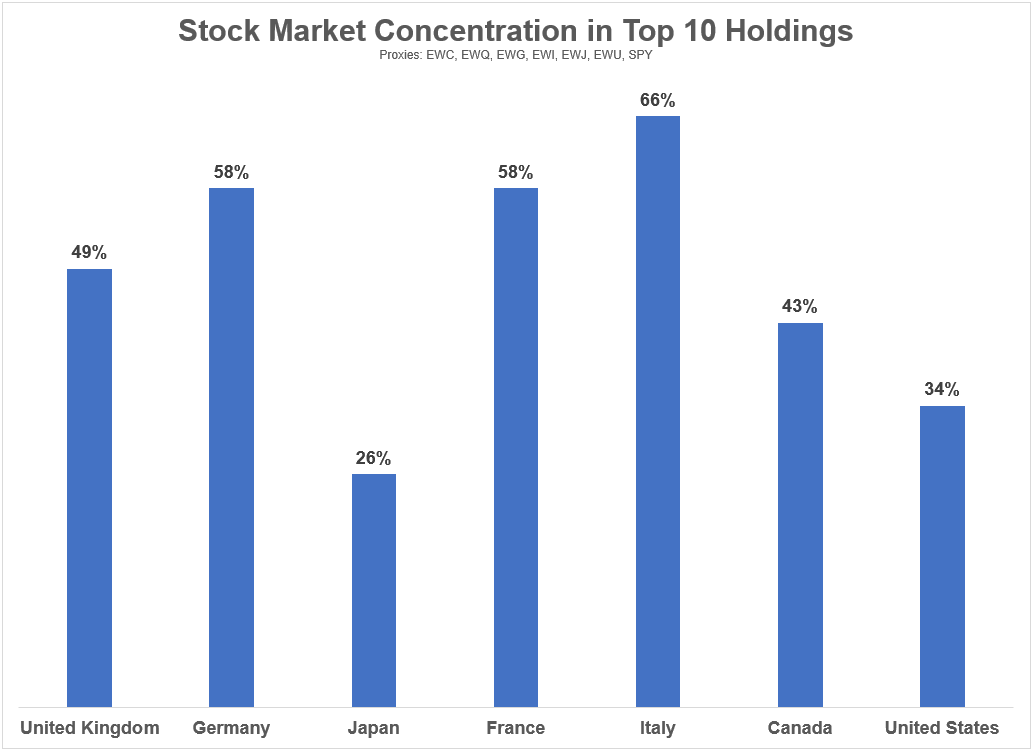

No the stock market isn’t being manipulated.

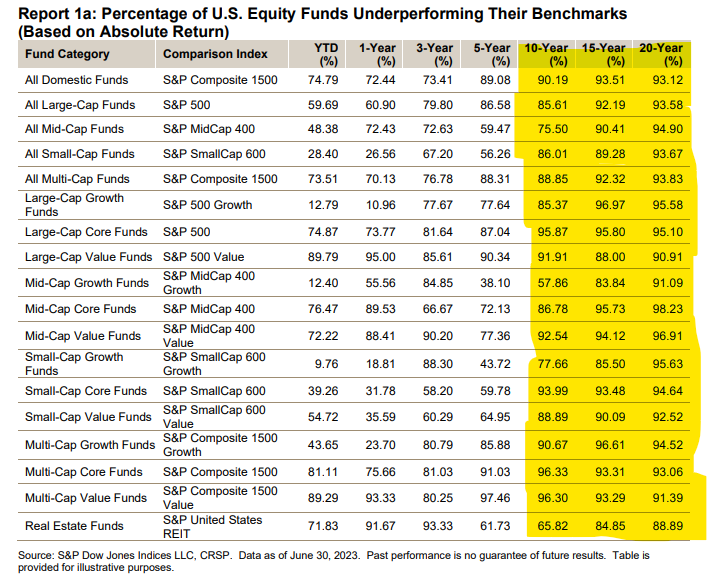

Portfolio management with individual stocks is harder.

Why I’m bullish on the financial advice business in the years ahead.

On today’s show, we discuss:

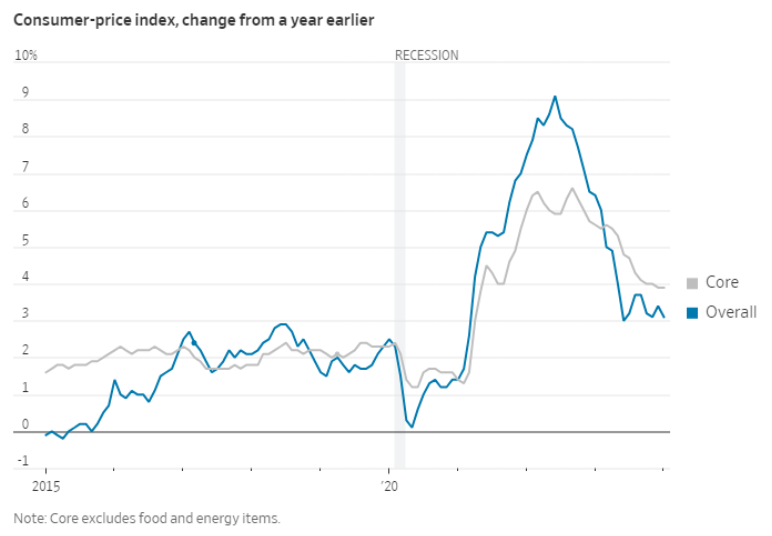

– Why McDonalds is getting more expensive

– The prospects for another bear market this year

– Fundamentals that drive stock returns

– Concentration in the S&P 500

– Nvidia vs. China

– Tail risk strategies

– Consumer credit

– Commercial real estate

– Youth sports, and more!

Why I’m not all that worried about stock market concentration.