A reader asks:

Josh is right that I’m inclined to trust my money with someone that I like, which I’m sure was the thought behind all the content you put out. My question is – when do I know it’s time to make that call? I have a goal number in mind which I am tracking towards nicely. But I’d hate to be under/over-aggressive as I reach the point of approaching retirement. I am currently likely 14-16 years away from retirement. But when do I make the call for help? Five years away from retirement? One year? Six months?

This is a question millions of people will be asking themselves in the coming years.

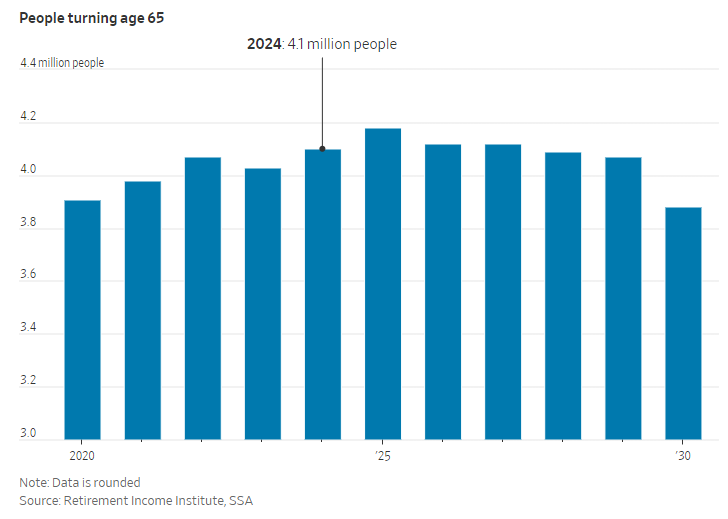

The Wall Street Journal notes there are more Americans turning 65 this year than at any point in history:

There are going to be 4+ million people reaching traditional retirement age every year for the rest of this decade.

The baby boomer generation controls more than $70 trillion of wealth. They are retiring in droves. We’ve never seen a wave of older people control this much money before.

This is one of the reasons I’m so bullish on the wealth management industry. Many of these new retirees will be seeking out financial advice in the years ahead.

Of course, not everyone needs an advisor.

I’ve spoken to hundreds (maybe thousands?) of DIY investors over the years who study this stuff themselves, have a plan, and follow that plan. Many of these people can handle it on their own.

That’s fine.

But there are plenty of people who cannot or do not want to.

Here are the biggest reasons you should hire a financial advisor:

You have a big life event. For many people it’s retirement but it could be a death in the family, marriage, kids, inheritance, the sale of a business, stock options, etc.

Sometimes life forces your hand and you need to seek outside counsel.

Your financial situation is getting more complex. As you grow your wealth the stakes tend to get higher because you have more to lose.

People seek out financial experts when their financial circumstances become more complex to deal with.

You don’t have the time or inclination. There are plenty of people who simply don’t have the bandwidth in their life to manage their finances effectively.

So they outsource.

This stuff can be hard if you don’t know what you’re doing or have other stuff going on in your life that requires your full attention.

Many people have better things to spend their time on than thinking about their portfolio or financial plan all the time.

You can also let someone else stress about your money so you don’t have to.

You’re worried about key person risk. I’ve talked to plenty of prospects over the years who are perfectly comfortable and capable of managing their own money.

But often times they’ve got a monopoly over the family finances. They know the various accounts where the money is stored. They have all the passwords. They manage the portfolio. They handle the taxes.

And their spouse is out of the loop.

I understand how this happens. Lots of relationships divide and conquer.

What happens to your family if something happens to you? What if you have a health scare or get hit by a bus?

Having a team that can support your family is a form of insurance for your dependents.

You’ve made a big mistake. I know a solo practitioner who runs his own RIA and regularly turns down business. He tells prospects: You aren’t ready to be my client yet. Come back to me in a few years after you’ve made some mistakes.

He only wants to work with clients he deems ready to buy into his form of wealth management.

Some people only come to the realization they need help after they’ve made a crippling error with their money.

You’re faced with a big financial decision. Big financial decisions are rarely black or white but rather a shade of grey. You can go down the rabbit hole of trade-offs and become paralyzed with fear you’ll make the wrong choice.

The best financial advisors don’t just tell you what to do; they give you a better decision-making framework to make good choices over and over again.

Some people seek financial advice to help make more informed decisions.

You need a financial plan or help defining your goals. The quantitative stuff is the easy part of the process. There are plenty of advisors who can walk you through the spreadsheets and Monte Carlo simulations.

It’s the qualitative aspects of financial planning that truly matter.

What are you going to do with your time?

What is your relationship with money?

What are your dreams and aspirations, and how can your financial plan help you fulfill them?

How can you use your money to fund contentment in life?

The timing of the advisor decision depends on how much your reasons for seeking advice are weighing on you.

The good news is there is no harm in having a handful of conversations with different advisors. You don’t have to sign a blood oath after your first meeting.

You can shop around a little to see how different advisors handle things like financial planning, portfolio management, tax planning, estate planning, insurance services, etc.

Trust is a key component in any service business and financial advice is no different in that respect.

You should certainly find someone you trust to manage your money but make sure it’s also someone who can help relieve whatever money stresses you have in life.

We covered this question on the latest edition of Ask the Compound:

Josh Brown joined me again this week to discuss questions about career advice for younger advisors, when it makes sense to hire a financial advisor for retirement, 401ks vs. brokerage accounts and how to deploy cash in the face of all-time highs in the stock market.

Further Reading:

How Rich Are the Baby Boomers?