I don’t know if this is my finance brain at work or just hitting middle age but anytime I travel now there invariably comes a point where I pull up home listings in the area on Zillow to get a sense of the local housing market.

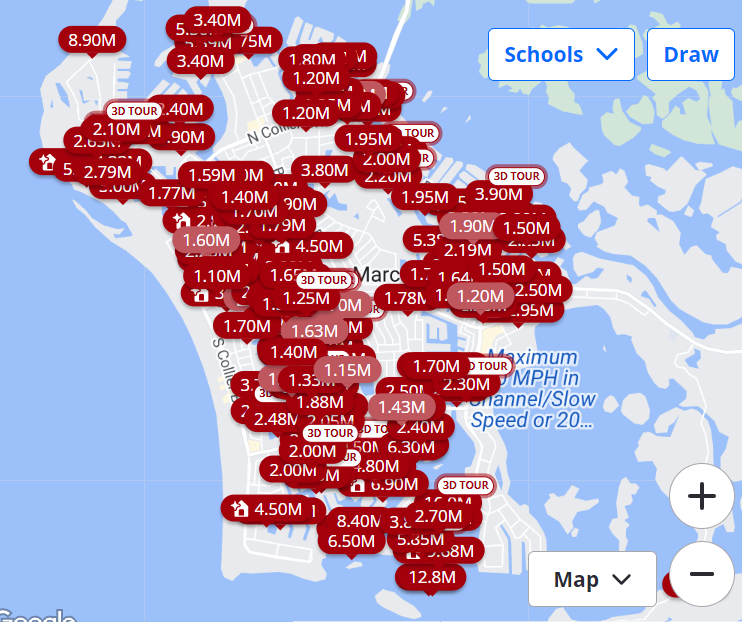

My family was in Marco Island, FL last week for spring break so of course I had to do some channel checks on housing prices in the area:

Two things stand out here:

(1) There are tons of listings in the area, especially when you consider how tight the housing supply is for the housing market at large in this country. That surprised me.

(2) Holy crap are the prices expensive. There are no price filters in this search. Basically, all of the listings on the island were 7-figures. Granted, Marco is a very nice area and the real estate market in Florida has been on fire but I was taken aback to see the average home is selling for somewhere in the $1.5 to $3 million range.

Since Florida is home to a lot of retirees and old people, the only logical conclusion I could form from this exercise is that baby boomers are LOADED.

The people selling the houses for millions are boomers sitting on huge gains while the people buying the houses (and tearing them down to build even bigger houses in many cases) are wealthy boomers who can afford multi-million homes.

Millennials are in their prime household formation years but it’s the boomers who are the ones in the catbird seat when it comes to the housing market right now.

Boomers have a homeownership rate of nearly 80% and many of them have their houses paid off.1 You don’t need to worry about 7% mortgage rates when your house is paid off and you can use that equity to fund your next purchase.

According to the National Association of Realtors, baby boomers were the largest share of homebuyers last year for the first time since 2012. They accounted for 39% of all home purchases (up from 29% the year before) while millennials bought 28% of houses last year (down from 43% the year before).

Owen Stoneking notes there were more homes purchased with all cash last year than by first-time homebuyers.

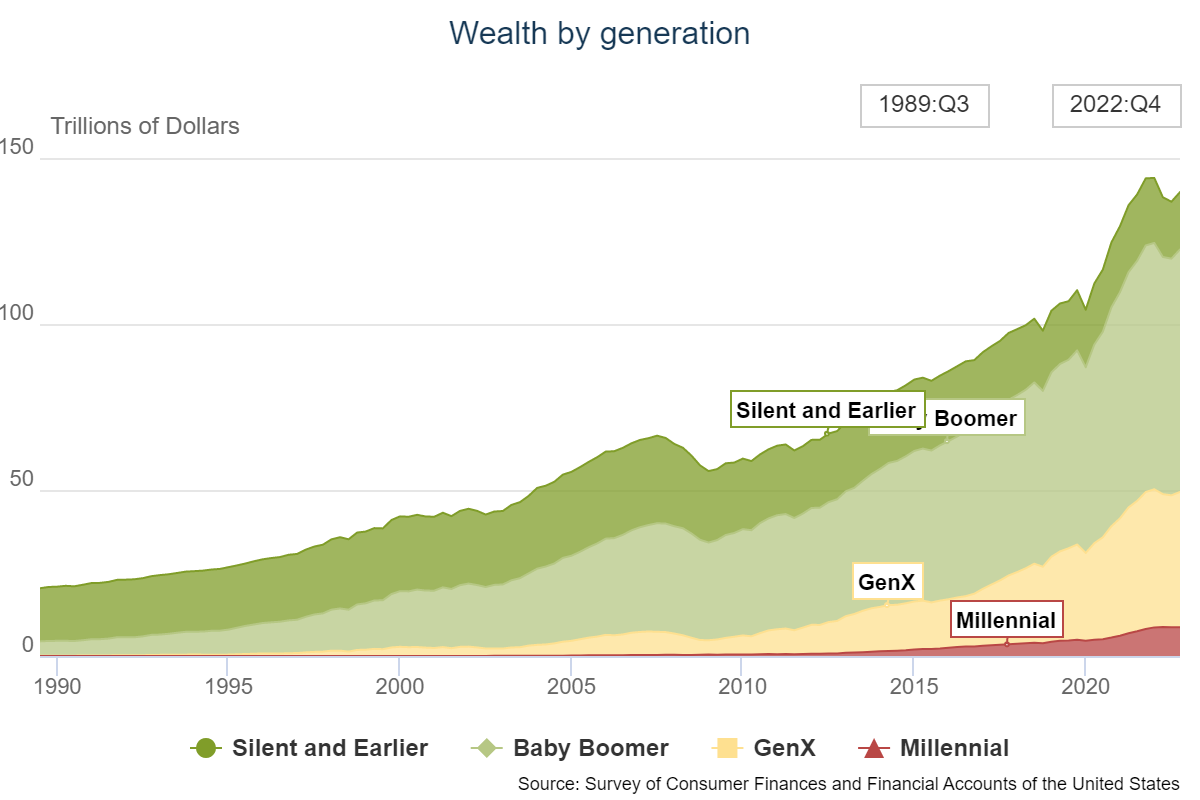

When you look at the generational wealth divide, boomers do hold the bulk of the net worth in the United States:

As of year-end 2022, that’s more than $73 trillion for boomers, with a little more than $40 trillion for Gen X and just $8 trillion for millennials.

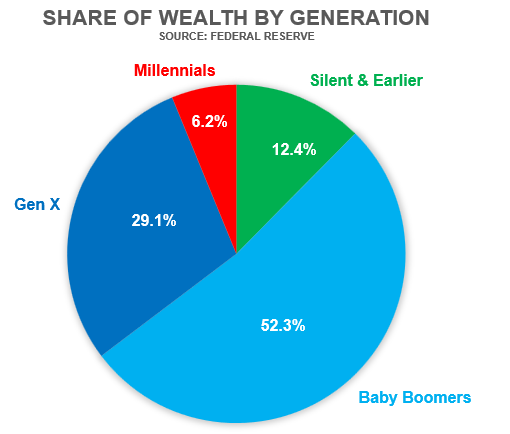

Here’s the breakdown by percentage share:

To be fair, millennials are doing just fine compared to previous generations at the same stage of their lives. And the forgotten generation (Gen X) is coming on strong.

However, there is no precedent for the boomer generation. We’ve simply never had a demographic this big with this much wealth live this long before.

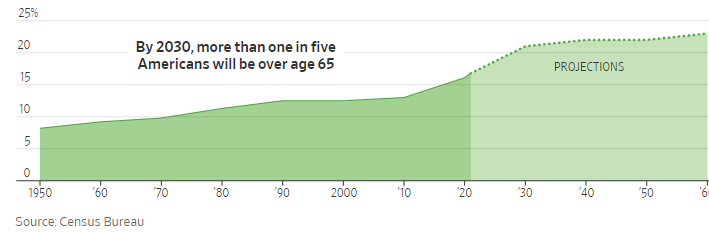

Just look at this chart from The Wall Street Journal that shows the number of people aged 65 or older (with projections out into the future):

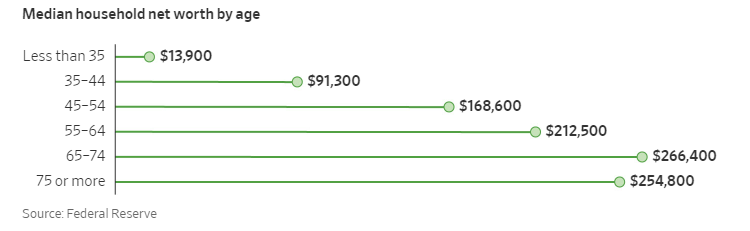

But things don’t line up very neatly with my boomers-are-all-rich take when you breakdown the median net worth numbers by age group:

The averages are fairly low because the wealth is not evenly distributed.

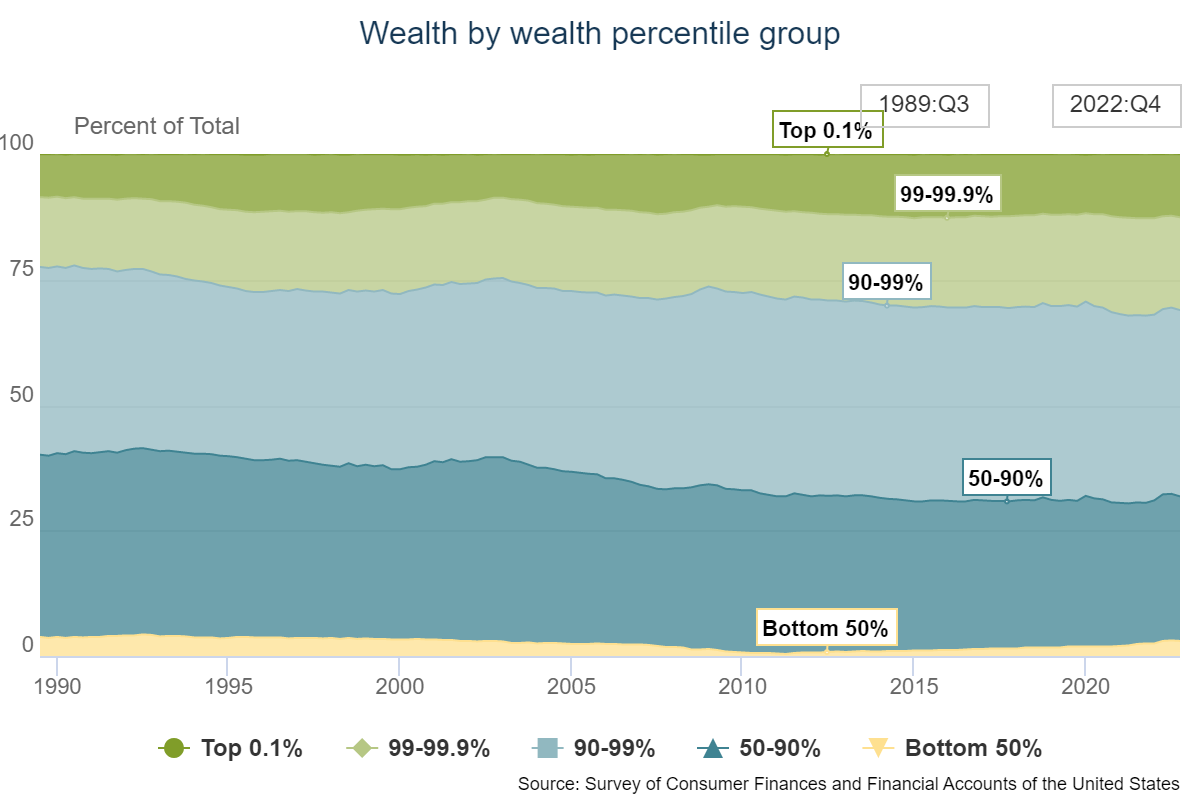

Much of that boomer wealth sits at the top of the wealth pyramid

The top 1% holds nearly one-third of the wealth in this country while the top 10% controls two-thirds of the wealth. The bottom 90% has around one-third of the wealth in the United States.

So the concentration of homes on a beautiful island in Florida is not a story about generational wealth discrepancies. It’s a story about the concentration of wealth in this country.

Sure many boomers are rich but most of that money is controlled by a small percentage of that demographic.

Unfortunately, I think the concentration of wealth is a feature not a bug in the system in which we operate.

I wish I had a better conclusion than that but I don’t really have a good answer here.

Further Reading:

How the Housing Market Has Changed America

1The homeownership rate for millennials is more in the 40-50% range.