There are basically three ways to become uber-wealthy:

1. Your family is rich.

2. You get lucky.

3. You take big risks and work really hard.

For a lot of people it tends to be some combination of numbers 2 and 3.

The majority of the uber-wealthy class in this country who didn’t get their money handed down to them created it by starting a business (or becoming an equity owner in a business). And starting a business is a risky proposition.

You need funding. You need an actual business plan. You need to hire. You need customers. You need health insurance. And you still need to get lucky.

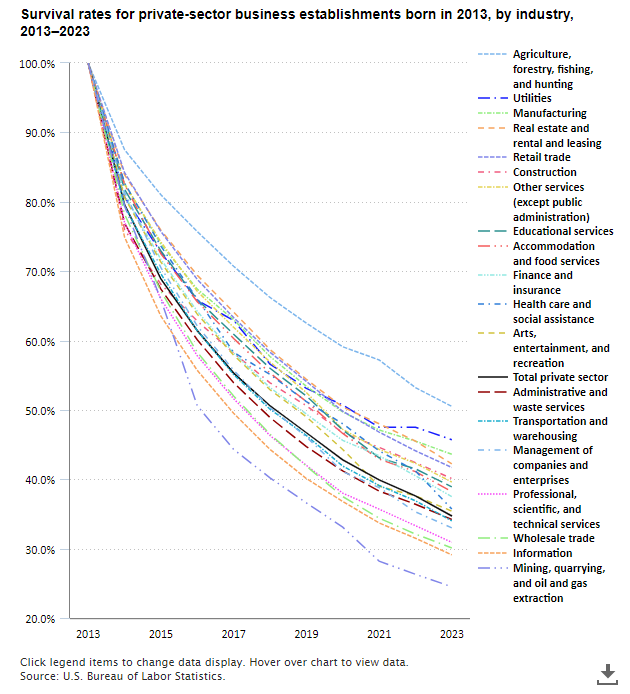

The BLS looked at all businesses started in 2013 and found that just one-third survived through 2023.

That means two-thirds of all businesses failed. Nearly half of all new business ventures fail in the first five years. The failure rate over the long-term is even worse than that.

And that doesn’t mean those surviving businesses are rolling in the dough. It just means they didn’t go out of business.

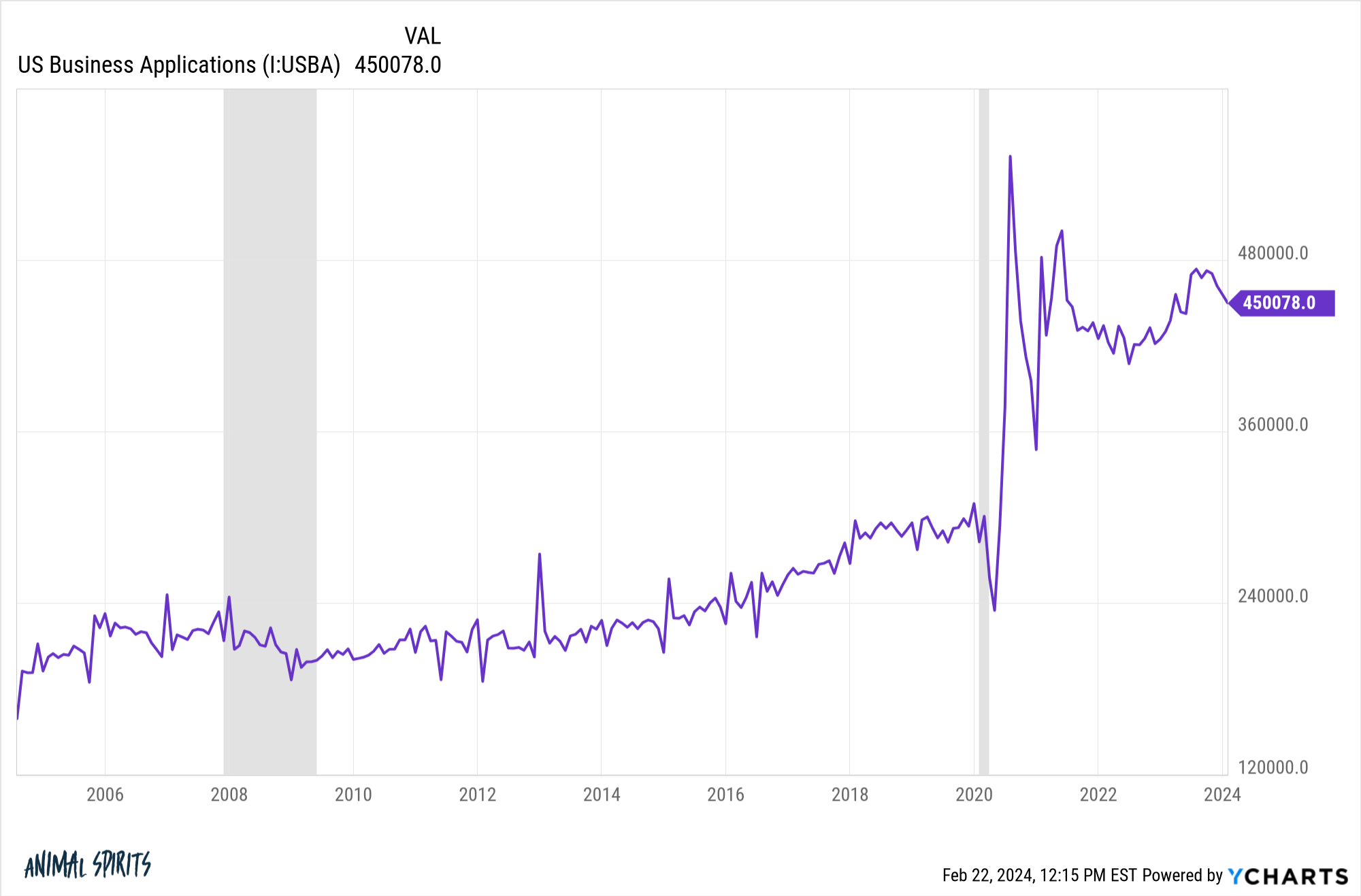

Despite the inherent risks involved, entrepreneurship in this country has exploded in recent years. Look at the massive uptick in business formation since the pandemic:

More than 5 million business applications were filed in 2022. In 2023 it was close to 5.5 million. That’s 2 million more than in 2019.

One of the best and worst things about our country is the irrational confidence we have in our abilities. There shouldn’t be so many people starting small businesses with failure rates so high. And yet…

I know why this is the case. It’s exciting to start your own business venture and be your own boss and it’s lucrative if you succeed. Equity ownership is how the majority of wealth has been created in this country.

Most of the people who have created obscene amounts of wealth through business ownership were slightly delusional when they started their ventures. In fact, you could argue delusion is a prerequisite.

Say what you will about a regular job, but there is safety in a regular salary, workplace health plan and 401k. Entrepreneurship requires some combination of risk-taking, delusion and confidence in your abilities.

It’s interesting to see how that confidence can manifest after you become successful.

I was thinking about rich person overconfidence when I saw the story on the news about the houses in California that were teetering on the edge of a cliff after a mudslide:

I’m sure the view from these houses overlooking the Pacific are incredible. But what the hell were these people thinking building their houses on the edge of a cliff?! Does that look safe to you?!

You have earthquakes, erosion and mudslides to contend with. Did they not think this was a possibility? Why would you ever build your house in such a risky spot?

My only explanation is rich person overconfidence. Seeing rewards from risk-taking endeavors can lead to further risk-taking. If you have enough money to build a $15 million mansion, you’ve probably taken some risks in your day. What’s one more?

There have been a lot of stories lately about the home insurance crisis in Florida. Hurricanes are becoming more severe each year and there are more houses on the coasts than ever before so insurance premiums are skyrocketing in the Sunshine State:

According to the Insurance Information Institute, homeowner’s insurance has increased 102% in the last three years in Florida and costs three times more than the national average.

The average cost of home insurance in the Sunshine State in 2023 was about $6,000, the highest average premium in the U.S.

Insurance is so high some residents are choosing to forego property insurance altogether.

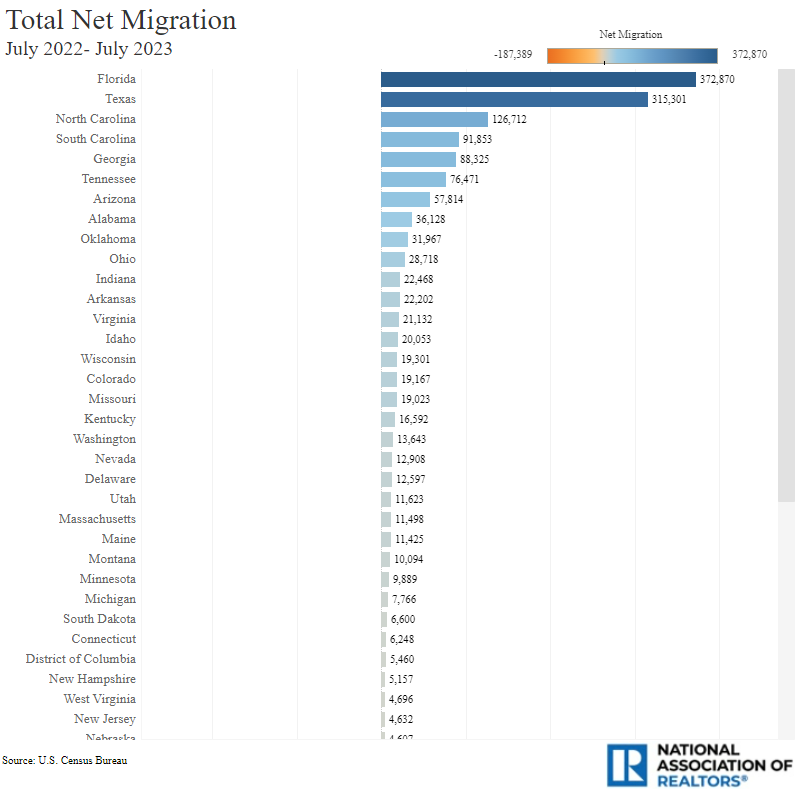

But these higher costs haven’t deterred homebuyers. In fact, Florida has seen the highest levels of migration of any state in recent years (via NAR):

The threat of hurricanes and rapidly increasing home insurances hasn’t dinged the housing market in Florida either.

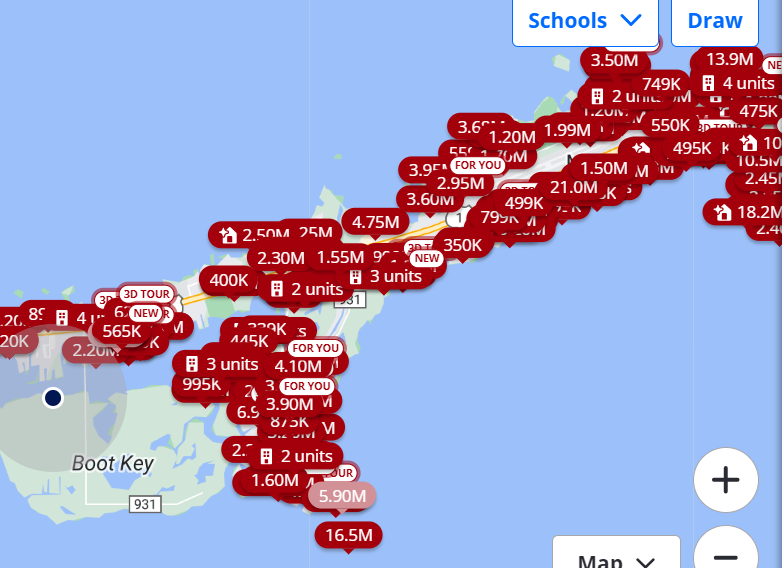

On my trip the Keys last week I pulled up home prices in the area on Zillow because that’s what you do when you’re a middle-aged finance guy. Multi-million dollar homes as far as the eye can see:

Maybe all the rich baby boomers just don’t care since they have a finite time to enjoy the sun in retirement.

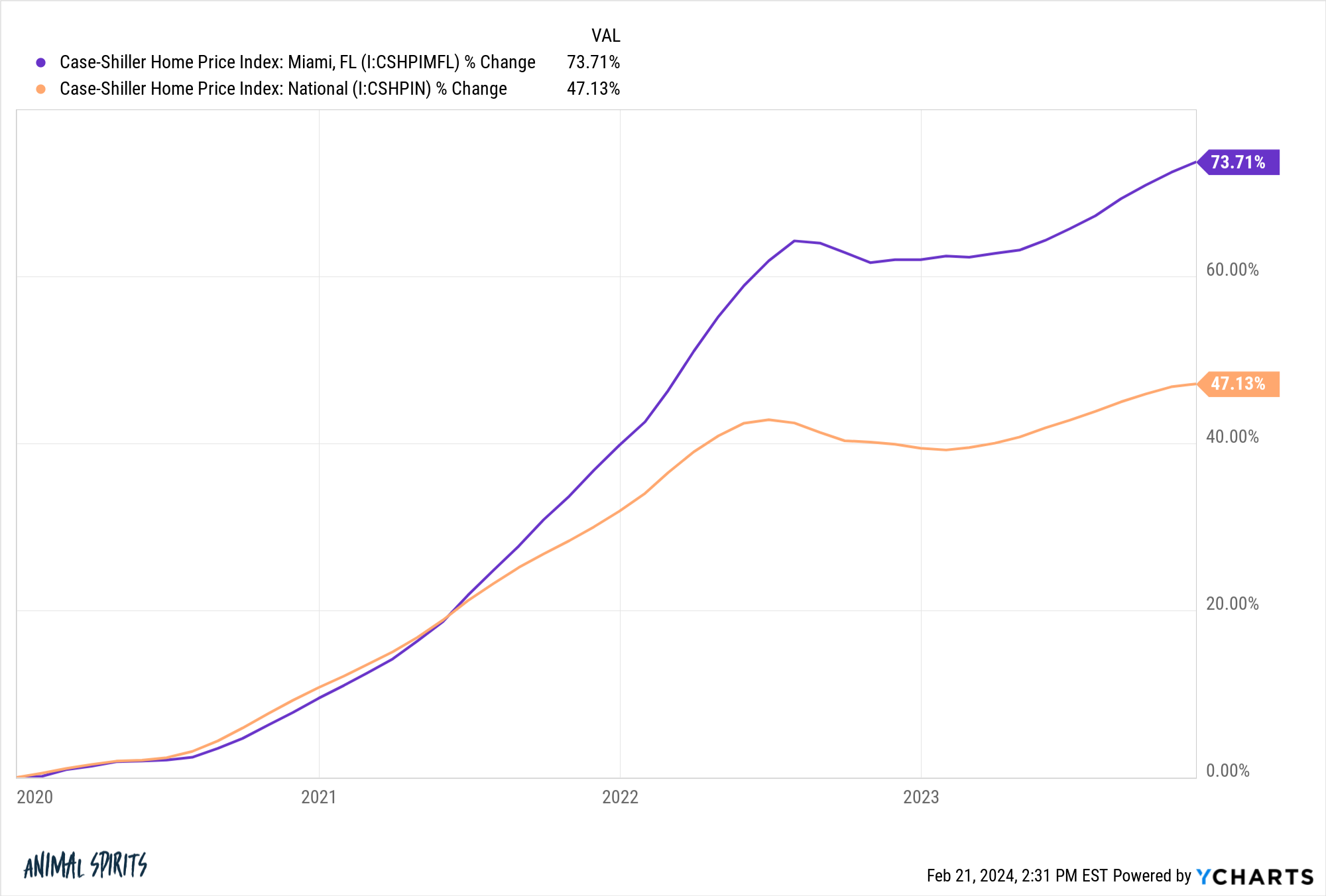

Look at prices in Miami versus the rest of the country since the start of the pandemic:

As someone who lives through the cold winters in Michigan, I understand the desire to take on the risk of living in Florida.

I’m not even saying it’s right or wrong, just interesting when viewed through the lens of risk.

The big stuff in life boils down to trade-offs and risk management.

Sometimes the payoff is worth the risk. And sometimes the risk wins.

Michael and I talked rich person overconfidence and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

- Stocks vs. earnings (Albert Bridge Capital)

- Millionaires don’t do astrology, billionaires do (Of Dollars & Data)

- The new era of market commentary (Downtown Josh Brown)

- Retired oilman offers advice for financial success (Chron)

- 37 pieces of helpful career advice (Ryan Holiday)

- How much does the national debt matter? (All That Matters)

- Why don’t we trust each other anymore? (Kyla’s Newsletter)

Now here’s what I’ve been reading lately: