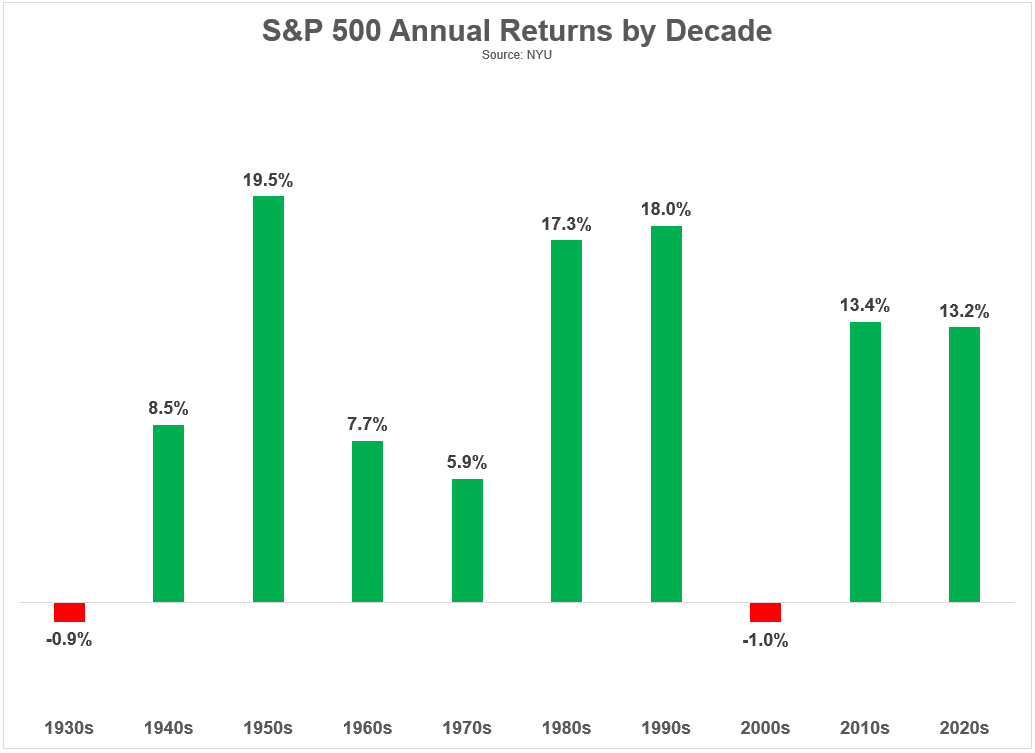

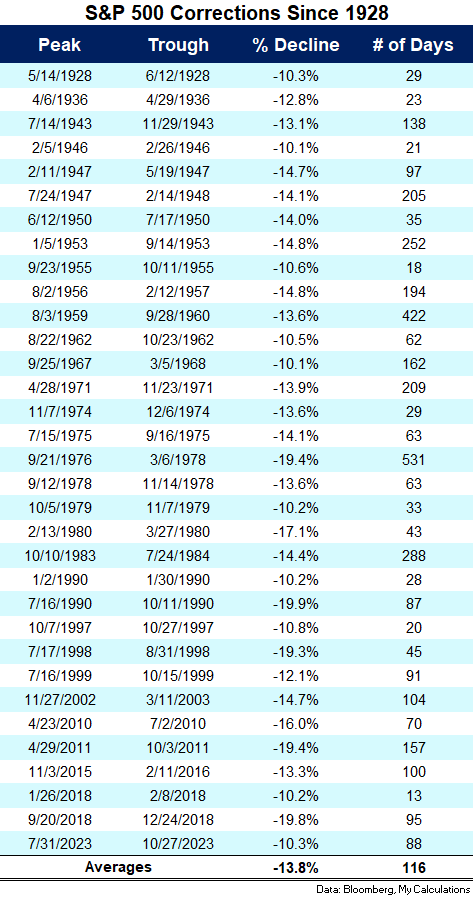

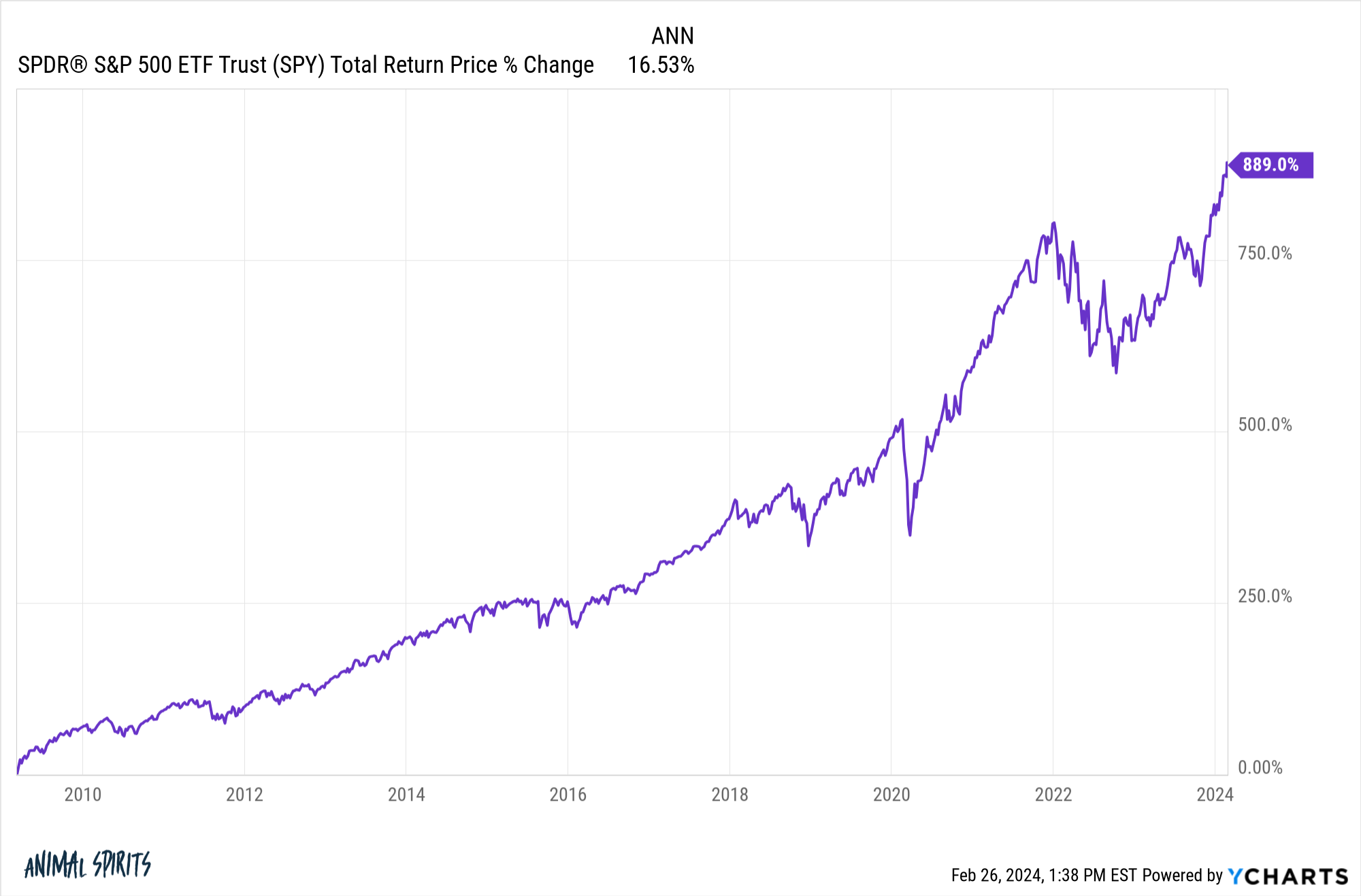

Some thoughts about being a long-term buy & hold investor.

Some thoughts about being a long-term buy & hold investor.

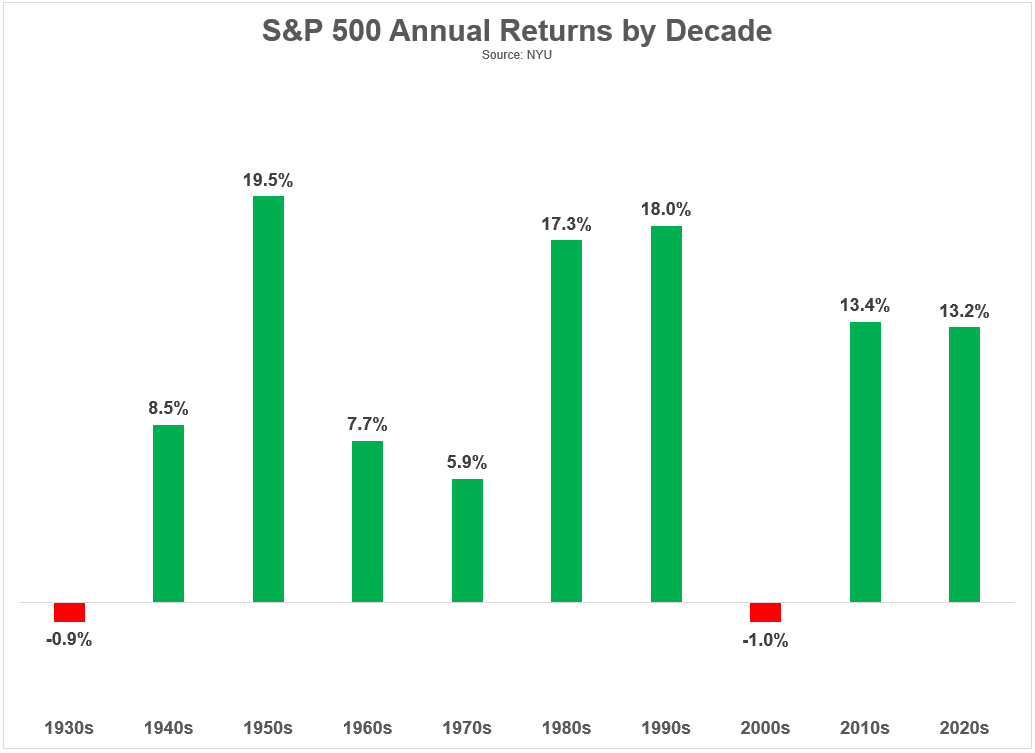

On today’s show, we are joined by Jacob Miller, Co-Founder of Opto Investments to discuss:

– How difficult it is for RIAs to get private market exposure

– The growth of private credit, and why that may be an issue

– Opto’s screening process for private investments, and much more!

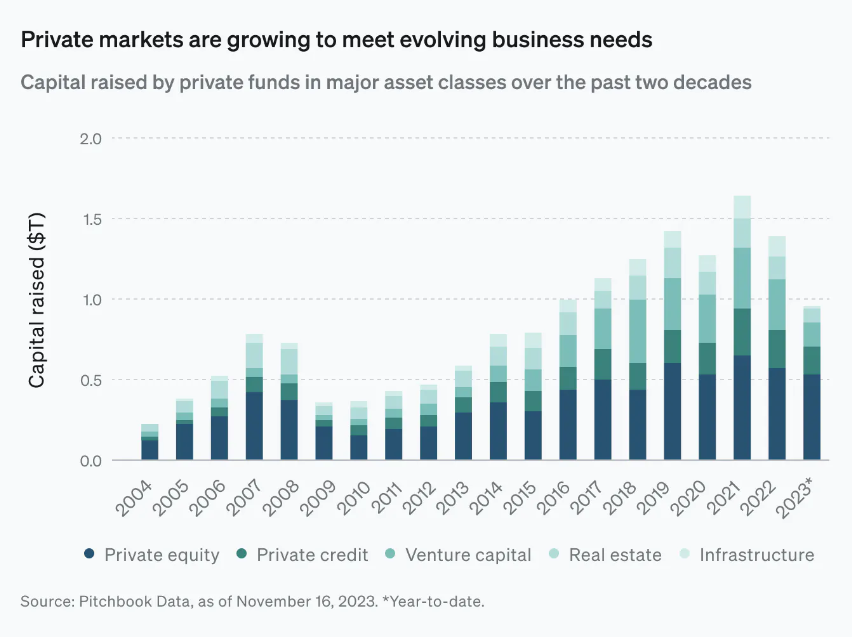

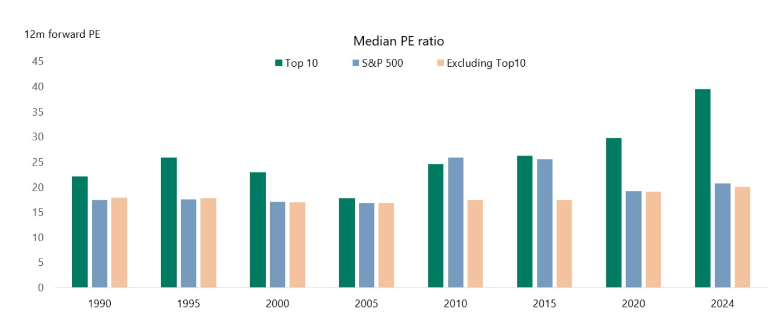

How often do we get a stock market correction?

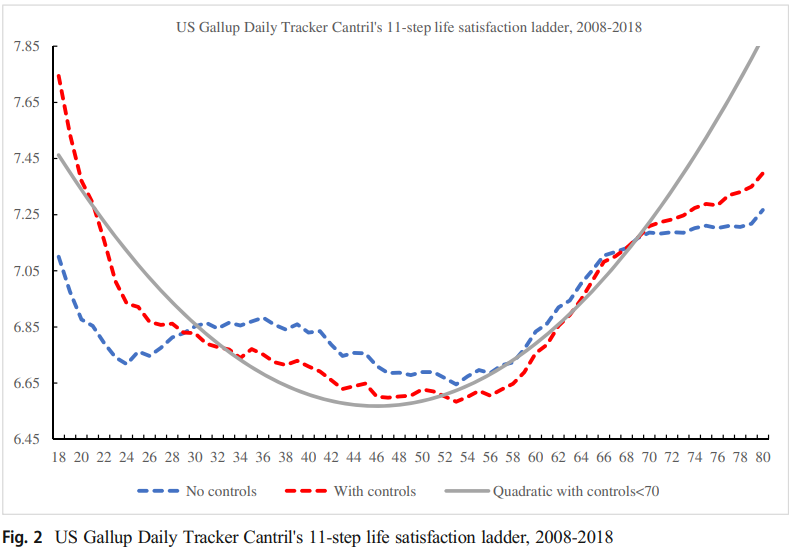

How can you avoid a mid-life crisis?

A list of risks to the financial markets along with the biggest one.

On today’s show, we discuss:

– Where to stay in the Florida Keys

– The Eli Manning podcast

– The market needs a healthy correction

– Japanese equities making a come back

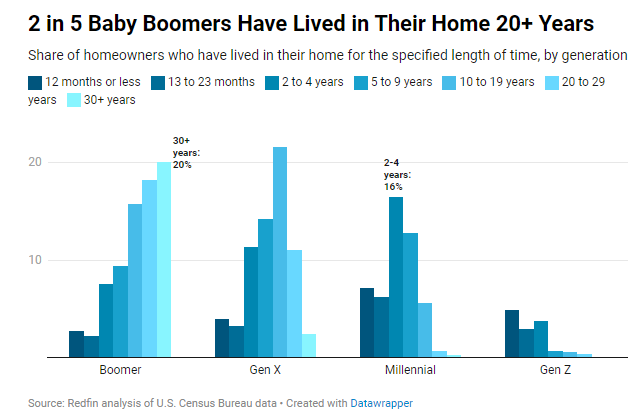

– Good news for homebuyers

– The new Costner trailer, and much more!

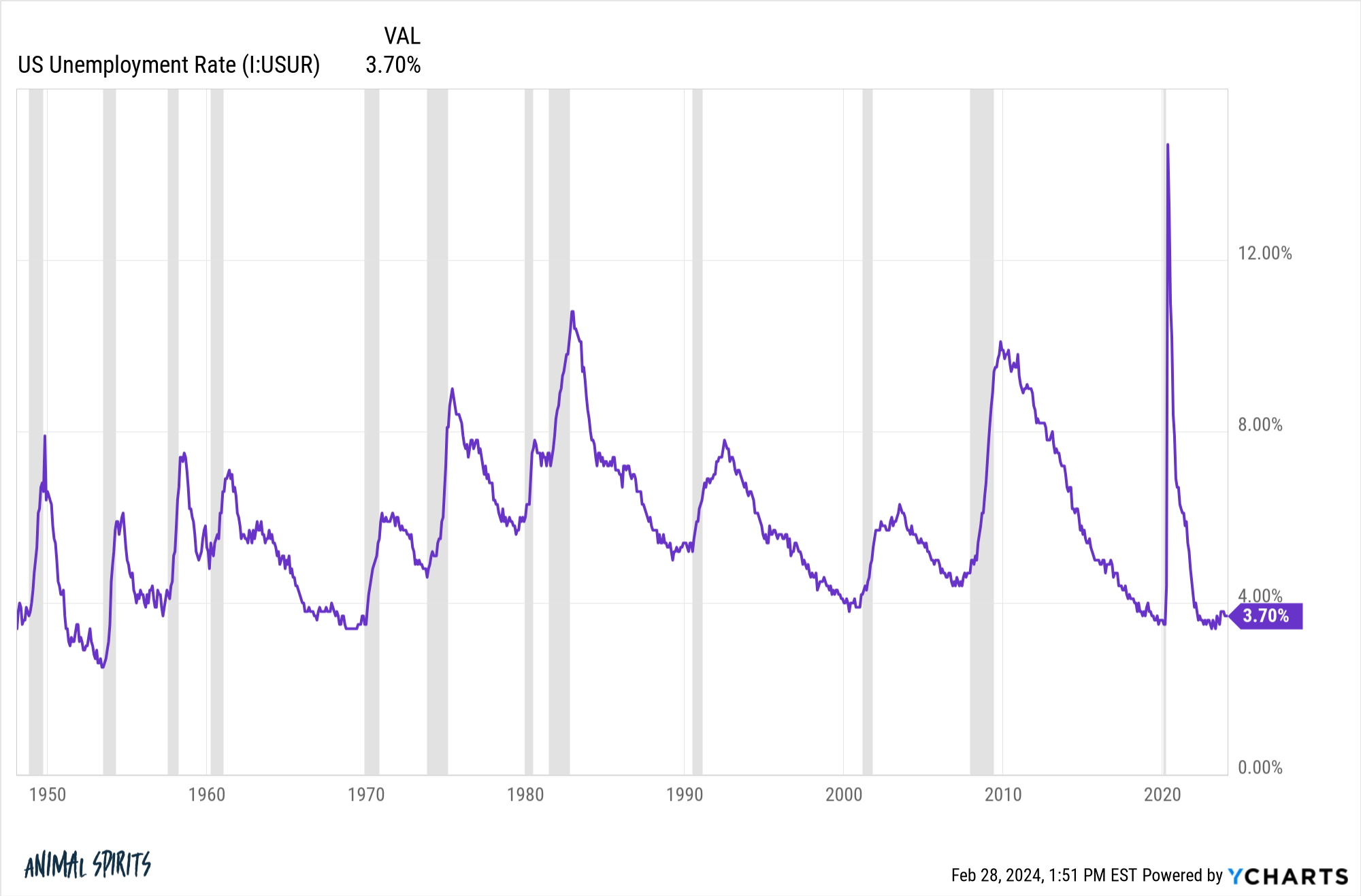

What if you would have invested at the peak right before the 2008 crisis?

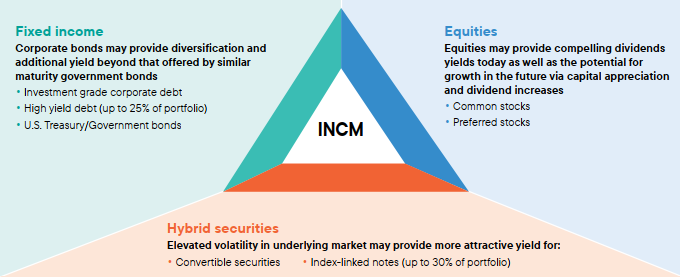

On today’s show, we are joined by Josh Greco, Senior VP and Senior Institutional Portfolio Manager for Franklin Income Investors to discuss:

– Asset allocation decisions within multi-asset funds

– How rate changes affect portfolio yield

– Investors overallocation to cash

– Understanding convertible bonds, and much more!

The bull case is still a lot stronger than the bear case for U.S. housing prices.

The pros and cons of overconfidence.